Where can I get a loan to buy a business franchise?

Bank loans. Your personal bank or credit union may offer financing options, and many traditional banks make franchise-specific loans available. General purpose business loans. The most widely used SBA loans, SBA 7(a) general loans can greatly help if you’re investing in a franchise.

What are the benefits of a loan broker franchise?

In return, the franchisee gains the use of a trademark, ongoing support from the franchisor, and the right to use the franchisor’s system of doing business and sell its loan services. When evaluating loan broker franchise opportunities, there are several things you want to consider before committing to a purchase.

Do franchisors have in-house financing?

Many franchisors have in-house financing for their franchisees. Franchisors typically specify how much you can borrow, the length of your repayment term and other conditions of your loan. Because there's no set standard, your exact loan options — if your franchisor offers loans at all — will vary greatly.

How long does it take to get an online franchise loan?

But again, you’ll need to have an already established franchise to qualify. This loan also takes longer to apply for (and receive) compared to most other online franchise loans, and it can potentially take a couple of months for the money to come through. You’ll need to submit the same documentation as you would for a traditional SBA loan.

Is it hard to get a loan for a franchise?

Getting approved for franchise financing can be difficult, particularly if you need startup funds, you need funding but have bad credit, or your franchise has been open for less than a year.

How do you get funding for a franchise?

The 6 Best Financing Options for Franchising a BusinessFranchisor financing. If you need funding to purchase a franchise, your first conversation should be directly with your prospective franchisor. ... Commercial bank loans. ... SBA loans. ... Alternative lenders. ... Crowdfunding. ... Friends and family loan.

Will a bank lend me money to start a business?

As I explained above, banks do lend money to startups. One exception to the rule is that the federal Small Business Administration (SBA) has programs that guarantee some portion of startup costs for new businesses so banks can lend them money with the government, reducing the banks' risk.

What kind of loan do you need to start a franchise?

Small business loans offer great rates. While that answer varies depending on your situation, if you're exploring opening your first franchise, Small Business Administration (SBA) loans are a good choice.

How much deposit do you need for a franchise?

Note: To get approved you must either have a minimum of 50% deposit or equity in a property that you own.

How much do you have to put down on a franchise?

Entrepreneurs looking to finance a franchise transfer typically need to put 20% down, while a new location or start-up business requires 25 – 30% down.

Who will lend me money to start a business?

The Best Financing Options for StartupsBusiness Credit Cards. This is one of the top choices for new businesses. ... SBA 7(a) Loans. For the most part, the U.S. Small Business Administration (SBA) doesn't make loans—it guarantees them. ... Crowdfunding. ... SBA Microloans. ... Other Microloans. ... Equipment Financing. ... Bank Loans. ... Line of Credit.More items...•

How do I convince a bank to give me a business loan?

With that in mind, here's how small business owners can increase their chances of getting the loans they need by following these five simple tips.First, Build a Real Relationship. ... Know the Numbers. ... Explain How You Made Your Forecasts. ... Show How They Get Their Money Back. ... Personally Guarantee the Loan.

How much of a loan will bank give for business?

How much of a business loan you can get is primarily a function of your business's annual gross sales, existing debt, and creditworthiness. Most lenders won't lend more than 10% to 30% of a business's annual revenue. Your company should be cash flow positive after accounting for all debt payments.

How do I open my first franchise?

Steps to Start a FranchiseStep 1: Research your options. ... Step 2: Select a franchise that aligns with your business goals. ... Step 3: Create an LLC or a corporation. ... Step 4: Arrange financing. ... Step 5: Talk to the franchisors and franchisees. ... Step 6: Talk to members of your community. ... Step 7: Create a business plan.More items...•

How often does a franchise owner get paid?

If a franchise's total monthly gross sales income was $10,000 and the contract states a 6% fee, then the fees for that month would equal $600. Fixed fees are set fees, typically paid in regularly timed intervals — like monthly, quarterly, annually.

Does owning a franchise make a lot of money?

Buying a franchise might seem like easy money, but those royalties and fees will quickly cut into profit margins. The majority of franchise owners earn less than $50,000 per year.

Can you buy a franchise with no experience?

Most people don't realize that they can have all of this and more through their own franchise. The best part is that there is no experience or education necessary to owning your own franchise.

What is franchise financing?

Franchise financing is how franchisees pay for franchise fees and other business start-up expenses. Most owners cannot afford to cover these out-of...

Who qualifies for franchise financing?

Entrepreneurs who qualify for franchise financing generally have positive net worth, or more assets than debts. Many franchisors will ask to see a...

How can I get a franchise with no money?

