What is the example of intangible assets?

Key Takeaways

- An intangible asset is an asset that is not physical in nature, such as a patent, brand, trademark, or copyright.

- Businesses can create or acquire intangible assets.

- An intangible asset can be considered indefinite (a brand name, for example) or definite, like a legal agreement or contract.

Is a franchise fee an intangible?

When a franchisee pays a franchise fee to a franchisor, this payment can be considered an intangible asset. It is permissible for the franchisee to recognize this cost as an asset, since it is an asset acquired from a third party. The franchisee should amortize this asset over its estimated useful life, which is presumed to be the term of the franchise agreement.

How do tangible and intangible assets differ?

- There are two types of categories of assets called tangible and intangible assets. ...

- typically physical assets or property owned by a company, such as computer equipment. ...

- Intangible assets don't physically exist, yet are they have a monetary value since they represent potential. ...

Is a leasehold an intangible asset?

This long-term exclusivity makes the leasehold an asset. Since the leasehold serves as a contractually provided interest, not the actual building, it is an intangible asset. A leasehold is the right to use a property that the leaseholder does not own for a specified, extended period of time for a specified price.

Why are franchises an intangible asset?

When a franchisee pays a franchise fee to a franchisor, this payment can be considered an intangible asset. It is permissible for the franchisee to recognize this cost as an asset, since it is an asset acquired from a third party.

Is a franchise considered an asset?

The franchise you purchase becomes an intangible asset that goes on your business balance sheet and is recorded as a noncurrent asset, according to Reference for Business. This is generally written off as an expense on your balance sheet and affects your bottom line when it comes to taxation.

What is a franchise classified as?

A franchise is a joint venture between a franchisor and a franchisee. The franchisor is the original business. It sells the right to use its name and idea. The franchisee buys this right to sell the franchisor's goods or services under an existing business model and trademark.

Is a franchise goodwill?

Although an important premise of franchising is that goodwill remains vested in the franchisor, 'market value' should include the value added to the franchise business by the franchisee that is often referred to as goodwill.

How do you depreciate a franchise?

A franchisee can amortize the initial fee over 15 years. The same amount must be deducted each year, so the fee needs to be divided evenly. To do this, you would divide the initial fee by 15. If your agreement lasts less than 15 years, your amortization schedule for the fee will just last the contract's length.

Who owns the assets of a franchise?

The assets of the franchise business including the premises would generally still be owned by the franchisee, although most franchise agreements allow a franchisor, on termination or expiry, to take over the franchisee's business assets and usually, the price which is payable to the franchisee is low because it takes ...

What are the 3 types of franchises?

There are three main types of franchise opportunities available, these are: Business format franchises. Product franchises, or Single operator franchises. Manufacturing franchises.

What are the 4 types of franchising?

The four types of franchise business you can invest inJob or operator franchise. These owner operator franchises are usually home based, which keeps overheads down to a minimum. ... Management franchise. ... Retail and fast food franchises. ... Investment franchise.

What are the 2 types of franchises?

There is a wide variety of types of franchise structures used in the industry today. There are two main types of franchising, known as Product Distribution Franchising (Traditional Franchising) and Business Format Franchising, which are conducted under a variety of franchise relationships.

Who owns the goodwill in a franchise?

Generally, all goodwill and assets are owned by the company. In the case of goodwill, the purchase will normally be accompanied by one or more covenants not to compete.

Is goodwill a franchise fee?

Franchise Accounts Franchise royalties refer to money paid to the franchisor each year in exchange for the continued use of the franchise name. Goodwill refers to the money paid to open the business in excess of the combined value of the assets.

What is goodwill in franchising agreement?

Goodwill is 'the legal right or privilege to conduct a business in substantially the same manner and by substantially the same means that have attracted custom to it. It is a right or privilege that is inseparable from the conduct of the business'1.

Is franchise an asset or expense?

On the balance sheet, the franchise fee is listed under the assets section as an intangible asset.

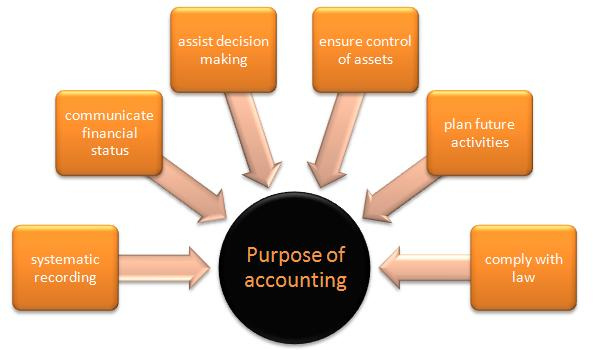

What is a franchise in accounting?

