Franchise taxes are levied yearly with varying deadlines. The due date may also depend on the type of business. For example, in Delaware, corporations must pay their franchise taxes by March 1st, while LLCs have until June 1st to pay their taxes.

Full Answer

When are franchise taxes due in your state?

Franchise taxes are levied yearly with varying deadlines. The due date may also depend on the type of business. For example, in Delaware, corporations must pay their franchise taxes by March 1st, while LLCs have until June 1st to pay their taxes. Some states have due dates on the 15th of the third or fourth tax year month.

Do corporations have to pay franchise taxes?

However, it is common for franchise taxes to be assessed not just to corporations but to other companies as well. In addition to federal corporate income tax, some states assess a corporate income tax. Some cities also assess corporate income taxes.

How much does it cost to file a franchise tax return?

In addition to filing and paying the $800 Annual LLC Franchise Tax, you’ll also have to file a return called Form 3536, Estimated Fee for LLCs, and pay an additional fee only if your LLC will make $250,000 or more during the tax year. The more you make, the higher the fee.

How do I pay the $800 franchise tax?

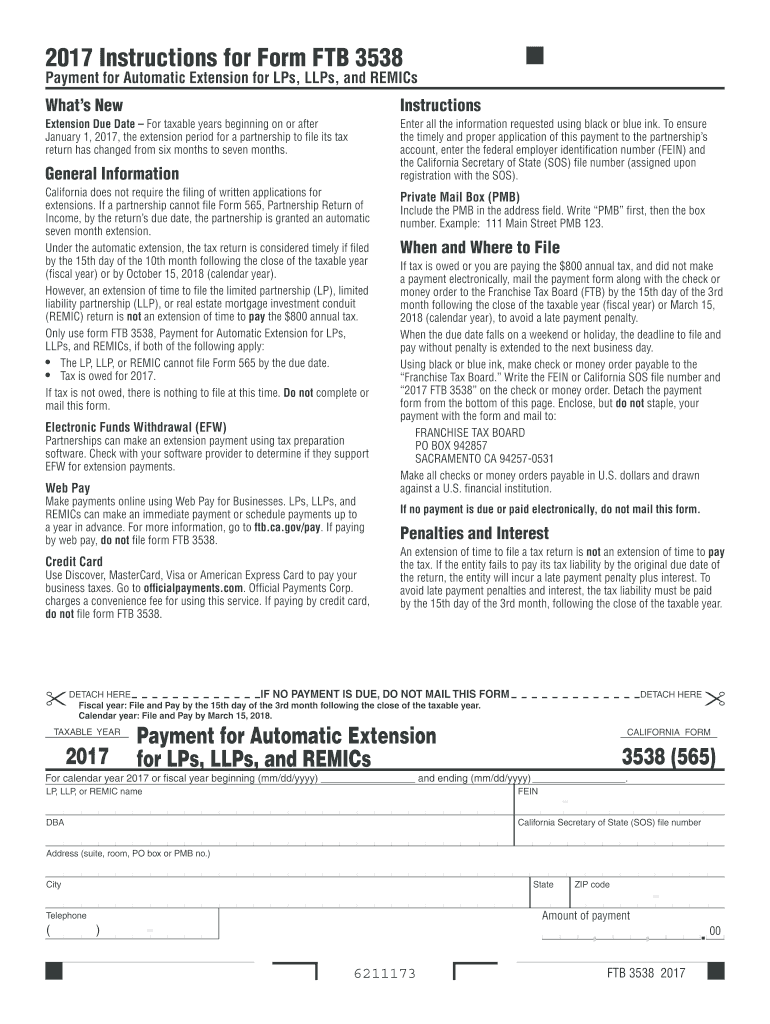

• Form 3522 is used to pay the $800 Annual Franchise Tax each year. • Download Form 3522: Visit the FTB Forms page. Click “Online”. Select the appropriate tax year.

Do I have to pay franchise tax in California the first year?

