You’ll also need to meet the franchise requirements set by the SBA. SBA loans can only be used if the franchise is listed in the SBA Franchise Directory. This is a list of franchise brands that the SBA has determined meet the “independent business” standards.

Full Answer

What is the SBA Franchise Directory?

Does the SBA include franchises in the FTC?

Does the SBA have an affiliation review?

About this website

SBA Franchise Directory - Small Business Administration

SBA Franchise Directory Effective September 10, 2019 SBA FRANCHISE IDENTIFIER CODE BRAND MEETS FTC DEFINITION? IS AN ADDENDUM NEEDED?

SBA Franchise Directory

This list is made available for use by Lenders/CDCs in evaluating the eligibility of a small business that operates under an agreement.

Does my franchise need to be on the SBA franchise directory?

Yes. If the Applicant is operating under a franchise or similar agreement that meets the Federal Trade Commission definition of a franchise in 16 CFR 436, the franchise must be listed on the SBA Franchise Directory with a franchise identifier code to ensure the franchise is eligible under SBA’s other eligibility criteria (e.g., 13 CFR § 120.110). ...

How to Find the Name of a Franchise Owner | Bizfluent

If you want to find the names of several franchise owners either in the same region or those who own the same kinds of franchises, a franchise email list is usually a good investment. If you just want the name of one specific franchise owner, you can usually find it through a business search.

SBA - PRO-Net - Search Database - Small Business Administration

Area Code or Phone Number Initial Fragment, (1 to 12 characters, 999-999-9999 format) Metropolitan Statistical Area (4-digit numeric, leading 0's if fewer digits): SBA Servicing Office: (4-digit numeric, leading 0's if fewer digits) Zip Code or Zip Code Initial Fragment (1 to 5 numeric digits)

How to decide whether to franchise or buy a business?

Quantify your investment: Review your financial landscape and decide how much you’re willing to spend to purchase — and ultimately manage — the business.

What is a franchise business?

A franchise is a business model where one business owner (the “franchisor”) sells the rights to their business logo, name, and model to an independent entrepreneur (the “franchisee”). Restaurants, hotels, and service-oriented businesses are commonly franchised. Two common forms of franchising are:

What is business format franchising?

Business format franchising : The franchisor and franchisee have an ongoing relationship. This style of franchising normally focuses on full-spectrum business management.

What is the difference between franchising and buying a business?

The main difference between franchising and buying an existing business is the level of control you’ll have over your business.

What is the most common form of franchising?

Two common forms of franchising are: Product/trade name franchising : The franchisor owns the right to the name or trademark of a business, and sells the right to use that name and trademark to a franchisee. This style of franchising normally focuses on supply chain management.

What does a franchisor do?

Typically, the franchisor offers services like site selection, training, product supply, marketing plans, and even help getting funding. When you buy a franchise, you get the right to use the name, logo, and products of a larger brand. You’ll also get to benefit from brand recognition, promotions, and marketing.

What are the zoning requirements for a business?

Zoning requirements : Zoning requirements may affect your business. Make sure your business follows all the basic zoning laws in your area. Environmental concerns : If you're buying real property along with the business, it's important to check the environmental regulations in the area.

Why SBA Franchise Loans?

Owning a franchise is an appealing option for a few reasons. A franchise operates with a model that has already proven to be successful and comes with a corporate reputation to back up the choice in your investment.

How Can Franchise Owners Use SBA Loans?

The SBA loan program has specific requirements for how the funds can be used, which are outlined in the loans’ eligible use of proceeds. In short, the SBA requires that loans are used to improve or establish a site to conduct your business, fund your operation’s soft costs, and/or refinance certain outstanding debts.

Which SBA Loan Program is Right for You?

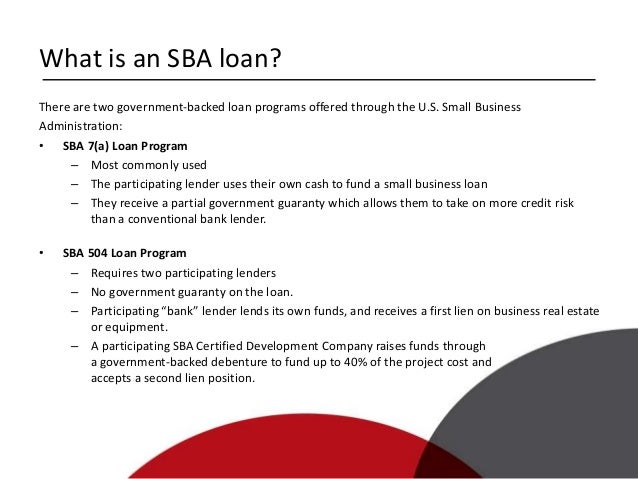

There are multiple SBA programs business owners may utilize to start or grow a franchise. The type of loan you should apply for depends on the amount of capital your project needs and how you plan to spend the funds. The three most popular SBA loan programs for franchise owners are:

Is My Franchise Eligible for SBA Franchise Financing?

