What is franchise tax in New Mexico?

What are the exemptions for New Mexico corporate income tax?

How to get a certificate of incorporation?

When does a corporation exercise its franchise?

Does New Mexico tax foreign corporations?

Does a corporation have to file a franchise tax return in New Mexico?

See 3 more

About this website

Is New Mexico a franchise registration state?

New Mexico is considered a non-registration state when it comes to franchising. Due to it being a non-registration state there are no special state requirements that need to be fulfilled in order to offer or sell franchises in the state of New Mexico.

Which states regulate franchises?

For franchisors with a federally registered trademark, the Franchise Filing States include: Connecticut, Florida, Kentucky, Nebraska, North Carolina, South Carolina, South Dakota, Texas, and Utah. For franchisors without federally registered trademarks Georgia and Louisiana also require filings.

What are the legal requirements for a franchise?

Generally, the offer and sale of franchises find legal basis in laws such as:The Indian Contract Act, 1872.The Foreign Exchange Management Act, 1999 (FEMA).The Competition Act, 2002.The Trademarks Act, 1999.The Copyright Act, 1957.The Patents Act, 1970.The Design Act, 2000.The Income Tax Act, 1961.More items...

What is a franchise exemption?

The sophisticated franchisee exemption is available to franchisors if their potential franchisees are sophisticated enough to protect their own interests. Potential franchisees having at least 50% ownership must have 24 months of experience in the business within the last 7 years. Cal. Corp. Code § 31106(a).

Which state is not a franchise registration state?

Alaska is not a franchise registration state and does not require FDD registration or filing. Learn More about franchising in Alaska. Arizona is not a franchise registration state and does not require FDD registration or filing.

What states require FDD registration?

The following states require a franchise's FDD to be registered with a state government agency before operating there: California....These states are:Connecticut.Florida.Kentucky.Maine.Nebraska.North Carolina.South Carolina.South Dakota.More items...

Can anyone start a franchise?

Before you can get your operation going, you'll need to have enough initial capital as well as an overall net worth before even considering starting a franchise. Unless you're independently wealthy, you may have to borrow money. Start with commercial banks since they fund many types of franchises.

How do I turn my business into a franchise?

How to Franchise a BusinessMake sure your business is ready to franchise.Protect your business's intellectual property.Prepare a financial disclosure document (FDD)Draft a franchise agreement.Compile an operational manual for franchisees.File or register your FDD.Set a strategy to achieve your sales goals.

How do you register a franchise?

Below are some guidelines on how to follow each of these steps in opening your own franchise.Online Self-Test. ... Set your budget. ... Choose a franchise industry. ... Choose a franchise. ... Apply to find out more information from the franchisor. ... Sign the franchise agreement. ... Sign lease agreement and pay rental deposit.

What is a fractional franchise?

Fractional Franchise Exemption A “fractional franchise” is meant to allow an existing business to add new, but similar products or services. Potential franchisees must have at least 2 years of experience in the type of business represented by the franchise.

What is the minimum investment exemption to the FTC rule?

The franchise sale is for more than $1 million – excluding the cost of unimproved land and any financing received from the franchisor or an affiliate – and thus is exempt from the Federal Trade Commission's Franchise Rule Disclosure requirements, pursuant to 16 C.F.R.

What federal agency regulates franchises?

Federal Trade CommissionFranchise Rule | Federal Trade Commission.

Who regulates franchises in Georgia?

Who Regulates Franchises in Georgia? Because Georgia has not enacted franchise specific laws Georgia does not have any state specific regulator. However, the Department of Law of the Georgia Consumer Protection Division is charged with overseeing enforcement of Georgia's Business Opportunity Laws.

Does a franchise have protection under the law?

State franchise laws are designed to protect residents of the state against unfair or deceptive practices by franchisors. Generally, the law of the state where the franchisee resides or where the franchisee will operate the franchised business is the applicable state law for regulatory compliance.

Does Florida have franchise laws?

Florida has not enacted franchise specific laws and is not a franchise registration state.