Franchise accounting is the application of accounting to franchises. It functions much like non-franchise accounting, but it takes the unique fees associated with franchises, like royalty fees, amortizing initial fees, and marketing fees, into consideration.

Is bank loan an asset or liability?

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses. Liabilities can be contrasted with assets. Liabilities refer to things that you owe or have borrowed; assets are things that you own or are owed.

What is an intangible asset in accounting?

An intangible asset is an identifiable non-monetary asset without physical substance. Such an asset is identifiable when it is separable, or when it arises from contractual or other legal rights. Separable assets can be sold, transferred, licensed, etc.

What are intangible assets?

Now, intangible assets can be understood as those assets that can neither be touched nor seen but which have some value for the business. Examples of this type of asset include patents, goodwill, etc. These types of assets are usually reviewed every year and are written down if it is found in the analysis that their value has changed over time.

What is a franchise business?

A franchise can be thought of as a business model where the company called the franchisor, comes up with the business design and provides the information including the details of the equipment, the business model, and the training, to the entrepreneur who we call the franchisee, to build his business. The franchisee typically pays a fee to the franchisor in exchange for using his business design, his name, and material to set his business up. The franchisee can also pay royalty or franchise fees to the franchisor depending upon the contract. It is basically like paying the franchisor for purchasing the right to operate his business design in a particular area.

How is franchise amortization calculated?

Its rate is calculated by dividing the initial value of the intangible asset over the years of its usefulness. Annually, the franchisee deducts the value of the asset by its amortization rate and records an expanse of that same rate.

How to calculate goodwill?

Now, to calculate the value of the goodwill, you will first have to determine the value of each asset that you have recorded in your books. In the second step, you will have to total up this amount and then deduct it from the total money that you have paid to the franchisor. This difference is recorded as the total goodwill amount. Now, this amount is again an intangible asset that stays in the records of the entrepreneur until he believes that it no longer holds the same value. This situation is called impairment when the business reduces the value of goodwill in its books.

How does franchise affect balance sheet?

Now, like you may have already understood, the franchise fee and the franchise loyalty represent expenses for the business, and hence they are deducted from the net profits of your company. As a result, the amount that you pay as tax to the government reduces as well. On the other hand, the Goodwill in your balance sheet is recorded as your asset and it increases the balance of your total assets. This is how the franchise affects your books and your income tax amount.

When a franchisor sets up a business under the franchise model, he typically gets a jump-?

This is because when you are opening the business under the name of a franchisor you are instantly recognized by the public and you already have a brand value. Thus, people trust you easily. So, for example, when the entrepreneur uses the franchise of Dominos and opens a pizza outlet, the public will recognize the brand easily, and so the business won’t face much difficulty in establishing itself.

How long does a franchise fee have to be amortized?

Instead, the franchise fee has to be amortized over a period of 15 years or the duration of the agreement. This fee usually covers the cost of your initial training, supplies, and that of providing you with the unique goods or services that are related to the business.

How many intangible assets does McRonald's have?

Example. McRonald’s has two intangible assets. The first is a patent worth $25,000,000 and with a useful life of 50 years. The patent expires and cannot be renewed. The second is a trademark worth $1,000,000 and with a useful life of 10 years, after which it expires. However, the trademark can be renewed at a marginal cost.

What are identifieable and unidentifiable assets?

Identifiable and Unidentifiable Intangible Assets. Identifiable intangible assets are those that can be separated from other assets and can even be sold by the company. These are assets such as intellectual property, patents, copyrights, trademarks, and trade names. Software and other computer-related assets outside of hardware also classify as ...

What is the difference between net and gross?

The net method deducts the grant from the assets book value to arrive at the carrying amount of the asset, while the gross method records the asset at its gross value (full purchase price) and sets up the grant as deferred income.

What is goodwill in accounting?

In accounting, goodwill represents the difference between the purchase price of a business and the fair value of its assets, net of liabilities. What this essentially means is the difference represents how much the buyer is willing to pay for the business as a whole, over and above the value of its individual assets alone.

What is considered a long term asset?

As a long-term asset, this expectation extend s for more than one year or one operating cycle. Intangible assets lack a physical substance like other assets such as inventory and equipment. They form the second largest category of long-term assets, behind number one – PP&E. They can be separated into two classes: identifiable and non-identifiable.

What is a CFI?

CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™#N#Become a Certified Financial Modeling & Valuation Analyst (FMVA)®#N#certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional CFI resources below will be useful:

When should depreciation expense be capitalized?

