What credit score is needed for a franchise?

680 or higherSome franchise requirements to take into consideration may include: Credit score. Minimum credit scores vary by franchisor, but most consider a grade of 680 or higher as ideal.

Is it hard to get approved for a franchise?

Getting approved for franchise financing can be difficult, particularly if you need startup funds, you need funding but have bad credit, or your franchise has been open for less than a year.

What are the requirements to get the franchise?

Here are five of the basic requirements for starting a franchise company, along with a few considerations and warnings....What Is a Franchise?Money for Getting Your Operation Off the Ground and Running. ... A Business Plan. ... Exceptional Management Skills and Experience. ... Regulatory or Legal Requirements. ... A Good Accountant.

How do people afford to open a franchise?

I've organized this list by level of risk, from most conservative to riskiest.SBA-Backed Loan. ... Find Partners Or Investors. ... Equipment Loan. ... Franchisor Financing. ... Personal Loan. ... 401(k) Rollover. ... Tap The HELOC.

Do banks give loans for franchise?

Credit unions and commercial banks too offer franchise business financing. However, the process of documentation may test your patience. Your choice institution will study both your personal and business credit scores.

Can you get a bank loan to start a franchise?

Banks and credit unions can offer a wide variety of loan options for franchise businesses. These loans will likely have the most competitive interest rates and repayment terms, but require strict criteria to qualify.

How do I purchase a franchise?

How to buy a franchise, step by stepBe sure about your reasoning. ... Research which franchises you may want to own. ... Begin the application process. ... Set up your “discovery day” meeting. ... Apply for financing. ... Review and return your franchise paperwork very carefully. ... Buy or rent a location. ... Get training and support.

Which is the first step in purchasing a franchise?

1. Research Potential Franchise Opportunities. The first step when buying a franchise is to do your initial research on the different franchise opportunities available. It's important to find the right franchise according to your budget, qualifications, and personal interest.

How much do franchise owners make?

When researchers accounted for the inflations caused by the few top franchises, it was established that the average annual income of 51 percent of franchisees is less than 50,000 dollars. The study also found that only 7 percent of franchise owners earn over 250,000 dollars a year.

What is the failure rate for a franchise?

Coincidentally when I was with NatWest I managed the survey for the last 22 years. Pretty much every year the survey has been conducted has shown between 8-12% of franchise businesses left their franchise each year. This is for a variety of reasons, including retirement, selling, ill-health and financial failure.

What franchise is the most profitable?

Most Profitable FranchisesDunkin'7-Eleven.Planet Fitness.JAN-PRO.Taco Bell.Orangetheory Fitness.Great Clips.Mac Tools.More items...•

How much does it cost to buy McDonald's franchise?

McDonald's franchisee applicants must have a minimum of $500,000 available in liquid assets and pay a $45,000 franchise fee. Those looking to launch a new McDonald's franchise can expect to shell out between $1,314,500 and $2,306,500. Existing franchise prices can cost upwards of $1 million or more.

Why does it cost 10k to own a Chick-fil-A?

The franchisee only pays the $10k franchise fee. Chick-fil-A pays for (and retains ownership of) everything — real estate, equipment, inventory — and in return, it takes a MUCH bigger piece of the pie. While a franchise like KFC takes 5% of sales, Chick-fil-A commands 15% of sales + 50% of any profit.

How hard is it to get a Chick-fil-A franchise?

It simply isn't easy to get a Chick-fil-A franchise. According to AOL, the company only accepts about 75 to 80 new franchises each year, despite the fact that it receives around 20,000 applications on an annual basis. That means about 0.4 percent of applicants get approved.

How much do franchise owners make?

When researchers accounted for the inflations caused by the few top franchises, it was established that the average annual income of 51 percent of franchisees is less than 50,000 dollars. The study also found that only 7 percent of franchise owners earn over 250,000 dollars a year.

What franchise is the most profitable?

Most Profitable FranchisesDunkin'7-Eleven.Planet Fitness.JAN-PRO.Taco Bell.Orangetheory Fitness.Great Clips.Mac Tools.More items...•

Why do franchises take root?

Some franchises take root and are immediately positioned for success simply because the brand is so well known and the demand is so high. Others take some time to get off the ground.

