Is a diversification strategy right for your franchisee?

Diversification is an enticing option that can lead to success for franchisees that are ready to grow. Those looking to diversify need to make sure they have their other businesses well-established and should seek out expansion advice before committing to anything.

What are the two types of diversification?

Low levels diversification has two sub-types; single business and dominant business. In a single company, 95% of the revenue/profit is from a single business. In the prevailing industry, 70% to 95% of the revenue is from the dominant company. Moderate to high-level diversification has two sub-types; related constrained & related linked.

What is a diversified company?

At the diversified company, the top-level executives develop a corporate strategy with inputs from the multiple business units. 1 What Is Diversification? What Is Diversification?

Which level of diversification operates primarily on a single or dominant business?

This level of diversification operates its actions primarily on a single or dominant business. The company is in sole business if its revenue is better than 95% of the entire sales. If the produced profits are between 70% and 95%, the company’s business is dominant.

What is the most extreme version of the related constrained diversification strategy?

Why did B. make the purchase?

Which leads to an optimal level of diversification?

Is Greg's employer bought by another company?

Is internal financial transaction subject to government regulation?

See 2 more

About this website

What type of growth strategy is franchising?

What is franchising? Franchising is an established business expansion strategy that has proven to deliver rapid growth – with arguably reduced risk. Some stellar examples include MacDonald's, Singer and Coca Cola.

What are the five categories of businesses based on level of diversification?

The five categories of businesses determined by level of diversification are as follows: (1) single business (more than 95 per cent of revenues from a single business); (2) dominant business (between 70 and 95 per cent of revenue from a single business); (3) related constrained (less than 70 per cent of revenue from ...

What is the classification of franchise?

The five major types of franchises are: job franchise, product franchise, business format franchise, investment franchise and conversion franchise.

What is diversification with example?

With diversification, a business can successfully cross-sell their products. For example, an automobile company famous for its car deals can also introduce engine oil or other car parts to an old market or cross-sell new products.

What are the 3 forms of diversification?

There are three types of diversification techniques:Concentric diversification. Concentric diversification involves adding similar products or services to the existing business. ... Horizontal diversification. ... Conglomerate diversification.

What are the four types of diversification?

There are six established types of diversification strategies:Horizontal diversification.Vertical diversification.Concentric diversification.Conglomerate diversification.Defensive diversification.Offensive diversification.

What are the three 3 main types of franchises?

There are three main types of franchise opportunities available, these are: Business format franchises. Product franchises, or Single operator franchises. Manufacturing franchises.

What type of franchise is mcdonalds?

McDonald's operates a heavy-franchised business model, where most stores are franchisees.

What are the two types of franchise?

There is a wide variety of types of franchise structures used in the industry today. There are two main types of franchising, known as Product Distribution Franchising (Traditional Franchising) and Business Format Franchising, which are conducted under a variety of franchise relationships.

What is the best example of diversification?

Apple. One of the most famous companies in the world, Apple Inc. is one of the greatest examples of a “related diversification” model. Related diversification means there are commonalities between existing products/services and new ones in development.

What are levels of diversification?

According to them, three levels of diversification exist; Low Levels of Diversification. Moderate to High Levels of Diversification. Moderate to High Levels of Diversification.

What is diversification in simple words?

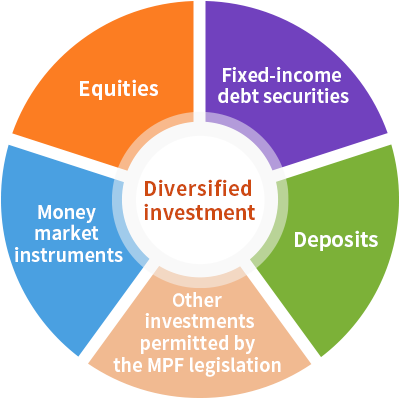

Diversification is a strategy that mixes a wide variety of investments within a portfolio in an attempt to reduce portfolio risk. Diversification is most often done by investing in different asset classes such as stocks, bonds, real estate, or cryptocurrency.

What are levels of diversification?

According to them, three levels of diversification exist; Low Levels of Diversification. Moderate to High Levels of Diversification. Moderate to High Levels of Diversification.

How many types of diversification are there?

three typesThere are three types of diversification: concentric, horizontal, and conglomerate.

What is business diversification?

What is diversification in business? Diversification is a strategy where companies expand on a particular area of their business. It can involve businesses developing new products or services for their existing customer base, for a similar market, or for a different clientele entirely.

What is diversification in business?

Related diversification occurs when a firm moves into a new industry that has important similarities with the firm's existing industry or industries (Figure 8.1). Because films and television are both aspects of entertainment, Disney's purchase of ABC is an example of related diversification.

