Which states have franchise tax?

The states that currently have franchise taxes are:

- Alabama

- Arkansas

- Delaware

- Georgia

- Illinois

- Louisiana

- Mississippi

- Missouri

- New York

- North Carolina

What is the corporate income tax rate in Oklahoma?

Under House Bill 2960, for tax years beginning Jan. 1, 2022, the corporate income tax rate is reduced to 4% from 6%. Oklahoma imposes a flat rate on all corporate income. Under House Bill 2962, the personal income tax rates in each of the state’s five brackets are reduced by 0.25% effective Jan. 1, 2022.

Are occasional sales taxable in Oklahoma?

Oklahoma, on the extreme end of the spectrum, does not have any exemption for casual, occasional, or isolated sales. Oklahoma levies its sales and use tax on all sales unless specifically exempt. Two common examples of applicable exemption are resale and manufacturing—both of which need to be documented with a completed exemption certificate.

What is the state tax rate for Oklahoma?

The state sales tax rate in Oklahoma is 4.500%. With local taxes, the total sales tax rate is between 4.500% and 11.500%. Oklahoma has recent rate changes (Thu Jul 01 2021). Select the Oklahoma city from the list of popular cities below to see its current sales tax rate.

Do Oklahoma LLCs pay franchise tax?

The Oklahoma franchise tax is mandatory for all for-profit corporations, including S-corporations, partnerships, and limited liability companies, organized and maintained in Oklahoma.

Who pays Oklahoma franchise?

Oklahoma levies a franchise tax on all corporations or associations doing business in the state. Corporations are taxed $1.25 for each $1,000 of capital invested or otherwise used in Oklahoma up to a maximum levy of $20,000 (foreign corporations are assessed an additional $100 per year).

How is an LLC taxed in Oklahoma?

The State of Oklahoma, like almost every other state, has a corporation income tax. In Oklahoma, the corporate tax is a flat 6% of Oklahoma taxable income. If your LLC is taxed as a corporation you'll need to pay this tax. The state's corporate income tax return (Form 512) is filed with the Oklahoma Tax Commission.

How does a franchise pay taxes?

Contrary to what the name implies, a franchise tax is not a tax imposed on a franchise. Rather, it's charged to corporations, partnerships, and other entities like limited liability corporations (LLCs) that do business within the boundaries of that state.

How do I pay my Oklahoma franchise tax?

