How are single member LLCs taxed?

The IRS considers a single member LLC to be a disregarded entity. Essentially, this means that single member LLCs are taxed in the same way as sole proprietorships. Members of the single member LLC will report the losses and profits of the company on the Schedule C form of their personal tax return.

What are the Texas single member LLC filing requirements?

Texas single member LLC filing requirements include paying a franchise tax and possibly state employment taxes. Single member LLCs in Texas are not required to file an annual report. Like many states, Texas allows for the formation of single member LLCs, and in fact, these entities are extremely common in this state.

Can an LLC with one member be treated as a corporation?

And an LLC with only one member is treated as an entity disregarded as separate from its owner for income tax purposes (but as a separate entity for purposes of employment tax and certain excise taxes), unless it files Form 8832 and affirmatively elects to be treated as a corporation.

Do I have to file taxes if my LLC owes money?

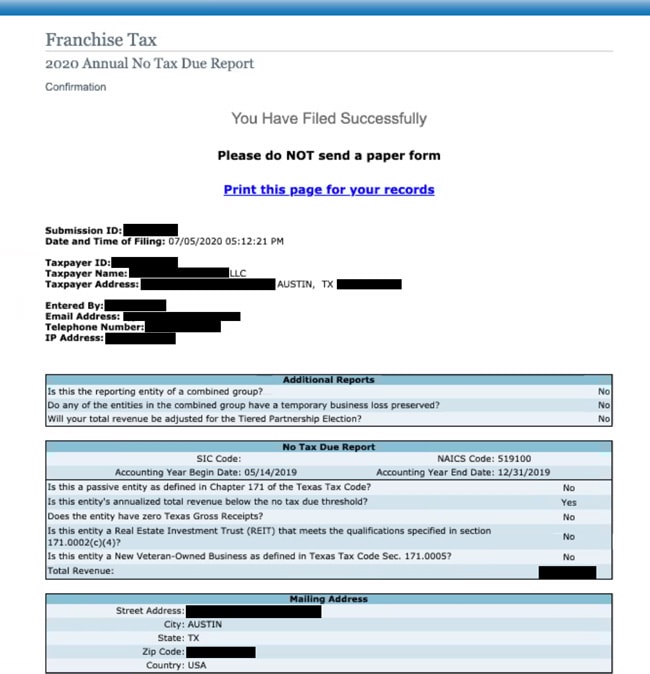

Remember, even if your LLC owes no tax, you still must file a No Tax Due Report (Form 05-163) and a Public Information Report (Form 05-102). If you have a veteran-owned Texas LLC, you are exempt from your first 5 years of franchise tax.

Does a single member LLC pay franchise tax in California?

California Single-Member LLC Taxation The California Franchise Tax Board states that a single-member LLC will be treated as a disregarded entity, unless it elects to be taxed as a corporation. Every single-member LLC must pay the $800 Franchise Tax fee each year to the Franchise Tax Board.

Does a single member LLC need to file a California tax return?

Even though an SMLLC may be a disregarded entity for federal tax purposes, the SMLLC is considered a separate, taxable entity for California's LLC tax and LLC fee and must report its income on a separate state tax return. The tax and fee are payable to the California Franchise Tax Board (FTB).

Who is subject to Louisiana franchise tax?

corporationIf a corporation is a domestic corporation, meaning it is organized under the laws of Louisiana, it is required to file Form CIFT-620, Louisiana Corporation Income and Franchise Tax return, each year unless exempt from both taxes.

How is an LLC taxed in Louisiana?

An LLC is treated and taxed in the same manner for Louisiana income tax purposes as it is treated and taxed for federal income tax purposes. If the LLC is taxed as a corporation for federal income tax purposes, the LLC will be taxed as a corporation for Louisiana income tax purposes.

Who must file a California Franchise Tax Return?

All corporations are required to pay at least the $800 minimum franchise tax if they are: Incorporated or organized in California. Qualified or registered to do business in California. Doing business in California, whether or not incorporated, organized, qualified, or registered under California law.

How do I pay the $800 franchise tax?

The state requires corporations to pay either $800 or the corporation's net income multiplied by its applicable corporate tax rate, whichever is larger. You may pay the tax online, by mail, or in person at the California Franchise Tax Board Field Offices.

Does an LLC pay franchise tax in Louisiana?