Strategic Planning quiz 6. Flashcards | Quizlet

Start studying Strategic Planning quiz 6.. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

MAN4720 Exam 2 - Chapter 6 Flashcards | Quizlet

Study with Quizlet and memorize flashcards containing terms like Backward integration is also known as what when a company produces its own inputs?, What is synergy?, Restructuring which uses unrelated diversification is typically accomplished by which of the following? and more.

Solved 1) The likelihood of entry of new competitors is | Chegg.com

Business; Operations Management; Operations Management questions and answers; 1) The likelihood of entry of new competitors is affected by_____ and _____ a) the power of existing suppliers; buyers b) barriers to entry; expected retaliation of current industry organizations c) the demand for the product; the profitability of the competitors d) the profitability of the industry; the market share ...

What Is Diversification?

In general, diversification means spreading out of business either through functioning in various industries instantaneously (product diversification) or starting a new business in the same industry, or inflowing into various geographic marketplaces (geographic market diversification). Diversification happens when a business unit enlarges into a new segment of the existing industry in which the company is already doing business at the business-unit level. Diversification happens when the diversified company arrives into a business outdoor the scope of the standing business units at the corporate-level. Diversification is pursued to upsurge cost-effectiveness through greater sales volume. However, it is not free from risks. And, thus, it needs careful analysis before entering into an unknown market with an unfamiliar product proposing.

What happens when a business unit enlarges into a new segment of the existing industry?

Diversification happens when a business unit enlarges into a new segment of the existing industry in which the company is already doing business at the business-unit level. Diversification happens when the diversified company arrives into a business outdoor the scope of the standing business units at the corporate-level.

What is corporate strategy?

Corporate strategy is an overall strategy for a diversified company. Since a diversified company has a mix or combination of some businesses in multiple industry environments, the corporate strategy embraces the whole mix of the businesses. It also hugs the ways of integrating and coordinating the strategies of individual business units.

How many levels of diversification are there?

Approximately management specialists have tried to show that diversified firms differ on the word of their levels of diversification. According to them, three levels of diversification existing:

What did Siddiqui do?

Siddiqui had undertaken initiatives to acquire a number of similar types of firms that resulted in the high growth of the company. The CEO replaced the traditional decentralized management with an aggressive strategy of corporate marketing.

What is vertical integration?

Vertical integration involves integrating business along the company’s value chain, either backward or forward. Horizontal diversification contains moving into fresh businesses at the same stage of production as the present operations of the company. Geographic diversification involves moving into new geographic areas. The three forms of diversification may be related or unrelated.

What is the responsibility of the top-level corporate managers?

The procedure of assigning resources among the many strategic business units (SBUs) is the responsibility of the top-level corporate managers. They decide and implement how cash, staffing, equipment, vehicles, finances, and other resources will be distributed among the SBUs.

What is Diversification Strategy?

Diversification strategy is when a business or a company proceed with the growth and development and expand its business in different markets and product areas. In other words, it means letting your business enter into the new markets and creating a new product.

What is the purpose of diversification?

When you follow this strategy, you diversify the product portfolio and increase the horizon of your business. Most importantly, it helps the company to amplify sales and profitability.

What are the parts of a matrix?

The matrix comprises four parts; market development, product development, diversification, and market penetration. Ansoff said that the diversification strategy is entirely different from the other matrix strategies. It’s because all three methods deal with utilizing the resources of the original product.

Why is it important to do an attractive test?

The purpose of an attractive test is to check the appeal and attractiveness of the latest market before entering it. However, it’s essential to answer this question because diversification incurs costs to add some value. The market diversification should generate enough revenue to cover the expenses. Here are some of the points of an attractive Test;

How much did Hubspot make in 2010?

The company’s profitability increased from 255,000 dollars in 2007 to 15.6 million dollars in 2010. The Software Solution Company went public in 2014; it raised 125 million dollars, and the company’s market value reached 880 million dollars.

What is the goal of a business?

The goal of every business is to grow and be productive. A particular point comes in the product and company’s life when the industry stops growing. The management expands their business into other areas. Diversification is also about expansion and growth.

Why do companies diversify?

One of the primary reasons companies follow the diversification strategy is to expand their business’s growth rate. The investors have made up their mind that bigger is better. They want a high growth rate, whether in terms of productivity, sales, or revenue.

Diversification and synergies

John Betz is president and CEO of Betz & Associates, which operates six Auntie Anne's Pretzels franchises and is a licensee for three Starbucks locations, all in the Philadelphia and southern New Jersey area.

Risks and rewards

Smaller franchise operators will want to make sure they don't spread themselves too thin (in terms of personnel and other resources) in the quest to add concepts. "We're a pretty small operation," says Brewer.

Comments

We were unable to load Disqus Recommendations. If you are a moderator please see our troubleshooting guide.

What are the benefits of diversification?

