What type of SBA loan is best for a franchisee?

SBA 504 Loans are typically best for franchise owners who are financing large purchases like real estate or equipment for a franchise they already own. The SBA 7 (a) Loan program is by far the most common due to the flexibility around how proceeds can be used.

How do I qualify for an SBA 504 loan?

The Small Business Administration (SBA) has some specific requirements for you to qualify for an SBA 504 loan, including: 504 Eligibility At-a-Glance: For purchase of commercial real estate and heavy equipment Your business must occupy at least 51% of the building

Is the CDC/SBA 504 loan worth the wait?

However, if you can qualify for an SBA loan, it’s well worth the wait. Of the many SBA programs, the CDC/SBA 504 loan is one of the most popular—mainly because it offers unique benefits to businesses that qualify.

What is a 504 504 loan?

504 loans are available through Certified Development Companies (CDCs), SBA's community-based partners who regulate non-profits and promote economic development within their communities. CDCs are certified and regulated by SBA. Am I eligible? To be eligible for a 504 Loan, your business must:

Are franchises eligible for SBA loans?

SBA 7(a) loans for franchises Franchise owners can use this loan for purchasing real estate, fixed assets, working capital and even refinancing existing debts. With amounts available up to $5 million, business owners can use it as a loan to start a franchise and cover initial startup costs.

Can SBA 504 be used to buy a business?

A 504 loan can be used for a range of assets that promote business growth and job creation. These include the purchase or construction of: Existing buildings or land. New facilities.

How do franchises get funding?

The SBA 7(a) loan program is one of the most popular for franchise financing. This program offers up to $5 million, usually with 10-year repayment periods, however, loans for equipment may extend to 25 years (or useful life) and real estate loans may also extend repayment periods up to 25 years.

What disqualifies you from getting an SBA loan?

Ineligible businesses include those engaged in illegal activities, loan packaging, speculation, multi-sales distribution, gambling, investment or lending, or where the owner is on parole.

Are SBA 504 loans hard to get?

So in conclusion, is it hard to get an SBA loan? No. Qualifying for a 504 Loan is simple and most for-profit businesses are eligible for SBA funding.

What is a 504 loan and how might it work for an entrepreneur?

With a 504 loan, an entrepreneur can purchase his or her business's real estate or machinery. He or she then gets the tax benefits and appreciation on the real estate while locking in occupancy costs for 20 years.

What franchise is the most profitable?

Most Profitable FranchisesDunkin'7-Eleven.Planet Fitness.JAN-PRO.Taco Bell.Orangetheory Fitness.Great Clips.Mac Tools.More items...•

What is the failure rate for a franchise?

Coincidentally when I was with NatWest I managed the survey for the last 22 years. Pretty much every year the survey has been conducted has shown between 8-12% of franchise businesses left their franchise each year. This is for a variety of reasons, including retirement, selling, ill-health and financial failure.

How do you qualify for a franchise loan?

How Do You Qualify for Franchise Financing?Acceptable personal credit history. Your personal credit score reflects whether you are reliable as a borrower. ... Required down payment. Almost any kind of SBA or conventional business loan will require a down payment.Financial information. ... Franchise information.

What is the minimum credit score for SBA loan?

The SBA does not state specific credit score minimum requirements, but business mentors recommend entrepreneurs have a credit score in the mid to high 600s. Some loan products, like the SBA microloan program, may have SBA loan credit requirements on the lower end.

What is the current SBA 504 interest rate?

Current Rates For SBA CDC/504 Loans: Approximately 5.8%-5.97% Current Rates For EIDL Loans For COVID Relief: 3.75% for for-profit businesses and 2.75% for nonprofit businesses.

What credit score does SBA use?

The SBA uses the FICO Small Business Scoring Service, or SBSS, in many cases to evaluate the credit history of your business. SBSS scores get pulled for SBA 7(a) loan application prescreens as well.

What is the difference between a 7a and 504 SBA loan?

