When will Illinois franchise tax be phased out?

The Illinois franchise tax is scheduled to be completely phased out in 2024, which will provide significant tax savings for corporations with large paid-in capital allocated to Illinois and eliminate an administrative burden for all corporations doing business in Illinois. Taxpayers should be aware, however, that although ...

What happens if you pay franchise taxes?

If a taxpayer pays all unpaid franchise taxes and license fees for any taxable period included in the amne sty program, the Secretary of State will abate and not seek to collect any interest or penalties, and it will not seek civil or criminal prosecution, for the period for which such taxes and fees are paid.

What is the amnesty program for Illinois?

The new law provides two amnesty programs for delinquent taxpayers. One program is for taxpayers owing franchise taxes or license fees imposed by the Illinois Business Corporation of 1983 for any tax period ending after March 15, 2008 and on or before June 30, 2019. This amnesty program is available only between October 1, 2019 and November 15, 2019. Taxpayers with unpaid franchise taxes or license fees for the relevant period can realize significant benefits by participating in the program. If a taxpayer pays all unpaid franchise taxes and license fees for any taxable period included in the amnesty program, the Secretary of State will abate and not seek to collect any interest or penalties, and it will not seek civil or criminal prosecution, for the period for which such taxes and fees are paid. Considering that unpaid franchise taxes accrue interest at a rate of 2% per month, the waiver of interest can result in significant savings. Further, amnesty will be available with respect to any taxable period for which a taxpayer pays all back franchise taxes and fees, even if the taxpayer does not pay all taxes and fees that it may owe for all periods. Amnesty is not available, however, for any taxpayer who is a party to any criminal investigation or any civil or criminal litigation pending in court for nonpayment, delinquency or fraud concerning franchise tax or license fees.

When is the second tax amnesty in Illinois?

A second amnesty program is available for unpaid taxes owed to the Illinois Department of Revenue for taxable periods ending after June 30, 2011 and prior to July 1, 2018. Like the franchise tax amnesty program, this program runs from October 1, 2019 through November 15, 2019, and provides that the Department of Revenue will abate and not seek to collect any interest or penalties, and it will not seek civil or criminal prosecution, for any taxable period for which amnesty is granted. However, unlike the franchise tax amnesty program, a taxpayer’s failure to pay all taxes owed to Illinois for any taxable period will invalidate any amnesty under this program, and amnesty under this program is not available to any taxpayer who is a party to any criminal investigation or any civil or criminal litigation pending in court for nonpayment, delinquency or fraud concerning any taxes owed to Illinois.

When are franchise taxes due?

Fortunately, the new legislation phases out the franchise tax beginning in 2020. The new law exempts the first $30 of a corporation’s franchise tax due in 2020, with the exemption amount increasing to $1,000 for taxes due in 2021, $10,000 for taxes due in 2022 and $100,000 for taxes due in 2023.

What is paid in capital in Illinois?

The amount of a corporation’s paid-in capital that is allocated to Illinois is based on the percentage of the corporation’s total property and total business that is allocated to Illinois. A corporation’s paid-in capital is generally the amount of consideration paid to the corporation in connection with the issuance of shares ...

Can a corporation with paid in capital be stuck paying franchise taxes?

Given the difficulty in reducing paid-in capital, a corporation with significant paid-in capital can be stuck paying high franchise taxes even for years in which the corporation performs poorly and even if the value of the corporation drops significantly from when it received its paid-in capital. This is just one of the franchise tax traps ...

What is franchise tax in Illinois?

The Illinois Franchise Tax is a weird tax. It is imposed on the privilege of exercising a franchise in Illinois or, in the case of foreign corporations, for the authority to transact business in the state. It is administered by the Illinois Secretary of State, not the Department of Revenue, and is measured by paid-in capital.

How long does it take to challenge a franchise tax?

Because the Franchise Tax is administered by the Secretary of State, challenges to an assessment of tax must be made to the Secretary within three years after the amount to be adjusted should have been paid.

What is franchise tax?

Franchise Tax Base. The Franchise Tax can be split into three different taxes: the initial franchise tax, the annual franchise tax, and an additional franchise tax. The initial franchise tax is paid when a foreign corporation applies with the state for authority to transact business in the state. In the case of a domestic corporation, ...

