How do I find my Texas franchise tax number? It is printed in the upper left corner of the tax report we mail to each taxpayer and on most notices. It is two letters followed by six numbers (Example: RT666666).

Who has to pay Texas franchise tax?

Franchise tax taxes all the businesses involved in the process from the manufacturer to the end distributor. It can be considered a tax for the privilege of doing business in Texas. Who Needs to File for Texas Franchise Tax? The short answer is everyone who has nexus in Texas has to file & pay Texas franchise tax.

How do you verify business in Texas?

Some of the highlights include:

- Business Name

- Taxpayer Number

- Entity type – Corporation, Limited Liability Company. ...

- Status – Active means the entity is in good standing and can conduct business in the state. ...

- Registered Agent’s information – A Texas Registered Agent is the singular point of contact for the entity should a legal, or tax notice need to be sent to the business. ...

How to file Texas franchise tax?

File and Pay Franchise Tax

- Approved Tax Preparation Software Providers

- Filing and Payment Requirements

- Request an Extension

- Report Common Owner Information

How to check business name availability in Texas?

Texas Entity Search

- Follow Texas Naming Guidelines. We recommend making sure your business name meets guidelines before completing your business name search.

- Do a Texas Business Name Search. Before filing your name reservation request, you can use Texas’s Business Entity Search to check the availability of your desired name.

- Search Available Domain Names. ...

How do I find my 11 digit Texas taxpayer number?

0:241:33How to Find Your 11-Digit Franchise Taxpayer Number - YouTubeYouTubeStart of suggested clipEnd of suggested clipWebsite choose the type of tax you need to file or pay. This will provide you with the 11 digitMoreWebsite choose the type of tax you need to file or pay. This will provide you with the 11 digit taxpayer number you're searching. For click on the franchise.

What is a Texas state franchise tax ID?

The Texas Taxpayer Number is the 11-digit number assigned by the Comptroller of Public Accounts. The Texas taxpayer number is not the same as the Federal Employer Identification Number or the Texas Secretary of State (SOS) File Number.

How do I get a copy of my Texas franchise tax report?

Contact the Comptroller's office by completing the online help form or calling 800-252-1381.

What is Texas 11 digit Taxpayer Number?

TIN – the number A Texas Identification Number (TIN) is an 11-digit number that identifies a state payee in TINS. It is based on the identification number (ID) the payee initially provides to the paying state agency, such as: A Social Security number (SSN) An employer identification number (EIN)

Is a Texas tax ID the same as an EIN?

Note: An EIN Number is not the same thing as a Texas Tax ID Number. An EIN is issued by the IRS. And a Texas Tax ID Number is issued by the Texas Comptroller.

How do I find my Texas file number?

It is printed in the upper left corner of the tax report we mail to each taxpayer and on most notices. It is two letters followed by six numbers (Example: RT666666). If you do not have your Webfile number, you can contact us at (800) 442-3453 24 hours a day, 7 days a week.

How do I get a copy of my franchise tax report?

You may be able to obtain a free copy of your California tax return. Go to MyFTB for information on how to register for your account. You may also request a copy of your tax return by submitting a Request for Copy of Tax Return (Form FTB 3516 ) or written request.

Does an LLC have to pay franchise tax in Texas?

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

How much is the franchise tax for an LLC in Texas?

In Texas, businesses with $1.18 million to $10 million in annual receipts pay a franchise tax of 0.375%. Businesses with receipts less than $1.18 million pay no franchise tax. The maximum franchise tax in Texas is 0.75%.

Do I need a Texas tax ID number?

You must obtain a Texas sales and use tax permit if you are an individual, partnership, corporation or other legal entity engaged in business in Texas and you: Sell tangible personal property in Texas; Lease or rent tangible personal property in Texas; Sell taxable services in Texas; or.

Is taxpayer number same as tax ID?

Number," or "Tax I.D. Number", all refer to the nine digit number issued by the IRS. They are different names for the same number.

