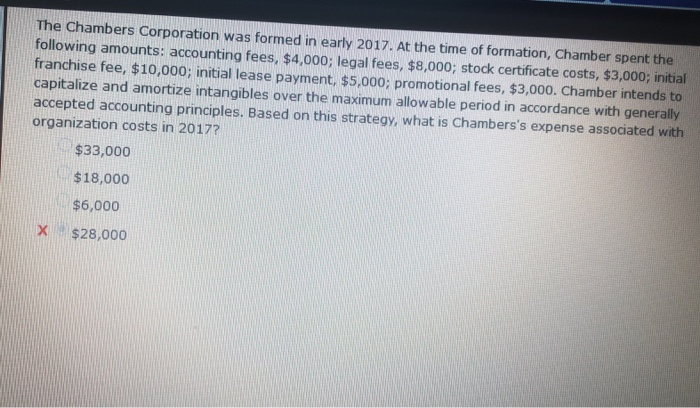

How to Account for Franchise Fees

- Intangible Asset Franchise fees are part of your initial start-up costs. ...

- Record the Purchase Cost Unless your agreement states otherwise, you normally pay the franchise fee up front as a lump sum. ...

- Yearly Franchise Fee Amortization You can amortize your franchise fee on a yearly basis. ...

- Monthly Franchise Fee Amortization ...

How do you amortize a franchise fee?

How to Account for Franchise Fees

- Intangible Asset. Franchise fees are part of your initial start-up costs. ...

- Record the Purchase Cost. Unless your agreement states otherwise, you normally pay the franchise fee up front as a lump sum. ...

- Yearly Franchise Fee Amortization. You can amortize your franchise fee on a yearly basis. ...

- Monthly Franchise Fee Amortization. ...

Can a franchise fee be amortized?

You can choose to amortize your franchise fee on a monthly basis rather than once a year. To calculate the monthly amortization, divide your yearly amortization amount by 12 months. For example ...

What are the fees and costs of a franchise?

• Franchise Fee: This amount can vary, depending on the franchise, but the average amount is typically $20,000 or $50,000, according to the Small Business Administration. This is paid when you...

What is included in a franchise fee?

The average franchise fee is $34k, but varies heavily by franchise category. Franchise fees are meant to cover the cost of onboarding new franchisees. In return for a franchise fee, you receive training, the rights to use the brand, opening support, operations manuals, and more which we cover below.

How to calculate amortization of a franchise fee?

How long do you have to amortize franchise fees?

How to calculate monthly amortization?

About this website

How do you calculate amortization of a franchise?

To determine the amortization amount, divide your franchise fee by the length of amortization. For example, if the franchise fee is $100,000 and the franchise agreement is longer than 15 years, divide the fee to get an annual deduction amount of $6,666.67. You can also opt for monthly amortization.

Are franchise costs amortized?

You must amortize your franchise fee over a 15-year period using a straight-line method so the same amount is deducted each year. If your franchise agreement runs out in less than 15 years, you amortize the fees over the duration of the agreement.

Are franchise fees expensed or capitalized?

Continuing franchise fees – Fees that are received for ongoing services provided by the franchisor to the franchisee. These costs will be expensed when incurred.

Are franchise renewal fees amortized?

Finally, the franchise agreement runs for 20 years, at which time it can be renewed for the same cost as the initial fee. Renewal fees are treated as Section 197 intangibles, too, so they must be amortized.

Are franchise fees considered cost of goods sold?

No, these are considered a selling cost and cannot be included in COGS. Can a motor vehicle sales finance company deduct interest expense as a cost of goods sold?

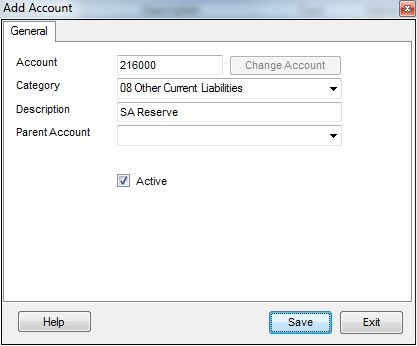

How do I record monthly franchise fee in QuickBooks?

How do you categorize franchise fees in QuickBooks? Monthly franchise fees are called royalties and those are recorded as an expense on the franchisee's books. A separate expense account would be set up as 'Royalties'. This figure is usually a percentage of net sales as listed in your franchise agreement.

How long do I amortize franchise fees?

15 yearsA franchisee can amortize the initial fee over 15 years. The same amount must be deducted each year, so the fee needs to be divided evenly. To do this, you would divide the initial fee by 15. If your agreement lasts less than 15 years, your amortization schedule for the fee will just last the contract's length.

Is a franchise an intangible asset?

Intangible Assets Definition: The assets you cannot touch or see but that have value. Intangible assets include franchise rights, goodwill, noncompete agreements and patents, among others.

Is franchise a current asset?

The franchise you purchase becomes an intangible asset that goes on your business balance sheet and is recorded as a noncurrent asset, according to Reference for Business. This is generally written off as an expense on your balance sheet and affects your bottom line when it comes to taxation.

How are franchises accounted for?

Franchise accounting is the application of accounting to franchises. It functions much like non-franchise accounting, but it takes the unique fees associated with franchises, like royalty fees, amortizing initial fees, and marketing fees, into consideration.

How do you record sales of a franchise?

How to Record Transactions for a FranchiseMake general journal entries. ... Royalty payments and franchise fees are paid by franchisees and recorded as revenue for a franchisor. ... Other contractually required payments in a franchise system may include advertising expenditures and/or membership in industry organizations.

Is a monthly franchise fee tax deductible?

Yes, you can deduct monthly franchise fees from your corporation tax bill. Because monthly franchise fees are a legitimate business expense, they will be recorded as an overhead when it comes to your end-of-year accounts.

Is a franchise a capital asset?

The agreement is a "franchise" as defined in section 1253(b)(1) of the Code. The franchise is also a "capital asset" in Y's hands, within the meaning of section 1221 of the Code.

Is a franchise agreement a capital asset?

A transfer of a franchise, trademark, or trade name shall not be treated as a sale or exchange of a capital asset if the transferor retains any significant power, right, or continuing interest with respect to the subject matter of the franchise, trademark, or trade name.

Is the cost of a franchise tax deductible?

Yes, you can deduct monthly franchise fees from your corporation tax bill. Because monthly franchise fees are a legitimate business expense, they will be recorded as an overhead when it comes to your end-of-year accounts.

How do franchise fees work?

Franchise marketing fees are usually based on your monthly revenue. For instance, if your average monthly revenue is $25, 000, and the franchisor charges a 2% marketing fee, you'll have to pay your franchisor $500. (That's $6, 000 annually.)

Solved: Where do I enter a franchise fee? - Intuit

I started my business last year and paid $49,500 franchise fee. Can I enter this amount under the other misc expenses and deduct the entire amount? I spent about $5000 on other business expenses, in addition to the franchise fee, which I distributed between varies expense categories. No income yet. Thank you!

How to treat a franchise fee | AccountingWEB

Its some & some The inland revenue website contains aggod deal of info on this subject. To summarise you have to look at and value(?) the elements you get for your franchise fee ie if you get a computer and stationery etc you can get tax relief on these whereas the intangibles cannot be claimed.

Amortisation of Franchise Fees | AccountingWEB

Hi I am reposting this as I didnt get a response the first time - any help with this would be appreciated. I know the convention is to amortise franchise fees is to apportion over the life over the franchise agreement.

When is a Franchise Fee Considered Income?

Franchisors should not rely on their “professionals” to put together the proper documents. A strong franchisor is one that “minds his or her own business.”

I understand that Franchise fee is amortize over 15 years…

Thanks for the feedback. I have 2 more questions? Please be as clear as possible.1. So if we extend the agreement for another 10 years, then do we carry both amortization assets on the balance sheet?A) Initial franchise fee amortizing the remaining 5 years B) Renewal franchise fee amortizing it for 15 years2. Your statement stating that: "If it is not renewed at the end of the ten years, the ...

How to Account for Franchise Fees | Bizfluent

Franchises have special accounting concepts. The main concept a franchise must worry about is accounting for franchise fees. Franchise fees are fees a franchisee pays a franchisor for the rights to use the franchise name and other services from the franchisor. The franchisee will report the amount as an intangible ...

How to calculate franchise amortization?

To determine the amortization amount, divide your franchise fee by the length of amortization. For example, if the franchise fee is $100,000 and the franchise agreement is longer than 15 years, divide the fee to get an annual deduction amount of $6,666.67. You can also opt for monthly amortization. Divide your yearly amount by 12.

What is franchise fee?

What Is a Franchise Fee? When you purchase a franchise, you become a business owner while benefiting from the goodwill the product or service has already established in the market. The franchise fee gives you the right to use the franchise name, logo, and branding for a specific time period.

What Factors Are Involved in Determining the Franchise Fee?

Some of the basic factors considered when establishing a fair franchise fee include:

Why do companies set a low franchise fee?

Some companies even decide to set a low franchise fee to encourage new franchisees to buy into the business. Often, they plan to make up the "lost" money over time in royalty fees and sales profit from the franchise.

Can franchise fees be set based on competitors?

Although many businesses set a franchise fee based on the fees set by their competitors , this is not necessarily the most effective method of establishing this fee. That's because these fees can be dramatically different even within the same industry.

Do franchises have to have a flat fee?

