A corporate franchise tax is a tax imposed by a state on corporations, LLCs, and partnerships. This tax is assessed to these companies for the privilege of either doing business in the state or incorporating their business in that state. Like income taxes, typically franchise taxes are assessed annually.

Are non-profit corporations subject to franchise tax?

Franchise and excise taxes are not applicable to nonprofit persons as defined by law. They must file an annual report with the Secretary of State and pay the filing fee.

What is the tax rate on a corporation?

What is the tax rate for corporations? Corporations, other than S corporations, pay 7 percent (.07) income tax. Small business corporations (S corporations) who file the federal Form 1120S, U.S. Income Tax Return for an S Corporation, do not pay income tax. Corporations, including S corporations, also pay replacement tax.

What is the tax form for a corporation?

Form 1120S, U.S. Income Tax Return for an S Corporation is the tax form S corporations (and LLCs filing as S corps) use to file their federal income tax return. 1120S is a five page form from the IRS, which looks like this: You’ll need the following information on hand before filling out 1120S:

What is the difference between franchise and Corporation?

the difference between franchising and Corporation is a franchise owned by franchisees, a third party. On the other hand, a corporation is owned by shareholders. The scope of responsibility and the work model is also different. A franchise is the chain of the same company. A corporation can have a single company or a group of companies.

What type of tax is franchise tax?

The term franchise tax refers to a tax paid by certain enterprises that want to do business in some states. Also called a privilege tax, it gives the business the right to be chartered and/or to operate within that state.

How is a franchise taxes?

A franchise tax is a government levy (tax) charged by some US states to certain business organizations such as corporations and partnerships with a nexus in the state. A franchise tax is not based on income. Rather, the typical franchise tax calculation is based on the net worth of or capital held by the entity.

What is a franchise tax in California?

The California annual franchise tax is exactly what it sounds like—a tax that the state's business owners must pay yearly. It is simply one of the costs of doing business if you choose to register your entity in California.

Who owes a franchise tax?

Every corporation that is incorporated, registered, or doing business in California must pay the $800 minimum franchise tax.

Is franchise tax the same as corporate tax?

There are two different types of taxes that can be assessed on businesses: corporate income taxes and franchise taxes. The difference is found in looking at what exactly is being taxed. Income taxes apply to profit. Franchise taxes do not apply to profit.

What is an example of a franchise tax?

For example, if a corporation does only 70% of its business in that state, then tax will be calculated on a 70% margin. For a corporation that operates entirely in the state will pay franchise tax on 100% of profits. The margin calculated is then taxed as per applicable tax rates of the state.

What is a California corporation?

An S corporation is a corporation that elects to be taxed as a pass-through entity. Income, losses, deductions, and credits flow through to the shareholders, partners or members. They then report these items on their personal tax return. IRS approval is required for the S election status.

Do C corporations pay franchise tax?

California's franchise tax applies to S-Corps, standard limited liability companies (LLCs), limited partnerships (LPs), and limited liability partnerships (LLPs), as well as traditional corporations (C corporations).

Do I owe franchise tax California?

All businesses registered with the state of California have to pay the California Franchise Taxes (except for tax-exempt businesses like nonprofits). This means that C corps, S corps, LLCs, LPs, LLPs, and LLLPs all are all responsible for the California Franchise Tax.

Is an LLC a corporation?

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

Do all states have franchise tax?

Only some states have businesses pay some sort of a franchise tax. These taxes can be charged in addition to the other states taxes.

How do I avoid franchise tax in California?

One way to avoid paying franchise tax is to operate as a sole proprietorship or general partnership—but you would have to sacrifice the liability protection that LLCs and corporations enjoy. Some charities and nonprofits qualify for an California Franchise Tax Exemption.

How can franchise tax be avoided?

One way to avoid paying franchise tax is to operate as a sole proprietorship or general partnership—but you would have to sacrifice the liability protection that LLCs and corporations enjoy. Some charities and nonprofits qualify for an California Franchise Tax Exemption.

What states have franchise taxes?

The specific states that impose a franchise tax include Delaware, Alabama, Arkansas, Illinois, Georgia, Louisiana, Missouri, Mississippi, North Carolina Oklahoma, New York, Texas, Tennessee, Pennsylvania, and West Virginia.