Louisiana Franchise Tax for LLCs Under Act 12, all entities that have elected corporate federal income tax treatment must also pay Louisiana franchise tax. Two exceptions exist: LLCs that have opted for pass-through taxation under Subchapter S (S corporations)

Is there a minimum franchise tax in Louisiana?

Corporate Franchise Tax is levied at the rate of $1.50 per $1,000 on the first $300,000 of capital stock, surplus, undivided profits and borrowed capital employed in Louisiana. The rate is $3.00 per $1,000 after the first $300,000 with a minimum tax of $10 per year.

What is the difference between income tax and franchise tax?

Unlike state income taxes, franchise taxes are not based on a corporation's profit. A business entity must file and pay the franchise tax regardless of whether it makes a profit in any given year. State income taxes—and how much is paid—on the other hand, are dependent on how much an organization makes during the year.

Do I have to file an annual report for my LLC in Louisiana?

Every Louisiana LLC is required to file an Annual Report each year. You need to file an Annual Report in order to keep your LLC in compliance and in good standing with the state of Louisiana.

What are the requirements for LLC in Louisiana?

How to Start an LLC in LouisianaChoose a Name for Your LLC. ... Appoint a Registered Agent. ... File Articles of Organization. ... Prepare an Operating Agreement. ... Obtain an EIN. ... File Annual Reports.

How do I file an annual report for an LLC in Louisiana?

Annual reports can only be filed within 30 days of renewal date. You have received a Renewal Notice from the Louisiana Secretary of State and can therefore file your annual report online by going to www.sos.la.gov\renewal and following the steps below. Review the information currently on file with our office.

Does my business need to file a California tax return?

It is mandatory for all corporations to file annual tax returns, even if the business was inactive or did not receive income.

Who must file a California Form 568?

every LLCForm 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California. The LLC is organized in California. The LLC is organized in another state or foreign country, but registered with the California SOS.

Do disregarded entities file tax returns in California?

Disregarded Entities and Federal Taxes When your SMLLC is a disregarded entity, it's treated like any other sole proprietorship for federal tax purposes. This means that you'll file IRS Schedule C, along with your personal tax return, in order to report all of your LLC's income and expenses.

Can you have a single member LLC in California?

Overview. If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC. We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes.

When is SMLLC tax return due?

Owned by a pass-through entity. If your SMLLC is owned by an: S corporation. Partnership. Then your return is due on the 15th day of the 3rd month at the close of your taxable year.

Is an LLC a single owner?

Overview. If your LLC has one owner, you’re a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC. , even though they are considered a disregarded entity for tax purposes.

What is a series LLC?

A series LLC is treated as a single legal entity. It pays one filing fee and registers as one entity with the Texas Secretary of State. It files one franchise tax report and one Public Information Report as a single entity, not as a combined group, under its Texas taxpayer identification number. If one of the series has nexus in Texas, ...

Is a family limited partnership taxable?

A family limited partnership is a taxable entity unless it meets the criteria of a passive entity under TTC 171.0003. Are sole proprietorships subject to the franchise tax? A sole proprietorship that is not legally organized in a manner that limits its liability is not a taxable entity. A single-member limited liability company filing as ...

Is a grantor trust taxable?

This subsection states that a grantor trust qualifies as a nontaxable entity if: all of the grantors and beneficiaries are natural persons or charitable entities and. it is not a trust taxable as a business entity pursuant to IRS Treasury Regulation Section 301.7701-4 (b).

Is a single member limited liability company a sole proprietor?

A single-member limited liability company filing as a sole proprietor for federal income tax purposes is a taxable entity. TTC 171.0002 (d). Is a non-Texas entity that owns a royalty interest in an oil or gas well in Texas subject to the franchise tax? Yes. A royalty interest in an oil or gas well is considered an interest in real property.

Is a taxpayer a disregarded entity?

The taxpayer is a disregarded entity for federal purposes. If such a taxpayer has nexus in Texas, does the taxpayer have a Texas franchise tax filing responsibility? Yes. The legal formation of an entity – not an entity's treatment for federal income tax purposes – determines filing responsibility for Texas franchise tax.

What is franchise tax?

Franchise tax is based on a taxable entity’s margin. Unless a taxable entity qualifies and chooses to file using the EZ computation, the tax base is the taxable entity’s margin and is computed in one of the following ways:

How much is the penalty for filing franchise tax return?