SBA 504 loans are typically larger loans in dollar amounts lent. Businesses can borrow from $125,000 up to $10 million, depending on the business's qualifications and needs. 7a loans, meanwhile, offer smaller dollar amounts, with the maximum loan topping off at $5 million dollars.

What is the maximum SBA 504 loan amount?

$5 millionMaximum SBA loan amount: Loans are generally capped at $5 million. Certain eligible energy-efficient or manufacturing projects may qualify for more than one 504 loan up to $5.5 million each. Interest rate: Below-market interest rates are fixed for the life of the loan.

Can you use an SBA loan to buy a car?

Yes! SBA loans, and SBA commercial vehicle loans for that matter, are incredibly flexible financing products. You can use SBA financing to buy a used vehicle.

Can I use my SBA loan for anything?

SBA loans and SBA express loans can be used for a wide range of expenses. According to the SBA, you can use these loans for “most” business purposes, including start-up, expansion, equipment purchases, working capital, inventory or real-estate purchases.

What is CDC 504 loan?

What is the 504 loan program? The CDC/504 Loan Program provides long -term, fixed rate financing of up to $5 million for major fixed assets that promote business growth and job creation.

What are the eligibility criteria for SBA loan?

Other general eligibility standards include falling within SBA size guidelines, having qualified management expertise, a feasible business plan, good character and the ability to repay the loan.

Can a loan be made to a nonprofit?

Loans cannot be made to businesses engaged in nonprofit, passive, or speculative activities. For additional information on eligibility criteria and loan application requirements, small businesses and lenders are encouraged to contact a Certified Development Company in their area.

Why SBA Franchise Loans?

Owning a franchise is an appealing option for a few reasons. A franchise operates with a model that has already proven to be successful and comes with a corporate reputation to back up the choice in your investment.

How Can Franchise Owners Use SBA Loans?

The SBA loan program has specific requirements for how the funds can be used, which are outlined in the loans’ eligible use of proceeds. In short, the SBA requires that loans are used to improve or establish a site to conduct your business, fund your operation’s soft costs, and/or refinance certain outstanding debts.

Which SBA Loan Program is Right for You?

There are multiple SBA programs business owners may utilize to start or grow a franchise. The type of loan you should apply for depends on the amount of capital your project needs and how you plan to spend the funds. The three most popular SBA loan programs for franchise owners are:

Is My Franchise Eligible for SBA Franchise Financing?

To receive an SBA 7 (a) loan, a franchise must meet universal SBA 7 (a) Loan Program requirements, franchise-specific requirements, and be evaluated by the lending institution as a viable and credit worthy financing candidate. According to the SBA, eligible businesses must:

How to Apply for an SBA Franchise Loan

After you determine that an SBA franchise loan is a good fit for your plans, it’s time to begin the application process. Follow these steps to get started:

What Are SBA Franchise Loans?

SBA franchise loans are loans designated for business owners planning to open a franchise.

What is a 504 loan?

SBA 504/CDC loans are best if you want to purchase major business assets. They allow you to buy an existing franchise, remodel a building, or buy expensive machinery.

What is the best loan for a franchise?

If you are looking for general financing to start a franchise, an SBA 7 (a) loan could be the best option for you. These loans can be used to buy land, expand a franchise, resolve debts, or use as working capital.

What is the interest rate on a 504 loan?

The largest part of an SBA 504/CDC loan is funded by a bank or other lender. The interest rate from this lender should be less than 9.25%. This interest rate can be either fixed or variable, depending on the lender.

What does a franchisee get from a franchisor?

Franchisees get access to all the business’s proprietary information, including the business name, branding, and resources. The franchisor gets a royalty for allowing the franchisee to use their business model.

How much down payment do you have to pay on a 504 loan?

Lastly, as the borrower, you have to pay 10% of the SBA 504/CDC loan as a down payment.

Can a non profit business qualify for a franchise loan?

Non-profit business, one involving gambling, or a life insurance company will not qualify for an SBA franchise loan. In addition to meeting these general requirements, there are other standards for qualifying as well.

