By doing so, these firms may become eligible for PPP benefits despite being otherwise too large to qualify:

- Any business that has accepted monetary assistance from the Small Business Investment Company (SBIC) program

- Franchise operations with an SBA-issued franchise identifier coder

- Faith-based organizations

- Hotels and restaurants that operate in the Accommodation and Food Service industry (according to the NAICS code list) and have fewer than 500 employees at each location

Can a franchisee apply for a PPP loan?

If a franchise brand is listed on the SBA Franchise Directory, each of its franchisees that meets the applicable size standard can apply for a PPP loan. Franchisors do not apply on behalf of each of its franchisees.

Why is a franchised business not aggregated under the PPP?

Under the PPP, a franchised business will not be aggregated if the franchise program has been assigned a franchise identifier code by the SBA (i.e., the franchise system is listed on the SBA Franchise Directory).

Can franchisees apply for Paycheck Protection Program Loans?

Under the CARES Act, franchise businesses can apply for Paycheck Protection Program (PPP) loans on a per-location basis.

What businesses are eligible for PPP loans?

What businesses are eligible to obtain PPP loans? Generally, businesses that employ no more than 500 employees. This includes sole proprietorships, self-employed individuals, and most non-profit organizations.

How many franchise owners have received PPP?

How does a franchise work?

Can a franchisee take a PPP loan?

Is a franchise a minority business?

Is Starbucks a PPP company?

Can franchises make payroll without funding?

Does IFA have a PPP loan?

See 4 more

About this website

What business is not eligible for PPP?

In general, if the applicant or the owner of the applicant is the debtor in a bankruptcy proceeding, either at the time it submits the application or at any time before the loan is disbursed, the applicant is ineligible to receive a PPP loan.

What type of business qualifies for PPP?

All Small Businesses Eligible Small businesses with 500 or fewer employees—including nonprofits, veterans organizations, tribal concerns, self-employed individuals, sole proprietorships, and independent contractors— are eligible.

Do startups qualify for PPP?

Businesses must also have 300 or fewer employees and have used up their first PPP loan or expect to use it up by the time they receive the second loan. A second loan can be up to $2 million. Startups that received PPP loans last year included Karma Automotive, Turo, and Mixpanel, according to CNBC.

Do owners count as employees for PPP?

Determining your salary for the PPP Your payroll cost for the PPP will be the earnings that you are taxed on. As an owner of an LLC, this is the full amount of your net profit, not your owner draws.

How long do you have to be in business to get a PPP loan?

Every business that applies for a PPP loan needs to have been in operation since at least February 15, 2020 to be eligible. First-time PPP borrowers from the following groups are eligible to apply: Small businesses or nonprofit organizations with 500 or fewer employees that qualify for other SBA 7(a) loans.

Can you get a PPP loan without an LLC?

Yes, Even if You Have Not Formed an LLC, You Still Qualify However, if you filed a Form 1040 Schedule C on your 2019 tax return, you likely qualify to receive a PPP loan.

Can I get a PPP loan to start a business in 2022?

Unfortunately, PPP loans in 2022 aren't happening –– eligibility for the program ended in May 2021 and there are no signs of it coming back. There are other options for securing small business funding besides PPP loans. Read on to learn about your options for how to get the funding you need.

Can a brand new business get a PPP loan?

Answer: No. In addition to small business concerns, a business is eligible for a First Draw PPP Loan if the business has 500 or fewer employees or the business meets the SBA employee-based or revenue-based size standard for the industry in which it operates (if applicable).

What are the new rules for PPP loan forgiveness?

Paycheck Protection Program (PPP) borrowers may be eligible for loan forgiveness if the funds were used for eligible payroll costs, payments on business mortgage interest payments, rent, or utilities during either the 8- or 24-week period after disbursement.

Can owners use PPP to pay myself?

You can use the PPP funds to pay yourself through what's called owner compensation share or proprietor costs. This is to compensate you for a loss of business income. To take the full amount of owner compensation share, you will have to use a covered period of at least 11 weeks weeks.