How does a corporation reduce its paid in capital?

A corporation may reduce its paid in capital by resolution of its board of directors by charging against its paid-in capital (i) the paid-in capital represented by shares acquired and cancelled by the corporation, (ii) dividends paid on preferred shares, or (iii) distributions as liquidating dividends. [7] .

What can a corporation do in Illinois without being subject to the tax?

Specifically, a corporation may conduct any of the following activities in Illinois without being subject to the tax: Maintain, defend, or settle any proceeding; Hold meetings of the board of directors or shareholders or carry on other activities concerning internal corporate affairs; Maintain bank accounts;

How long does it take to complete an isolated transaction in Illinois?

Solicit or obtain orders if orders require acceptance outside Illinois before they become contracts; own, without more, real or personal property; Conduct an isolated transaction that is completed within 120 days and that is not one in the course of repeated transactions of a like nature; or.

Do foreign companies pay franchise tax in Illinois?

Not all foreign corporations with nexus in Illinois need pay the Franchise Tax. Illinois law provides a list of activities that do not constitute “transacting business.”. [3] Thus, even though a business may have nexus with Illinois for sales tax, corporate income tax, or some other Illinois tax, that business may not be subject to ...

When is the second tax amnesty in Illinois?

A second amnesty program is available for unpaid taxes owed to the Illinois Department of Revenue for taxable periods ending after June 30, 2011 and prior to July 1, 2018. Like the franchise tax amnesty program, this program runs from October 1, 2019 through November 15, 2019, and provides that the Department of Revenue will abate and not seek to collect any interest or penalties, and it will not seek civil or criminal prosecution, for any taxable period for which amnesty is granted. However, unlike the franchise tax amnesty program, a taxpayer’s failure to pay all taxes owed to Illinois for any taxable period will invalidate any amnesty under this program, and amnesty under this program is not available to any taxpayer who is a party to any criminal investigation or any civil or criminal litigation pending in court for nonpayment, delinquency or fraud concerning any taxes owed to Illinois.

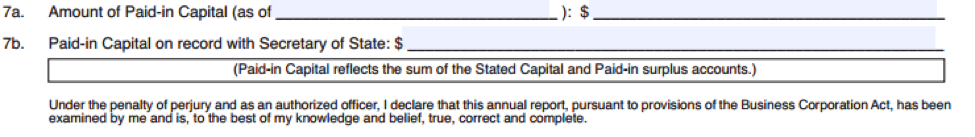

What is paid in capital in Illinois?

The amount of a corporation’s paid-in capital that is allocated to Illinois is based on the percentage of the corporation’s total property and total business that is allocated to Illinois. A corporation’s paid-in capital is generally the amount of consideration paid to the corporation in connection with the issuance of shares ...

What is the amnesty program for Illinois?

The new law provides two amnesty programs for delinquent taxpayers. One program is for taxpayers owing franchise taxes or license fees imposed by the Illinois Business Corporation of 1983 for any tax period ending after March 15, 2008 and on or before June 30, 2019. This amnesty program is available only between October 1, 2019 and November 15, 2019. Taxpayers with unpaid franchise taxes or license fees for the relevant period can realize significant benefits by participating in the program. If a taxpayer pays all unpaid franchise taxes and license fees for any taxable period included in the amnesty program, the Secretary of State will abate and not seek to collect any interest or penalties, and it will not seek civil or criminal prosecution, for the period for which such taxes and fees are paid. Considering that unpaid franchise taxes accrue interest at a rate of 2% per month, the waiver of interest can result in significant savings. Further, amnesty will be available with respect to any taxable period for which a taxpayer pays all back franchise taxes and fees, even if the taxpayer does not pay all taxes and fees that it may owe for all periods. Amnesty is not available, however, for any taxpayer who is a party to any criminal investigation or any civil or criminal litigation pending in court for nonpayment, delinquency or fraud concerning franchise tax or license fees.

Is Illinois a franchise tax?

The Illinois franchise tax is imposed on domestic and foreign corporations for the privilege of doing business in Illinois. Its repeal is welcome news to many who have long criticized the way the tax is calculated, the administrative burdens it places on taxpayers, and its traps for the unwary.

