I was able to successfully FedEx my California State return by mailing it to the address-checked address mentioned above: Franchise Tax Board POBOX 942867 SACRAMENTO, CA 94267 US The FedEx employees were dubious that this would actually be delivered because of their usual no-PO-BOX rule but it did work.

Does the IRS accept FedEx?

Yes, the IRS will accept either. Taxpayers or Tax Professionals can use certain private delivery services designated by the IRS to meet the "timely mailing as timely filing/paying" rule for tax returns and payments. These private delivery services include only the following: June 4, 2019 11:07 PM Can I file my tax documents via Fedex..?

Can I FedEx my California State return?

I was able to successfully FedEx my California State return by mailing it to the address-checked address mentioned above: Franchise Tax Board POBOX 942867 SACRAMENTO, CA 94267 US The FedEx employees were dubious that this would actually be delivered because of their usual no-PO-BOX rule but it did work.

Can I file my tax documents via FedEx?

June 4, 2019 11:07 PM Can I file my tax documents via Fedex..? Or Should I have to use USPS only..? Can I use overnight delivery if I send my documents via Fedex..? June 4, 2019 11:07 PM Yes, the IRS will accept either.

Can I use overnight delivery if I send documents via FedEx?

Can I use overnight delivery if I send my documents via Fedex..? June 4, 2019 11:07 PM Yes, the IRS will accept either. Taxpayers or Tax Professionals can use certain private delivery services designated by the IRS to meet the "timely mailing as timely filing/paying" rule for tax returns and payments.

Why was FedEx dubious that this would actually be delivered?

Does DHL deliver to post office?

About this website

Can you mail tax returns through FedEx?

Use certified mail, return receipt requested, if you send your return by snail mail. It will provide proof that it was received. The IRS accepts deliveries from FedEx, UPS, and DHL Express. But you must use an approved class of service.

Where do I send my Franchise Tax Board payment?

To pay by check or money order, make payment payable to FRANCHISE TAX BOARD and write your account number on your payment. Mail your payment to: STATE OF CALIFORNIA, FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0011.

Is the Franchise Tax Board the same as the IRS?

While the IRS enforces federal income tax obligations, the California Franchise Tax Board (FTB) enforces state income tax obligations. A taxpayer will face collections actions by the FTB because they have ignored the obligation, refused to pay, or are unable to pay an outstanding tax balance that is due and owing.

Where do I send my state tax return in California?

Download forms through the FTB website. You can complete and mail these forms to the Franchise Tax Board, PO Box 942840, Sacramento, CA 94240-0001, if no balance is due or you're owed a refund. If you're filing with a payment, mail it to PO Box 942867, Sacramento, CA 94267-0001.

How do I pay my California Franchise Tax?

How to Pay CA Franchise Tax Board TaxesWeb Pay – Individual and Business taxpayers.Mail – Check, Money Order.In-Person at Franchise Tax Board Field Offices.Credit Card – Online through Official Payments Corporation at: www.officialpayments.com.

Can I make payments to the Franchise Tax Board?

Business. If you can't pay your tax bill in 90 days and want to get on a payment plan, you can apply for an installment agreement. It may take up to 60 days to process your request. Typically, you will have up to 12 months to pay off your balance.

What happens if I don't pay the Franchise Tax Board?

Penalty. 5% of the amount due: From the original due date of your tax return. After applying any payments and credits made, on or before the original due date of your tax return, for each month or part of a month unpaid.

What happens if you don't pay California Franchise Tax?

The California Franchise Tax Board imposes a penalty if you do not pay the total amount due shown on your tax return by the original due date. The penalty is 5 percent of the unpaid tax (underpayment), plus 0.5 percent of the unpaid tax for each month or part of a month it remains unpaid (monthly).

How long can the Franchise Tax Board collect back taxes?

20 yearsWe have 20 years to collect on a liability (R&TC 19255 ).

How do I send my tax return by mail?