How much can owners pay themselves PPP?

It's now clear that in some situations when bank lenders applied the rules of the PPP Loan to owner compensation, they based it on your salary up to $100,000. This allowed you to use that portion of the issued funds to give yourself a full paycheck, while you were under the impression that it would later be forgiven.

Do S corp owners qualify for PPP?

Owners of 5 percent or more of an S corporation who are also employees are eligible for Payroll Protection Plan (PPP) loan forgiveness of up to 20.83% of their employee cash compensation (capped at $20,833; maximum salary of $100,000 times 20.83%), with cash compensation defined as it is for all other employees (Box 1 ...

Can a sole proprietorship get a PPP loan?

All small businesses qualify for the Payment Protection Program. This includes: Sole proprietors who report income and pay taxes on a Schedule C in your personal tax return.

What can PPP loan be used for?

First Draw PPP loans can be used to help fund payroll costs, including benefits, and may also be used to pay for mortgage interest, rent, utilities, worker protection costs related to COVID-19, uninsured property damage costs caused by looting or vandalism during 2020, and certain supplier costs and expenses for ...

Is PPP still available 2022?

Notice: The Paycheck Protection Program (PPP) ended on May 31, 2021. Existing borrowers may be eligible for PPP loan forgiveness.

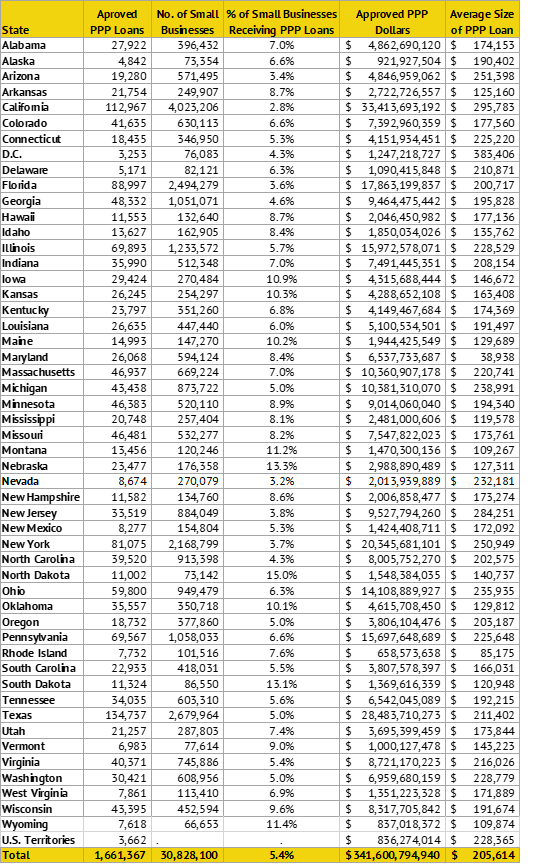

SBA Paycheck Protection Program Data Lookup - FederalPay

Under open government transparency guidelines, information on recipients of the $793B in forgivable government loans issued through the 2020 Paycheck Protection Program by the US Small Business Administration (SBA) are a matter of public record.FederalPay.org has created a powerful search tool that allows public access to the PPP loan database.

SBA Franchise Directory

This list is made available for use by Lenders/CDCs in evaluating the eligibility of a small business that operates under an agreement.

Small Business Administration

We support America's small businesses. The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow their business.

Small Business Administration | USAGov

The Small Business Administration helps Americans start, build and grow businesses. Through an extensive network of field offices and partnerships, the Small Business Administration assists and protects the interests of small business concerns.

What Is A Small Business? - United States Department of State

To be a small business, vendors must adhere to industry size standards established by the U.S. Small Business Administration (SBA) . When small firms register as a government contractor in the System for Award Management (SAM) , they also self-certify their business as small. The SBA, for most industries, defines a “small business” either in terms of the […]

Is a franchise a minority business?

