Who is exempt from a 1099?

Trusts and nonprofit organizations are usually exempt from taxes, so you don't need to send them a 1099 form. However, if you're a tax-exempt organization, you must fill out and send this form to independent contractors, vendors, attorneys and other parties, says the IRS.

Are you self-employed if you own a franchise?

In franchising, you are self-employed and are the one that can directly impact your business performance, and in turn, your paycheck. In a job, you are most likely beholden to the employer's rules and standards.

Are franchisees considered independent contractors?

Franchisees Are Independent Contractors Franchisees are not in any partnership or joint venture with the franchisor and, in a sense, are independent contractors being taught how to operate a business while maintaining your brand standards (see “Franchise Partner: Why This is a Bad Word”).

Do I need to send a 1099 to an S Corp?

You are not required to send a 1099-MISC form to a corporation. This rule includes both C corporations and S corporations. You should still send a 1099-MISC to a single-member limited liability company or a one-person limited corporation (Ltd.), but not an LLC that has elected S corporation or C corporation status.

How do franchisees pay themselves?

Franchise owners can pay themselves a salary or depending on their business entity, they may be able to take a draw from their accumulated equity. The latter is usually only an option for limited liability corporations (LLC), S corporations, sole proprietorships and partnerships.

Is it better to be a franchise or independent?

An independent business is a good choice. But if the time and effort seem daunting or time-consuming, a franchise may be the better choice. Most of the development is already done. Franchises are turn-key businesses.

Who is my employer if I work for a franchise?

There is no “bright line” rule. Just because a business is a franchise, and your work assignments and paychecks come from the franchisee, it doesn't necessarily mean that the franchisor is not also your employer. You can have more than one employer, if both the franchisee and the franchisor control your employment.

Are franchisees considered employees?

Under Prong A of the ABC Test, a franchisee is deemed an employee rather than an independent contractor unless the franchisee is free from the control and direction of the hiring entity (the franchisor) in connection with the performance of the work, both under the contract for the performance of the work and in fact.

Does the franchisee work for the franchisor?

The relationship between the franchisor and the franchisees is symbiotic with the franchisor depending on the franchisees for revenue and the franchisees depending on the franchisor to grow the brand and create greater demand for the product/service which, in turn, leads to more customers.

Why do S corps not get 1099?

S Corps are not required to get a form 1099-MISC or 1099-NEC from their clients. Similarly, businesses that contract with S Corps do not need to issue them a Form 1099-MISC. Businesses taxed as S Corps report their employee earnings directly to the IRS and so do not require this form.

Who gets a 1099-MISC and who doesn t?

Anyone your business paid $600 or more in non-employee compensation over the year must be issued a Form 1099-MISC. According to IRS guidance, a form 1099-MISC may be required if a company makes the following types of payments: At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

Do LLC S corps get a 1099?

For single-member LLC or partnership, you will get a 1099 from a company paying $600 or more in yearly revenue. However, if an LLC is taxed as an S corporation, it will not receive a form 1099. For income tax filing with the IRS, you should know how and when to issue or get a 1099.

Does an S Corp get a 1099-NEC?

In general, you don't have to issue 1099-NEC forms to C Corporations and S Corporations. But there are some exceptions, including: Medical and health care payments. Payments to an attorney.

Does an S Corp need to fill out a w9?

When an S corporation performs services for another business, the S corporation must complete Form W-9 to provide important information to the employer. Form W-9 is not submitted to the Internal Revenue Service. An S corporation's employer has the responsibility of keeping the W-9.

Do I need to send a 1099 to an LLC?

If your business pays an LLC more than $600 a year for rent or services, you'll need to issue a 1099 Form to the LLC and file it with the Internal Revenue Service. Issuing a 1099 isn't difficult, but it's an important part of your business's accounting and tax preparation plan.

Who do you have to send a 1099 to?