What is the SBA 504 loan?

Think of the SBA 504 loan as a building block for small businesses that support local communities. As the SBA’s flagship loan program, CDC/SBA 504 loans are made available through Certified Development Companies (CDCs)—that is, nonprofit corporations that promote economic development within their communities—and are guaranteed by the SBA. Keep in mind that the 504 loan is specifically designed to promote business growth and create jobs. In fact, a qualifying company is expected to create one job for every $65,000 borrowed.

Why is the SBA 504 loan so popular?

Of the many SBA programs, the CDC/SBA 504 loan is one of the most popular—mainly because it offers unique benefits to businesses that qualify. SBA 504 loans are all about fueling the economy—they help business owners purchase land or buildings, improve existing facilities, purchase machinery and equipment, or purchase commercial real estate. Plus, they promote job growth in local communities.

Why is the SBA loan so useful?

What makes SBA loans so useful? First, the SBA federally backs the loans so they’re less risky to lenders, making it easier for you to get a loan with lower interest rates. Plus, they have different types of SBA loans that all offer low interest rates, low down payments, and long-term financing. That’s a rare treasure worth taking if you can swing it. Note that they do have strict requirements, so you’ll have to wait a long time for funding. However, if you can qualify for an SBA loan, it’s well worth the wait.

How long does it take for a SBA loan to be approved?

Unfortunately, SBA loans through Lendio can take up to 30 to 90 days to fund. To help navigate your SBA loan options, we recommend contacting your personal loan manager.

How many jobs have 504 loans created?

In fact, 504 loans have helped create over 2 million jobs. 1 Here’s everything you need to know to help you apply and qualify for an SBA 504 loan. A small business loan can help you when the time comes to invest in new business resources.

What is the difference between SBA 7 and 504?

Similar to the 504, the 7 (a) loan requires a 10% down payment. The remaining 90% is covered by the bank loan. The maximum loan amount for SBA 7 (a) loans is $5 million, whereas the 504 maximum loan amount is a whopping $20 million.

How does a 504 loan help small business?

An SBA 504 loan not only helps small business owners buy commercial real estate and long-term equipment , but it also encourages economic development and promotes job creation. In fact, 504 loans have helped create over 2 million jobs. 1 Here’s everything you need to know to help you apply and qualify for an SBA 504 loan.

What is SBA franchise loan?

What is an SBA Franchise Loan? An SBA Franchise Loan is the funding mechanism that an entrepreneur utilizes with the help of the Small Business Administration to help procure an approved franchise. The subject franchise may be either an existing location purchased through a transfer agreement, or a brand new location that has been approved by the franchisor (corporate). Business loans up to $5,000,000 may be obtained through the Small Business Administration's two most popular business funding programs; the SBA 7a Loan Program and the SBA 504 loan Program. For more information on the SBA 7a or SBA 504, click on the type of SBA loan:

How much can a franchise borrow from the SBA?

The Franchise SBA Loan Program allows businesses to borrow up to $5,000,000 for qualified franchises and businesses. Higher SBA Franchise Loan amounts mean that the lender will require more in terms of sufficient collateral to secure their investment.

Why are SBA franchise loans so popular?

These loans are extremely popular with business owners due to their favorable terms and relatively low interest rates.

Do CDCs have to review franchises?

Under these changes, Lenders and CDCs will no longer have to review franchise or other brand documentation for affiliation or eligibility.

Can a franchise business be disqualified from the SBA?

If the business applying for the Franchise SBA Loan Program is unable to check all of the above, the business is not automatically disqualified from the program.

Is it risky to start a franchise?

To be clear, although the franchise location that you will be starting may be brand new, more than likely, the franchise itself has been in business for a very long time. Usually, startups are seen as risky investments; 50% of small businesses fail within the first five years. But not so much with franchises, as the business concept has proven its model and the franchise corporation has developed a blue print for your franchise's success.