What are franchise taxes in Arkansas?

What is the purpose of the Arkansas Franchise Tax? Arkansas LLC Franchise Tax is a “privilege tax”. Meaning, it's a flat-rate tax of $150 per year for the privilege to do business in the state. The purpose of the tax is to generate revenue for the State of Arkansas.

Who pays franchise tax in Florida?

) if one or more of its owners is a corporation. In addition, the corporate owner of an LLC classified as a partnership for Florida and federal income tax purposes must file a Florida corporate income/franchise tax return.

What is the difference between franchise and income tax?

There are several differences between a franchise tax and income tax. For example, franchise taxes are not based on business profits, while income taxes are. Regardless of whether profit is made, a business made pay franchise tax, whereas income tax and the amount paid is based on the organization’s earnings during that particular year.

What states have franchise tax?

In 2020, some of the states that implement such tax practices are: Alabama. Arkansas.

What is franchise tax in West Virginia?

West Virginia. Franchise taxes are charged to corporations, partnerships, and other corporate entities such as limited liability companies. Limited Liability Company (LLC) A limited liability company (LLC) is a business structure for private companies in the United States, one that combines aspects of partnerships and corp. .

What is indirect tax?

Indirect Taxes Indirect taxes are basically taxes that can be passed on to another entity or individual. They are usually imposed on a manufacturer or supplier who then. Gross Income. Gross Income Gross income refers to the total income earned by an individual on a paycheck before taxes and other deductions.

What is an Articles of Incorporation?

Articles of Incorporation Articles of Incorporation are a set of formal documents that establish the existence of a company in the United States and Canada. For a business to be.

What is operational in business?

The definition of operating may vary by state. For example, selling or offering their services and goods in a specific state or having employees live there may be considered operational for various jurisdictions.

Do sole proprietorships pay franchise tax?

Although companies usually have to pay franchise tax based on where they are operating and registered in each state, sole proprietorships are not often subject to franchise taxes. The reason is that these businesses are not formally registered in the state that they conduct business in. Additional entities that are not subject to franchise tax are: ...

What is franchise tax?

A franchise tax is a levy paid by certain enterprises that want to do business in some states. Contrary to what the name implies, a franchise tax is not a tax imposed on a franchise. Some entities are exempt from franchise taxes including fraternal organizations, nonprofits, and some limited liability corporations.

What is the difference between franchise and income tax?

Income Tax. There are some key differences between a franchise and income tax. Unlike state income taxes, franchise taxes are not based on a corporation’s profit. A business entity must file and pay the franchise tax regardless of whether it makes a profit in any given year.

How to calculate franchise tax?

As noted above, each state may have a different method of calculating franchise taxes. Let's use Texas as an example. The state's comptroller levies taxes on all entities that do business in the state and requires them to file an Annual Franchise Tax Report every year by May 15th. The state calculates its franchise tax based on a company’s margin which is computed in one of four ways: 1 Total revenue multiplied by 70% 2 Total revenue minus cost of goods sold (COGS) 3 Total revenue minus compensation paid to all personnel 4 Total revenue minus $1 million

What is the purpose of the California Franchise Tax Board?

For example, the California Franchise Tax Board states that its mission is to "help taxpayers file tax returns timely, accurately, and pay the correct amount to fund services important to Californians.". 3.

How much is franchise tax in California?

In California, the franchise tax rate for S corporations is the greater of either $800 or 1.5% of the corporation's net income. For LLCs, the franchise tax is calculated based on gross income tiers and can span between $800, up to $11,790.

How to calculate corporate revenue?

Corporate revenue is calculated by subtracting statutory exclusions from the amount of revenue reported on a corporation's federal income tax return .

When do you have to file a franchise tax return?

The state's comptroller levies taxes on all entities that do business in the state and requires them to file an Annual Franchise Tax Report every year by May 15th. The state calculates its franchise tax based on a company’s margin which is computed in one of four ways: Total revenue multiplied by 70%.

What is franchise tax in Texas?

The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.

When are Texas franchise tax returns due 2021?

