Texas franchise tax reports are due in advance, not in arrears This is easier explained with an example. Let’s say your Texas LLC is approved on August 5th 2021. So your LLC franchise tax reports are due the following year, by May 15th 2022. your LLC’s report year will be 2022 but your LLC’s accounting year will be 8/5/2021 – 12/31/2021

Is there a franchise tax in Texas for small businesses?

As Texas has no net corporate or personal income tax, the Texas Franchise Tax is our state’s primary tax on businesses. Fortunately, the No Tax Due Threshold, currently set at $1,080,000, prevents most small companies (like LLCs) from having to pay any franchise tax.

When do you have to file a franchise tax report in Texas?

Each business in Texas must file an Annual Franchise Tax Report by May 15 each year. Do I have to pay franchise tax in Texas? In Texas, businesses with $1.18 million to $10 million in annual receipts pay a franchise tax of 0.375%. Businesses with receipts less than $1.18 million pay no franchise tax.

What is the accounting year for Texas franchise tax 2020?

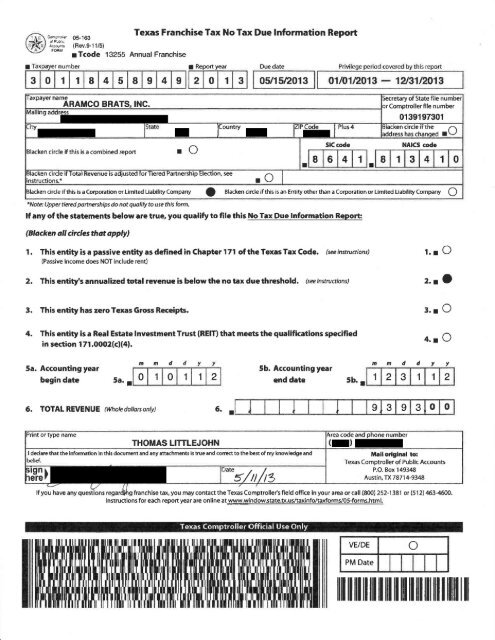

Your LLC’s net surplus is the basis for the franchise tax. What is the accounting year for Texas franchise tax 2020? On page 1 of the franchise tax report, the accounting year begin date is 01-01-2020, and the accounting period end date is 12-31-2020. Do LLCs in Texas pay franchise tax?

How do you calculate franchise tax in Texas?

The franchise tax in Texas is computed using the margins of taxable enterprises. The tax base is established using one of the following procedures if a taxable entity does not meet the requirements or elects to utilize the EZ computation: 70% of revenues or revenue less the cost of goods sold (COGS). How do I amend my filed franchise tax report?

What is the accounting year for Texas franchise tax?

It uses a fiscal year (June 30) accounting period when reporting with the IRS. On its 2021 first annual franchise tax report, it enters its accounting year end date as 09/01/2021.

What is the accounting year for franchise tax 2022?

A 2022 Texas annual report is to be filed for any fiscal year federal return ending in 2021. Franchise tax returns cannot have an accounting year end that is greater than January 4th of the report year being filed.

How do franchise taxes work in Texas?

Franchise tax is based on a taxable entity's margin. Unless a taxable entity qualifies and chooses to file using the EZ computation, the tax base is the taxable entity's margin and is computed in one of the following ways: total revenue times 70 percent; total revenue minus cost of goods sold (COGS);

How often is franchise tax paid in Texas?

The Texas Franchise Tax is levied annually by the Texas Comptroller on all taxable entities doing business in the state. The tax is based upon the entity's margin, and can be calculated in a number of different ways. Each business in Texas must file an Annual Franchise Tax Report by May 15 each year.

Is Texas franchise tax paid in arrears?

Unlike federal taxes, which are due in arrears (being filed for the prior year), Texas franchise tax reports are due in advance (being filed for the current year).

What is the accounting year for Texas franchise tax 2022?