Mail Your Tax Return with USPSSend to the Correct Address. Check the IRS website for where to mail your tax return. ... Use Correct Postage. Weigh your envelope using a kitchen scale or postage scale and apply the right amount of postage. ... Meet the Postmark Deadline.

What address do I send my taxes to?

Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Internal Revenue Service, P.O. Box 7704, San Francisco, CA 94120-7704.

How do I pay my California state taxes online?

How Do You Pay California Taxes?Navigate to the website State of California Franchise Tax Board website.Choose the payment method. Your payment options include drawing from your bank account, credit card, check, money order, or electronic funds withdrawal. You can also set up a payment plan.

How do I pay the $800 franchise tax?

The state requires corporations to pay either $800 or the corporation's net income multiplied by its applicable corporate tax rate, whichever is larger. You may pay the tax online, by mail, or in person at the California Franchise Tax Board Field Offices.

How do you pay your taxes?

How to pay your taxesElectronic Funds Withdrawal. Pay using your bank account when you e-file your return.Direct Pay. Pay directly from a checking or savings account for free.Credit or debit cards. Pay your taxes by debit or credit card online, by phone, or with a mobile device.Pay with cash. ... Installment agreement.

Can I pay CA state taxes with credit card?

You can make credit card payments for: Annual tax. Bill or other balance due. Current year or amended tax return.

Do you have to pay the $800 California S Corp fee the first year?

California law generally imposes a minimum franchise tax of $800 on every corporation incorporated, qualified to transact business, or doing business in California. A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year.

What is the address for the California Franchise Tax Board? - JustAnswer

I don't know the type of form you are filing, but I found this in the CA Form 100X Instructions: Private Delivery Services California law conforms to federal law regarding the use of certain designated private delivery services to meet the “timely

Fedex mailing address for IRS fresno, california and Franchise tax ...

@ pjdu wrote:. Fedex mailing address for IRS fresno, california and Franchise tax board, CA. I am paper filing and mailing the tax return. What is the FedEx mailing address for these IRS Fresno, CA and Franchise tax board, CA?

Can I mail my California state income tax return with Fedex?

Answer (1 of 2): Your local Fedex Office has an equivalent address for all income tax processesing centers. The counter person will be able to find the appropriate center in the same city as your tax return directions indicate.

Mailing addresses | FTB.ca.gov - California

Form Without payment With payment Other correspondence; 100 100S 100W 100X 109 565 568: Franchise Tax Board PO Box 942857 Sacramento CA 94257-0500: Franchise Tax Board

California - Where to File Addresses for Taxpayers and Tax ...

and you are filing a Form... and you are not enclosing a payment, then use this address... and you are enclosing a payment, then use this address...; 1040. Department of Treasury Internal Revenue Service Ogden, UT 84201-0002: Internal Revenue Service P O Box 802501

File by mail | FTB.ca.gov - California

If you would like to file a paper tax return by mail, you’ll need to download and print our forms and instructions.To find out what form you need to use, visit our file page and select your filing situation.. Your return must be postmarked by the extended due date to be timely. It may take longer for us to process your tax return by mail.

Why was FedEx dubious that this would actually be delivered?

The FedEx employees were dubious that this would actually be delivered because of their usual no-PO-BOX rule but it did work.

Does DHL deliver to post office?

Private Carrier Services (such as Federal Express, United Parcel Service, or DHL Global Mail) do not deliver to USPS post office boxes.

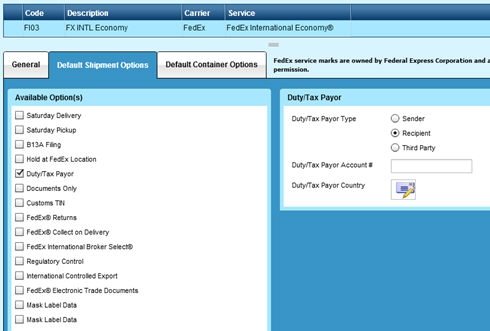

Who is responsible for duties and taxes on FedEx packages?