Due to statewide inclement weather in February 2021, the Texas Comptroller of Public Accounts is automatically extending the due date for 2021 Texas franchise tax reports to June 15, 2021, consistent with the Internal Revenue Service (IRS). See Comptroller Hegar’s press release.

Do franchise tax filers get a reminder?

Most franchise tax filers will receive an email in lieu of a mailed reminder to file or seek an extension. If we do not have your email address on file (if you are a first-year filer, for example), we will mail a reminder notice to you.

Who pays franchise tax?

Many business entities, such as corporations and limited liability companies ( LLC ), have to pay franchise tax if the state they operate in imposes it.

How to find out if your business has a franchise tax exemption?

Contact the state (s) you operate in to find out whether or not your business or organization has a franchise tax exemption.

Do you have to pay franchise taxes each year?

If your state requires you to make franchise tax payments, you generally must make payments to the state taxation department each year. The franchise tax payment process can vary from state to state.

Is franchise tax the same as federal tax?

Franchise tax is different from a tax imposed on franchises. And, it is not the same as federal or state income taxes. Business owners must pay franchise taxes in addition to business income taxes. Depending on where you do business, you may have to pay franchise taxes to multiple states. For example, you may need to pay franchise taxes in other ...

Do franchises have to register with a state?

Many states’ privilege taxes are controlled by a state controller’s office or taxation department (e.g., Franchise Tax Board). Any business that must register with a state, including corporations, partnerships, and LLCs, may be charged a franchise tax.

Do all businesses pay franchise tax?

While businesses are charged franchise tax for doing business in a state, income taxes are based on the company’s profits. And, all business entities pay some form of income tax, while not all companies have to pay business privilege tax.

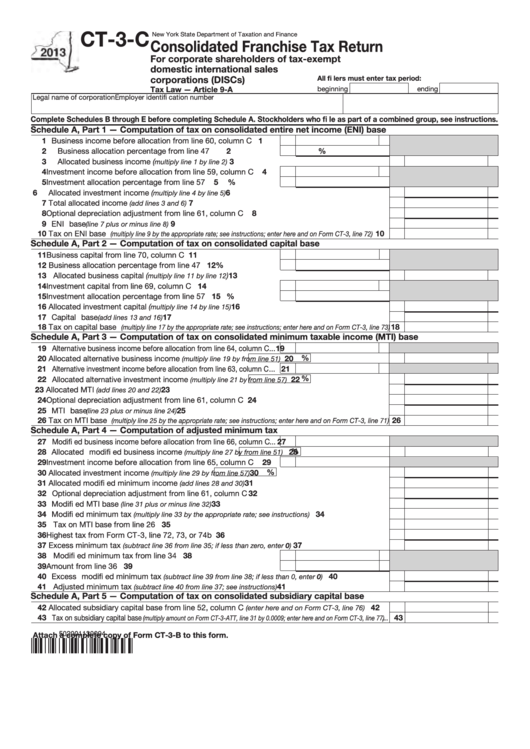

What is a foreign corporation?

you are a foreign corporation (incorporated outside New York State) that does business, employs capital, owns or leases property, maintains an office, or derives receipts from activity, in New York State; or. you are a foreign corporation that is a general partner in a partnership that does business, employs capital, owns or leases property, ...

When do you file your tax return?

Within 3 ½ months after end of reporting period. If your due date falls on a Saturday, Sunday, or legal holiday, you may file your return on or before the next business day.

Is LLC a partnership in New York?

When considering the last 2 bullets above , an LLC or LLP that is treated as a partnership for federal income tax purposes will be treated as a partnership for New York State tax purposes. Corporations engaged in a unitary business with another corporation (s) should see Form CT-3-A-I, page 4, “Who must file a combined return” for information concerning the combined return filing requirements.

Do corporations have to file e-file returns?

Most general business corporations are mandated to e-file returns. See e-file and e-pay requirements for certain filers for details.

What is a corporation?

A corporation is an entity that is owned by its shareholders (owners). Corporations can be taxed 2 different ways. C corporation. Generally taxed on their income and the owners are taxed on these earnings when distributed as payments or when the shareholder sells stock. S corporation.

When does a SOS corporation begin?