No, in fact the vast majority are small business owners in every sense. According to industry research firm FRANdata, 75% of all franchise owners have fewer than 20 employees. Franchising is also more diverse than non-franchise businesses: according to U.S. Census data, nearly 30% of franchises are minority-owned, compared to 18% of non-franchised businesses.

Can franchises apply for PPP?

That allows for independently-owned and operated franchises to apply for PPP loans; without it, these independently-owned franchise businesses who operate under the same “affiliated” brand wouldn’t be eligible since only one business in the franchise system could apply. As with all PPP loans, loans going to franchise businesses require 60% ...

Can a franchisee take a PPP loan?

Since the corporate business is a separate business from its franchisees, the corporate office may be eligible for a PPP loan to ensure that corporate office employees can remain on payroll. Some franchise brands can take loans on behalf of locations they operate directly.

Is Starbucks a PPP company?

No. Some chains, like Shake Shack and Starbucks, are wholly corporately owned. When a corporate chain applies for a PPP loan by location, all the loan funding goes to the corporate entity.

Is 90% of franchise money local?

No, this could not be further from the economic truth. 90% of the money generated by franchises stays local, where it is locally shared, locally invested, and leads to growth in the community. Most franchise agreements are structured so that the individual business owner pays an upfront initial franchise fee, and then a small percentage of royalties to the franchise brand annually throughout the life of their contract. The idea that corporate HQ's just "siphon" money - including PPP money - away from individual franchise owners and local communities is preposterous and simply not true.

Why did the PPP run out of funds?

Because of overwhelming demand from businesses applying for loans through the PPP since the program’s April 3, 2020 launch, last week the PPP ran out of funds. This prompted Congress to develop a plan to replenish the funds to continue the program.

What is the PPP increase?

On April 23, 2020, the House passed the Paycheck Protection Program Increase Act of 2020 after the Senate unanimously passed the legislation on April 21. The new act adds an additional $310 billion to fund the Paycheck Protection Program (PPP) under the Coronavirus Aid, Relief and Economic Security Act (CARES Act). President Trump has committed to signing the act into law. The act sets aside $60 billion for community-based and smaller lenders to assist smaller businesses that were unable to access PPP funds during the first round of loans.

What happens if a franchise is not listed on the SBA Franchise Directory?

If a franchised business is not listed on the SBA Franchise Directory, the SBA’s affiliation rules will apply to determine whether the franchised business will be aggregated for purposes of determining PPP eligibility. If affiliation is found within a franchise system, the businesses will be aggregated. As a result, franchisors and franchisees may be disqualified from obtaining relief under the PPP, or the franchisors and franchisees may face delays in the application process as a result of having to challenge the affiliation determination if the franchised business is not listed on the SBA Franchise Directory.

How to list on SBA franchise directory?

Listing on the SBA Franchise Directory under the traditional category is obtained through an application by the franchisor. The franchisor must typically submit its franchise agreement and FDD. In lieu of submitting its franchise agreement, the franchisor may agree to use a form SBA addendum to the franchise agreement, which removes the disqualifying control provisions from the franchise agreement, to bypass the affiliation determination and be added to the SBA Franchise Directory. Alternatively, the franchisor may negotiate the terms of an addendum with the SBA, removing the disqualifying franchise agreement provisions.

What are the two categories of SBA franchises?

There are now two separate categories on the SBA Franchise Directory: 1) the traditional category, applicable to SBA 7 (a) loans and PPP loans; and 2) the new category, applicable solely to PPP loans.

What is an affiliate test?

Traditionally, the SBA has used an “affiliation” test to assess whether a business’s affiliates will be considered part of the same entity in order to determine eligibility for SBA-administered loan programs (i.e., whether the entity is a small business concern or, in this case, has more than 500 employees). According to the SBA, “affiliation exists when one business controls or has the power to control both businesses. Control may arise through ownership, management, or other relationships or interactions between the parties.”