The following are the advantages of diversification: 1 As the economy changes, the spending patterns of the people change. Diversification into a number of industries or product line can help create a balance for the entity during these ups and downs. 2 There will always be unpleasant surprises within a single investment. Being diversified can help in balancing such surprises. 3 Diversification helps to maximize the use of potentially underutilized resources. 4 Certain industries may fall down for a specific time frame owing to economic factors. Diversification provides movement away from activities which may be declining.

Why does a diversified entity lose out?

However, a diversified entity will lose out due to having limited investment in the specific segment. Therefore, diversification limits the growth opportunities for an entity. Diversifying into a new market segment will demand new skill sets. Lack of expertise in the new field can prove to be a setback for the entity.

How does diversification help the economy?

As the economy changes, the spending patterns of the people change. Diversification into a number of industries or product line can help create a balance for the entity during these ups and downs. There will always be unpleasant surprises within a single investment. Being diversified can help in balancing such surprises.

What is a concentric diversification strategy?

In a concentric diversification strategy, the entity introduces new products with an aim to fully utilize the potential of the prevailing technologies and marketing system. For example, a bakery making bread starts producing biscuits.

What is the effect of mismanaged diversification?

A mismanaged diversification or excessive ambition can lead to a company over expanding into too many new directions at the same time. In such a case, all old and new sectors of the entity will suffer due to insufficient resources and lack of attention.

Why is it important to be diversified?

Being diversified can help in balancing such surprises. Diversification helps to maximize the use of potentially underutilized resources. Certain industries may fall down for a specific time frame owing to economic factors. Diversification provides movement away from activities which may be declining.

What are some of the most successful diversification stories?

Some very famous success stories of diversification are General Electric and Disney. However, the entry of Quaker oats into the fruit juice business, Snapple lead to a very costly failure.

What is the most extreme version of the related constrained diversification strategy?

d. A conglomerate is the most extreme version of the related constrained diversification strategy.

Why did B. make the purchase?

b. made the purchase because its future cash flows are uncertain.

Which leads to an optimal level of diversification?

a. internal capital allocation leads to an optimal level of diversification.

Is Greg's employer bought by another company?

Greg's employer has just been bought by another company which owns a number of other businesses. Greg and his family are very happy in their home and community and wish to stay there at least 10 more years until the children are out of school. Greg is a manager with in-depth understanding of one of major core competencies of his firm. Greg should be MOST worried about a transfer if the purchasing organization:

Is internal financial transaction subject to government regulation?

d. internal financial transactions are not subject to government regulation as are capital market transactions.

What is the most extreme version of the related constrained diversification strategy?

d. A conglomerate is the most extreme version of the related constrained diversification strategy.

Why did B. make the purchase?

b. made the purchase because its future cash flows are uncertain.

Which leads to an optimal level of diversification?

a. internal capital allocation leads to an optimal level of diversification.

Is Greg's employer bought by another company?

Greg's employer has just been bought by another company which owns a number of other businesses. Greg and his family are very happy in their home and community and wish to stay there at least 10 more years until the children are out of school. Greg is a manager with in-depth understanding of one of major core competencies of his firm. Greg should be MOST worried about a transfer if the purchasing organization:

Is internal financial transaction subject to government regulation?

d. internal financial transactions are not subject to government regulation as are capital market transactions.

What Is Diversification Strategy?

Why Do Companies Diversify?

- Businesses and companies follow the diversification strategy for three significant reasons. They are as follows;

Levels of Diversification

- Low Levels of Diversification

Low levels diversification has two sub-types; single business and dominant business. In a single company, 95% of the revenue/profit is from a single business. In the prevailing industry, 70% to 95% of the revenue is from the dominant company. - Moderate to High-Level Diversification

Moderate to high-level diversification has two sub-types; related constrained & related linked. In case of a related constrained, if all the businesses share technological, product, and distribution linkage, then the revenue is lower than 70% from the dominant companies. In related links, the li…

Porter’s Three Tests For Diversification

- Michael Porter offers three tests that the companies should perform to check whether their diversification would become successful or not. The Michael Porters’ three tests for diversification are as follows;

Advantages of Diversification Strategy

- More Revenue & Sale

The most apparent advantage of diversification strategy is that businesses want to increase their revenue and sale. Primarily if the company has gathered enough customer shares, there would be little room left for improvement. When the company enters into the new market and launches a … - Economic Stability

Small businesses and companies usually have limited clients and sources of revenue. It makes them vulnerable to the country’s economic condition. The diversification strategy allows them to reduce the risk factors and expand the company’s profitability.

Disadvantages of Diversification Strategy

- Strained Operations

If your company has limited resources and the customer wants a new product. If you start developing the latest product and the current one, your workforce’s performance will fall because they aren’t accustomed to multitasking. when you take the debt to fund the diversification, it will … - Overextension

If a company doesn’t diversify carefully, then it would result in the form of extra delays of resources. Every department of the company needs timely availability of resources to run various operations. If they don’t receive it on time, their productivity will decrease. It usually happens wh…

Examples of Diversification