To receive an SBA 7 (a) loan, a franchise must meet universal SBA 7 (a) Loan Program requirements, franchise-specific requirements, and be evaluated by the lending institution as a viable and credit worthy financing candidate. According to the SBA, eligible businesses must:

How to Apply for an SBA Franchise Loan

After you determine that an SBA franchise loan is a good fit for your plans, it’s time to begin the application process. Follow these steps to get started:

What Are SBA Franchise Loans?

SBA franchise loans are loans designated for business owners planning to open a franchise.

What does a franchisee get from a franchisor?

Franchisees get access to all the business’s proprietary information, including the business name, branding, and resources. The franchisor gets a royalty for allowing the franchisee to use their business model.

What is the best loan for a franchise?

If you are looking for general financing to start a franchise, an SBA 7 (a) loan could be the best option for you. These loans can be used to buy land, expand a franchise, resolve debts, or use as working capital.

Can a non profit business qualify for a franchise loan?

Non-profit business, one involving gambling, or a life insurance company will not qualify for an SBA franchise loan. In addition to meeting these general requirements, there are other standards for qualifying as well.

Does the SBA determine eligibility?

The SBA lender will also determine eligibility based on you as a lender. Do you have experience running a business? Are you reliable?

How to apply for SBA loan as a franchise owner?

The steps for applying for an SBA loanare similar to any other applicant with one exception: You must first verify your franchise brand is eligible for SBA financing. Confirm your franchise is eligible for SBA financing.

How to determine if a franchise is eligible for financing?

Review the SBA franchise directoryon the SBA website to determine whether your franchise is eligible for financing. When SBA franchise lenders review your documents, they will also reference the directory to confirm your eligibility.

What to do if your brand is not listed in the franchise directory?

If a brand is not listed in the directory, consider asking the franchiser if they have plans to be listed. The directory is updated weekly and there are no application fees.

How long can a 7A loan be?

Terms for a 7(a) loan can extend up to 25 years but will vary depending on the franchisee’s intended use of the proceeds. Interest rates can be either fixed (up to 11.25%) or variable (up to 8%).

Can a franchise owner apply for SBA loans?

However, only business owners whose franchises are listed in the SBA franchise directory can apply. The listed franchises operate business models that meet the SBA’s eligibility criteria.

Does the SBA loan directly to franchise owners?

Keep in mind that the SBA does not issue loans directly to franchise owners — you’ll need to apply through SBA-approved lenders. The SBA’s Lender Match Toolcan help connect you with qualified lenders in your area.

How long can you go without bankruptcy with SBA?

Personal/Business bankruptcy. Recent personal or business bankruptcies are barriers to obtaining an SBA loan. Some banks will want to see no bankruptcies for three years while others will be wanting five years without bankruptcies.

How much is the SBA Express loan?

The SBA Express loan has traditionally been for loans up to $350,000, but recently Congress increased the Express loan maximum to $1,000,000 until December 31, 2020.

What is the minimum credit score for a SBA loan?

FICO SBSS scores range from 0 – 300. The SBA wants to see a minimum score of 140, whereas many SBA banks (including our SBA lending partners) want to see a minimum liquid business credit score of 150 – 160. For larger loans – $1M or greater – an SBA lender may not consider SBSS at all and instead focus more attention and due diligence efforts on the finances of the business. The credit agencies and some credit agency services will provide a borrower’s FICO SSBS score, usually for a fee between $50 – $100.

Why is the interest rate on a SBA loan higher than a home loan?

An interest rate for an SBA loan will be higher than your home mortgage or a traditional commercial loan. Why? Because an SBA loan is a higher risk for the bank. Here is a chart that shows the average interest rate for all SBA loans the past few years that have terms of at least 84 months and a minimum loan amount of $250,000 along with the statutory maximum rate an SBA bank can charge for a loan:

What form is required for SBA loans?

SBA Form 1919 is required on all SBA loans.

How long do you need to file a business tax return?

2) Business and Personal Tax Returns – Last 2 or 3 years.

Do SBA loans require collateral?

SBA lenders are not required to take collateral for loans up to $25,000. For $25,000 – $350,000, the lender must follow its collateral policies for non-SBA-guaranteed commercial loans. At a minimum, the lender must take a first lien on assets financed with loan proceeds and the SBA bank must take a lien on all the applicant’s fixed assets ...

What is the SBA Franchise Directory?

The SBA has created the SBA Franchise Directory (the "Directory") of all franchise and other brands reviewed by the SBA that are eligible for SBA financial assistance. The directory will only include business models that the SBA determines are eligible under the SBA's affiliation rules and other eligibility criteria. If the applicant's brand meets the FTC definition of a franchise, it must be on the directory in order to obtain SBA financing.

Does the SBA include franchises in the FTC?

To help minimize confusion over brands that may appear to be franchises but that do not meet the FTC definition, SBA will include such brands in the Directory at their request if they are eligible in all other respects. Lenders will be able to rely on the Directory and will no longer need to review franchise or other brand documentation ...

Does the SBA have an affiliation review?

If a brand agrees to use SBA Form 2462 (Addendum to Franchise Agreement), SBA will only conduct an eligibility review and will not conduct an affiliation review.