Does the SBA require a franchise to submit FDD?

The SBA reports it is processing SBA Franchise Directory requests “as quickly as possible” and still requires a franchisor who wants its brand on the SBA Franchise Directory under either category to submit its franchise agreement and FDD. However, the SBA is conducting expedited reviews and not undertaking the affiliation assessment for franchisors in the new category.

When will the SBA start taking PPP loans?

On April 3, 2020, banks commenced taking applications for the Small Business Administration’s (“SBA”), Paycheck Protection Program (the “PPP”) loans, as provided in the Coronavirus Aid, Relief, and Economic Security Act aka the CARES Act . At the highest level, the PPP allows eligible businesses to borrow up to 2.5x average monthly payroll costs from the last year, subject to a $10 million cap.

Why is the SBA's PPP determination important?

Affiliation determinations are significant under the PPP because the applicant and each “affiliate” is viewed as one business for purposes of calculating the number of employees.

When are entities affiliates?

Under the SBA’s PPP guidance, entities are affiliates when one controls or has the power to control the other, or a third party has the power to control both. It does not matter if control is exercised, just that it may be exercised.

Can a franchise business get a PPP loan?

Under the guidance, a franchised business is eligible for a PPP loan, but if the franchise system has over 500 employees and the franchisor is not listed on the Registry, it is possible the SBA may apply the affiliation rules. At this point, it is not certain.

What are the rules for PPP?

On April 14, 2020, the SBA issued additional Interim Rules, which confirm and clarify eligibility of the following: 1 Businesses who have certain directors or certain equity holders that sit on the board of directors of PPP Lenders; and 2 Businesses that receive legal gaming revenues.

How many loans are guaranteed under PPP?

The Small Business Administration ("SBA") has guaranteed over one million loans under the Paycheck Protection Program ("PPP") through April 13, 2020. Over 4,600 lenders throughout the U.S. have been tasked with serving as conduits for distributing $350 billion in federal loan funds made available for the PPP, with 85% of those funds having already ...

What information is required for a PPP loan?

Lenders are required to collect owner name, title, ownership percentage, TIN/SSN, and address for each owner of 20% ownership stake in any applicant for a PPP loan. If a PPP loan is being made to a new customer, the lender's collection of such information will satisfy the BSA and FinCEN regulations regarding collection of beneficial ownership information. If any ownership interest of 20% or greater in the applicant business belongs to a business or other legal entity, lenders must collect appropriate beneficial ownership information for that entity as well.

Can a franchisee apply for a PPP loan?

If a franchise brand is listed on the SBA Franchise Directory, each of its franchisees that meets the applicable size standard can apply for a PPP loan. Franchisors do not apply on behalf of each of its franchisees. The $10 million cap is a limit per franchisee, and each franchisee is limited to one PPP loan.

Who has a responsibility to collect information and certifications contained in the Borrower Application Form?

Lenders have a responsibility to collect the information and certifications contained in the Borrower Application Form, and must have fulfilled its obligations set forth in the PPP Interim Final Rule before submitting a PPP loan application to SBA through E-Tran.

Do you need a written statement for a PPP loan?

However, for PPP loans, no such written statement is required.

When does the PPP run out?

The window to apply for the PPP closes either when the $349 billion runs out (on a first-come-first-served basis) or on June 30, 2020 —whichever happens first.

How much is the PPP loan cap?

The $10 million cap on PPP loans is a limit per franchisee entity, and each franchisee is limited to one PPP loan. Franchise brands that have been denied listing on the Directory because of affiliation between franchisor and franchisee may request listing to receive PPP loans.

What is the SBA form for PPP?

Generally, applicants must initially submit a completed SBA Form 2483 (Paycheck Protection Program Application Form) and payroll and other documentation to a PPP lender. The lender may require additional documentation as it deems necessary.

When can independent contractors apply for PPP?

