What are the annual costs of a Delaware LLC?

Delaware LLC Annual Fee. When assessing a Delaware LLC annual fee, you need to know that it costs $300 to maintain your LLC. The tax is usually due on June 1. Such a fee stems from the state’s Annual Franchise tax, which is the right or privilege to conduct business in the state.

Do Delaware LLC have to pay taxes to US?

Taxes. A non-U.S. resident cannot own an S corporation in the United States; therefore your Delaware company will be an LLC or a C corporation. A Delaware LLC will typically be required to pay taxes on all U.S. sourced income, but often avoids taxation on non-U.S. sourced income if all of its members non-U.S. residents and not physically ...

How much does it cost to form a Delaware LLC?

The main cost of forming an LLC is the $90 fee to file your LLC's Certificate of Formation online with the Delaware Department of State. In Delaware, all LLCs are required to file and pay a $300 annual franchise tax. This can be done online. Delaware charges a penalty of $200 plus 1.5% interest per month if you miss the June 1 filing deadline.

Do I have to pay Delaware franchise tax?

In the state of Delaware, most companies and corporations that are incorporated in the state are legally required to pay an annual franchise tax. This tax pays for the privilege of being incorporated in the state, even if the company does business elsewhere. The Delaware Department of State, Division of Corporations, administers the franchise tax program.

How do I avoid franchise tax in Delaware?

There are ways to reduce your Delaware franchise costs in certain circumstances. To reduce the taxes paid by a startup, use the Assumed Par Value method. This method calculates the taxes by total assets. As long as your issued shares constitute a third to half of your authorized shares, this method will save you money.

What taxes do LLCS pay in Delaware?

This means that the LLC itself does not pay taxes and does not have to file a return with the State of Delaware. As the sole member of your LLC, you must report all profits (or losses) of the LLC on Schedule C and submit it with your Delaware personal income tax return (Form 200).

What happens if you don't pay Delaware LLC franchise tax?

If you don't pay the Delaware Franchise Tax and file the Annual Report for two straight years, the State of Delaware will administratively dissolve the Corporation. If you have any questions about forming your new Delaware LLC, LP, or Corporation, give us a call today.

How do Delaware franchise taxes work?

If your company has authorized 5,000 shares or fewer, your total Delaware franchise tax amount is $175. If you've authorized 5,001 to 10,000 shares, your franchise tax is $250. For every** additional 10,000 shares** authorized after that, you pay another $85 in franchise tax, up to a maximum of $200,000.

Why is it better to form an LLC in Delaware?

Delaware is often considered one of the best states to form an LLC because it has limited fees and tax obligations. In fact, many businesses choose to form an LLC in Delaware even if they don't intend on doing business in Delaware.

Does Delaware have franchise tax?

Every for-profit corporation incorporated in Delaware is subject to the annual franchise-tax requirement. The corporation does not have to be doing business in Delaware or earn any income there. It's not an income tax; it's a franchise tax.

How much is franchise tax for LLC in Delaware?

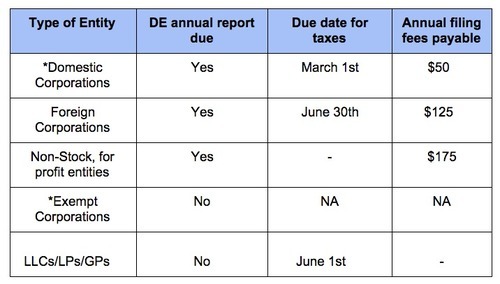

$300.00LLC/Partnership Tax Information All Domestic and Foreign Limited Liability Companies, Limited Partnerships, and General Partnerships formed or registered in Delaware are required to pay an annual tax of $300.00. There is no requirement to file an Annual Report.

Do LLCs have to file an Annual Report in Delaware?

Although Limited Partnerships, Limited Liability Companies and General Partnerships formed in the State of Delaware do not file an Annual Report, they are required to pay an annual tax of $300.00. Taxes for these entities are due on or before June 1st of each year. Penalty for non-payment or late payment is $200.00.

What is the Delaware annual franchise tax?

$300The Franchise Tax for a Delaware LLC or a Delaware LP is a flat annual rate of $300. A non-stock/non-profit company is considered exempt by the State of Delaware. This type of company does not pay the standard annual Delaware Franchise Tax, but must still file and pay the annual report fee of $25 per year.

Why do companies incorporate in Delaware?

Delaware doesn't impose income tax on corporations registered in the state which don't do business in the state. Also, shareholders who don't reside in Delaware need not pay tax on shares in the state. For these reasons, Delaware is sometimes referred to as a tax haven.

Is Delaware franchise tax paid in arrears?

