Lawn care and landscaping (other than pest control services requiring a license) are nontaxable when done by a self-employed individual who:

- does the actual lawn care or landscaping services;

- has no employees, partners or other persons providing the services;

- has gross receipts from the services of $5,000 or less during the most recent four calendar quarters.

Full Answer

How much is the franchise tax in Texas?

In Texas, businesses with $1.18 million to $10 million in annual receipts pay a franchise tax of 0.375%. Businesses with receipts less than $1.18 million pay no franchise tax. The maximum franchise tax in Texas is 0.75%.

What happens if I don’t pay my Texas franchise tax return?

If the Comptroller’s office does not receive your franchise tax report (and payment, if you owe one) within 45 days of the deadline, they are required by law to forfeit your business’s right to transact business in Texas.

Do I have to pay franchise tax on my business?

Nearly all business types in the state are subject to the franchise tax. The only exceptions are sole proprietorships and certain types of general partnerships . Small businesses with gross receipts below $1,180,000 pay zero franchise tax for tax year 2020. For many businesses, the actual tax rates are much lower than the stated rates.

Are lawn services taxable in Texas?

If you do landscaping or lawn or plant care, you should be collecting sales and use taxes. Landscaping and lawn and plant care services include any work you do to maintain or improve lawns, yards and ornamental plants and trees.

Who is exempt from Texas franchise tax?

A nonprofit corporation organized under the Development Corporation Act of 1979 (Article 5190.6, Vernon's Texas Civil Statutes) is exempt from franchise and sales taxes. The sales tax exemption does not apply to the purchase of an item that is a project or part of a project that the corporation leases, sells or lends.

Who must pay franchise tax in Texas?

The Texas Franchise Tax is calculated on a company's margin for all entities with revenues above $1,230,000. The margin's threshold is subject to change each year.

Do you need a license to mow lawns in Texas?

There is no state license for landscapers working in Texas. However, if you'll be applying restricted-use or state-limited-use pesticides as part of your lawn care or landscaping service, you must hold a commercial pesticide applicator license. This is awarded by the Texas Department of Agriculture.

Do single member LLCs pay franchise tax in Texas?

Therefore, each taxable entity that is organized in Texas or doing business in Texas is subject to franchise tax, even if it is treated as a disregarded entity for federal income tax purposes and is required to file a franchise tax report.

How much is franchise tax in Texas?

0.375%Tax Rates, Thresholds and Deduction LimitsItemAmountTax Rate (retail or wholesale)0.375%Tax Rate (other than retail or wholesale)0.75%Compensation Deduction Limit$390,000EZ Computation Total Revenue Threshold$20 million2 more rows

How do I know if I need to pay franchise tax in Texas?

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

What is a disregarded entity for Texas franchise tax?

Disregarded Entities Therefore, partnerships, LLCs and other entities that are disregarded for federal income tax purposes are considered separate legal entities for franchise tax reporting purposes. The separate entity is responsible for filing its own franchise tax report unless it is a member of a combined group.

How much tax does an LLC pay in Texas?

Texas Taxes As mentioned above, Texas charges most local businesses the franchise tax, which is usually about 1% of some portion of the income of the company. This tax is leveled against LLCs, C Corporations, and S Corporations. Sole proprietorships and partnerships are immune to the tax.

How much does it cost to mow an acre in Texas?

Average price of lawn mowing in TexasFrequency1/8 Acre1 AcreWeekly$35.37$89.60Every Two Weeks$37.25$150.40Every Four Weeks$47.91$142.40

How do I start a landscaping business in Texas?

What Are the Basic Steps for Starting a Lawn Care Business?Choosing How to Register a Lawn Care Business. ... Selecting a Name for Your Business. ... Obtaining a Tax Identification Number. ... Opening a Business Bank Account. ... Getting Proper Licenses. ... Creating a Social Media Profile.

Do I need a license to apply fertilizer in Texas?