Can a corporation with paid in capital be stuck paying high franchise taxes?

Given the difficulty in reducing paid-in capital, a corporation with significant paid-in capital can be stuck paying high franchise taxes even for years in which the corporation performs poorly and even if the value of the corporation drops significantly from when it received its paid-in capital. This is just one of the franchise tax traps that have surprised corporations doing business in Illinois.

When will Illinois remove 1248 dividends?

Applicable to tax years ending on or after June 30, 2021, Section 1248 dividends are removed from the definition of “dividends” for purposes of Illinois' DRD. Observation: Generally an IRC Section 1248 dividend for federal purposes is afforded IRC Section 245A DRD treatment, although some exceptions may apply.

What is the Illinois withholding credit?

Partners or shareholders of the electing entity are allocated a credit reflecting their share of the entity-level tax that can then be used against their own tax liability within Illinois, and Illinois withholding requirements are suspended for any year in which a partnership has elected into the tax. The credit is equal to 4.95% of their distributive share of the net income of the electing partnership or S corporation.

When does the 50% GILTI deduction end?

providing addbacks for the 50% GILTI deduction, IRC Section 245A deduction and IRC Section 243 (e) deduction, starting in tax years ending on or after June 30, 2021

How long does the statute of limitations for a refund last?

Effective upon enactment, S.B. 2279 provides that, upon filing a claim for a credit or for a refund, if the statute of limitations will expire less than six months after the date a taxpayer files the claim for credit or refund, there will be an automatic six-month extension of the statute of limitations for assessing additional tax due. The change applies to income tax and sales tax (retailers occupation tax, use tax, service occupation tax, and service use tax).

Does Illinois allow foreign dividends?

Prior to S.B. 2017, Illinois generally allowed a DRD for foreign dividends . Applicable to tax years ending on or after June 30, 2021, the Illinois DRD does not apply to dividends for which a deduction is allowed under IRC Section 245 (a). IRC Section 245 (a) allows dividends from a qualified 10%-owned foreign corporation to qualify for ...

Is 100% bonus depreciation federal?

Depreciation is treated as if the taxpay er elected not to claim bonus depreciation on such 100% federally depreciable property. This results in 100% bonus property being depreciated under regular Section 168 treatment.

Is the Illinois Legislature expected to sign bills?

The Illinois Legislature has passed several bills that the governor is expected to sign. The bills as passed by the legislature are summarized below. We will update this Insight to provide enactment dates, veto actions, or other changes to these bills.

Applicability of The Franchise Tax

- The Franchise Tax is imposed upon domestic corporations and foreign corporations for the authority to transaction business in Illinois. The tax strictly applies to corporations; banks and insurance companies, which register with separate Illinois agencies, are not subject to the tax. Similarly, while LLCs have their own registration obligation with...

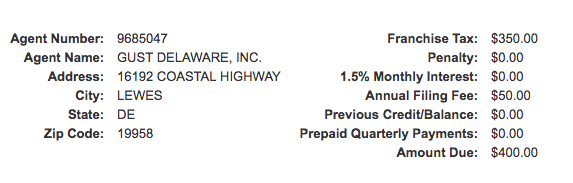

Franchise Tax Base

- The Franchise Tax can be split into three different taxes: the initial franchise tax, the annual franchise tax, and an additional franchise tax. The initial franchise tax is paid when a foreign corporation applies with the state for authority to transact business in the state. In the case of a domestic corporation, the initial franchise tax is due upon the first issuance of shares. An annua…

Appeals and Protests

- Because the Franchise Tax is administered by the Secretary of State, challenges to an assessment of tax must be made to the Secretary within three years after the amount to be adjusted should have been paid. Generally speaking, but not always, a corporation should file a statement of correction with the Secretary which will supply the grounds for the need for an adju…

Conclusion

- Very few states employ a tax on paid-in capital in the manner Illinois does. Foreign corporations that may be doing business in Illinois should be careful to examine their business activities to determine whether they have a Franchise Tax obligation. Most importantly, corporations engaged in mergers and acquisitions with Illinois corporations should be careful to examine how such re…