The Ohio corporation franchise tax is a tax applied to both domestic corporations (those incorporated in Ohio) and foreign corporations (those incorporated outside of Ohio) for the privilege of doing business in Ohio, owning capital or property in Ohio, holding a charter or certificate of compliance authorizing the corporation to do business in Ohio, or otherwise having a presence (nexus) in Ohio during a calendar year.

Does Ohio have a corporate income tax?

While Ohio does not have a corporate income tax, the Ohio gross receipts tax serves a similar purpose and applies to most businesses. Three other states have a similar setup instead of a corporate income tax, including Texas, Michigan, and Washington.

Does Ohio have franchise tax?

The Ohio corporation franchise tax is a tax applied to both domestic corporations (those incorporated in Ohio) and foreign corporations (those incorporated outside of Ohio) for the privilege of doing business in Ohio, owning capital or property in Ohio, holding a charter or certificate of compliance authorizing the corporation to do business in Ohio, or otherwise having a presence (nexus) in Ohio during a calendar year.

What is the business tax rate in Ohio?

This is commonly referred to as Ohio’s Business Income Deduction (form IT BUS). Any remaining business income above these thresholds is then taxed at a flat 3% rate. Only business income earned by a sole proprietorship or a pass-through entity generally qualifies for the deduction.

Are non-profit corporations subject to franchise tax?

Franchise and excise taxes are not applicable to nonprofit persons as defined by law. They must file an annual report with the Secretary of State and pay the filing fee.

When are Ohio business taxes due?

What are the most common forms of business in Ohio?

Which states do not have corporate income tax?

Is LLC a corporation in Ohio?

Is a corporation subject to state tax?

Do sole proprietorships pay Ohio state taxes?

Do partnerships pay Ohio state tax?

See 4 more

About this website

What states have no franchise tax?

Understanding Franchise Taxes As of 2020, these states included Alabama, Arkansas, California, Delaware, Georgia, Illinois, Louisiana, Mississippi, New York, North Carolina, Oklahoma, Tennessee, and Texas. Kansas, Missouri, Pennsylvania, and West Virginia all discontinued their corporate franchise taxes.

Does Ohio have an LLC tax?

State Business Taxes By default, LLCs themselves do not pay federal income taxes, only their members do. Ohio, however, has a Commercial Activity Tax that applies to most Ohio business entities including LLCs. The tax is based on gross receipts for your business and is calculated at a small series of marginal rates.

Does Ohio have business tax?

Yet Ohio is one of just six states with no state-level corporate income tax. [1] All surrounding states have such taxes, with rates ranging from 5.0% to 9.99%.

How do business taxes work in Ohio?

Owners pay self-employment tax on business profits. Owners pay state tax on any profits, less state allowances or deductions. Owners pay federal income tax on any profits, less federal allowances or deductions. Some LLCs pay Ohio sales tax on products.

Is there an annual fee for LLC in Ohio?

The Ohio Secretary of State doesn't require you to file any annual information form or pay any annual fee for your LLC. Ohio is one of only 5 states that have a true “No Annual Report Due”. In Ohio, there is no money owed annually to the Secretary of State and there is no Information Report to submit.

How much are taxes for LLC in Ohio?

How Much Does It Cost to Maintain an LLC in Ohio. To maintain an LLC in Ohio you do not need to pay an annual fee. However, state income tax at 1.98% to 5%, sales & use tax at 5.75% and federal taxes are levied.

What taxes do you pay in Ohio?

The state of Ohio requires you to pay taxes if you're a resident or nonresident that receives income from an Ohio source. The 2021 state income tax rates range from 2.765% to 3.99%, and the sales tax rate is 5.75%.

What is the business tax rate in Ohio?

Ohio does not have a corporate income tax but does levy a gross receipts tax. Ohio has a 5.75 percent state sales tax rate, a max local sales tax rate of 2.25 percent, and an average combined state and local sales tax rate of 7.22 percent.

Does Ohio still have a cat tax?

As a gross receipts tax, the CAT is levied on the entirety of a company's Ohio business receipts, without deductions for compensation, costs of goods sold, or other expenses....Ohio's CAT Is Out of the Bag.Industry SectorProfit/Receipts RatioEffective Tax RateManagement of Companies (Holding Companies)70%0.4%18 more rows•Nov 23, 2021

What income is not taxed in Ohio?

Taxpayers with $25,000 or less of non-business income are not subject to income tax for 2021.

How much can a small business make before paying taxes in Ohio?

Do I have to file taxes for my small business in Ohio? It depends. If you have gross receipts below $150,000 you won't have to file and pay the CAT. However, if your business has employees, you will need to file state employment withholding and unemployment insurance taxes.

What do LLCs pay taxes on?

The IRS treats co-owned LLCs as partnerships for tax purposes. Like one-member LLCs, co-owned LLCs do not pay taxes on business income; instead, the LLC owners each pay taxes on their share of the profits on their personal income tax returns (with Schedule E attached).

What do LLCs pay taxes on?

The IRS treats co-owned LLCs as partnerships for tax purposes. Like one-member LLCs, co-owned LLCs do not pay taxes on business income; instead, the LLC owners each pay taxes on their share of the profits on their personal income tax returns (with Schedule E attached).

How much is business tax in Ohio?

Ohio does not have a corporate income tax but does levy a gross receipts tax. Ohio has a 5.75 percent state sales tax rate, a max local sales tax rate of 2.25 percent, and an average combined state and local sales tax rate of 7.22 percent.

What taxes do self employed pay in Ohio?

How much is the self employment tax for Ohio? A self employed individual must pay Ohio self employment tax, since they don't have an employer to withhold those federal payments on their behalf. The Ohio self employment tax totals 15.3%, with 12.4% covering Social Security and 2.9% going to Medicare.

What is Ohio pass through entity tax?

The pass-through entity tax is not so much a separate tax but rather a mechanism designed to collect individual income tax or corporate franchise tax which is oth erwise due and payable by pass-through entity in vestors pursuant to Ohio tax law.

Ohio Corporate Income Tax: Everything You Need to Know - UpCounsel

Updated November 5, 2020: The Ohio corporate income tax must be paid by most corporations and businesses that operate in this state. The tax applies to a business's gross taxable income, and the rate you pay depends on how much your business has earned in a tax year.

Ohio Corporate Tax Rates - 2022

Ohio has no corporate income tax at the state level, making it an attractive tax haven for incorporating a business. Ohio corporations still, however, have to pay the federal corporate income tax.

Income - Business Income and the Business Income Deduction

For tax years 2016 and forward, the first $250,000 of business income earned by taxpayers filing “Single” or “Married filing jointly,” and included in their federal adjusted gross income, is 100% deductible. For taxpayers who file “Married filing separately,” the first $125,000 of business income included in their federal adjusted gross income is 100% deductible.

Business Income Deduction - Ohio Department of Taxation

Ohio taxes income from business sources and nonbusiness sources differently on its individual income tax return (the Ohio IT 1040). For tax years 2016 and forward, the first $250,000 of business income earned by taxpayers filing “Single” or “Married filing jointly,” and included in federal adjusted gross income, is 100% deductible. For taxpayers who file “Married filing separately ...

Ohio Commercial Activity Tax: Ohio Gross Receipts Tax Repeal

Coming out of the pandemic, the state of Ohio is estimating significant tax revenue growth, and a group of Ohio lawmakers is looking to take advantage and repeal the Commercial Activity Tax (CAT). Ohio’s CAT, implemented in 2005 as part of tax reform that lowered and consolidated business taxes, is one of only a few gross receipts taxes still levied in the country.

What is corporate income tax in Ohio?

The corporate income tax is a progressive tax system. Businesses in Ohio must file a tax return every year. On these returns, corporations can claim deductions for issues such as: In addition to the corporate income tax, Ohio requires a commercial activity tax (CAT).

Who pays Ohio corporate tax?

The Ohio corporate income tax must be paid by most corporations and businesses that operate in this state. The tax applies to a business's gross taxable income, and the rate you pay depends on how much your business has earned in a tax year.

How much tax do you pay on a business with less than $150,000?

No tax for businesses with less than $150,000 in gross receipts

When do you pay CAT in Ohio?

For instance, if your business has gross receipts of more than $1 million, your CAT is required quarterly, and you must pay on May 10, Aug. 10, Nov. 10, and Feb. 10. A business's net income usually is not taxed in Ohio. Individual income will be taxed marginally with rates between 1.9 and 4.9 percent.

Which state has a similar tax system for corporations?

The commercial activity tax functions similarly to a corporate income tax. Other states that use a similar tax system for corporations include: Michigan.

Does Ohio have a franchise tax?

Before 2014, a corporate franchise tax was also required for Ohio businesses. This tax was repealed and is no longer applicable.

Which states have a similar tax system?

Other states that use a similar tax system for corporations include: Michigan. Texas. Washington. If you want to structure your Ohio business as an S-corporation, you would first need to establish a traditional C-corporation and then make a special tax election with the IRS.

When was franchise tax repealed?

The corporation franchise tax, a business privilege tax that dates back to 1902, was repealed for tax year 2014 and after (see Amended Substitute House Bill 510, 129th General Assembly). Instead, most corporations are now subject to the commercial activity tax (CAT) or the financial institutions tax (FIT).

Is there a franchise tax report for 2013?

Note: Tax year 2013 (based on taxable year ending in 2012) was the final year for the corporation franchise tax with the enactment of the new financial institutions tax (FIT). There will be no franchise tax reports for tax year 2014. Please do not modify a 2013 report to the 2014 tax year as it is no longer required.

What are the taxes that are paid in Ohio?

There are two main types of tax that you will pay to the Ohio Department of Taxation: Ohio state income tax and Ohio state sales tax.

Where do you pay sales tax in Ohio?

If you sell physical products or certain types of services, you may need to collect sales tax (also known as sales and use tax) and then pay it to the OH Department of Taxation. Ohio sales tax is collected at the point of purchase. Ohio sales tax rates do vary depending on the region, county or city where you are located.

How does an Ohio LLC work?

Instead, taxes for an Ohio LLC work as follows: 1. Ohio LLC owners pay self-employment tax on business profits. 2. Ohio LLC owners pay OH state tax on any profits, less state allowances or deductions. 3. All LLC owners pay federal income tax on any profits less federal allowances or deductions. 4.

What is the Ohio self employment tax rate?

It applies to all the earnings you withdraw from your Ohio business. The current self-employment tax rate is 15.3 percent.

What is payroll tax?

Employees pay federal, state and payroll tax on their earnings. Items 1, 2 and 3 are taxed as “pass-through” income for any LLC owners, managers or members who receive profits from the business.

How much payroll tax do employers have to withhold?

All employers must collect and withhold payroll tax from their employees when they receive their salaries. You would normally withhold 7.65 percent of the taxable salary that you pay to your employees.

What items do you need to pay sales tax on in Ohio?

You will typically need to collect Ohio sales tax on: Tangible, personal property and goods that you sell like furniture, cars, electronics, appliances, books, raw materials, etc.

What is the sales tax rate in Ohio?

[4] The Ohio sales tax rate is 5.75%, and the Counties on behalf of themselves and other governmental organizations, can add additional so-called piggy back taxes increasing the tax rate. [5] The piggy back sales tax rate in Cuyahoga County, for example, is 2.75%. Information on sales tax rates in the various jurisdictions in Ohio can be located at the following link: https://www.tax.ohio.gov/sales_and_use/rate_changes.aspx.

How long do you have to file taxes in Ohio?

[16] If an Ohio employer sells its business or inventory, the seller must file a final return within 15 days after the date of the sale. [17] The buyer will be liable for the seller’s unpaid income tax withholding, interest and penalties if the buyer does not withhold a sufficient amount of the purchase price to pay those taxes, interest and penalties before receiving from the Ohio Tax Commissioner a receipt indicating the taxes have been paid, or a certificate that no taxes are due. [18] Interestingly, this statute provides that the Tax Commissioner may adjust the liability of the seller, or the responsibility of the purchaser, for income tax withholding, if required to ensure that the State collects the maximum of withholding tax revenue. [19] Presumably, this is in order to persuade a buyer to purchase a business where the potential tax liability exceeds the purchase price. A similar provision is not included in the sales tax or CAT statutes.

What happens if you don't pay sales tax in Ohio?

A purchaser of the assets of a business will be liable for any unpaid sales tax of the seller, as well as any accrued interest and penalties related thereto, if it does not withhold from the purchase price for such assets an amount sufficient to pay such taxes, interest, and penalties. The amount withheld from the purchase price must not be paid to the seller until such time as it obtains from the Ohio Tax Commissioner a receipt indicating all taxes have been paid, or a certificate indicating no taxes are due. [6]

What happens if a seller doesn't pay Ohio taxes?

If a seller has not paid its Ohio taxes that is generally because its business is in financial distress. This raises the issue of whether a purchaser of the assets of a business can avoid liability for the seller’s taxes by making the purchase as part of a debtor relief proceeding. Purchasers have argued that since the sale is being conducted by someone other than the seller of the business that owed the taxes, the statutes cited above do not apply. In two cases, Common Pleas Courts have held that a sale of assets by a receiver in a receivership proceeding, or a Sheriff at a foreclosure sale, are not sales by the taxpayer who owed State taxes, and the purchaser therefore acquired the assets sold free of trailing State tax liabilities. [20] In a later Court of Appeals decision pertaining to a Chapter 11 Bankruptcy Court proceeding, the Court of Appeals for Hamilton County held that a sale by a debtor in possession with bankruptcy court approval could be subject to successor liability under RC § 5739.14 and reversed a trial court decision citing these Common Pleas Court opinions. The Appeals Court reasoned that in a Chapter 11 proceeding the seller of the assets is not the Bankruptcy Court and so the purchaser could be subject to the obligation to withhold potential State tax liability from the purchase price. The Bankruptcy Court Order approving the sale was unclear as to whether the purchaser acquired title free of the claims of the Ohio Department of Taxation and the Court of Appeals remanded the case for the trial court to make that determination. [21] It certainly seems that a purchaser in a judicial proceeding can acquire title to assets of a business free from liability for Ohio State taxes, but only if the Court Order approving the sale so provides, and counsel for such a purchaser should make certain that the Order is properly drafted. As set forth below, Section 363 of the Bankruptcy Code specifically authorizes a sale free and clear of all claims and interests including those of State tax authorities.

What are the remedies for fraudulent transfer in Ohio?

These remedies include an injunction against further disposition of property, the appointment of a receiver to take charge of the assets transferred, avoidance of the transfer, or attachment or garnishment of the transferred property. [28] In practice, if the purchaser of a troubled business is found to have paid inadequate consideration, the purchaser will be required to pay more to the creditor or creditors bringing an action under the Uniform Fraudulent Transfer Act.

How much is a conveyance fee in Ohio?

Ohio County Auditors charge a fee upon the filing of a deed for the conveyance of real property in this State equal to 10 cents for each $100, or fraction of $100, of the value of the real property. [35] A buyer does not have to pay this fee, but the deed for the property purchased by the buyer will not be recorded if this fee is not paid. The buyer must file a Statement with the County Auditor (Form DTE 100) reporting the purchase price and thereby establishing the basis for determining the amount of the conveyance fee. [36] Certain conveyances are exempt from the conveyance fee, including distributions from a business entity to its owners, and capital contributions to a business entity in consideration for the issuance of an interest therein. [37]

Does Ohio have franchise tax?

Ohio does not impose a franchise tax on corporations doing business in the State, but all commercial enterprises with substantial nexus with the State are required to pay a commercial activity tax (“CAT”) upon their gross receipts. [12] On gross receipts in excess of $1 million, the CAT rate is .26%. [13] The liability of all businesses forming a consolidated or combined group under the applicable statute is joint and several. [14]

What is Ohio corporate income tax?

What is the Ohio corporate income tax? Ohio's corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in Ohio. The Ohio corporate income tax is the business equivalent of the Ohio personal income tax, and is based on a bracketed tax system.

How to get tax exempt status in Ohio?

In order to gain Ohio tax-exempt status, a corporation must qualify as a 501 (c) and obtain a Nonprofit Tax-Exempt ID Number from the IRS. Ohio may also require nonprofits to file additional paperwork with the Ohio Department of Revenue to gain exemption from Ohio's corporate taxes.

Why do C corporations pay double tax?

Because C-Corporations pay corporate taxes on their revenue in addition to the personal income taxes shareholders and owners pay on profits withdrawn from the company, profits received from a C-Corporation are subject to a phenomenon known as double taxation .

How does corporate tax differ from personal tax?

The federal corporate tax's brackets differ from the personal income tax in that the brackets are not completely progressive (the last tax bracket is not the highest). This allows the corporate tax burden to be spread more evenly among companies with various revenue levels. The current corporate tax rates have been in effect since 1994 (unlike the federal income tax brackets, which are updated yearly for inflation).

Does Ohio have corporate tax?

In addition to the Ohio corporate income tax, Ohio corporations must also pay the federal corporate income tax. Like the personal income tax the federal business tax is bracketed based on income level, with eight corporate tax brackets. The federal corporate tax's brackets differ from the personal income tax in that the brackets are not completely ...

Do S corporations pay taxes?

S-Corporations and other flow-through entities aren't subject to the double taxation of revenue imposed on a C-Corp, because they aren't required to pay corporate taxes on their revenue. However, the owners or members of the corporation must report their share of the corporation's income on their personal tax returns and pay Ohio and federal income tax .

Is a nonprofit a tax exempt organization?

Nonprofit educational and scientific groups are tax-exempt, including nonprofit schools and colleges and certain research institutions. Covered under § 501 (c) (3) of the IRC. Bona-fide charities are exempt from all corporate income taxes, including both religious and non-religious charities. Covered under § 501 (c) (3) of the IRC.

How to pay Ohio state taxes?

You can mail your return to the at the correct address below, and include your payment by check or money order. You may also electronically file your Ohio tax return through a tax preparer or using online tax software, and pay your taxes instantly using direct debit or a credit card ( an additional credit card fee may apply).

What are Ohio tax deductions?

Ohio Tax Deductions. Income tax deductions are expenses that can be deducted from your gross pre-tax income. Using deductions is an excellent way to reduce your Ohio income tax and maximize your refund, so be sure to research deductions that you mey be able to claim on your Federal and Ohio tax returns.

How to check on Ohio tax refund?

If you want to check the status of your Ohio tax refund, you can visit the Ohio Income Tax Refund page .

What happens if Ohio witholds?

If your state tax witholdings are greater then the amount of income tax you owe the state of Ohio, you will receive an income tax refund check from the government to make up the difference.

What is the most popular tax software?

The two most popular tax software packages are H&R Block At Home, sold by the H&R Block tax preparation company, and TurboTax Federal & State, sold by the Intuit software company. Both companies produce multiple editions for simple to very complex tax returns, so be sure to carefully compare the features offered by each package.

When do you mail your Ohio tax return?

If you filled out physical tax return forms, mail your completed Ohio income tax return to the Ohio no later then December 31st. Please be sure to send your completed tax forms to the correct address for your filing type.

Does Ohio have a standard deduction?

4.1 - Ohio Standard Deduction. Unlike many other states, Ohio has no standard deduction . Certain itemized deductions (including property tax, qualified charitable contributions, etc) may be allowed depending on the income level and filing type of the taxpayer.

What is franchise tax in Ohio?

The franchise tax was Ohio’s corporate income tax , levied on profits or net worth. The tangible personal property tax was a local tax on machinery, equipment, furniture, fixtures and inventory – property not in land or buildings.

How much did Ohio franchise tax in 2004?

According to data released by the Ohio Department of Taxation, 18 of the top 50 companies in Ohio ranked by sales paid $1,000 or less in corporate franchise tax for tax year 2004, prior to the repeal of the tax. [36] . Each had Ohio sales of at least $500 million.