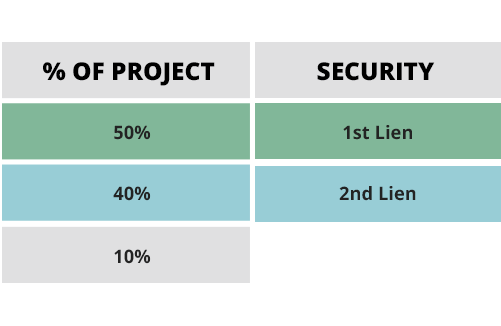

Does the SBA guarantee a 7A loan?

While the SBA guarantees a large percentage of 7a Franchise SBA Loans and a sizeable portion of the 504 Franchise SBA Loans, your lender is still on the line for the remaining non-guaranteed percentage. The collateral you provide for obtaining the SBA Franchise Loan goes a long way in persuading the lender to loan you the money; offering collateral instills confidence in recovery should you default.

Who approves SBA 504 loans?

Any attempts to use the collateral for your SBA 504 loan to secure more financing must be approved by the Small Business Administration first (in writing).

What Are The Requirements For My Small Business Once I Have An SBA 504 Loan?

Once you have secured an SBA 504 loan, there are a few requirements to follow during the life of the loan. It is important to be aware of these, as there are consequences if you do not meet the requirements.

What Are The SBA 504 Loan Eligibility Requirements?

The Small Business Administration (SBA) has some specific requirements for you to qualify for an SBA 504 loan, including:

How long has the CDC been helping small businesses?

At CDC Small Business Finance, we’ve been helping small business owners get access to capital including SBA 504 loans for over 40 years.

What is a 504 loan?

The 504 loan program is for the purchase of commercial real estate and heavy equipment. Your business must occupy 51% of the building: If you are purchasing commercial real estate, your business must occupy at least 51% of the property you plan to purchase if it’s an existing building, or 60% of the building if it’s new construction. Job creation.

How much money do you need to get a 504 loan?

Business must be worth less than $15 million USD. Businesses worth more than $15 million USD are not eligible for the 504 loan program.

Why is job creation important for 504?

Job creation is an important part of the 504 loan program’s goal to help improve economic development in communities. As a side benefit, when a borrower works with a high volume 504 lender like us, there are some built in flexibilities.

How to apply for SBA loan as a franchise owner?

The steps for applying for an SBA loanare similar to any other applicant with one exception: You must first verify your franchise brand is eligible for SBA financing. Confirm your franchise is eligible for SBA financing.

What is a 504 loan?

Unlike the general-purpose 7(a) loan, the 504/CDC loan program is for securing major fixed assets, such as machinery and equipment, and can be used for purchasing real estate and remodeling buildings, too. A restaurant franchise owner, for example, may use a 504 loanto purchase commercial kitchen equipment. The 504 loan’s maximum amount for the CDC portion is $5 million, with terms extending up to 25 years.

How to determine if a franchise is eligible for financing?

Review the SBA franchise directoryon the SBA website to determine whether your franchise is eligible for financing. When SBA franchise lenders review your documents, they will also reference the directory to confirm your eligibility.

What to do if your brand is not listed in the franchise directory?

If a brand is not listed in the directory, consider asking the franchiser if they have plans to be listed. The directory is updated weekly and there are no application fees.

How long can a 7A loan be?

Terms for a 7(a) loan can extend up to 25 years but will vary depending on the franchisee’s intended use of the proceeds. Interest rates can be either fixed (up to 11.25%) or variable (up to 8%).

Can a franchise owner apply for SBA loans?

However, only business owners whose franchises are listed in the SBA franchise directory can apply. The listed franchises operate business models that meet the SBA’s eligibility criteria.

Do short term loans require weekly payments?

Also, repayment for short-term loans tends to follow a more frequent payment schedule, sometimes requiring weekly or even daily installments. Traditional bank loans. Like the SBA, traditional banks can offer various financing products in generous loan amounts that best suit your needs.