All franchises, whether they be high or low-end options, require money on the part of the investor. Those with limited funds might need to wait and...

Do banks give loans to franchises?

Franchisees who have good credit history and a business plan may be eligible for a commercial loan with a bank. It sometimes helps to apply with fi...

How much can I borrow for a franchise?

The Small Business Association (SBA) allows investors to borrow up to $5 million for the purpose of opening a franchise or small business. Other le...

What is franchise financing?

The best loans for franchise financing can help you open a new franchise, buy an existing franchise, or secure working capital for your franchise. Franchise financing includes SBA loans, term loans, lines of credit, and more. The following loans are faster than a bank loan, and you can apply entirely online.

What does it mean to be a franchise owner?

Becoming a franchise owner gives you the flexibility of owning a business with the added security of being part of an established brand. However, as with owning any new business, startup costs can be high, and you may require infusions of capital if you encounter hard times. Franchisees must also pay a franchise fee when opening a new franchise as ...

How long does Applepie loan last?

ApplePie offers both SBA loans and conventional loans with a five to ten year repayment period at fixed or variable interest rates, depending on the loan product. Read our post on SBA franchise loans to learn more about SBA-backed franchise loan options.

What is funding circle?

Funding Circle was established in 2010 when one of its founders started a gym franchise and realized how difficult it was to obtain funding. Today, Funding Circle has numerous franchise partners across the US, including Papa John’s, Pinkberry, Quiznos, and many others. This lender is also very flexible, offering various loan products through partnered lenders for franchises in different stages of growth. For qualified applicants, Funding Circle has the advantage of offering faster funding than a bank loan would, as well as having relatively low rates and fees.

What is a smartbiz loan?

SmartBiz is a viable online loan option for franchise owners who want the security and low-interest rates of an SBA-backed loan but with the ease and speed of an online loan. SmartBiz is the number one marketplace for SBA 7 (a) small business loans online. It offers online SBA loans up to $5 million for commercial real estate purchases, loans up to $350,000 for debt refinancing and business capital, and bank term loans up to $500,000. This lender is only an option for established franchises. You’ll need at least two years in business, a positive cash flow, and good personal credit.

How long does it take to get a loan from Ondeck?

The entire process from starting your application to receiving your funds usually only takes a couple of days.

What is the interest rate on Credibly loans?

Credibly offers a mix of short-term loans, medium-term loans, and merchant cash advances. You can borrow up to $400,000 with the merchant cash advance or short term loan, or up to $200,000 for the medium-term loan. Flat rates start at 15% for the advances and short-term loans , while the medium-term loans have an interest rate between 10% and 36%.

How many lenders are there for franchises?

There are lenders that specifically fund franchises. You can browse the Franchise Registry to connect with over 9,000 lenders.

What does franchising mean?

Franchisors typically specify how much you can borrow, the length of your repayment term and other conditions of your loan. Because there's no set standard, your exact loan options — if your franchisor offers loans at all — will vary greatly.

How do I compare my financing options?

Now that you know your different routes to choose from, here’s what to keep an eye out for when weighing your options.

How do lenders determine interest rates?

Lenders determine your interest rate by weighing many factors, but your personal credit score and business plan are two of the most important. Remember that the better your collateral offered, the less of a risk a lender will see you. When you’re perceived as less risky, your interest rate is generally lower. Fees.

What is FDD in franchising?

Read the franchise disclosure document (FDD) provided by your franchisor carefully to fully understand the costs specific to the franchise you’re representing.

What is the best source of information for franchising?

The International Franchise Association is one of the most extensive sources of information on franchising out there. Aside from the IFA, the Small Business Administration offers a good deal of resources regarding franchising in general and financing specifically.

How long does it take to get a mortgage loan?

It depends on the type of financing you’re seeking and the lender. Financing can take anywhere from a few days to more than two months.

What is open banking?

Years ago, financial data was kept within the biggest high street banks, and this cemented their market monopoly. Open Banking, as its name denotes , is part of Europe-wide regulation to open this process up to the growing fintech sector. It stipulates that your bank or payment provider must share your information (bank account, credit card details, etc.) if you request it via authorised third parties, such as budgeting or saving apps.

How do banks implement continuous authentication?

Banks can implement continuous authentication by analysing each online user’s BionicID at every interaction – from login, to transaction, to logout, making it near impossible for any threat to slip through undetected.

Will franchising change the banking industry?

At the same time, it may well be that the rise of franchising will not only change franchisors’ behavioral patterns, but also encourage the banking sector to develop unique and relevant products. Due to the growing demand for franchises, banks and microfinance organizations are likely to introduce special, more lucrative offers for those who want ...