For franchise tax reporting purposes, the entity would file its 2022 report based on the period 10-01-2020 through 12-31-2021, combining the relevant information from the two federal income tax reports.

How is franchise tax calculated?

Divide your total gross assets by your total issued shares carrying to 6 decimal places. ... Multiply the assumed par by the number of authorized shares having a par value of less than the assumed par. ... Multiply the number of authorized shares with a par value greater than the assumed par by their respective par value.More items...

Is Texas franchise tax the same as sales tax?

The first thing to know when it comes to Texas franchise tax is that it is NOT the same as sales tax. Sales tax only taxes the end consumer. Franchise tax taxes all the businesses involved in the process from the manufacturer to the end distributor.

Do LLCs in Texas pay franchise tax?

Texas, however, imposes a state franchise tax on most LLCs. The tax is payable to the Texas Comptroller of Public Accounts (CPA). In general terms, the franchise tax is based on an LLC's "net surplus" (the net assets of the LLC minus its members' contributions).

What happens if I dont pay Texas franchise tax?

Penalties and Interest A $50 penalty is assessed on each report filed after the due date. If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed. If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

Do single member LLCs pay franchise tax in Texas?

Therefore, each taxable entity that is organized in Texas or doing business in Texas is subject to franchise tax, even if it is treated as a disregarded entity for federal income tax purposes and is required to file a franchise tax report.

What happens if you don't file Texas franchise tax?

In Texas, failure to file your franchise tax returns or pay your franchise tax liability will cause you to lose your limited liability protection. The Texas Tax Code provides for personal liability for the management of a company if there is a failure to file a report or pay a tax or penalty.

What is the business tax filing deadline for 2022?

April 18, 2022For most small businesses, business tax deadlines for 2022 are on April 18, 2022. S corporations and partnerships, however, have to file tax returns by March 15, 2022.

What are the VAT quarters 2022?

7 June 2022 – Deadline for VAT returns and payment Accounting Quarter period ending 30 April 2022 if filed online. 7 July 2022 – Deadline for VAT returns and payments of Accounting Quarter period ending 31 May 2022. 7 August 2022 – Deadline for VAT returns and payments of Accounting Quarter period ending 30 June 2022.

What is the extended tax deadline for 2022?

October 17, 2022April 18 tax filing deadline for most Taxpayers in Maine or Massachusetts have until April 19, 2022, to file their returns due to the Patriots' Day holiday in those states. Taxpayers requesting an extension will have until Monday, October 17, 2022, to file.

How is NC franchise tax calculated?

Franchise Tax Rate for General Business Corporations The franchise tax rate is one dollar and fifty cents ($1.50) per one thousand dollars ($1,000) and is applied as set forth in the law.

What is franchise tax in Texas?

What is franchise tax? The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. What does an entity file if it is ending its existence or no longer has nexus? An entity ending its existence that is not part of a combined group must file.

How to annualize franchise revenue?

To annualize total revenue, divide total revenue by the number of days in the period upon which the report is based, then multiply the result by 365.

What to do if a tax return is filed incorrectly?

The entity that filed incorrectly should submit a letter with its name and taxpayer number stating that the report was filed in error and the entity will report with a combined group. The letter must also include the name and taxpayer number of the combined group's reporting entity, along with a request for a refund or authorization to transfer any tax payment from the member's account to the reporting entity's account.

Do you have to file an annual report?

If the entity is a fiscal year end taxpayer that ceases business after its normal accounting year end, it must file both an annual and a final report. The annual report will cover the period from its beginning date through the entity's normal accounting year end. The final report will cover the day after its normal year end through the last day the entity conducted business. Only one information report is due.

When is a payment considered timely?

If you are not paying electronically, your payment will be considered timely if it is postmarked on or before the due date, or hand delivered to a local Comptroller's office during normal business hours on or before the due date.

Who is required to file OIR?