To whom are you required to send a 1099? As a general rule, you must issue a Form 1099-MISC to each person to whom you have paid at least $600 in rents, services (including parts and materials), prizes and awards or other income payments. You don't need to issue 1099s for payments made for personal purposes.

What is a 1099?

Information Returns (Forms 1099) A tax-exempt organization must file required information returns, such as Form 1099-MISC PDF. An organization does not withhold income tax or social security and Medicare taxes from, or pay social security and Medicare taxes or federal unemployment tax on amounts it pays to an independent contractor (non-employee) . ...

When do you need to file 1099-MISC?

Generally, if the organization pays at least $600 during the year to a non-employee for services (including parts and materials) performed in the course of the organization’s business, it must furnish a Form 1099-MISC, Miscellaneous Income to that person by January 31 of the following year. The tax-exempt organization will need ...

How much royalties do you have to pay in lieu of dividends?

At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

What is the 1099 for fishing boats?

In addition, use Form 1099-MISC to report that you made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

What is cash payment for fish?

Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish.

What is a 1099 form?

A 1099 form is a tax form used to report income paid out in a non-employee setting. In addition to payments received as an independent contractor, 1099 forms exist to cover a range of payment types such as investment gains and prizes. Other 1099 forms include:

What information do you need to file state taxes?

State tax information: As with your federal information, your payer needs to provide their state payer identification number, the total of all state-eligible wages they paid you and the amount of state taxes withheld on your behalf.

What is a 1099?