Your notification of annual report and franchise tax due is sent to a corporation's registered agent in December or January of each year. Delaware requires these reports to be filed electronically. Franchise taxes are generally due in arrears for the prior calendar year.

What states have franchise tax?

The specific states that impose a franchise tax include Delaware, Alabama, Arkansas, Illinois, Georgia, Louisiana, Missouri, Mississippi, North Carolina Oklahoma, New York, Texas, Tennessee, Pennsylvania, and West Virginia.

Do Delaware LLCs pay federal taxes?

Limited Liability Companies (LLCs) Like S corporations, standard Delaware LLCs are pass-through entities and are not required to pay federal or state income tax. LLCs are, however, required to pay a flat annual tax of $300 to the state.

Does a Delaware LLC need to file a federal tax return?

An LLC will typically be required to file the same federal tax forms as a partnership or sole proprietorship when it comes time to prepare and file the federal tax returns with the IRS. An LLC may elect to be treated and taxed as an S corporation or a C corporation by the IRS.

Does Delaware have state income tax for business?

Every domestic or foreign corporation doing business in Delaware, not specifically exempt under Section 1902(b), Title 30, Delaware Code, is required to file a corporate income tax return (Form 1100 or Form 1100EZ) and pay a tax of 8.7% on its federal taxable income allocated and apportioned to Delaware.

Why is Delaware considered a tax haven?

There is no sales tax in Delaware, so any goods or services you purchase in the state for your business will not be subject to taxation. For business owners who reside outside of Delaware, there is no state income tax. As well, there are no property taxes or value-added taxes (VATs).

How to pay taxes on LLC in Delaware?

1. Visit the state’s online filing system: https://icis.corp.delaware.gov/Ecorp/logintax.aspx?FilingType=FranchiseTax. 2. Enter your LLC’s File Number and click the “Continue” button. 3. Review the tax that is due (if applicable, late fees will show) and then click the “Pay Taxes” button. 4.

When are franchise taxes due?

You can make payment using a credit card or your checking account. Your Annual Franchise Tax must be paid by June 1st every year. Your first payment is due the calendar year following the year that your LLC was approved.

What is the tax number for LLC?

If you have any questions about your LLC’s Annual Franchise Tax, you can contact the Franchise Tax Division at 302-739-3073 (option 3). Their hours are Monday through Friday from 8am to 4:30pm Eastern Time.

What happens if you don't file your franchise tax?

If you do not file your Annual Franchise Tax by June 1st, you will be charged a late fee of $200. Your account will also be penalized at 1.5% interest for every month it remains unpaid. You’ll need your Business Entity File Number (also known as your “File Number”) in order to make payment online.

Do you have to pay franchise tax after making payment?

There is nothing else you need to do after making payment. Just make sure to pay your Annual Franchise Tax each year going forward.

Do LLCs have to file annual reports in Delaware?

Delaware LLCs do not have to file an Annual Report (like Corporations do), but they do have to pay a flat-rate Annual Franchise Tax of $300 each year. The $300 tax must be paid by every LLC formed in Delaware, regardless of income or business activity. This is a requirement to keeping your LLC in compliance with the state.

What is an LLC?

A. A limited liability company (LLC) combines certain characteristics of both a corporation and also a partnership or sole proprietorship (depending on how many owners there are).

Can you have separate state elections on LLC?

NOTE: A separate state election is not allowed on a LLC.

Is a single member LLC a corporation?

A single-member LLC can be either a corporation or a single-member “disregarded entity.”. To be treated as a corporation, the single-member LLC has to file IRS Form 8832 and elect to be classified as a corporation.

Is a multi member LLC a partnership?

A multi-member LLC can be either a partnership or a corporation, including an S-corporation. To be treated as a corporation, an LLC has to file IRS Form 8832 and elect to be treated as a corporation. A multi-member LLC that does not elect to be treated as a corporation will be classified as a partnership. Related Topics: business, company, faq, ...

Does an LLC have to file taxes in Delaware?

A. Delaware treats a single-member “disregarded entity” as a sole proprietorship for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the State of Delaware.

Is a single member disregarded entity a division?

NOTE: A single-member “disregarded entity” that is owned by a corporation is treated as a “branch” or “division” of its owner.

Is LLC a partnership in Delaware?

A. A Limited Liability Company doing business in Delaware is classified as a partnership for Delaware income tax purposes, unless it has otherwise been classified for federal income tax purposes. A LLC is always classified in the same manner for Delaware income tax as it is for federal income tax purposes. NOTE: A separate state election is not ...

What is Delaware Franchise Tax?

Delaware franchise tax is a tax charged by the state of Delaware for the right to own a Delaware company. The tax does not affect income or company activity. The tax is required to maintain the company's good standing in Delaware.

Why do you need to use franchise tax in Delaware?