Is franchising a sector?

FRANCHISING: BANKING SECTOR IS A PILLAR OF EFFECTIVE BUSINESS. Franchising as one of the most progressive forms of business is becoming an increasingly comprehensive phenomenon of the modern economy. According to the experts, 2019 is expected to mark the year of professionalization for franchising: competition for new franchisees has ...

Is Credit Bank of Moscow a franchisee?

In late February, Credit Bank of Moscow, one of the country’s largest banks in terms of lending to enterprises and organizations, became a partner of the Russian Franchise Association (RAF) – a rather outside-the-box solution, given that members from the banking sector can be counted on fingers. However, the bank considers membership in the RAF as a resource that will allow more efficient financing of entrepreneurs who are going to purchase or develop franchises. Alexey Rudakov, Managing Director at Credit Bank of Moscow highlighted the advantages of banks’ participation in franchise cooperation: “It is important that we offer solutions for revenue collection, including self-encashment terminals, as well as tools for working with balances on settlement and deposit accounts. Using such complex solutions, we are able to completely cover the financial needs of the franchisee”. RAF membership typically covers networks that do business in the HoReCa field (e.g. Hilton, Burger King, Domino’s) and food retailers. The latter includes, for example, Pyaterochka, the grocery store network and partner of CBOM – that is part of X5 Retail Group, a multi-format retail company that was listed among Europe’s 10 largest retailers in 2018.

Is 2019 a franchise year?

According to the experts, 2019 is expected to mark the year of professionalization for franchising: competition for new franchisees has never been more intense. Thus, a flexible approach and new solutions are required from market players – both growing franchise networks and top range brands – to increase competitive efficiency.

Do franchisors get support from banks?

In this regard, it is possible to expect an increasing interest of both franchisors and franchisees in getting support from the banking sector, which is able to provide not only financial, but also equally important external expert support: for example, before approving a loan to buy a franchise, a bank gives the company that sells its product a long look, scrupulously checking its business model as well as its financial and legal documents.

Who said that the loan application is the asset?

Winston Shrout has said that we’ve been taught to see everything backwards, in terms of banking, with debits being credits, and credits being debits. That the loan application is the asset fits in with his theory. [ This video with Winston might have this statement.]

What is a deposit in banking?

Deposits: Customers lend money to the banks, and that becomes an asset to the bank. The bank then creates an account (payable) showing how much the bank owes the customer. The account that I think is mine, is really a bookkeeping entry. It’s an accounts payable; but the bank calls it an account for short. [Hat tip to Stop the Pirates ]

Who created the money when the customer signed the promissory note?

Many people say that the banks or Federal Reserve create money out of thin air. Well, it’s actually the customer that created the money when the customer signed the promissory note. Federal Reserve notes represent the promised dollars of loan applicants.