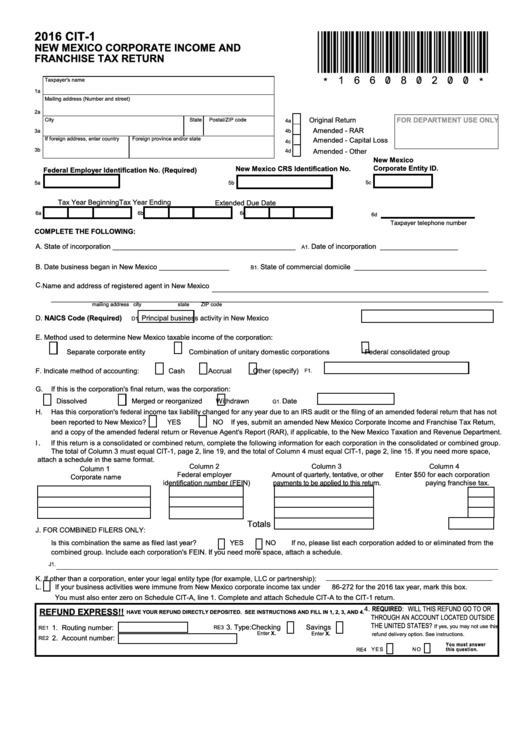

Corporate Income and Franchise Tax - Taxation and Revenue New Mexico

A corporation that generates income from activities or sources in New Mexico and must file a federal corporation income tax return or an equivalent return is subject to New Mexico Corporate Income Tax.

New Mexico Form CIT-1 Instructions (Instructions for Form CIT-1 ...

Download or print the 2021 New Mexico Form CIT-1 Instructions (Instructions for Form CIT-1 Corporate Income and Franchise Tax Return) for FREE from the New Mexico Taxation and Revenue Department.

CORPORATE INCOME TAX and CORPORATE FRANCHISE TAX - Taxation and Revenue ...

FYI-350 Rev. 7/2020 FYI-350 FOR YOUR INFORMATION Tax Information/Policy Office P.O. Box 630 Santa Fe, New Mexico 87504-0630

Who must a corporation register with in New Mexico?

A corporation also must register with the New Mexico Secretary of State’s Office.

Does New Mexico require a CRS number?

helium, or other non-hydrocarbon gas. A CRS identification number is not required for those who must pay withholding tax on oil or gas proceeds payments to nonresidents of New Mexico for wells located in this state. Pay those withholdings using RPD-41284, Quarterly Oil and Gas Proceeds Withholding Tax Return.

How long do you have to disclose a franchise before selling?

Franchisors must disclose a properly issued and current franchise disclosure document 14 days before offering or selling a franchise.

What is the role of a franchisor in a franchise?

Franchisors must manage and maintain their FDD, franchise disclosures and franchise relationships in compliance with a broad range of state franchise regulations and state franchise relationship laws.

What is a franchise disclosure document?

Franchisors must develop, maintain, register, and disclose a uniform Franchise Disclosure Document ( FDD ). The FDD must be registered in the franchise registration states, filed in the franchise filing states, and disclosed in every state to a prospective franchisee. Franchisors must manage and maintain their FDD, franchise disclosures and franchise relationships in compliance with a broad range of state franchise regulations and state franchise relationship laws.

Do franchises have to register FDD?

Under the federal rule, franchise compliance is largely self-regulated and franchisors are not required to file or register their FDD with any federal agency.

Non-Registration States

The following States do not require filing or registration to be able to sell Franchises in the State. They only require that the Franchisor follow the FTC Guidelines and have an approved FDD.

Filing States

A Filing State is one that requires the Franchisor to file and pay a fee, but does not require the Franchisor to submit documents and seek approval to sell Franchises, like a registration State.

Which states do not require a trademark?

Utah. Virginia. Washington. Wisconsin. Registration may not be required in the following states once you have a federally registered trademark for your franchise’s principal trademark: Connecticut. Maine. North Carolina. South Carolina.

Do you need a franchise agreement before selling?

However, the laws of several states require prior franchise registration before you may offer or sell franchises in those states. Several states require submission of your Franchise Disclosure Document (including the Franchise Agreement) so that the state franchise administrators may review it for legal compliance.

What is required to obtain a driver's license in New Mexico?

To obtain (and maintain) this license, the State of New Mexico requires an application, extensive supporting documentation, and annual reports.