The Delaware franchise tax is beneficial to corporations because it is a simple process to submit and calculate payment. The Delaware franchise tax is also beneficial to businesses as it is a small fee in comparison to other states.

How much is the late fee for franchise tax in Delaware?

If you pay your Delaware franchise tax late, you'll be charged a late fee. The late fee is $125.00 and a 1.5 percent monthly interest afterward.

What information is required to file a franchise tax in Delaware?

When filing a franchise tax in Delaware, all the must be submitted is the physical address of the business and the name of the registered agent. This can be a business owner or someone else. By not requiring more information, businesses that file their franchise tax in Delaware can maintain privacy.

What happens if you don't file Delaware franchise tax?

If you don't file your Delaware franchise tax on time, you will be charged a late fee.

What is Delaware's court of chancery?

Delaware has what is called a Court of Chancery. This allows the state to adjudicate corporate litigation. The corporate laws and cases decided in Delaware are often used by the Supreme Court to influence decisions.

How much does it cost to register a foreign business in Delaware?

Foreign File. Business that are formed out of state but are registered to do business in Delaware must pay a $125 registration fee. Foreign corporations, those that are formed outside of Delaware, cannot file online. To file as a foreign corporation, mail in the necessary documents.

What is Delaware LLC Tax?

The Delaware LLC Tax, the franchise tax for a limited liability company situated in the state of Delaware, requires that a standard fee of $300 be paid each year by June 1 st. If the Delaware Secretary of State doesn’t receive payment by this time, an LLC that has failed to pay will incur a fine of $200. Obviously, these payments only pertain to companies based in Delaware. LLCs based elsewhere will send a different sum to the office of their state’s Secretary of State.

What happens if an LLC fails to pay in Delaware?

If the Delaware Secretary of State doesn’t receive payment by this time, an LLC that has failed to pay will incur a fine of $200. Obviously, these payments only pertain to companies based in Delaware. LLCs based elsewhere will send a different sum to the office of their state’s Secretary of State.

What Is the Cost to Incorporate in Delaware?

If you want to incorporate your LLC in the state of Delaware, state fees are a minimum payment of $89. The state also gets $90 in Delaware LLC fees when your Delaware LLC formation is filed.

What is LLC in Delaware?

As an LLC based in Delaware, your company is legally obliged to nominate a resident of the state as a Registered Agent. A Registered Agent will handle all of your company’s legal matters, and all legal documents either leaving or entering your office will pass through them.

Do you pay franchise tax in Delaware?

In Delaware, your LLC will be paying a franchise tax, a corporate income tax, and additional LLC and partnership taxes. Additionally, if you plan on someday turning your LLC into a Corporation or S Corporation, a franchise tax will also be required.

How to contact Delaware Division of Corporations?

Please contact the Delaware Division of Corporations at (302) 739-3073 if you have any questions or concerns about a solicitation.

When are franchise taxes due?

All active Domestic Corporation Annual Reports and Franchise Taxes for the prior year are due annually on or before March 1st and are required to be filed online. Failure to file the report and pay the required franchise taxes will result in a penalty of $200.00 plus 1.5% interest per month on tax and penalty.

How much is the Delaware annual report?

Foreign Corporations must file an Annual Report with the Delaware Secretary of State on or before June 30 each year. A $125.00 filing fee is required to be paid. If the Annual Report and remittance is not received by the due date, a $125.00 penalty will be added to filing fee.

How to report deceptive solicitation in Delaware?

If a Delaware business entity received such a solicitation or sent payment as a result of receiving this solicitation, please complete a complaint form complaint form and immediately contact the Consumer Protection Unit of the Attorney General’s Office at (302) 577-8600 or 1-800-220-5424.

When are Delaware annual reports due?

Notification of Annual Report and Franchise Taxes due are sent to all Delaware Registered Agents in December of each year. Delaware has mandated electronic filing of domestic corporations Annual Reports.

How much is the annual report fee for a foreign corporation?

Foreign Corporations. Foreign Corporations are required to file an Annual Report on or before June 30th. The fee for filing the Annual Report is $125.00. Foreign corporations are assessed a penalty of $125 if the Annual Report is not filed.

How much does it cost to file an amended annual report?

The filing fee for filing an Annual Report or Amended Annual Report for exempt domestic corporations is $25. For an Annual Report or Amended Annual Report for non-exempt domestic corporations the filing fee is $50. Taxes and Annual Reports are to be received no later than March 1st of each year.

Do corporations pay franchise tax in Delaware?

Corporate Annual Report and Franchise Tax Payments. All corporations incorporated in the State of Delaware are required to file an Annual Report and to pay a franchise tax. Exempt domestic corporations do not pay a tax but must file an Annual Report. The filing fee for filing an Annual Report or Amended Annual Report for exempt domestic ...