Applicators who apply only fertilizer do not need to be licensed by either agency. To license with TDA, applicators will certify as either commercial or noncommercial. Commercial applicators apply restricted-use and state-limited-use pesticides or regulated herbicides for hire.

What are exclusions from revenue Texas franchise tax?

The tax is not imposed on: • sole proprietorships (except for single member LLCs); • general partnerships where direct ownership is composed entirely of natural persons (except for limited liability partnerships); • entities exempt under Subchapter B of Chapter 171, Tax Code; • certain unincorporated passive entities; ...

How do I check my Texas tax-exempt status?

Questions about state tax-exempt status? Review the comptroller's FAQs or contact the comptroller's Exempt Organizations Section by phone at (800) 531-5441 or (512) 463-4600 or by email.

What does tax-exempt mean in Texas?

As a Texas property owner, you might qualify for a reduction in the taxable appraised value of your property, thereby reducing the amount of your tax bill. These deductions are referred to as property tax exemptions, and in Texas, they are the most common way property owners reduce their tax burden.

What items are exempt from sales tax in Texas?

For example, flour, sugar, bread, milk, eggs, fruits, vegetables and similar groceries (food products) are not subject to Texas sales and use tax. Tax is due, however, on non-food items such as paper, pet, beauty and hygiene products; clothing; books; and certain edible items.

What is franchise tax?

Franchise tax is based on a taxable entity’s margin. Unless a taxable entity qualifies and chooses to file using the EZ computation, the tax base is the taxable entity’s margin and is computed in one of the following ways:

How much is the penalty for filing franchise tax return?

You can file your franchise tax report, or request an extension of time to file, online. There is a $50 penalty for a franchise tax report filed after the due date, even if no tax is due with that report and even if the taxpayer subsequently files the report.

How is margin apportioned in Texas?

Margin is apportioned to Texas using a single-factor apportionment formula based on gross receipts.

When are franchise tax reports due?

Franchise tax reports are due on May 15 each year. If May 15 falls on a Saturday, Sunday or legal holiday, the next business day becomes the due date. The Comptroller’s office will tentatively grant an extension of time to file a franchise tax report upon timely receipt of the appropriate form.

Do you have to file franchise tax in Texas?

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax. These entities include:

What is franchise tax in Texas?

In the state of Texas, franchise tax is considered to be a "privilege" tax, which is a tax that is imposed on companies chartered in Texas or doing business in Texas. Franchise tax is charged by many states in the U.S. as a means to generate revenue.

What entities must pay franchise tax in Texas?

This includes: corporations. limited liability companies (LLCs) banks and savings and loan associations. partnerships (general, limited and limited liability) trusts.

How to contact the Texas Comptroller of Public Accounts?

If you need further assistance determining whether the franchise tax applies to you, you can call a Taxpayer Services Line, dedicated particularly to franchise taxes, at 1-800-252-1381, between the hours of 8 a.m. and 5 p.m., Monday through Friday.

How much tax do you pay for wholesale?

Estimate the tax. Using the lowest figure that results from the three subtractions, a company that is primarily engaged in wholesale or retail trade will pay a tax of 0.375%; all others will pay 0.75%.

When are franchise tax reports due?

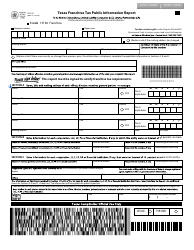

Annual franchise tax reports are due each year by May 15. There are three different forms to select from:

How many different reporting methods does Texas accept?

Select your reporting method. Texas accepts three different methods for reporting and payment:

Where to find Texas tax information?

The web site for the Texas Comptroller of Public Accounts, http://comptroller.texas.gov/taxinfo/franchise/ , has a great deal of information about all tax issues. You can use this site, https://www.window.state.tx.us/franchi se/taxhelp/, to submit your own direct questions about franchise taxes.

What is the difference between franchise tax and income tax in Texas?