You can file your franchise tax report, or request an extension of time to file, online. There is a $50 penalty for a franchise tax report filed after the due date, even if no tax is due with that report and even if the taxpayer subsequently files the report.

What are the benefits provided to all personnel to the extent deductible for federal income tax purposes?

benefits provided to all personnel to the extent deductible for federal income tax purposes, including workers’ compensation, health care and retirement benefits.

When are franchise tax reports due?

Franchise tax reports are due on May 15 each year. If May 15 falls on a Saturday, Sunday or legal holiday, the next business day becomes the due date. The Comptroller’s office will tentatively grant an extension of time to file a franchise tax report upon timely receipt of the appropriate form.

Who must file a combined group report?

Taxable entities that are part of an affiliated group engaged in a unitary business must file a combined group report. Members of a combined group must use the same method to compute margin.

Do you have to file franchise tax in Texas?

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax. These entities include:

What is a single member LLC?

In general, single member LLCs are pass-through entities, which means the organization itself does not pay taxes. With an LLC, the members of the entity are responsible for reporting and paying federal income taxes on the losses and profits of the company.

How to file for LLC in Texas?

Next, you need to file your Certificate of Incorporation. You should file this document with the Texas Secretary of State after making sure it includes the following information: 1 The name of your single member LLC 2 Contact information for your Registered Agent 3 An indication of your management structure 4 Contact information for each managing member or outside manager 5 Contact information for the organizer of your LLC

How much does it cost to get a blank LLC certificate in Texas?

A blank certificate can be downloaded from the SOS website, and you will need to pay a $300 filing fee when submitting this document. Before filing your Certificate of Formation, make sure that you have appointed a Registered Agent, which is a requirement of every LLC in Texas. You can choose an individual who is a Texas resident as your Registered Agent, or you can appoint a business entity that is allowed to transact business in the state.

What is the first step in forming an LLC?

The first step you need to take when forming your LLC is choosing a name for your company. In addition to choosing a unique name that cannot be confused with the names of other Texas LLCs, your company name needs a designator indicating its entity status:

Is a single member LLC taxed in Texas?

Essentially, this means that single member LLCs are taxed in the same way as sole proprietorships. Members of the single member LLC will report the losses and profits of the company on the Schedule C form of their personal tax return. Some single member LLCs choose to be taxed as an S Corporation or a C Corporation instead of accepting disregarded entity status.

Is a single member LLC the same as a multi member LLC?

Both single member LLCs and multi-member LLCs provide the exact same liability. Whichever type of LLC you decide to form, owners of the company will not be held personally liable for the debts or obligations of the company. If an LLC is sued and loses the lawsuit, the personal property of the LLC members is not at risk.

Do you have to file an annual report for a single member LLC in Texas?

Texas single member LLC filing requirements include paying a franchise tax and possibly state employment taxes. Single member LLCs in Texas are not required to file an annual report.

What is the tax number of an LLC?

Your LLC’s Taxpayer Number is an 11-digit number that is issued by the Texas Comptroller. This number is used to identify your LLC for state tax obligations and filings. If you ever call the Comptroller’s Office, they’ll use your Taxpayer Number to lookup your LLC. Also, when you use WebFile (the online filing system) you’ll need this number.

What is franchise tax in Texas?

Texas franchise tax is a “privilege tax” for doing business in Texas. Part of this privilege includes liability protections provided by state law. The franchise tax is administered by the Texas Comptroller of Public Accounts.

How long does an LLC have to give notice of foreclosure in Texas?

Texas law requires that the Comptroller’s Office gives your LLC at least 45 days grace period. That 45-day grace period starts after you receive the “Notice of Pending Forfeiture”.

Do LLCs pay franchise tax in Texas?

Most LLCs don’t pay franchise tax, but still have to file. Again, about 90% of Texas LLCs don’t have to pay franchise tax. Your Texas LLC won’t have to pay franchise tax if either of the following are true: your LLC’s annualized total revenue for the tax year is below the “ No Tax Due Threshold “.

When are Texas franchise tax reports due?

Texas franchise tax reports are due in advance, not in arrears. This is easier explained with an example. Let’s say your Texas LLC is approved on August 5th 2019. So your LLC franchise tax reports are due the following year, by May 15th 2020. your LLC’s report year will be 2020.