Depreciation Expense When a long-term asset is purchased, it should be capitalized instead of being expensed in the accounting period it is purchased in. method. If an intangible asset has a perpetual life, it is not amortized.

What happens when a business creates an intangible asset?

If a business creates an intangible asset, it can write off the expenses from the process , such as filing the patent application, hiring a lawyer, and paying other related costs. In addition, all the expenses along the way of creating the intangible asset are expensed.

What Is an Intangible Asset?

An intangible asset is an asset that is not physical in nature. Goodwill, brand recognition and intellectual property, such as patents, trademarks, and copyrights, are all intangible assets. Intangible assets exist in opposition to tangible assets, which include land, vehicles, equipment, and inventory.

What is an example of a definite intangible asset?

An example of a definite intangible asset would be a legal agreement to operate under another company's patent, with no plans of extending the agreement. The agreement thus has a limited life and is classified as a definite asset.

Can a business acquire intangible assets?

Businesses can create or acquire intangible assets. An intangible asset can be considered indefinite (a brand name, for example) or definite, like a legal agreement or contract. Intangible assets created by a company do not appear on the balance sheet and have no recorded book value.

Do intangible assets appear on the balance sheet?

However, intangible assets created by a company do not appear on the balance sheet and have no recorded book value. Because of this, when a company is purchased, often the purchase price is above the book value of assets on the balance sheet. The purchasing company records the premium paid as an intangible asset on its balance sheet.

Is goodwill amortized?

Indefinite life intangible assets, such as goodwill, are not amortized. Rather, these assets are assessed each year for impairment, which is when the carrying value exceeds the asset's fair value.

Is a bond a tangible asset?

Additionally, financial assets such as stocks and bonds, which derive their value from contractual claims, are considered tangible assets.

What are intangible assets?

Intangible assets include patents, copyrights, trademarks, trade names, franchise licenses, government licenses, goodwill, and other items that lack physical substance but provide long‐term benefits to the company. Companies account for intangible assets much as they account for depreciable assets and natural resources.

How long does an intangible asset last?

The cost of intangible assets is systematically allocated to expense during the asset's useful life or legal life, whichever is shorter, and this life is never allowed to exceed forty years. The process of allocating the cost of intangible assets to expense is called amortization, and companies almost always use the straight‐line method ...

How does copyright amortize?

Copyrights provide their owner with the exclusive right to reproduce and sell artistic works, such as books, songs, or movies. The cost of copyrights includes a nominal registration fee and any expenditures associated with defending the copyright. If a copyright is purchased, the purchase price determine s the amortizable cost. Although the legal life of a copyright is extensive, copyrights are often fully amortized within a relatively short period of time. The amortizable life of a copyright, like other intangible assets, may never exceed forty years.

Why is goodwill recorded?

Goodwill may be recorded only after the purchase of a company occurs because such a transaction provides an objective measure of goodwill as recognized by the purchaser.

Why are franchise licenses valuable?

These rights are valuable because they provide the purchaser with immediate customer recognition.

How to record amortization expense of $10,000?

One way to record amortization expense of $10,000 is to debit amortization expense for $10,000 and credit accumulated amortization‐patent for $10,000.

What are intangible assets?

Tangible assets are any physical assets: equipment, real estate, products, and even customers. These are all things you can physically see and touch (although you maybe shouldn't).

What are the two categories of intangible assets?

Intangible assets can be broken down into two categories: those with indefinite useful lives, and limited-life intangible assets.

What is limited life intangible asset?

A limited-life intangible asset is exactly as it sounds: an intangible asset that will only generate cash flow for a certain period of time. The most common type of limited-life intangible asset is a patent because patents have an agreed-upon term when they're created.

How to do a market valuation of an intangible asset?

To perform a market valuation of an intangible asset, take note of the asset you're trying to value. Then, look to your competitors and see if any of them have publicly traded or sold a similar intangible asset.

What is the difference between tangible and intangible assets?

Tangible assets, on the other hand, are more often associated with short-term success, cash flow, and overall working capital. (You can sell a tangible asset.)

Why is a licensing agreement an intangible asset?

Licensing agreements: A licensing agreement between you and another party is an intangible asset because it allows your company to generate increased revenue but can't be labeled with a clear dollar amount.

What are some examples of indefinite useful life assets?

These types of assets can generate income indefinitely. Some indefinite useful-life intangible assets include trademarks, goodwill, and brand recognition. For example, think of a popular franchise like McDonald's or Chick-fil-A. For franchises of this size, brand recognition is indefinitely useful.