The difference between corporate income tax and a corporate franchise tax is that income taxes apply to profit while franchise taxes do not apply to profit. A corporate franchise tax is essentially a fee that a company must pay for the privilege of doing business in a city or state.

What is the tax rate for wholesalers in Texas?

The tax for wholesalers and retailers is 0.375%. The tax rate for businesses other than retail and wholesale is 0.75%. 2. It's worth emphasizing that this is a tax on gross receipts, not on net corporate income. Texas is one of only four states with this type of system. The others are Nevada, Ohio, and Washington .

What is LLC tax?

Limited Liability Company Taxes. LLC is the other common designation for small businesses. In most states, LLCs are entities that protect business owners from certain legal liabilities but pass their incomes to those owners, who pay personal income tax rather than business income tax on their proceeds.

What is the economy of Texas?

Texas has the second-largest economy in the U.S., with a gross state product of $1.76 trillion in 2020. 1 Much of that money is made in the oil and gas industry, though farming, steel, banking, and tourism were also big contributors. Part of the reason may be that Texas, in the 21st century, has a very pleasant business climate.

Does Texas have franchise tax?

Like most states, Texas subjects corporations to its standard business tax, the franchise tax. As with all businesses, the no-tax-due threshold and E-Z Computation rules apply to corporations.

Is a partnership subject to franchise tax in Texas?

The majority of partnerships in Texas, including LPs and LLPs, are subject to the franchise tax.

Is a small business a corporation in Texas?

Most small businesses are not corporations, but they sometimes switch from LLCs and S corporations to C corporations when their growth reaches a certain level. Therefore, it is helpful to understand how corporations are taxed in Texas.

What is franchise tax in Texas?

The Texas Franchise Tax is an annual business privilege tax processed by the Texas Comptroller of Public Accounts. Essentially, it’s a tax levied on business owners in exchange for the opportunity to do business in Texas. Here's what you should know about it.

When are Texas franchise taxes due?

What’s the Texas Franchise Tax due date? The Texas Franchise Tax Report is due every year on May 15 , starting the year after you form or register. Qualifying veteran-owned businesses do not need to pay any franchise tax for their first 5 years, although business owners still need to file a No Tax Due Report. Note: Due to Covid-19, the 2020 filing deadline for all franchise taxpayers has been extended to July 15. Updates to filing deadlines are posted to the Comptroller’s main Franchise Tax page.

What does independent Texas do?

When you hire Independent Texas to form your Texas company or serve as your registered agent, we keep your state correspondence organized, send you multiple reminders ahead of the franchise tax due date, and provide affordable franchise report filing service.

What happens if you don't get your franchise tax report in Texas?

If the Comptroller’s office does not receive your franchise tax report (and payment, if you owe one) within 45 days of the deadline, they are required by law to forfeit your business’s right to transact business in Texas. This forfeiture is essentially a loss of corporate liability protection: business owners will become liable for the debts of the business, and the entity will not be permitted to defend itself in a court of law.

How to check if a franchise is active in Texas?

How can I check my business’s Texas Franchise Tax status? You can check on the Texas Franchise Tax account status of your company (or another company) by conducting an online Taxable Entity Search on the Comptroller’s website. To search for a business, enter its name, 11-digit Texas taxpayer ID number, 9-digit Federal Employer Identification Number (FEIN) or Texas SOS file number. Once you locate the business you’re looking for, click on the blue “Details” button to the left of the business name. Under the “Franchise Search Results” tab, you’ll see an item called “Right to Transact Business in Texas.” If the right to transact business is “Active,” then the entity is still entitled to conduct business in Texas.

How often do you need to file a franchise tax return in Texas?

But whether or not tax is owed, you’ll need to file a Texas Franchise Tax Report every year to keep your business in good standing.

How to pay taxes on Webfile?

Log in to WebFile. From the eSystems menu, select WebFile / Pay Taxes and Fees.