Please note: As per the contract of carriage with FedEx, the shipper is ultimately liable for any duties and taxes assessed on the shipment. If the recipient refuses the package, or the recipient or third-party FedEx account holder refuses to pay for duties and taxes, the original shipper will be billed for duties and taxes.

How do duties and taxes affect a shipment?

How Duties and Taxes Impact Your Shipment. In some countries, duties and taxes must be paid before the shipments are released from customs. A shipment's duty and tax amount is based on the following: Product value. Trade agreements. Country of manufacture. Description and end use of the product.

Do you have to pay taxes before FedEx release?

Prepayment of duties and taxes before release to the recipient may be required if the recipient does not have a valid FedEx account number or a FedEx account in good standing. Shipments will be held at the destination station until payment arrangements are made.

Can you gift a gift without a tax?

Many countries allow gifts to enter duty-free if the value of the gift is less than a certain amount and if the gift being shipped is not considered to be a regulated or prohibited commodity. Any gift valued greater than the stated value may be subject to import duties and taxes .

Can you get tax relief after export?

Many countries allow tax relief (either duties and tax exemption upon entry or a refund after exportation) for items that are temporarily imported or exported, as long as certain conditions are met and procedures are followed. For instance, items are often temporarily imported or exported for:

Do you have to send a shipment person to person?

In some countries, the shipment must be sent person-to-person — with no company involvement or indication of involvement on the shipping documentation. Pay Duties & Taxes. FedEx Disbursement Fee. Duties, taxes and other charges might be due when importing a shipment.

Determine Whether You Qualify

Answer a few simple questions to determine whether you qualify for the FASC program.

Create a FedEx Account

If your store is new or you’re taking over a store from a previous owner, set up a new FedEx account number by calling 1.800.496.9310, opt. 3.

Fill Out an Application

Once you’ve qualified for the program, create your profile and submit your store information to apply.

Fahim and Seema Mojawalla

Find out what makes their store the “Spa of Shipping” near Niagara Falls, New York.

Kelli and Ted Tamez

Discover what drew them to the Pak Mail franchise after deciding they needed a new business opportunity.

Rajan and Martha Dorasami

Learn about their popular Fort Worth, Texas, store and what makes it so unique within the community.

Where to find FedEx tax center?

Your local Fedex Office has an equivalent address for all income tax processesing centers. The counter person will be able to find the appropriate center in the same city as your tax return directions indicate.

What does it mean when FedEx says "Tendered for Delivery"?

It may be the closest FedEx processing facility or the closest post office to its delivery address, but when this message pops up it means that your package has a pretty imminent ETA.

What is the phone number for the FTB?

Call the FTB at (800) 852–5711 during normal working hours (7AM - 5PM Pacific time Mo-Fr). It’s usually best to call in the middle of the week.

Can you use federal deductions on California state taxes?

When you prepare you California state income tax return, you may use your federal itemized deductions. However, the amount you deducted for federal purposes are going to be adjusted by certain items w

Does FedEx ship 100% of the time?

FedEx packages are (usually) going to be handled by FedEx 100% of the way and you might never have to worry about seeing this kind of message pop up in your tracking information no matter how often you use this shipping service.

Do workers who don't live in New York have to pay state taxes?

Documents from the New York Department of Taxation and Finance confirm what the Instagram post claimed: Workers who don’t live in New York and temporarily come to the state to help fight the coronavirus are required to pay state income taxes , as Cuomo said in his recent news conference.

Can FedEx Smartpost be handed off?

At the same time, though, if you’re using FedEx Smartpost to get your package to its ultimate destination the chances are pretty good that it’s going to be handed off at the end of the line for the USPS to finish delivery.

Why was FedEx dubious that this would actually be delivered?

The FedEx employees were dubious that this would actually be delivered because of their usual no-PO-BOX rule but it did work.

Does DHL deliver to post office?

Private Carrier Services (such as Federal Express, United Parcel Service, or DHL Global Mail) do not deliver to USPS post office boxes.