When a business has many franchises, they may establish a flat franchise fee even though some locations are more profitable than others , rather than coming up with a new fee for every new franchise. In this way, the high-performing franchises supplement the cost of the additional support that tends to be required of franchise locations that earn less profit.

Do franchise fees have to be recorded?

Franchise fees should be recorded at full value in your business's financial books. It is also listed under the intangible assets section. The yearly or monthly amortization amount must also be recorded. This should be done the same way every time no matter what amortization schedule you decide to use.

What is franchise fee amortization?

Amortisation of Franchise Fees for Tax Purposes. Amortisation is a technical term used in accounting. It means to gradually write off the initial cost of an asset over time. There are several types of asset in accounting. A tangible asset – something like your vehicle or equipment – is subject to depreciation over time.

What Is the Royalty Fee in a Franchise System?

Sometimes simply referred to as the “franchise fee”, a royalty fee is the money that the franchisee pays to the franchisor. In return, the franchisee gets the ability to use their franchisor’s trademarks, branding, and highly effective processes.

What is the initial fee payment?

The initial fee payment usually has to be completed before a franchisee can begin to use their franchisor’s name and other trademarks. This fee counts as part of the initial costs of setting up your business.

How often do franchisees pay an ongoing fee?

After the initial franchise fee is paid and the franchisee starts trading, they usually have to pay an ongoing fee. This may be monthly, quarterly or annually. The ongoing fee covers things like the franchise’s fixed costs.

How many years of experience does Fantastic Services have?

Fantastic Services manages 25+ professional home cleaning and maintenance services, provided within the UK, Australia and the USA. With 10+ years of experience behind our back, and 400+ of successful franchises, we continuously set the bar higher with our cutting edge technology implementation and marketing approach. Explore our business opportunities on the main website!

Is franchise fee revenue expense?

There are very few circumstances where any part of your initial franchise fee will be recognised as revenue expense rather than capital ex penditure.

Is franchise fee tax deductible?

Initial franchise fees – effectively a kind of capital expenditure. This means they are not tax-deductible. Even if you end up paying your initial fees in several instalments or they include legal fees. Ongoing franchise fees – according to HMRC, a kind of revenue expense rather than capital expenditure.

How to record franchise fees?

Record the initial franchise fees by debiting "Franchise" and crediting "Cash." This has the franchisee paying initial franchise fees. If the franchisee pays the initial franchise fees over an extended period of time, the business would use the present value of initial franchise fees.

What is franchise accounting?

Franchise fees are fees a franchisee pays a franchisor for the rights to use the franchise name and other services from the franchisor. The franchisee will report the amount as an intangible asset.

Is franchise fee amortization an expense?

Debit "Franchise Fee Amortization" and credit "Franchise." This recognizes the franchise fee as an expense.

What is franchising agreement?

Under a franchising agreement, the franchisee pays the franchisor to use its brand name, marketing materials, store configuration, products, and other trade secrets and intellectual property. Franchising is usually allowed in locations where the franchisor isn't present, and the rights must be renewed after a number of years.

Can expenses be capitalized?

Under accounting rules, certain expenses can be capitalized -- or recorded as an asset on a company's balance sheet -- while others must be expensed immediately. The logic is that spending that results in future benefits over multiple years shouldn't be expensed right away.

Is franchise rights a long term asset?

Thus, a $100,000 payment to run a restaurant franchise for five years would be capitalized as a long-term asset. Using straight-line amortization, the franchisee would reduce its franchise rights asset on the balance sheet by $20,000 and record a corresponding $20,000 amortization expense on the income statement each year.

How long do you have to amortize franchise fees?

The IRS requires you to amortize this initial franchise fee over 15 years, rather than all at once. The good news is that for the next 15 years, you’ll have that as a tax deduction! This will be entered as a business asset.

How long is amortization for a property?

The amortization amount is computed as if the asset will be held for 15 years. If it is not renewed at the end of the ten years, the remaining balance can be deducted in the 10th year.

How to calculate amortization of a franchise fee?

For example, your $50,000 franchise fee has a useful life of 10 years. Calculate the yearly amortization amount by dividing $50,000 by 10 years, or $5,000 per year. To record the amortization at the end of your accounting year, debit your Franchise Fee Amortization account for $5,000 and credit your Franchise account by $5,000.

How long do you have to amortize franchise fees?

With franchise fees, this rule does not apply. You must amortize your franchise fee over a 15-year period using a straight-line method so the same amount is deducted each year. If your franchise agreement runs out in less than 15 years, you amortize the fees over the duration of the agreement.

How to calculate monthly amortization?

To calculate the monthly amortization, divide your yearly amortization amount by 12 months. For example, if your yearly amortization is $2,400, divide that by 12 months to get your monthly amortization of $200.