Newly Incorporated or Qualified Corporations Your first tax year is not subject to the minimum franchise tax. After the first year, your tax is the larger of your California net income multiplied by the appropriate tax rate or the minimum franchise tax.

Do you have to pay the $800 California LLC fee the first year?

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

How do I pay my California Franchise Tax?

How to Pay CA Franchise Tax Board TaxesWeb Pay – Individual and Business taxpayers.Mail – Check, Money Order.In-Person at Franchise Tax Board Field Offices.Credit Card – Online through Official Payments Corporation at: www.officialpayments.com.

How do I pay the $800 franchise tax?

The state requires corporations to pay either $800 or the corporation's net income multiplied by its applicable corporate tax rate, whichever is larger. You may pay the tax online, by mail, or in person at the California Franchise Tax Board Field Offices.

What happens if you don't pay California Franchise Tax?

The California Franchise Tax Board imposes a penalty if you do not pay the total amount due shown on your tax return by the original due date. The penalty is 5 percent of the unpaid tax (underpayment), plus 0.5 percent of the unpaid tax for each month or part of a month it remains unpaid (monthly).

What happens if you dont pay franchise tax Board?

Penalty. 5% of the amount due: From the original due date of your tax return. After applying any payments and credits made, on or before the original due date of your tax return, for each month or part of a month unpaid.

How do I avoid franchise tax in California?

One way to avoid paying franchise tax is to operate as a sole proprietorship or general partnership—but you would have to sacrifice the liability protection that LLCs and corporations enjoy. Some charities and nonprofits qualify for an California Franchise Tax Exemption.

Why do I owe money to the Franchise Tax Board?

The California Franchise Tax Board is responsible for collecting personal income tax and corporate income tax in the State of California. California taxpayers are required to pay their taxes to the FTB. However, after filing their taxes, many taxpayers still have an outstanding tax bill with the FTB.

Can you pay CA franchise tax Online?

California's Franchise Tax Board has made it easier to pay your individual and business state-related taxes online.

How much tax does an LLC pay in California?

Your LLC pays California corporation taxes. If taxed like a C Corp, you pay a flat 8.84% tax on net income. If taxed like an S Corp, pay a 1.5% tax on net income.

What is the minimum franchise tax in California?

$800Every corporation that is incorporated, registered, or doing business in California must pay the $800 minimum franchise tax.

How much does it cost to file an LLC in California?

California LLC Fee The CA LLC fee is $85, payable to the secretary of state. In addition, a California LLC fee is also due for the statement of information, a document that must be submitted within 90 days of LLC formation and carries a filing cost of $20.

How do I pay my 800 LLC fees?

You can pay the $800 annual tax with Limited Liability Company Tax Voucher (FTB 3522) by the 15th day of the 4th month after the beginning of the current tax year. You can estimate and pay the LLC fee with Estimated Fee for LLCs (FTB 3536) by the 15th day of the 6th month after the beginning of the current tax year.

What is account period beginning date?

In financial accounting the accounting period is determined by regulation and is usually 12 months. The beginning of the accounting period differs according to jurisdiction. For example, one entity may follow the calendar year, January to December, while another may follow April to March as the accounting period.

How do I avoid LLC tax in California?

Can I avoid the California Franchise Tax? There's no way for a registered business to legitimately avoid the California Franchise Tax. Sole proprietors and general partnerships don't have to pay the California Franchise Tax, but they also don't have any personal liability protection.

Is the $800 LLC fee deductible for California?

Every year after that, the tax payments are due on the 15th of the fourth month of your tax year — April 15 for most businesses. Plus, California's LLC annual fee is tax deductible for federal taxes. You can deduct the $800 Franchise Tax – and any additional annual fee you pay.

What is franchise tax in Texas?

The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.

When are Texas franchise tax returns due 2021?