While the PPP regulations clearly state that businesses cannot include independent contractors in their payroll calculations, it also states that independent contractors can apply separately for their own PPP loans starting on April 10, 2020.

How many employees are eligible for small business tax?

However, some businesses can be eligible even if they have more than 500 employees, as long as they satisfy the existing statutory and regulatory definition of a “small business concern” under section 3 of the Small Business Act, 15 U.S.C. 632.

When can EIDL be added to PPP?

If there is an outstanding amount of an Economic Injury Disaster Loan (EIDL) made between January 31, 2020, and April 3 , 2020, that amount can be added to the PPP loan amount request, less the amount of any loan advance received.

Does the SBA have affiliation rules?

SBA will not apply affiliation rules to a franchise brand requesting listing on the Directory to participate in the PPP, but SBA will confirm that the brand is otherwise eligible for listing on the Directory.

What was the shortcoming of the original PPP guidelines?

The ease with which larger corporations could take advantage of the affiliate rule exemptions was a shortcoming of the original PPP guidelines. Many franchises, restaurant chains, and large hotels successfully applied for loans, even though they had other assets and safety nets to keep them afloat through the temporary pandemic shutdown. Critics argued that this violated the spirit of the law by depriving small businesses of urgently needed funds.

What is the Paycheck Protection Program?

In general, the program was designed to assist small businesses with fewer than 500 employees. Larger companies may have also been eligible through the affiliate rule exemptions and the loan necessity certification process.

What is the eligibility for PPP loan?

Eligibility in General: A business is eligible for a First Draw PPP loan if it was operating on February 15, 2020, with 500 or fewer employees whose principal place of residence is in the United States, or if it is a business that operates in a certain industry and meets the applicable SBA employee-based size standards for that industry or applicable annual receipts-based size standards. There are other categories, including certain nonprofit organizations, veteran organizations, and tribal organizations, and self-employed workers and independent contractors. Under the Economic Aid Act, 501 (c) (6), destination marketing organizations, eligible nonprofit news organizations, and housing cooperatives are also eligible, although some have a 300 employee limitation. Under the ARP, additional entities were made eligible. In addition, the Treasury Department and the SBA have issued interim final rules and FAQs indicating that businesses must also meet the SBA’s definition of a “small business concern,” unless that requirement is specifically waived in the CARES Act and other guidance. For general eligibility requirements for First Draw PPP Loans, see our article “ What to Know about the Paycheck Protection Program, Round Two .”

What are the factors that make a business ineligible for PPP?

PPP Specific Industries, Activities, and Other Factors: The following activities and industries make a business ineligible: illegal activity under federal, state, or local law; household employer (individuals who employ household employees such as nannies or housekeepers);

When was the PPP loan enacted?

On December 27, 2020, the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (the “ Economic Aid Act ”) was enacted and authorized additional funds for new First Draw PPP Loans and for Second Draw PPP Loans. On January 6, 2021, the SBA and the Department of Treasury released an Interim Final Rule called “Business Loan Program ...

Why is a hedge fund considered a private equity firm?

a hedge fund or private equity firm because they are primarily engaged in investment or speculation.

Can a business in bankruptcy get a PPP loan?

The SBA’s position has been that businesses in bankruptcy were disqualified from receiving PPP loans. In Alaska, a federal court granted a summary judgment for a debtor that challenged its ineligibility for a PPP loan because it was in “bankruptcy.” However, there is a split among courts that have considered the question. The Economic Aid Act has addressed some of this issue for debtors that are proceeding under Subchapter V of Chapter 11, as well as Chapter 12 and Chapter 13 debtors, by providing that the bankruptcy court, after notice and a hearing, may authorize such a debtor in possession or a trustee to obtain a First Draw PPP Loan or Second Draw PPP Loan. In addition, the SBA has addressed some issues in their guidance. However, these items do not resolve pending litigation over the SBA’s prohibition against extending PPP loans to Chapter 11 debtors that are not proceeding under Subchapter V.