Will Texas have an email reminder for LLC in 2021?

Effective 2021: If the Texas Comptroller already has an email address on file for your LLC, you will receive an email reminder instead of a physical mail reminder (the Comptroller is going more and more digital).

Can an LLC sue in Texas?

the Comptroller has the power to forfeit the right of your LLC to transact business in this state (as per section 171.251 and section section 171.252 of the Texas Tax Code), your LLC being denied the right to sue or defend itself in a Texas court,

What taxes does an LLC pay?

The kind of taxes an LLC pays depends on its tax structure. An owner whose LLC is taxed by default pays personal income tax on their share of the business profits as well as self-employment tax on their distribution. An owner whose LLC is taxed as an S corp pays personal income tax on their share of the business profits ...

What is franchise tax?

Franchise Tax. A franchise tax is typically an annual tax that allows businesses to continue activity in a state. Some states may refer to this tax by a different name. The amount of business tax and how it’s calculated varies by state, but in many cases, it is a flat rate. Failure to comply may result in the termination of your business.

Which state does not tax out of state income?

Delaware: This state offers low filing fees and does not tax out-of-state income.

Does an LLC have to pay self employment tax?

An owner whose LLC is taxed as an S corp pays personal income tax on their share of the business profits but does not have to pay self-employment tax on their salary. An owner whose LLC is taxed as a C corp pays personal income tax on their share of the business but does not have to pay self-employment tax on their salary.

Do LLCs have to pay a partnership tax in Minnesota?

Minnesota: Multi-Member LLCs that have over $970,000 in combined property, payroll, and annual sales must pay a Partnership Tax. LLCs are also required to file an additional form with the state to determine their minimum fees.

Do S corp owners pay self employment taxes?

C corp and S corp owners pay themselves a salary and therefore do not have to pay self-employment tax on their individual returns.

Do LLCs have to report income?

Businesses tend to look for states that have no income tax or other forms of tax breaks, but keep in mind that these states can also come with Annual Report fees and can require LLCs to report income based on where profits are earned, not where the business is formed.

Is a limited liability company taxable?

The law specifically says that limited liability companies are subject to tax, by including them in the definition of "taxpayer" or "person.". Therefore, unless a particular limited liability company falls within an exemption contained in the law (see Tenn. Code Ann. Section 67-4-2008), it is taxable.

Do limited liability companies file taxes?

A limited liability company must file a franchise and excise tax return even if it chooses to be ignored as an entity for federal tax purposes and is treated as an individual taxpayer or as a "division" of a general partnership federally. The law specifically says that limited liability companies are subject to tax, by including them in the definition of "taxpayer" or "person." Therefore, unless a particular limited liability company falls within an exemption contained in the law (see Tenn. Code Ann. Section 67-4-2008), it is taxable.

What is the franchise tax rate in Missouri?

A franchise tax is also accessed on assets within the state of Missouri. The current rate is 1/30th of one percent of the asset base for assets more than $1 million dollars.

What happens if you elect to be taxed as a sole proprietorship?

If electing to be taxed as a sole proprietorship, the income from the business is attributed to the owner (s).

What is the form for LLC in Missouri?

For LLCs electing to be taxed as corporations, Form MO-1120 must be filed in Missouri. A single-member LLC that is considered disregarded for federal taxation purposes must report income and expenses accrued by the LLC on the member's tax return. In Missouri, a state tax identification number is required.

Does an LLC have to file a separate tax return?

If the LLC opts to forego the default pass-through tax process and chooses to be taxed as a corporation, a separate tax return must be filed for the LLC. The Missouri Department of Revenue accesses corporate taxes. The tax accessed is against all income earned by a registered company in Missouri.

Where to contact the Secretary of State Corporations Division?

A. Contact the Secretary of State Corporations Division at 600 W. Main St., Room 322, Jefferson City, MO 65101. You may also call toll free at 1-866-223-6535.

Is LLC a partnership in Missouri?

The Department of Revenue for Missouri follows the same procedures as the Internal Revenue Service, meaning, the LLC can be taxed as a partnership, corporation, or disre garded if the LLC is a single-member entity. The corporate tax bill for companies doing business in Missouri is generally lower than other states.