Associations, trusts and all other taxable entities file the OIR. Prior to Jan. 1, 2016, professional associations and limited partnerships were required to file OIRs instead of PIRs.

Can a taxable entity file a no tax due report?

Because annualized revenue is not less than the $1,080,000 no-tax-due threshold, the taxable entity does not qualify to file a No Tax Due Report. It is eligible to file using the E-Z Computation.

What is franchise tax in Texas?

The Texas Franchise Tax is an annual business privilege tax processed by the Texas Comptroller of Public Accounts. Essentially, it’s a tax levied on business owners in exchange for the opportunity to do business in Texas. Here's what you should know about it.

How often do you need to file a franchise tax return in Texas?

But whether or not tax is owed, you’ll need to file a Texas Franchise Tax Report every year to keep your business in good standing.

What does independent Texas do?

When you hire Independent Texas to form your Texas company or serve as your registered agent, we keep your state correspondence organized, send you multiple reminders ahead of the franchise tax due date, and provide affordable franchise report filing service.

What happens if you don't get your franchise tax report in Texas?

If the Comptroller’s office does not receive your franchise tax report (and payment, if you owe one) within 45 days of the deadline, they are required by law to forfeit your business’s right to transact business in Texas. This forfeiture is essentially a loss of corporate liability protection: business owners will become liable for the debts of the business, and the entity will not be permitted to defend itself in a court of law.

How to calculate annualized revenue?

To find annualized revenue, divide your business’s total revenue by the number of days since it became subject to the franchise tax, then multiply the result by 365.

How to check if a franchise is active in Texas?

How can I check my business’s Texas Franchise Tax status? You can check on the Texas Franchise Tax account status of your company (or another company) by conducting an online Taxable Entity Search on the Comptroller’s website. To search for a business, enter its name, 11-digit Texas taxpayer ID number, 9-digit Federal Employer Identification Number (FEIN) or Texas SOS file number. Once you locate the business you’re looking for, click on the blue “Details” button to the left of the business name. Under the “Franchise Search Results” tab, you’ll see an item called “Right to Transact Business in Texas.” If the right to transact business is “Active,” then the entity is still entitled to conduct business in Texas.

How to pay taxes on Webfile?

Log in to WebFile. From the eSystems menu, select WebFile / Pay Taxes and Fees.

What is franchise tax in Texas?

Texas franchise tax is a “privilege tax” for doing business in Texas. Part of this privilege includes liability protections provided by state law. The franchise tax is administered by the Texas Comptroller of Public Accounts.

When are Texas franchise tax reports due?

Texas franchise tax reports are due in advance, not in arrears. This is easier explained with an example. Let’s say your Texas LLC is approved on August 5th 2019. So your LLC franchise tax reports are due the following year, by May 15th 2020. your LLC’s report year will be 2020.

What is a tiered partnership in Texas?

A Tiered Partnership election (for Texas franchise tax purposes) applies to an LLC that is in a parent/child relationship, also referred to as parent/subsidiary relationship.

What is the tax number of an LLC?

Your LLC’s Taxpayer Number is an 11-digit number that is issued by the Texas Comptroller. This number is used to identify your LLC for state tax obligations and filings. If you ever call the Comptroller’s Office, they’ll use your Taxpayer Number to lookup your LLC. Also, when you use WebFile (the online filing system) you’ll need this number.

How long does an LLC have to give notice of foreclosure in Texas?

Texas law requires that the Comptroller’s Office gives your LLC at least 45 days grace period. That 45-day grace period starts after you receive the “Notice of Pending Forfeiture”.

How to contact the Texas Comptroller?

If you have any questions, you can contact the Texas Comptroller at 800-252-1381. Their hours are Monday through Friday, from 8am to 5pm Central Time. If you call early, their hold times are very short (1-5 minutes).

How long does it take to get a welcome letter from the Texas Comptroller?

Within about 2-3 weeks, you’ll receive a “Welcome Letter” from the Texas Comptroller. This is what it will look like: