How do you amortize a franchise fee?

How to Account for Franchise Fees

- Intangible Asset. Franchise fees are part of your initial start-up costs. ...

- Record the Purchase Cost. Unless your agreement states otherwise, you normally pay the franchise fee up front as a lump sum. ...

- Yearly Franchise Fee Amortization. You can amortize your franchise fee on a yearly basis. ...

- Monthly Franchise Fee Amortization. ...

Can a franchise fee be amortized?

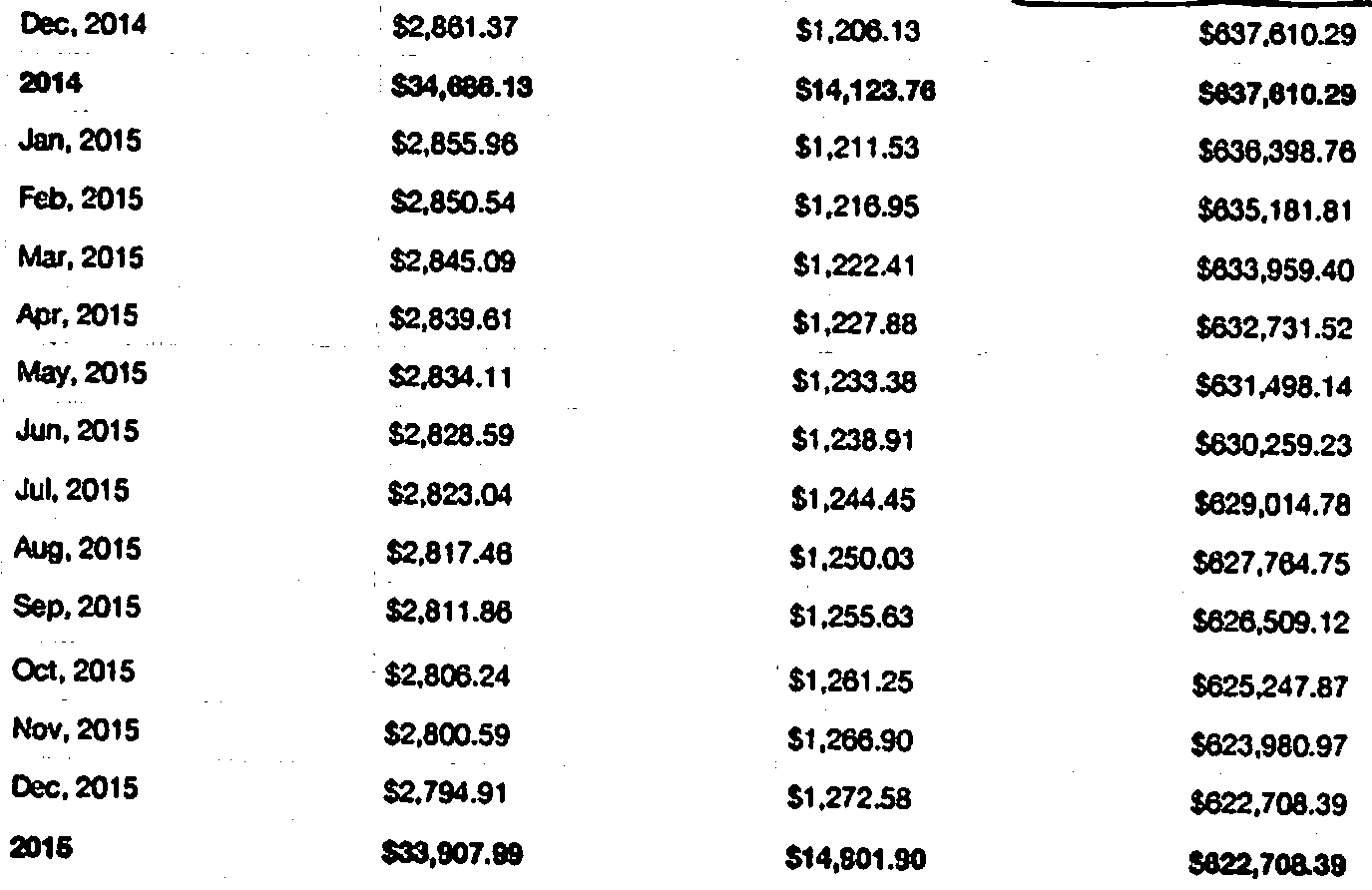

You can choose to amortize your franchise fee on a monthly basis rather than once a year. To calculate the monthly amortization, divide your yearly amortization amount by 12 months. For example ...