The corporation's existence begins when the SOS endorses the Articles of Incorporation and continues until the owner (s) dissolve the corporation

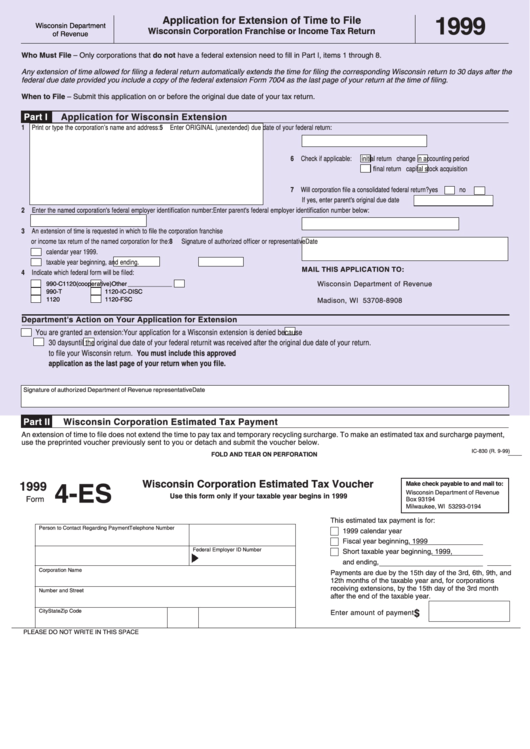

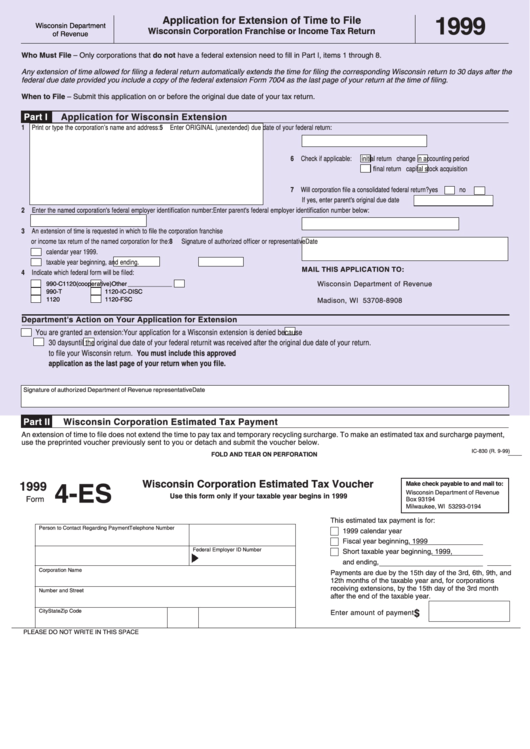

How long does it take to get an extension for a corporation?

Corporations filing after the original due date are granted an automatic 6-month extension.

Can you file an extension for a suspended corporation?

We do not grant automatic extensions to file for suspended corporations.

Does a foreign corporation qualify for SOS?

A foreign corporation that does not qualify with the SOS, but does business in California, is subject to the franchise tax

Is a S corporation taxable income?

Generally taxed on their income and shareholders are taxed on their share of the S corporation’s taxable income whether payments are distributed or not

Understanding income tax vs corporate franchise tax

Understanding the tax system and the tax responsibilities of the citizen to the federal and state government as it concerns the location of business operations is an essential duty of every business owner. Ignorance is not an excuse and therefore there are penalties and punishments for irresponsible tax behavior.

Corporate Income Tax

Income tax usually applies to the net profit of the business entity because it is usually calculated based on the corporation’s net profit for the year. Consequently, if no Profit is made for the year, no income tax will be required.

Franchise Tax

A franchise tax is a government tax/levy charged annually by some states to certain business organizations for the right to legally do business within that state. When a business organization refuses to pay franchise taxes, it can result in becoming disqualified from incorporating or doing business in that state.

Understanding Franchise Tax

- A franchise tax is a tax imposed on companies that wish to exist as a legal entity and do business in particular areas in the U.S. In 2020, some of the states that implement such tax practices are: 1. Alabama 2. Arkansas 3. California 4. Delaware 5. Georgia 6. Illinois 7. Louisiana 8. New York 9. Texas However, some states no longer impose the fran...