How much does it cost to get a plant license in New Mexico?

To obtain (and maintain) this license, the State of New Mexico requires an application; a $10,000 application fee*; a $40,000 license fee; additional fees based on the number of plants; extensive supporting documentation including business plans, a diagram of the facility, and sales and distribution plans; and periodic renewals.

What is licenselogix?

LicenseLogix can help you acquire and maintain business licenses for all U.S. states and for most industries.

Do you need a medical license in New Mexico?

New Mexico Durable Medical Equipment Business Licenses. The State of New Mexico does not require a Durable Medical Equipment License. However, if your business is selling durable medical equipment in New Mexico, you may still be required to comply with other licensing laws at the state or local level.

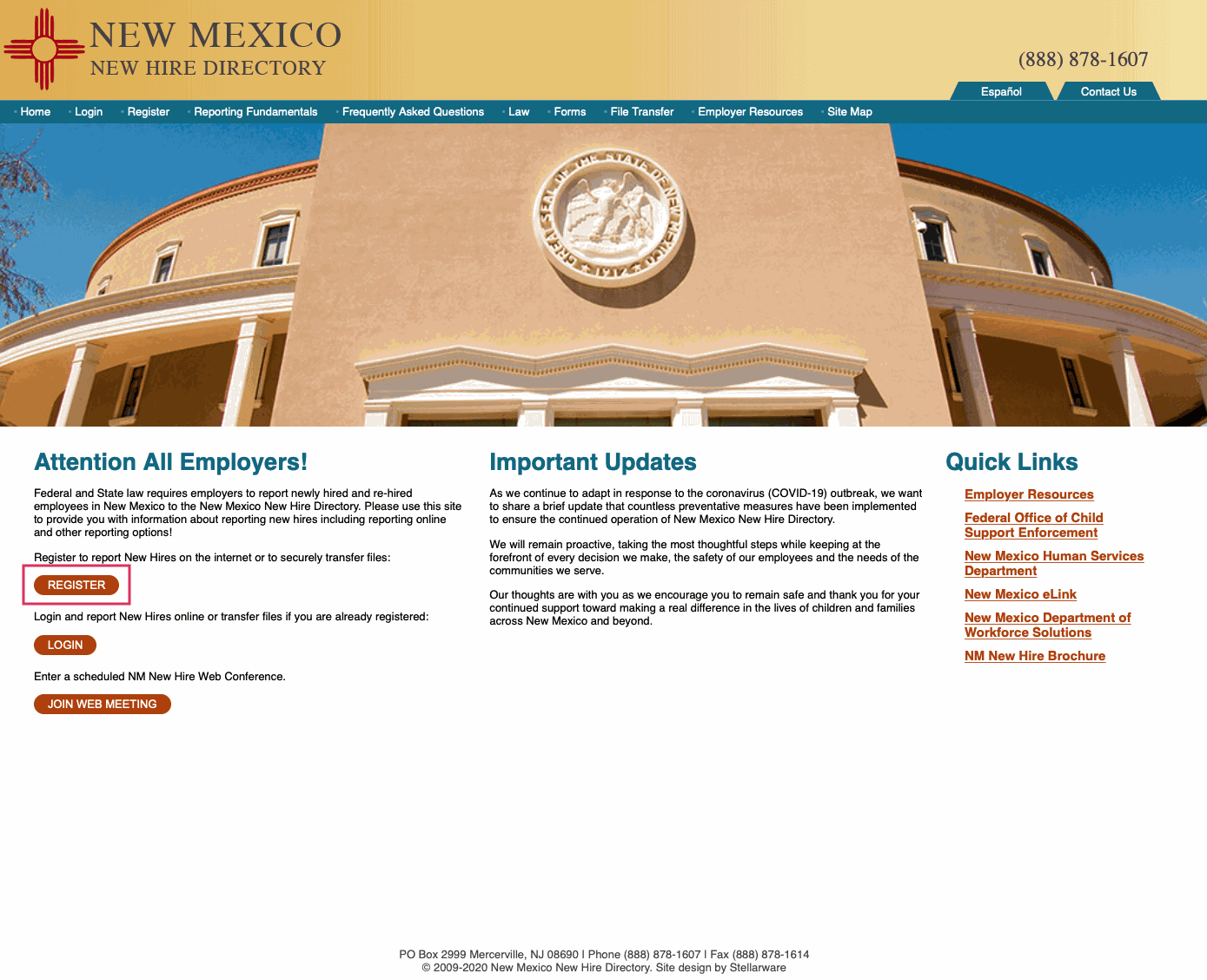

Does New Mexico require a franchise?

New Mexico Franchise Business Licensing. The State of New Mexico does not require Franchise Registration. However, if your business is operating a franchise in New Mexico, you may still be required to comply with other licensing laws at the state or local level.

Does New Mexico require a debt management license?

New Mexico Debt Management Business Licensing. The State of New Mexico does not require a Debt Management License. However, if your business is providing debt management services in New Mexico, you may still be required to comply with other licensing laws at the state or local level.

Does New Mexico require an architectural license?

The State of New Mexico does not require an Architectural Firm License, but an affidavit is required. However, if your business is providing architecture services in New Mexico, you may still be required to comply with other licensing laws at the state or local level.

What is franchise tax in New Mexico?

New Mexico Corporate Franchise Tax is the obligation of every domestic and foreign corporation, including S corporations, that either engages in business in New Mexico or exercises its corporate franchise in this state , whether actively engaged in business or not.

What are the exemptions for New Mexico corporate income tax?

Exempt from New Mexico Corporate Income Tax and Franchise Tax are: Insurance companies, reciprocal or inter-insurance exchanges which pay a premium tax to the state; Trusts organized or created in the United States and forming part of stock bonus, pension or profit-sharing plans of an employer for the exclusive benefit of his employees ...

How to get a certificate of incorporation?

To obtain a certificate of incorporation or to dissolve a corporation, you must contact the Secretary of State (SOS), which regulates corporations in this state.

When does a corporation exercise its franchise?

A corporation exercises its corporate franchise when it seeks treatment as a legal entity or person who is subject to the jurisdiction of, and privileges provided by, state law. Indications of exercise of a corporate franchise include, but are not limited to: Registering with the Public Regulation Commission;

Does New Mexico tax foreign corporations?

New Mexico imposes its corporate income tax on the net income of every domestic corporation and every foreign corporation that: Has income from property or employment within this state. Limited liability company or partnership taxed as a corporation under the United States Internal Revenue Code.

Does a corporation have to file a franchise tax return in New Mexico?

A corporation that has, or exercises, its corporate franchise in New Mexico is subject to the Franchise Tax, even if the corporation is not actively engaging in business in New Mexico or owes no New Mexico Corporate Income Tax. Taxpayers must use form CIT-1, Corporate Income and Franchise Tax Return to report the $50 annual Franchise Tax.

Oil and Gas

- A person or business that produces oil and gas must obtain an Oil and Gas Reporting Identification Number (OGRID). This is different from a Business Tax Identification Number. For information about obtaining an OGRID, please contact our Oil and Gas Bureau at (505) 827-0812. Persons or businesses that must obtain an OGRID include those that produce:...

Corporations

- A corporation must obtain a Business Tax Identification Number if it has any of the following taxes to report: 1. Compensating Tax: 2. Governmental Gross Receipts Tax 3. Gross Receipts Tax 4. Interstate Telecommunication Gross Receipts Tax 5. Leased Vehicle Gross Receipts Tax and Surcharge 6. Non-wage Withholding Tax 7. Wage Withholding Tax A corporation without liability …

How to Apply For A Business Tax Identification Number

- You can apply for a Business Tax Identification Number Onlineat our website tap.state.nm.us. You will click “Apply for a New Mexico Business Tax ID” and follow the prompts. Upon completion and approval of the online application you may log in with the credentials set up during the application. Any entity other than a sole proprietor/individual owner that does not have employe…

Special Tax Programs

- There are some cases in which certain businesses need another kind of registration in addition to the Business Tax ID Number. Special registration is required for sales of cigarettes, tobacco products, and liquor, for water production, for gasoline and special fuels, and for businesses engaged in severance and resources activities. Submit form ACD-31015 Business Tax Registrati…