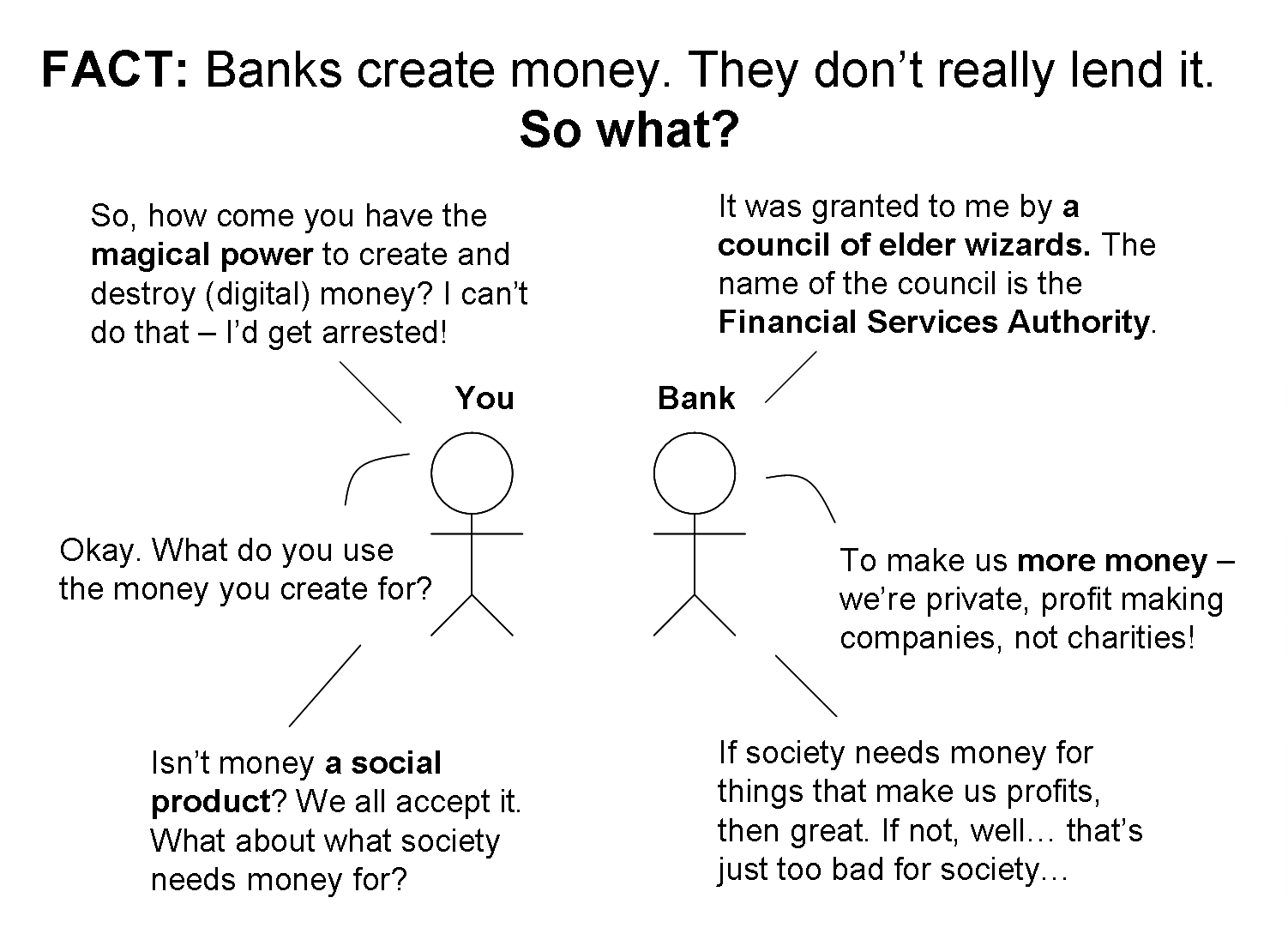

Do banks lend money?

What about lending? Surely they’re lending money. Umm. No, they don’t . Banks don’t lend money. Banks again, at law, it’s very clear. They’re in the business of purchasing securities. That’s it.

Is there money in the Federal Reserve notes?

This is true because I have not paid that $200,000. I have only promised to pay it. The Federal Reserve Notes are the ledger entries of the banks and that is what we use to trade. Those notes, I think, are currency, not money. Yes, this may be technical , but it could be significant.

Is a bank an intermediary?

Banks are being thought of intermediaries, but this not really what’s happening. Banks are creators of the money supply.

Does a bank put money into an existing account?

Note that the bank does not place the funds into the customer’s existing account. The bank creates a new account and I am saying that this is really an accounts payable.

Why do you need a franchise for a loan broker?

New franchisees can avoid a lot of the mistakes startup entrepreneurs typically make because the franchisor has already perfected daily operations through trial and error.

What does a franchisee pay?

Essentially, a franchisee (you) pays an initial fee and ongoing royalties to a franchisor. In return, the franchisee gains the use of a trademark, ongoing support from the franchisor, and the right to use the franchisor’s system of doing business and sell its loan services. When evaluating loan broker franchise opportunities, ...

What Do You Have to Lose With a Commercial Finance Franchise?

The franchisee (you) are responsible for paying these fees each year regardless of your gross income or total sales.

How to choose a franchise?

Once you’ve decided a franchise is the right route for you, how do you choose the right one? Start by investigating different commercial lending franchises which have the highest growth potential. Narrow the choices to a few companies you’re most interested in, then analyze your geographic area to see if there’s a market for that type of business. Loan broker franchise opportunities are dependent on your local market for borrowers and the types of loans your franchise is set up to provide.

What is CLBI loan broker?

The Commercial Loan Broker Network supports our students and graduates from the very beginning. From marketing your business to networking, assessing the client’s books and on to closing deals, CLBI covers the skills you need to get your feet under you for a solid launch.

How does a loan broker make money?

The loan broker franchisee makes their money from a percentage of closed deals, not from any consulting fee. A commercial finance franchise focused on consulting will assume much greater liability than a commercial loan broker franchise because the latter limits their consulting role to advising the client on loan types ...

Can a loan broker loan personal money?

Before jumping into those, it is important to highlight that in most commercial lending franchises and commercial loan broker franchises, the loan broker doesn’t loan any of their personal money.