What are the fees and costs of a franchise?

• Franchise Fee: This amount can vary, depending on the franchise, but the average amount is typically $20,000 or $50,000, according to the Small Business Administration. This is paid when you...

What is included in a franchise fee?

The average franchise fee is $34k, but varies heavily by franchise category. Franchise fees are meant to cover the cost of onboarding new franchisees. In return for a franchise fee, you receive training, the rights to use the brand, opening support, operations manuals, and more which we cover below.

Should franchise fees be amortized?

You must amortize your franchise fee over a 15-year period using a straight-line method so the same amount is deducted each year. If your franchise agreement runs out in less than 15 years, you amortize the fees over the duration of the agreement.

How do you calculate amortization of a franchise?

To determine the amortization amount, divide your franchise fee by the length of amortization. For example, if the franchise fee is $100,000 and the franchise agreement is longer than 15 years, divide the fee to get an annual deduction amount of $6,666.67. You can also opt for monthly amortization.

Are franchise fees expensed or capitalized?

Continuing franchise fees – Fees that are received for ongoing services provided by the franchisor to the franchisee. These costs will be expensed when incurred.

How do you account for a franchise fee?

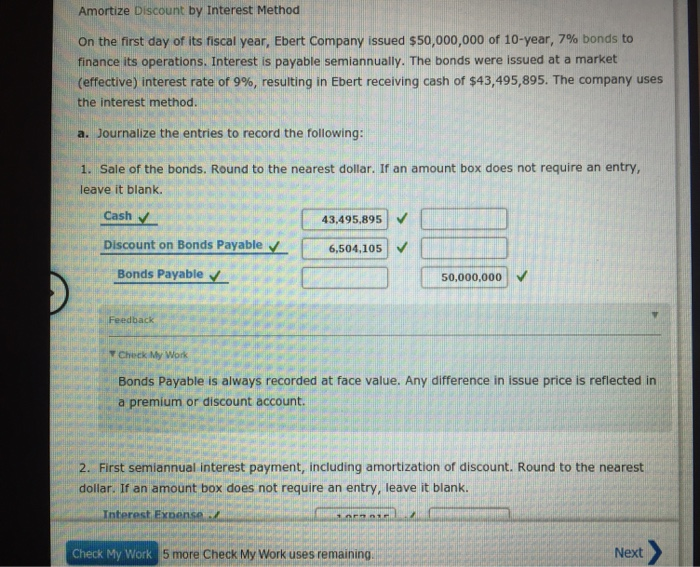

Record the initial franchise fees by debiting "Franchise" and crediting "Cash." This has the franchisee paying initial franchise fees. If the franchisee pays the initial franchise fees over an extended period of time, the business would use the present value of initial franchise fees.

Do I depreciate franchise fees?

According to the IRS, franchise fees fall under “Section 197 Intangibles”3 and are not tax deductible. However, since the IRS requires you to amortize the franchise fee over 15 years, you can recoup the fee through a depreciation tax deduction every year during that time period.

Are franchise fees considered cost of goods sold?

No, these are considered a selling cost and cannot be included in COGS. Can a motor vehicle sales finance company deduct interest expense as a cost of goods sold?

Are franchise fees considered start up costs?

An upfront fee paid to acquire a franchise for a particular area is treated for tax purposes as a startup cost, regardless of whether you buy a brand-new franchise from the franchisor or an existing franchise from someone else.

How do I categorize franchise fees paid in QuickBooks?

How do you categorize franchise fees in QuickBooks? Monthly franchise fees are called royalties and those are recorded as an expense on the franchisee's books. A separate expense account would be set up as 'Royalties'. This figure is usually a percentage of net sales as listed in your franchise agreement.