How States Determine Franchise Taxes

- Despite mentioning briefly above, each state bases its franchise tax on different criteria. The following list below is more extensive: 1. Income 2. Par valueof a stock, shares of stock, or authorized shares 3. Gross assets 4. Flat fee rate 5. Net worth 6. Paid-in capital 7. Real and tangible personal property or after-tax investment on tangible personal property 8. Gross receipts

Additional Considerations

- Although companies usually have to pay franchise tax based on where they are operating and registered in each state, sole proprietorships are not often subject to franchise taxes. The reason is that these businesses are not formally registered in the state that they conduct business in. Additional entities that are not subject to franchise tax are: 1. General partnerships where direct …

Franchise Tax vs. Income Tax

- There are several differences between a franchise tax and income tax. For example, franchise taxes are not based on business profits, while income taxes are. Regardless of whether profit is made, a business made pay franchise tax, whereas income tax and the amount paid is based on the organization’s earnings during that particular year. Moreover, income taxes are applied to co…

More Resources

- CFI offers the Commercial Banking & Credit Analyst (CBCA)™certification program for those looking to take their careers to the next level. To keep learning and advancing your career, the following resources will be helpful: 1. Articles of Incorporation 2. Business Strategy vs. Business Model 3. Indirect Taxes 4. Gross Income

What Is a Franchise Tax?

- The term franchise tax refers to a tax paid by certain enterprises that want to do business in so…

A franchise tax is a levy paid by certain enterprises that want to do business in some states. Contrary to what the name implies, a franchise tax is not a tax imposed on a franchise. - Some entities are exempt from franchise taxes including fraternal organizations, nonprofits, an…

Franchise taxes are paid in addition to federal and state income taxes.

Understanding Franchise Taxes

- A franchise tax is a state tax levied on certain businesses for the right to exist as a legal entity a…

Contrary to what the name implies, a franchise tax is not a tax imposed on a franchise. Rather, it's charged to corporations, partnerships, and other entities like limited liability corporations (LLCs) that do business within the boundaries of that state. Some entities are exempt from franchise ta…

Franchise Tax Rates

- Franchise taxes do not replace federal and state income taxes, so it's not an income tax. These …

Still, other states may charge a flat fee to all businesses operating in their jurisdiction or calculate the tax rate on the company’s gross receipts or paid-in capital .

Special Considerations

- A company that does business in multiple states may have to pay franchise taxes in all the state…

Sole proprietorships (except for single-member LLCs) - General partnerships when direct ownership is composed entirely of natural persons (except for …

Entities exempt under Tax Code Chapter 171, Subchapter B

Franchise Tax v Income Tax

- There are some key differences between a franchise and income tax. Unlike state income taxes, …

Income tax is also applied to all corporations that derive income from sources within the state, even though they may not do business within its boundaries. Doing business may be defined differently by some states as several factors are considered in establishing nexus, including whe…

Example of a Franchise Tax

- As noted above, each state may have a different method of calculating franchise taxes. Let's us…

Total revenue multiplied by 70% - Total revenue minus cost of goods sold (COGS)

Total revenue minus compensation paid to all personnel

What Is the Franchise Tax Board?

- The Franchise Tax Board is usually a state-operated tax agency for both personal and business taxes.

Is the Franchise Tax Board the Same as the IRS?

- The Franchise Tax Board operates similarly to the IRS, but operates at the state level, rather than the federal. For example, the California Franchise Tax Board states that its mission is to "help taxpayers file tax returns timely, accurately, and pay the correct amount to fund services important to Californians." 3

When Are Franchise Taxes Due?

- Franchise tax deadlines vary by state. In Delaware, the franchise tax deadline is March 1 of each year. 1

What Happens If You Don’t Pay Your Franchise Tax?

- Different states have penalties for late payments of franchise taxes, which the Franchise Tax Board will track and penalize corporations for. In Delaware, the penalty for non-payment or late payment is $200, with an interest of 1.5% per month. 1

The Bottom Line

- Franchise taxes allow corporations to do business within a state, though states have varying tax rates for the corporations based on their legal filing and gross income levels.