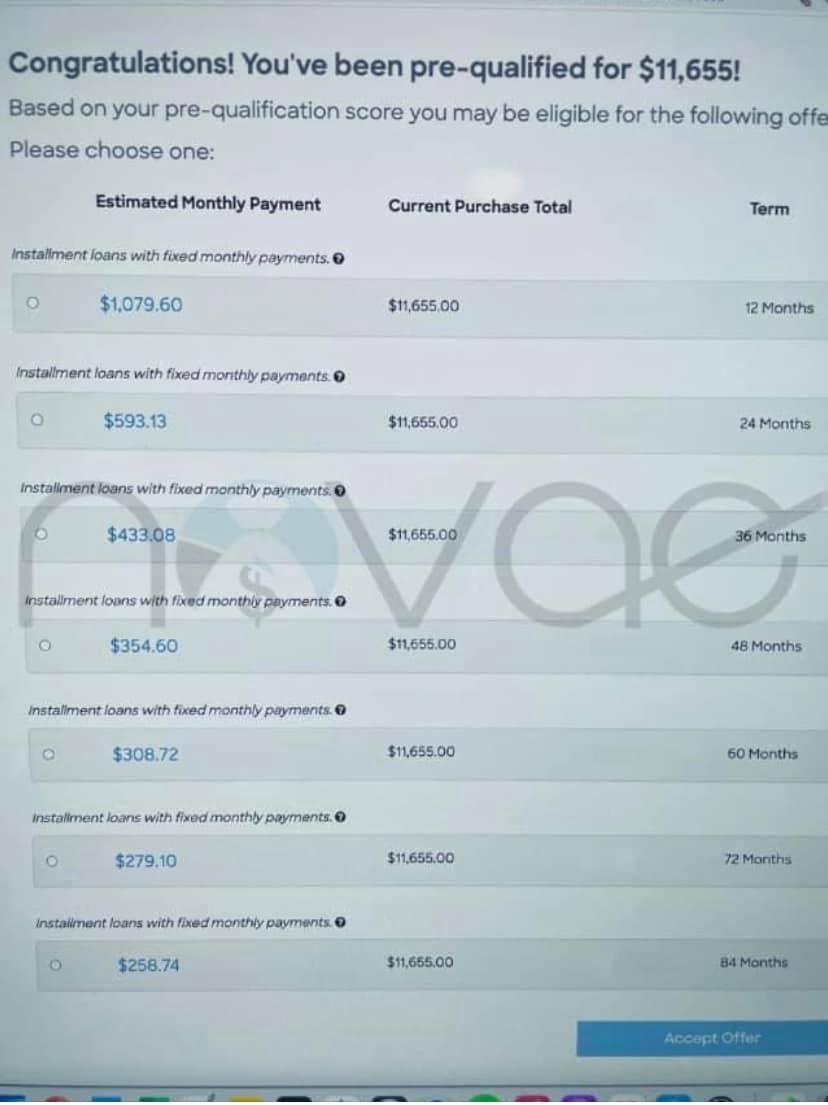

Can a bank give you a franchise loan?

Sometimes, a bank will give you the loan you need to finance your franchise, but you might encounter a higher interest rate. In this case, you’ll be required to pay higher monthly payments.

Why do franchisees use credit scores?

Credit Scores are used by Franchisors to identify their ideal candidates. Any individual that is looking to apply to become a Franchisee with a major brand should be aware that their credit is going to be pulled. In anticipation of this, it is advised that individuals wait until their credit score is good prior to applying.

Why is Credit score important to Franchisors?

Credit scores provide a lot of information on how individuals have managed their finances in the past. On a credit report; a Franchisor can get an idea of how long an individual has been using credit to make purchases. In addition, a Franchisor can see if an applicant has taken on large loans in the past such as a mortgage or car loans, and whether these loans have been repaid. A strong history of repaying debt is attractive to Franchisors. They are looking for individuals that have a history of managing finances well.

How good should my credit score be?

Experian.com states that most credit scores fall between 600 and 750. The website also states that they consider a score above 700 as good credit. Many franchise websites list that they are looking for individuals with good credit, so it is safe to say a credit score should be above 700 if an individual is applying to be a Franchisee. Having a credit score below 700 normally will not result in a candidate automatically being disqualified. Many Franchisors are willing to work with individuals with credit scores below 700 if they have a good reason for a low score or if there are other factors on their application that presents them as a strong candidate. If a candidate has a credit score below 700, they should be prepared to discuss why their credit score is low, and what they are doing to improve it. Conversely a credit score above 700 will not automatically get a candidate approved. If a candidate’s credit history demonstrates that they have a large amount of debt or if it shows that they have a bankruptcy or other derogatory information on their report this may raise a red flag that prevents a Franchisor from moving forward with a candidate.

Reassuring the Franchise of Your Abilities

The simple truth is that it is difficult to tell who is going to be a good business owner and who isn’t, especially when the people in question may not have any experience with owning a business before.

Success in the Lending Market

Lenders have had a bumpy road over the past few years, leading to tightened requirements for getting a loan. Even if you aren’t relying on a loan to get you set up with a franchise, it’s useful to have a line of credit for your business to insure that you’re always able to handle what comes at you.