How much is it to get a tax ID number in Texas?

To obtain an EIN for your Texas business, you must file a Form SS-4. There is no fee for applying for an EIN.

What is the Texas franchise tax?

Tax Rates, Thresholds and Deduction LimitsItemAmountTax Rate (retail or wholesale)0.375%Tax Rate (other than retail or wholesale)0.75%Compensation Deduction Limit$390,000EZ Computation Total Revenue Threshold$20 million2 more rows

Do you need a state tax ID in Texas?

Most businesses operating in Texas will require both a federal tax ID and a Texas state tax ID number. Fortunately, despite the fact that these two numbers are distinct, the process for applying to them is highly similar and easy to follow.

Do I have to file Texas franchise tax?

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

Do single member LLCs pay franchise tax in Texas?

Therefore, each taxable entity that is organized in Texas or doing business in Texas is subject to franchise tax, even if it is treated as a disregarded entity for federal income tax purposes and is required to file a franchise tax report.

What is franchise tax in Texas?

The Texas Franchise Tax is an annual business privilege tax processed by the Texas Comptroller of Public Accounts. Essentially, it’s a tax levied on business owners in exchange for the opportunity to do business in Texas. Here's what you should know about it.

How to check if a franchise is active in Texas?

How can I check my business’s Texas Franchise Tax status? You can check on the Texas Franchise Tax account status of your company (or another company) by conducting an online Taxable Entity Search on the Comptroller’s website. To search for a business, enter its name, 11-digit Texas taxpayer ID number, 9-digit Federal Employer Identification Number (FEIN) or Texas SOS file number. Once you locate the business you’re looking for, click on the blue “Details” button to the left of the business name. Under the “Franchise Search Results” tab, you’ll see an item called “Right to Transact Business in Texas.” If the right to transact business is “Active,” then the entity is still entitled to conduct business in Texas.

What is a webfile number?

Your WebFile number.This number, which begins with “FQ,” is the temporary access code that allows you to create a WebFile account. After you log in to the system for the first time and complete your franchise tax questionnaire (addressed in the next step), you’ll receive a permanent WebFile number beginning with “XT” for your franchise tax account.

What does independent Texas do?

When you hire Independent Texas to form your Texas company or serve as your registered agent, we keep your state correspondence organized, send you multiple reminders ahead of the franchise tax due date, and provide affordable franchise report filing service.

What happens if you don't get your franchise tax report in Texas?

If the Comptroller’s office does not receive your franchise tax report (and payment, if you owe one) within 45 days of the deadline, they are required by law to forfeit your business’s right to transact business in Texas. This forfeiture is essentially a loss of corporate liability protection: business owners will become liable for the debts of the business, and the entity will not be permitted to defend itself in a court of law.

How to calculate annualized revenue?

To find annualized revenue, divide your business’s total revenue by the number of days since it became subject to the franchise tax, then multiply the result by 365.

How often do you need to file a franchise tax return in Texas?

But whether or not tax is owed, you’ll need to file a Texas Franchise Tax Report every year to keep your business in good standing.

What is franchise tax in Texas?

Texas franchise tax is a “privilege tax” for doing business in Texas. Part of this privilege includes liability protections provided by state law. The franchise tax is administered by the Texas Comptroller of Public Accounts.

When are Texas franchise tax reports due?

Texas franchise tax reports are due in advance, not in arrears. This is easier explained with an example. Let’s say your Texas LLC is approved on August 5th 2019. So your LLC franchise tax reports are due the following year, by May 15th 2020. your LLC’s report year will be 2020.

What is a tiered partnership in Texas?

A Tiered Partnership election (for Texas franchise tax purposes) applies to an LLC that is in a parent/child relationship, also referred to as parent/subsidiary relationship.

What is the tax number of an LLC?