How do you record sales of a franchise?

How to Record Transactions for a FranchiseMake general journal entries. ... Royalty payments and franchise fees are paid by franchisees and recorded as revenue for a franchisor. ... Other contractually required payments in a franchise system may include advertising expenditures and/or membership in industry organizations.

How are franchises accounted for?

They are typically calculated as a percentage of revenue, and the franchisor collects them in exchange for allowing the franchisee to use its branding. Marketing fees: Like royalty fees, marketing fees are a monthly expense.

Is a franchise an intangible asset?

Intangible Assets Definition: The assets you cannot touch or see but that have value. Intangible assets include franchise rights, goodwill, noncompete agreements and patents, among others.

Is a franchise a fixed asset?

Franchise rights are an intangible asset, recorded on the long-term asset portion of the balance sheet.

Is a franchise an intangible asset?

Intangible Assets Definition: The assets you cannot touch or see but that have value. Intangible assets include franchise rights, goodwill, noncompete agreements and patents, among others.

What is an amortization expense?

Amortization expenses account for the cost of long-term assets (like computers and vehicles) over the lifetime of their use. Also called depreciation expenses, they appear on a company's income statement.

What is amortization of intangible assets?

Amortization of intangibles, also simply known as amortization, is the process of expensing the cost of an intangible asset over the projected life of the asset for tax or accounting purposes. Intangible assets, such as patents and trademarks, are amortized into an expense account called amortization.

Is franchise a current asset?

The franchise you purchase becomes an intangible asset that goes on your business balance sheet and is recorded as a noncurrent asset, according to Reference for Business. This is generally written off as an expense on your balance sheet and affects your bottom line when it comes to taxation.

What is franchise rights?

Franchise rights are the rights to use a specific name or business method. Franchise rights have a specific cost and usually are purchased for a specific time period. For example, you might purchase the right to a franchise food operation called XYZ Chicken.

How is franchise expense shown on the balance sheet?

When a franchise right is purchased, it is shown in the long-term asset section of the balance sheet. Long-term assets are items that have a life of longer than one year, such as equipment or real estate. Since the expense is initially shown in the balance sheet, the cost is not directly deducted on the profit and loss statement. Instead, an accounting entry is made for the tax year that allocates a percentage of the cost of the asset as a depreciation or amortization expense. For example, the accounting entry for a franchise right that cost $50,000 for five years would be: debit franchise amortization expense on the profit and loss statement for $10,000, and credit amortization allowance on the balance sheet for $10,000.

What form do you report amortization expenses on?

Amortization expenses should be reported on IRS Form 4562, which is for depreciation and amortization expenses. The amortization expense total on this form is then transferred to the schedule of income and expenses, which is Schedule C of the individual tax return. If the business is a corporation, the depreciation expense is transferred to the corporate return, which is IRS Form 1120. To be deductible, the franchise right must have a specific cost, be necessary in the operation of the business, and be written for a specific time period.

Is franchise expense deductible?

If the business is a corporation, the depreciation expense is transferred to the corporate return, which is IRS Form 1120. To be deductible, the franchise right must have a specific cost, be necessary in the operation of the business, and be written for a specific time period.

Should franchise rights be amortized?

You should consult with a tax professional regarding the amortization of franchise rights, because the cost can be significant and capital assets must be amortized based on a specific set of rules. If an amortization expense is improperly taken, the penalties and interest could be substantial for a business.

What is franchising agreement?

Under a franchising agreement, the franchisee pays the franchisor to use its brand name, marketing materials, store configuration, products, and other trade secrets and intellectual property. Franchising is usually allowed in locations where the franchisor isn't present, and the rights must be renewed after a number of years.

How long does a factory last?

Thus, a factory might be deemed to last 10 years, a piece of equipment five years and a franchise agreement three years. Most companies use the straight-line amortization method to allocate the cost of a capitalized asset, spreading its cost evenly over the asset's useful life.

Is franchise rights a long term asset?

