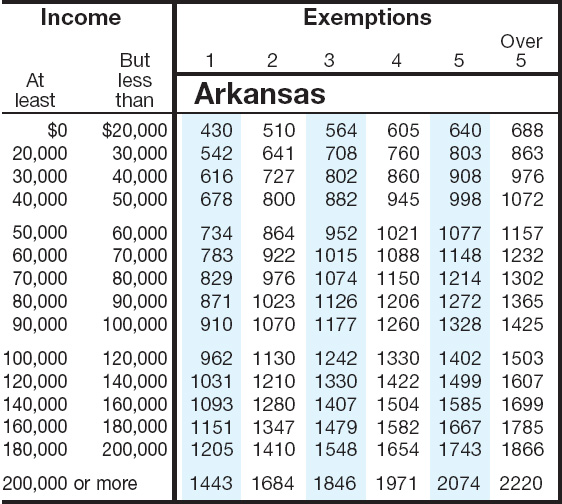

| Franchise Tax Type | Current Rate |

|---|---|

| Corporation/Bank without Stock | $300 |

| Limited Liability Company | $150 |

| Insurance Corporation Legal Reserve Mutual, Assets Less Than $100 million | $300 |

| Insurance Corporation Legal Reserve Mutual, Assets Greater Than $100 million | $400 |

Which states have franchise tax?

The states that currently have franchise taxes are:

- Alabama

- Arkansas

- Delaware

- Georgia

- Illinois

- Louisiana

- Mississippi

- Missouri

- New York

- North Carolina

How to file and pay sales tax in Arkansas?

- Taxpayer is registered with the state for the type of tax that is being transmitted and has been issued an account ID.

- Tax payment is transmitted in the format required by Arkansas.

- Tax payment is transmitted with the correct tax type code for the specific type of tax being paid.

Are services taxable in Arkansas?

While Arkansas' sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes. This page describes the taxability of services in Arkansas, including janitorial services and transportation services. To learn more, see a full list of taxable and tax-exempt items in Arkansas .

Are food and meals taxable in Arkansas?

However, food sales do not fall within the general sales tax. Arkansas has a lower food tax that is separate from the general sales tax. The food tax only applies to unprepared foods. That means groceries typically fall within the food tax rate. On the other hand, fast food and other restaurant foods fall within the general sales tax.

How is Arkansas franchise tax calculated?

Arkansas LLCs and corporations without stock will pay a fixed amount for their franchise tax. Corporations with stock, however, will pay 0.3% of their total outstanding capital stock OR $150 – whichever is greater.

Does Arkansas have franchise tax?

A.C.A. § 26-54-101 et al., also known as the “Arkansas Corporate Franchise Tax Act of 1979”, requires all Corporations, LLC's, Banks, and Insurance Companies registered in Arkansas to pay an annual franchise tax.

How much are taxes on an LLC in Arkansas?

$150 each yearAll LLCs operating in Arkansas must file an annual report and pay a flat-rate tax of $150 each year. The $150 tax and the annual report together are known as the Annual LLC Franchise Tax Report.

What happens if you don't pay franchise tax Arkansas?

If you don't pay your Arkansas Franchise Tax for three years, your LLC will enter revoked status.

How do I pay my business taxes in Arkansas?

New users sign up at www.atap.arkansas.gov or click on the ATAP link on our web site www.dfa.arkansas.gov. ATAP is a web-based service that allows taxpayers, or their designated representative, online access to their tax accounts and related information.

Does Arkansas have an annual report?

In the state of Arkansas, every business entity is required to complete an annual report filing. Arkansas requires that you file by May 1st of each year, otherwise you may fall into noncompliance and face fees and penalties.

Does Arkansas have a business income tax?

Arkansas has both a corporation franchise tax and a graduated corporate income tax. Your business may be subject to one, both, or neither of these taxes depending on its legal form.

Does Arkansas require a business license?

Along with many states, Arkansas does not require every business to obtain a generic business license at the state level. The only statewide permit or license applicable to most businesses is the Arkansas sales tax permit, often called a seller's permit, which registers your business for the Arkansas sales and use tax.

How long does it take to get an LLC in Arkansas?

You can get an LLC in Arkansas in 2-3 business days if you file online (or 3-4 weeks if you file by mail). If you need your Arkansas LLC faster, you can file by mail and pay for expedited processing.

What happens if you don't pay personal property taxes in Arkansas?

If you fail to pay your property taxes in Arkansas, you could lose your home through a tax forfeiture—but you'll get some time to save your property. Having delinquent property taxes in Arkansas could lead to the loss of your home through a tax sale.

Can you set up a payment plan for Arkansas state taxes?

Review of the Arkansas State Tax Payment Plan. The Arkansas Department of Finance and Administration (DFA) may be willing to let you pay off your back taxes in monthly payments. To qualify, you typically need to show the DFA that you cannot pay your tax liability in full but you can afford to make monthly payments.

How do I pay my Arkansas state taxes?

Credit card payments may be made over the telephone by calling 1-800-2PAY-TAX (1-800-272-9829) or over the internet by visiting https://acipayonline.com and clicking the "State Payments" link and either choosing Arkansas or entering the jurisdiction code 1400. Both of these options are available 24 hours a day.

What is Arkansas state income tax?

Arkansas has a graduated individual income tax, with rates ranging from 2.00 percent to 5.50 percent. Arkansas also has a 1.0 to 5.9 percent corporate income tax rate.

Do nonprofits pay franchise tax in Arkansas?

Other Business Entity Types Other business entities, nonprofits, limited partnerships (LPs), limited liability partnerships (LLPs), and limited liability limited partnerships (LLLPs) must file an annual report. However, they do not pay a franchise tax.

Does Georgia have a franchise tax?

Corporations – Due Date: March 15 (S Corps) or April 15 (C corps) Georgia imposes a net worth tax (like a franchise tax) in addition to the corporate income tax. The net worth tax is based on a corporation's issued capital stock, paid-in surplus, and earned surplus employed within Georgia.

What is SOS filing number Arkansas?

For assistance with this form contact Business and Commercial Services by phone 501-682-3409, toll free 888-233-0325 or by email, [email protected]. Arkansas Secretary of State.

Where to file Arkansas franchise tax?

Businesses can file their reports and pay the Annual Franchise Tax online via the Arkansas Secretary of State website . Alternatively, business owners can file by mail to the Business and Commercial Services Division at:

When do you have to pay franchise tax?

Businesses may file and pay their Annual Franchise Tax as early as January 1.

What happens if a business fails to file a tax return?

If a business fails to file or files past the May 1 deadline, it may be subject to penalties, interest, or worse!

Can Arkansas revoke a company's franchise?

Worst Case: The state might even revoke a company’s authority to do business in Arkansas if it continues to ignore its franchise tax reporting and payment responsibilities.