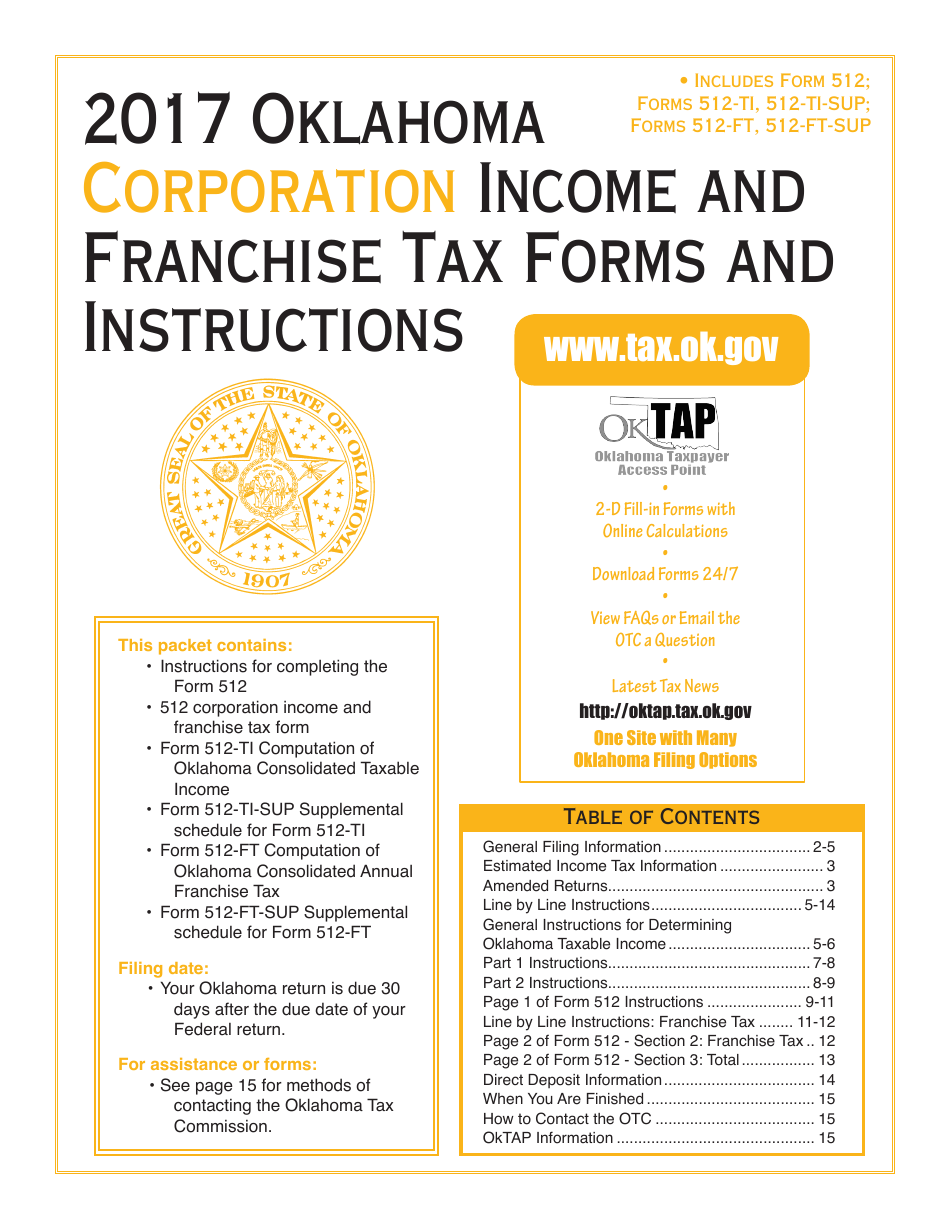

Oklahoma Taxpayer Access Point (OkTAP) makes it easy to file and pay. Visit us at tax.ok.gov to file your Franchise Tax Return, Officer Listings, Balance Sheets and Franchise Election Form 200-F. Line 1 (through 3) Cash, notes, accounts receivable, and inventories are to be reported at book value.

How is Oklahoma franchise tax calculated?

Oklahoma franchise (excise) tax is levied and assessed at the rate of $1.25 per $1,000.00 or fraction thereof on the amount of capital allocated or employed in Oklahoma.

Is there a yearly fee for a LLC in Oklahoma?

How much does it cost to form an LLC in Oklahoma? The Oklahoma Secretary of State charges a $100 fee to file the Articles of Organization. You can reserve your business name by filing an LLC name reservation for $10. Oklahoma LLCs are also required to file an Annual Certificate each year, the fee for which is $25.

How much does it cost to renew an LLC in Oklahoma?

Fees:Filing ServiceFee AmountCertificate of Registration - LLC 18 OS 2055300.00Certificate of Renewal Revival Extension/Restoration - Oklahoma For Profit Corporation 18 OS 114250.00Certificate of Withdrawal - Foreign Corporation 18 OS 1142100.00Change of Registered Agent and/or Office25.0098 more rows

What are the benefits of an LLC in Oklahoma?

The benefits of starting an LLC in Oklahoma: Separates and protects your personal assets from your business liability and debts. Quick and simple filing, management, compliance, regulation and administration. Easy tax filing and tax treatment advantages. Low filing fee ($100)

What triggers franchise tax?

All corporations are required to pay at least the $800 minimum franchise tax if they are: Incorporated or organized in California. Qualified or registered to do business in California. Doing business in California, whether or not incorporated, organized, qualified, or registered under California law.

How can franchise tax be avoided?

One way to avoid paying franchise tax is to operate as a sole proprietorship or general partnership—but you would have to sacrifice the liability protection that LLCs and corporations enjoy. Some charities and nonprofits qualify for an California Franchise Tax Exemption.

Why did I receive a franchise tax?

The California annual franchise tax is exactly what it sounds like—a tax that the state's business owners must pay yearly. It is simply one of the costs of doing business if you choose to register your entity in California.

How much do businesses pay in taxes in Oklahoma?

Oklahoma corporations must file an Oklahoma income tax return and pay corporate income tax. As of 2021, the rate is 6%. For tax years beginning on January 1, 2022, the corporate income tax rate will reduce to 4%.

Does Oklahoma have business income tax?

Oklahoma has a graduated individual income tax, with rates ranging from 0.25 percent to 4.75 percent. Oklahoma also has a 4.00 percent corporate income tax rate.

Does Oklahoma recognize single member LLC?

Single member LLCs are treated the same as sole proprietorships. Profits are reported on Schedule C as part of your individual 1040 tax return. Self-employment taxes on Oklahoma LLC net income must be paid just as you would with any self-employment business.

Does A Oklahoma LLC need an EIN?

For complete details on state taxes for Oklahoma LLCs, visit Business Owner's Toolkit or the State of Oklahoma . Federal tax identification number (EIN). An EIN is required for LLCs that will have employees. Additionally, most banks require an EIN in order to open a business bank account.