Due to statewide inclement weather in February 2021, the Texas Comptroller of Public Accounts is automatically extending the due date for 2021 Texas franchise tax reports to June 15, 2021, consistent with the Internal Revenue Service (IRS). See Comptroller Hegar’s press release.

How much is the penalty for filing taxes after the due date?

Penalties and Interest. A $50 penalty is assessed on each report filed after the due date. If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed. If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

Do franchise tax filers get a reminder?

Most franchise tax filers will receive an email in lieu of a mailed reminder to file or seek an extension. If we do not have your email address on file (if you are a first-year filer, for example), we will mail a reminder notice to you.

What is franchise tax?

A corporate franchise tax is a tax imposed by a state on corporations, LLCs, and partnerships. This tax is assessed to these companies for the privilege of either doing business in the state or incorporating their business in that state. Like income taxes, typically franchise taxes are assessed annually.

What is corporate franchise tax?

A corporate franchise tax is a tax imposed by a state on corporations, LLCs, and partnerships for doing business or incorporating their business in that state.10 min read. A corporate franchise tax is a tax imposed by a state on corporations, LLCs, and partnerships.

What States Have Franchise Taxes?

Currently, there are 14 states that have franchise taxes, including the following:

How Do States Determine Franchise Taxes?

Each individual state has its own individual criteria for determining the type of entities that are required to pay franchise tax and how they are going to tax such entities.

How much did Minnesota franchise tax collections total in 2015?

For example, the Minnesota Management and Budget office estimated that in February 2015, corporate franchise tax collections totaled approximately $1.32 billion for fiscal year 2015. The Minnesota Management and Budget office also estimated that 2016's corporate franchise tax collection would amount to approximately $1.3 billion.

How much is franchise tax in Louisiana?

It charges a minimum franchise tax of $110.

What are the different types of taxes?

There are two different types of taxes that can be assessed on businesses: corporate income taxes and franchise taxes. The difference is found in looking at what exactly is being taxed. Income taxes apply to profit. Franchise taxes do not apply to profit.

How to annualize franchise revenue?

To annualize total revenue, divide total revenue by the number of days in the period upon which the report is based, then multiply the result by 365.

What is franchise tax in Texas?

What is franchise tax? The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. What does an entity file if it is ending its existence or no longer has nexus? An entity ending its existence that is not part of a combined group must file.

When is a payment considered timely?

If you are not paying electronically, your payment will be considered timely if it is postmarked on or before the due date, or hand delivered to a local Comptroller's office during normal business hours on or before the due date.

When are LLC taxes due?

Your first $800 payment for the LLC Franchise Tax is due by 15th day of the 4th month after your LLC is filed. The month your LLC is filed counts as Month 1, regardless if you file on the 1st of the month, the last of the month, or any day of the month, really. This means that if you were to file your LLC on March 22nd, ...

How long do you have to pay taxes on an LLC in California?

There’s no way to get around this tax. If you want to form an LLC in California, you have to pay this $800 tax within 4 months after you file your LLC and then again by April 15th of each year. Next is Form 3536, the Estimated Fee for LLCs.

What happens if you don't pay the 800 annual tax?

Failure to file before the deadline will result in the State charging late fees and penalties, and they will eventually dissolve your LLC if you do not pay the $800 Annual LLC Franchise Tax. This is not a popular requirement for California, but it is mandatory and it is the cost of doing business in the State.

How long after LLC approval is it?

As we learned earlier, although that sounds like 6.5 months after your LLC is approved, it’s really 5.5 months after your LLC is approved. For example, if your California LLC is approved in May of 2018, then May is “month 1”. And 6.5 months after that is October. And the 15th day would make that October 15th, 2018.

Can an accountant help with tax returns?

So not only will an accountant help you file your federal, state, and local returns properly, but they’ll be available to discuss tax strategies, such as if and when it makes sense to have your LLC taxed as an S-Corp, among other things.

Who to work with after LLC in California?