Thus, a $100,000 payment to run a restaurant franchise for five years would be capitalized as a long-term asset. Using straight-line amortization, the franchisee would reduce its franchise rights asset on the balance sheet by $20,000 and record a corresponding $20,000 amortization expense on the income statement each year.

How to calculate franchise amortization?

To determine the amortization amount, divide your franchise fee by the length of amortization. For example, if the franchise fee is $100,000 and the franchise agreement is longer than 15 years, divide the fee to get an annual deduction amount of $6,666.67. You can also opt for monthly amortization. Divide your yearly amount by 12.

What is franchise fee?

What Is a Franchise Fee? When you purchase a franchise, you become a business owner while benefiting from the goodwill the product or service has already established in the market. The franchise fee gives you the right to use the franchise name, logo, and branding for a specific time period.

What Factors Are Involved in Determining the Franchise Fee?

Some of the basic factors considered when establishing a fair franchise fee include:

Why do companies set a low franchise fee?

Some companies even decide to set a low franchise fee to encourage new franchisees to buy into the business. Often, they plan to make up the "lost" money over time in royalty fees and sales profit from the franchise.

Can franchise fees be set based on competitors?

Although many businesses set a franchise fee based on the fees set by their competitors , this is not necessarily the most effective method of establishing this fee. That's because these fees can be dramatically different even within the same industry.

Do franchises have to have a flat fee?

When a business has many franchises, they may establish a flat franchise fee even though some locations are more profitable than others , rather than coming up with a new fee for every new franchise. In this way, the high-performing franchises supplement the cost of the additional support that tends to be required of franchise locations that earn less profit.

Do franchise fees have to be recorded?

Franchise fees should be recorded at full value in your business's financial books. It is also listed under the intangible assets section. The yearly or monthly amortization amount must also be recorded. This should be done the same way every time no matter what amortization schedule you decide to use.

What is the principle of amortization?

Accounting is the process of recording economic activity and reporting this information in a timely and accurate manner. Basically, the information should be fairly stated in the financial reports.

How long does it take to get into the sophistication phase of investing?

Sophistication – Most members reach this phase of understanding after about six months. Many members create their own pools of investments and share with others their knowledge. Members are introduced to more sophisticated types of investments and how to use them to reduce risk and improve, via leverage, overall returns for their value investment pools.

What happens if you pay off a loan early?

If the loan is paid off early, any remaining balance of financing costs is expensed (recognized as a cost of business) at that time.

When a business acquires a loan, are closing costs involved?

Generally Accepted Accounting Principles (GAAP) require these financing costs to be amortized (allocated) over the life of the loan. There are several principles the reader needs to understand to properly calculate and assign these costs to the financial statements.

Where is amortization reported on income statement?

Over on the income statement (profit and loss statement) amortization is reported in the capital costs section of expenses as illustrated here:

How long does a loan last?

The loan document states the life usually in months. Most loans have a definitive period of time such as 84 months (7 years), 120 months (10 years) and so on.

Is amortization the last expense account?

As illustrated, amortization is typically the last expense account for reporting purposes. This is not a rule but a general practice in reporting expenses.

How long is a franchise intangible?

A franchise engaged in professional sports and any intangible assets acquired in connection with acquiring the franchise (including player contracts) is a section 197 intangible amortizable over a 15-year period.

How long does it take to get a 1040X amended?

Go to IRS.gov/WMAR to track the status of Form 1040-X amended returns. Please note that it can take up to 3 weeks from the date you filed your amended return for it to show up in our system, and processing it can take up to 16 weeks.

What happens when you go into business?

If you go into business. When you go into business, treat all costs you had to get your business started as capital expenses. Usually, you recover costs for a particular asset through depreciation. Generally, you cannot recover other costs until you sell the business or otherwise go out of business.

Where are interest capitalization rules applied?

The interest capitalization rules are applied first at the partnership or S corporation level . The rules are then applied at the partners' or shareholders' level to the extent the partnership or S corporation has insufficient debt to support the production or construction costs.

Can you use a loss from a business without making a profit?

If you carry on your business activity without the intention of making a profit, you cannot use a loss from it to offset other income. For more information, see Not-for-Profit Activities , later.