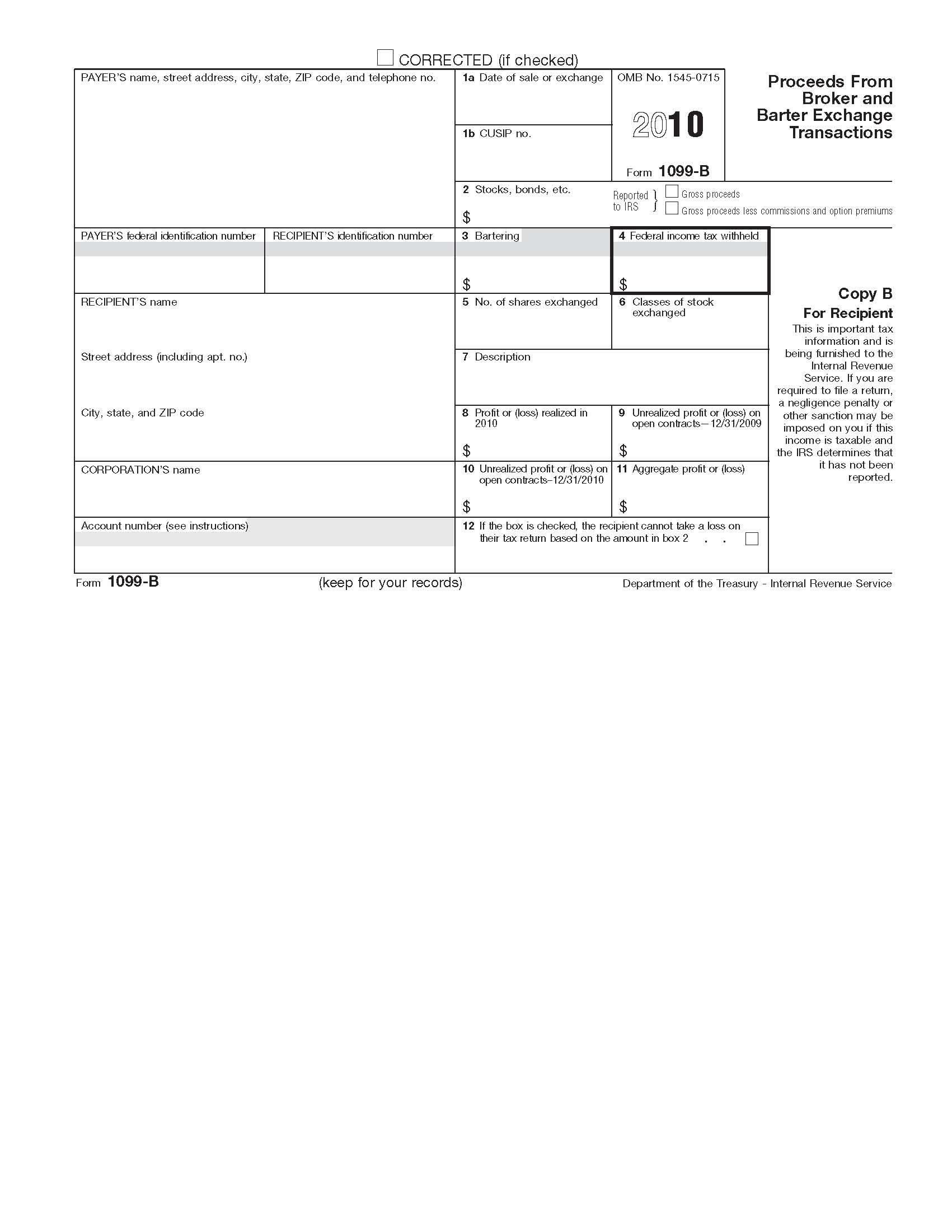

A 1099 form is a tax form used to report income paid out in a non-employee setting. In addition to payments received as an independent contractor, 1099 forms exist to cover a range of payment types such as investment gains and prizes. Other 1099 forms include: 1 1099-A for acquisition or abandonment of secured property 2 1099-B for proceeds from broker and barter exchange transactions 3 1099-C for cancellation of debt in excess of $600 4 1099-CAP for changes in corporate control and capital structure of more than $100 million 5 1099-DIV for dividends and distributions exceeding $10, or $600 for liquidations 6 1099-G for government payments larger than $10 7 1099-H for health insurance advance payments 8 1099-INT for interest income above $10 or $600 in select cases 9 1099-K for merchant card and third-party network payments over $20,000 10 1099-LTC for long-term care benefits 11 1099-OID for original issue discount more than $10 12 1099-PATR for taxable distributions received from cooperatives greater than $10 13 1099-Q for payments from qualified education programs 14 1099-R for distributions from pensions, annuities, retirement plans, IRAs or insurance contracts above $10 15 1099-S proceeds from real estate transactions above $600 16 1099-SA for distributions from HSA, Archer MSA or Medicare Advantage MSA 17 1099-SSA for social security benefits 18 1099-RRB for payments by the railroad retirement board 19 RRB-1099-R for pension and annuity income from the railroad retirement board

What information should be included on a 1099?

Compensation and federal tax information : Your 1099 should arrive with an accurate account of the total compensation you received from the payer during that year. If you elected to have the payer withhold federal income taxes from your payments, this should also be included on the form.

What should a payer include?

Payer contact information: The payer should include both a telephone number and a mailing address where you can reach them.

What happens if you overreport your income?

Over-reporting income will result in you reporting taxable income in excess of what you received, resulting in you paying more taxes than you need to. Paying taxes for a lower amount than you received can result in you then unexpectedly owing money if the mistake is noted and fixed, and it could lead to a penalty if it is determined you knowingly filed your taxes with inaccurate information. This is why it's especially important to make sure your payer's records match your own.

Why do you need an accountant?

By hiring an accountant, you simply deliver all of your relevant tax-related forms and documents. Your accountant will then perform an assessment of everything you provide and potentially ask you some follow-up questions to ensure they have all the information you need. Working with an accountant helps ensure that there are no mistakes and no savings are overlooked.

When you file 1099 for an LLC that doesn't need it?

If your company is not sure that an independent contractor should get 1099, it is recommended to make the blunder and file 1099 for the tax year. There is no penalty if you file an additional 1099 for a contractor who doesn't need it.

When should you issue 1099-MISC or 1099-NEC?