Is a business eligible for a PPP loan?

For PPP purposes and as amended by the Economic Aid Act, the ARP Act and rules, some businesses are ineligible for both First and Second Draw PPP Loans. There are PPP specific exclusions and general SBA categories of ineligible businesses depending on the owners’ or businesses’ status, activities, or industry, and there are other eligible businesses. There have also been challenges to the ineligibility rules for PPP loans.

Is there a second draw for PPP?

The eligibility requirements for Second Draw PPP Loans are narrower than the eligibility requirements for First Draw PPP Loans. For the general eligibility requirements for Second Draw PPP loans, see our article “ Economic Aid Act: 10 Things to Know about Second Draw PPP Loans .”

Who can apply for PPP with an unaffiliated lender?

You are an officer or key employee of the lender you are applying with, or a close relative of one (you may only apply for the PPP with an unaffiliated lender)

When do you need to run payroll for PPP?

You will need to have run payroll in 2019 or 2020 to qualify for the PPP. Faith-based organizations should also consult the SBA’s guidance on eligibility.

Can you file for PPP if you were only paid through owner draws?

Only S corps who have payroll are eligible for the PPP. If you were only paid through owner draws or distributions and did not pay payroll tax, you have no payroll costs to report and the PPP is not suitable for you.

Can a C corps receive PPP?

Only C corps who have payroll are eligible for the PPP. If you were only paid through owner’s draws or distributions and did not pay payroll tax, you have no payroll costs to report and the PPP is not suitable for you.

Can a PPP loan be used for self employment?

PPP loans also provide coverage for the partners that can’t take a salary. You can include their self-employment earnings as reported on their Schedule K-1 capped at $100,000 and multiplied by 0.925

Is PPP open for second time borrowers?

PPP loan applications for both first and second time borrowers are open now.

Do you have to file a 940 for 2019?

While it does not have to be filed, it must be complete and accurate. You must have reported a net profit on your Schedule C in 2019 or 2020. If you also have employees on payroll, you do not need a net profit, but you must have payroll tax forms 940 and 941/944 for 2019 or 2020.

How many franchise owners have received PPP?

The International Franchise Association conducted a survey of its membership and found that only 11% of franchise owners have received PPP funding. These are small businesses that are trying to keep their employees on payroll but cannot do so because they do not have funding and do not have customers to bring in revenue.

How does a franchise work?

How Does Franchising Work? Franchising is an arrangement where a name brand company grants a local entrepreneur the right to use its business name, trademarks, and processes to produce and market a good or service. The business owner usually pays a one-time fee and a percentage of sales revenue as royalty. Typically, the brand provides national ...

Can a franchisee take a PPP loan?

Since the corporate business is a separate business than its franchisees, the corporate office may be eligible for a PPP loan to ensure that corporate office employees can remain on payroll. Some franchise brands can take loans on behalf of locations they operate directly. Additionally, this funding is regularly used to provide royalty relief or other assistance to franchises so that franchise employees can also remain on payroll.

Is a franchise a minority business?

No, in fact the vast majority are small business owners in every sense. According to industry research firm FRANdata, 75% of all franchise owners have fewer than 20 employees. Franchising is also more diverse than non-franchise businesses: according to U.S. Census data, nearly 30% of franchises are minority-owned, compared to 18% of non-franchised businesses.

Is Starbucks a PPP company?

No. Some chains, like Shake Shack and Starbucks, are wholly corporately owned. When a corporate chain applies for a PPP loan by location, all the loan funding goes to the corporate entity.

Can franchises make payroll without funding?

Additionally, the survey results show that many of those who have had their loans approved are still waiting for their funding. Without these funds, many franchise businesses will be unable to make payroll and pay other business expenses, like rent and utilities.

Does IFA have a PPP loan?

Yes, IFA’s goals for the PPP loan program are outlined in this letter from the Economic Innovation Group. They are focused on increasing access and effectives for businesses who need PPP loans.