We strongly encourage you to work with an accountant and/or a tax attorney after you form an LLC in California. It’s also a good idea to speak with a few accountants before your LLC is even formed.

When is the first $800 due for California LLC?

• So for example, if your LLC is approved in November of 2018, then your first $800 payment will be due by February 15th, 2019.

When are California LLC franchise taxes due?

When is my LLC’s franchise tax due? If your California LLC goes into existence on or after January 1st, 2021 (but before December 31st, 2023), there is no $800 payment due the 1st year. The first $800 payment is due in the LLC’s 2nd year. Let’s look at a few examples below.

How to contact California Franchise Tax Board?

If you have any questions, you can contact the California Franchise Tax Board (FTB) at 800-852-5711. Their hours are Monday through Friday from 8am to 5pm, Pacific Time. While hold times can sometimes be long, the FTB has an option to hold your place in line and call you back.

Does my California LLC need to file Form 3522 (Limited Liability Company Tax Voucher) in the 1st year?

No, since your California LLC doesn’t need to pay the $800 franchise tax for its 1st year, you don’t need to file Form 3522.

Why is it called an estimated fee?

It’s called an “Estimated” Fee because you will need to forecast your LLC’s total revenue. If your LLC will come close (or exceed) $250,000 in total revenue, then you should file Form 3536 and pay the Estimated Fee.

What section of the California tax code was changed?

California Assembly Bill 85 changed Section 17935, Section 179 41, and Section 17948 of the California Revenue and Taxation Code.

When do you file Form 3522?

Form 3522 will need to be filed in the 2nd year.

Do LLCs pay franchise tax in California?

California LLCs don’t pay $800 Franchise Tax (for 1st year) beginning 2021. This Quick Start Guide is a brief overview of how to form an LLC in California.

When are Delaware franchise taxes due?

Franchise Taxes and annual Reports are due no later than March 1st of each year. An annual Franchise Tax Notification is mailed directly to the corporation’s registered agent. Blank Franchise Tax Returns are not available. The Delaware Division of Corporations will require all Annual Franchise Tax Reports and alternative entity taxes ...

Do corporations have to file taxes in Delaware?

Corporations incorporated in Delaware but not conducting business in Delaware are not subject to corporate income tax, [30 Del.C, Section 1902 (b) (6)] but do have to pay Franchise Tax administered by the Delaware Department of State. Any corporation that is incorporated in Delaware (regardless of where you conduct business) must file an Annual ...

What is franchise tax in NC?

NC franchise tax is a tax placed on companies for the privilege of doing business in North Carolina. It applies to corporations and S corporations and is a tax on a business's net worth. C corporations in the state are subject to other types of taxes.

What is the tax rate for a business?

Corporate rates tend to be flat no matter the business income. They typically range from four to nine percent. Personal rates, which usually vary based on the amount of personal income, may range from zero to around nine percent or higher in some states.

Do S corps pay franchise taxes?

However, S corps are still required to pay franchise taxes. In addition, each shareholder in an S corp owes taxes on their share of the S corp's income. Like S corps, limited liability companies are pass-through entities. In general, an LLC does not pay income tax to the state or federal government.

Does an LLC pay taxes?

In general, an LLC does not pay income tax to the state or federal government. Instead, business income is distributed to the individual owners or members in the LLC. They pay state and federal taxes on the amount of income they receive.

Do franchises have to pay taxes?

States charge franchise taxes either based on a company's net worth or as a flat fee.

Who pays taxes on partnership income?

Income from partnerships goes to individual partners who pay taxes on the amount that they receive. They pay both state and federal taxes on this income. In a sole proprietorship, business income goes to the proprietor. They pay state taxes on that income.

Does North Carolina have a franchise tax?

North Carolina imposes a corporate income tax on traditional corporations, which are also known as C corps. The state also imposes a franchise tax that applies to traditional corporations and S corporations. If your business income passes directly to you, you must pay taxes on it via your personal state tax return.