The last date to file in 2021 was 1st February because the 31st was the weekend. At the same time, the actual deadline is 31st January.

Can an LLC get a form 1099?

However, if an LLC is taxed as an S corporation, it will not receive a form 1099.

Do you need to send 1099 to a Limited Liability Company?

If the person you are working with is taxed as a company, you don't have to issue a 1099-MISC for that LLC.

How to send a 1099 to the IRS?

To ensure that you issue a correct 1099 to the recipient, complete Form W-9, Request for Taxpayer Identification and Certification. The W-9 includes the individual or businesses legal name, tax ID number, address and their signature attesting to the correctness of the content. You will then use this information to create the 1099 and send it to the IRS.

What happens if you fail to file a correct return?

If you fail to file a correct information return by the due date and you cannot show reasonable cause, you may be subject to a penalty. The amount of the penalty is based on when you file the correct information return. Currently, the penalty is:

What to do if playback doesn't begin?

If playback doesn't begin shortly, try restarting your device.

Do LLCs file the same as partnerships?

Partnerships or Multimember LLCs as they essentially file the same return as a partnership

Do I need to send a 1099 to a sole proprietor?

In addition to individuals, you must also send a 1099 to the following if you paid them for doing work: Businesses that file on form 1040 Schedule C (i.e. sole proprietors/self employed) Single member LLCs, as they are considered disregarded entities (DREs) and also file on Sch C.

When do you need to send 1099-MISC?

Generally you must furnish a copy of form 1099-MISC to the recipient by January 31 st of the year following when the payments were made. If you are reporting payments in boxes 8 or 14, then you have until February 15 th of the year following when the payments were made.

When are 1099-NEC due for 2020?

As a result of the The Protecting Americans from Tax Hikes Act of 2015 (the PATH Act), independent contractor payments are now reported via Form 1099-NEC effective tax year 2020 (being filed in 2021). The deadline for filing remains January 31st.

What businesses are exempt from 1099?

What Businesses Are Exempt From a 1099? The IRS requires businesses to send out Form 1099s to small businesses or individuals that serve as independent contractors or participate in specific transactions with the provider company. The majority of small businesses which operate as sole proprietorships, partnerships and LLCs require these 1099s ...

What business structures require a 1099?

Business structures besides corporations — general partnerships, limited partnerships, limited liability companies and sole proprietorships — require Form 1099 issuance and reporting but only for amounts exceeding $600; anyone else is 1099 exempt. Therefore, if you paid any of these entities less than $600 for rental payments or services rendered, ...

Do LLCs need 1099s?

The majority of small businesses which operate as sole proprietorships, partnerships and LLCs require these 1099s if the amounts exceed $600; however, the IRS generally exempts corporations from receiving a 1099 form except in a few circumstances.

Does the IRS levy penalties for filing 1099s?

The IRS does not levy penalties for filing 1099s that are not needed. Tiffany C. Wright has been writing since 2007. She is a business owner, interim CEO and author of "Solving the Capital Equation: Financing Solutions for Small Businesses.". Wright has helped companies obtain more than $31 million in financing.

Is a telephone payment exempt from the IRS?

The IRS exempts any payments you made to companies for telephone, freight, storage or related items. Payments you made to businesses for the purchase of merchandise are also exempt from reporting.

Is a rental payment tax exempt?

For example, all rental payments made to real estate agents are exempt, as are payments made to tax exempt entities including trusts. The IRS exempts any payments you made to companies for telephone, freight, storage or related items.

Is a 1099-MISC a barter transaction?

Although Form 1099-MISC is the most commonly used 1099, other forms apply for specific situations. Corporations are not completely exempt in those situations. Cancellation of a corporation's debt below $600 is exempt but more than that amount requires the submission and filing of Form 1099-C. Sale or abandonment of security property to you by a corporation requires Form 1099-A. A barter transaction of any amount requires Form 1099-B.