Your LLC’s Taxpayer Number is an 11-digit number that is issued by the Texas Comptroller. This number is used to identify your LLC for state tax obligations and filings. If you ever call the Comptroller’s Office, they’ll use your Taxpayer Number to lookup your LLC. Also, when you use WebFile (the online filing system) you’ll need this number.

How long does an LLC have to give notice of foreclosure in Texas?

Texas law requires that the Comptroller’s Office gives your LLC at least 45 days grace period. That 45-day grace period starts after you receive the “Notice of Pending Forfeiture”.

How to contact the Texas Comptroller?

If you have any questions, you can contact the Texas Comptroller at 800-252-1381. Their hours are Monday through Friday, from 8am to 5pm Central Time. If you call early, their hold times are very short (1-5 minutes).

How long does it take to get a welcome letter from the Texas Comptroller?

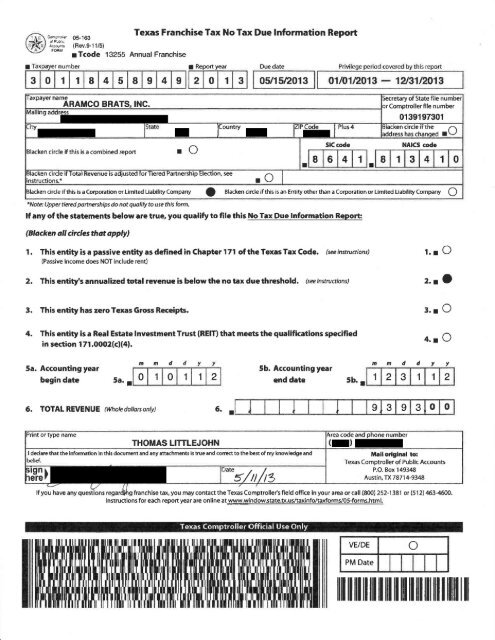

Within about 2-3 weeks, you’ll receive a “Welcome Letter” from the Texas Comptroller. This is what it will look like:

How to file a franchise tax report in Texas?

How to File. There are three ways to file the Texas Franchise Tax Report: No Tax Due. EZ Computation. Long Form. If your business falls under the $1,110,000 revenue limit, then you don’t owe any franchise tax. If you are above the limit, you can choose to fill out and file the EZ Computation form or to take the time to fill out the Long Form.

What is franchise tax in Texas?

What is the Texas Franchise Tax? The Texas Franchise Tax is levied annually by the Texas Comptroller on all taxable entities doing business in the state. The tax is based upon the entity’s margin, and can be calculated in a number of different ways.

How many types of franchise tax extensions are there?

There are four different types of Franchise Tax Extensions, depending upon your situation.

How is Total Revenue Calculated?

Total revenue is calculated by taking revenue amounts reported for federal income tax and subtracting statutory exclusions.

Reporting Change For Passive Entities

- Effective for franchise tax reports originally due on or after Jan. 1, 2011, a passive entity that is registered (or required to be registered) with either the Texas Secretary of State or the Comptroller’s office must file Form 05-163 to affirm that the entity qualifies as passive for the period upon which the tax is based. Form 05-163 is available on our Franchise Tax Forms page.

Franchise Tax Accountability Questionnaires – New Online Version

- This questionnaire must be completed by any Texas or out-of-state entity who recently registered with the Secretary of State or established a franchise tax account with this office. Learn more about our new online version of the questionnaire.

Get Account Status/Texas Taxpayer ID Number

- Check current franchise tax account standing, view and print a certificate of account status (good standing) or look up a Texas franchise taxpayer ID number. Any entity’s account status that is in “temporary good standing” will be updated when the franchise tax report is processed to the account. Learn more about Certification of Account Status.

Tax Assistance and Customer Service Response Times

- We are committed to responding to calls and e-mails as quickly as possible. See our call tips and peak schedulefor details on factors that may impact response times.

Additional Support

- Submit an e-mailto our experienced tax professionals .

- Find a Comptroller field officenear you.