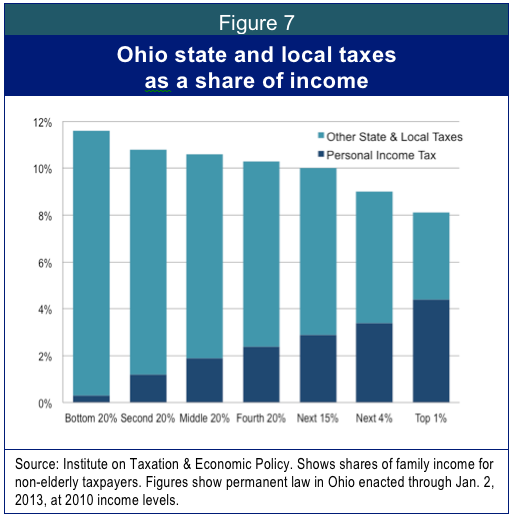

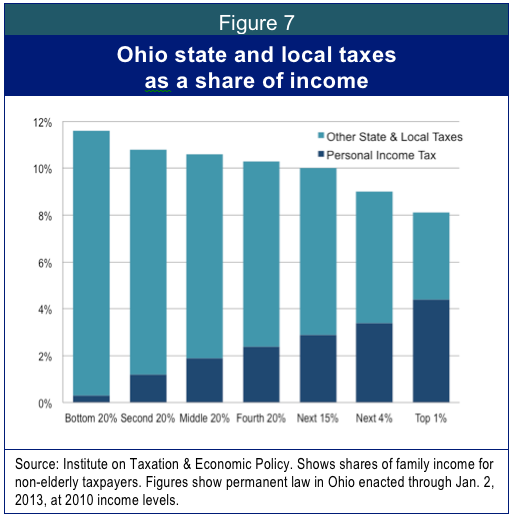

How much did Ohio shareholders get in tax cuts?

The Institute on Taxation and Economic Policy (ITEP), a national nonprofit with a sophisticated model of state and federal tax systems, analyzed the law and found that in 2018, Ohio shareholders got the bulk of $2.5 billion in corporate tax cuts from the law.

What are the weaknesses of franchise tax?

One of the weaknesses of the old corporate franchise tax was that it excluded partnerships, S Corporations, sole proprietorships and other passthrough entities. Most companies, including limited liability companies (LLCs), are now organized this way. But whatever the merits of such treatment for small companies, there is little justification for extending it to large passthroughs that operate similarly to other big corporations.

Why is Ohio's corporate franchise tax called Swiss cheese?

Ohio’s old corporate franchise tax was often described as a “swiss cheese” tax because it was easy for corporations to avoid paying it.

Why did the Tax Cuts and Jobs Act give a big tax break to S corporations?

The Tax Cuts and Jobs Act, slashed corporate taxes and provided a big new tax break for owners of partnerships, S Corporations and other businesses known as “passthrough entities” because their profits are taxed under the individual income tax as they pass through to the owners.

Is raising the tax rate on corporate profits reasonable during a recession?

As Reed College Economics Professor Kimberly Clausing observed in a Los Angeles Times column on federal taxes, “raising the tax rate on corporate profits is perfectly reasonable during a recession. Corporate taxes are paid only by profitable corporations, and for those without profits, any percent of zero is zero.”.

When are Ohio business taxes due?

For example, businesses with over $1 million in gross receipts must pay this tax on a quarterly basis; the quarterly returns are due by the 10th day of the second month following each calendar quarterly tax period (May 10th, August 10th, November 10th, and February 10th).

What are the most common forms of business in Ohio?

Here's a brief look at additional details for five of the most common forms of Ohio business: corporations (C corporations), S corporations, LLCs, partnerships, and sole proprietorships.

Which states do not have corporate income tax?

Currently, six states – Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming – do not have a corporate income tax. However, four of those states – Nevada , Ohio, Texas, and Washington – do have some form of gross receipts tax on corporations. Moreover, five of those states – Nevada, South Dakota, Texas, Washington, ...

Is LLC a corporation in Ohio?

Note that while by default LLCs are classified for tax purposes as partnerships (or, for single-member LLCs, disregarded entities), it is possible to elect to have your LLC classified as a corporation. However, because Ohio's commercial activity tax applies in the same manner to corporations, partnerships, and disregarded entities, your choice in this regard will not affect how your business is taxed by the state.

Is a corporation subject to state tax?

In most states corporations are subject to a corporate income tax, while income from pass-through entities such as S corporations, limited liability companies (LLCs), partnerships, and sole proprietorships is subject to a state's tax on personal income.

Do sole proprietorships pay Ohio state taxes?

Sole Proprietorships. Income from your business will be distributed to you as the sole proprietor, and you will pay tax to the state on that income. In addition, your business is also required to pay Ohio's commercial activity tax on gross receipts.

Do partnerships pay Ohio state tax?

Income from partnerships is distributed to the individual partners, who then pay tax on the amount distributed to them on both their federal and state tax returns. Partnerships are also required to pay Ohio's commercial activity tax on gross receipts.