- 5,000 shares or less (minimum tax) $175.00.

- 5,001 – 10,000 shares – $250.00,

- each additional 10,000 shares or portion thereof add $85.00

- maximum annual tax is $200,000.00

How does the calculate franchise tax?

Divide your total gross assets by your total issued shares carrying to 6 decimal places. ... Multiply the assumed par by the number of authorized shares having a par value of less than the assumed par. ... Multiply the number of authorized shares with a par value greater than the assumed par by their respective par value.More items...

What is Illinois annual franchise tax?

0.1%This method is based on the amount of money your business earns from its shareholders in exchange for stock. The first year, you'll pay 0.15% of your total paid in capital. Afterwards, you'll pay 0.1%.

What is the percentage of franchise tax?

The California Franchise Tax rates depend on your business's tax classification: C corporations: 8.84% S corporations: 1.5%

How do franchise owners pay taxes?

There are usually two major tax kinds that franchise owners are required to pay. The first would be the franchise, and the other is the run of the mill federal/state income. Both are usually assessed on a yearly basis, and if you fail to remit, your business risk being delisted from doing business in the said state.

How do I fill out an annual report in Illinois?

Complete your annual report online OR download a paper form....To File by Paper:Go to the Publications/Forms page on the Illinois Secretary of State website.Select the link for your business type.Click the link for “Annual Report.”The form will automatically download onto your computer.

How do I pay my LLC taxes in Illinois?

For typical LLCs (those not electing to be taxed as corporations) the tax is 1.5% of net income. The tax is payable to the Illinois Department of Revenue (IDOR). Use Form IL-1065 to pay the tax. In some cases, the owners of an LLC choose to have their business treated like a corporation for tax purposes.

How do u calculate tax?

Sales Tax Calculation FormulasSales tax rate = sales tax percent / 100.Sales tax = list price * sales tax rate.Total price including tax = list price + sales tax, or.Total price including tax = list price + (list price * sales tax rate), or.Total price including tax = list price * ( 1 + sales tax rate)

How can franchise tax be avoided?

One way to avoid paying franchise tax is to operate as a sole proprietorship or general partnership—but you would have to sacrifice the liability protection that LLCs and corporations enjoy. Some charities and nonprofits qualify for an California Franchise Tax Exemption.

How can I avoid $800 franchise tax?

For tax years beginning on or after January 1, 2021, and before January 1, 2024, LLCs that organize, register, or file with the Secretary of State to do business in California are not subject to the annual tax of $800 for their first tax year.

What is an example of a franchise tax?

For example, if a corporation does only 70% of its business in that state, then tax will be calculated on a 70% margin. For a corporation that operates entirely in the state will pay franchise tax on 100% of profits. The margin calculated is then taxed as per applicable tax rates of the state.

Is franchise tax same as income tax?

Franchise taxes do not replace federal and state income taxes, so it's not an income tax. These are levies that are paid in addition to income taxes. They are usually paid annually at the same time other taxes are due. The amount of franchise tax can differ greatly depending on the tax rules within each state.

Do franchise owners take a salary?

Franchise owners can pay themselves a salary or depending on their business entity, they may be able to take a draw from their accumulated equity.

Does Illinois have a minimum franchise tax?

The final number is your franchise tax. Remember to round up to the nearest cent and the minimum tax is $25.00. You may also want to review our page on How to Complete the Annual Report.

What is Illinois franchise tax repeal?

Franchise tax phase-out repealed Enacted on June 5, 2019, S.B. 689 provided for a phase-out and repeal of the Illinois Franchise Tax. Starting in the 2021 tax year, taxpayers received an exemption for their first $1,000 of liability. In 2022, the exemption was scheduled to increase to $10,000.

What is paid in capital in Illinois?

PAID-IN CAPITAL: Paid-in capital is the amount of money or other property paid to the corporation for, or on account of, the issued shares, less expenses incurred with the issuance of shares, plus any cash or other consideration contributed to the corporation.

What is franchise tax Repeal amount?

Repeal of Corporate Minimum Franchise Tax. SUMMARY. This bill would, under the Corporation Tax Law (CTL), repeal the $800 corporate minimum franchise tax for corporations doing business in the state for taxable years beginning on or after January 1, 2020. RECOMMENDATION.

What percentage of Illinois franchise tax revenue is paid in capital?

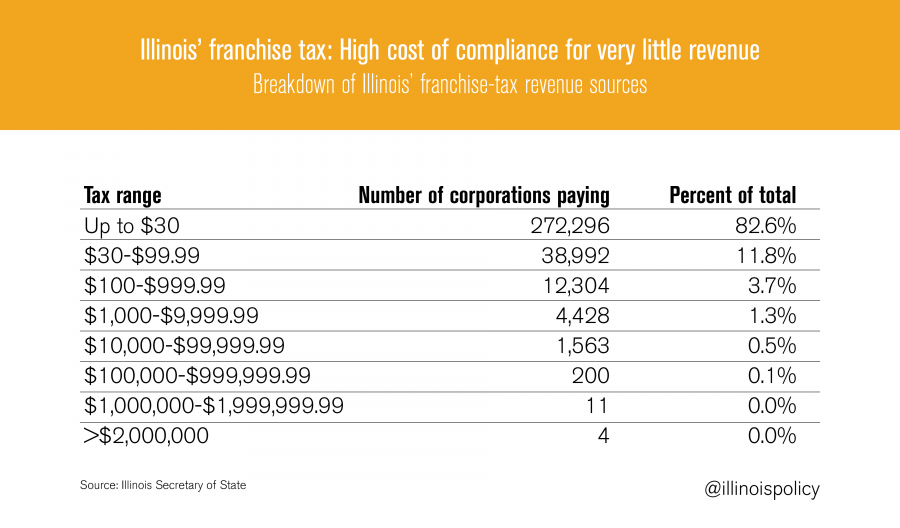

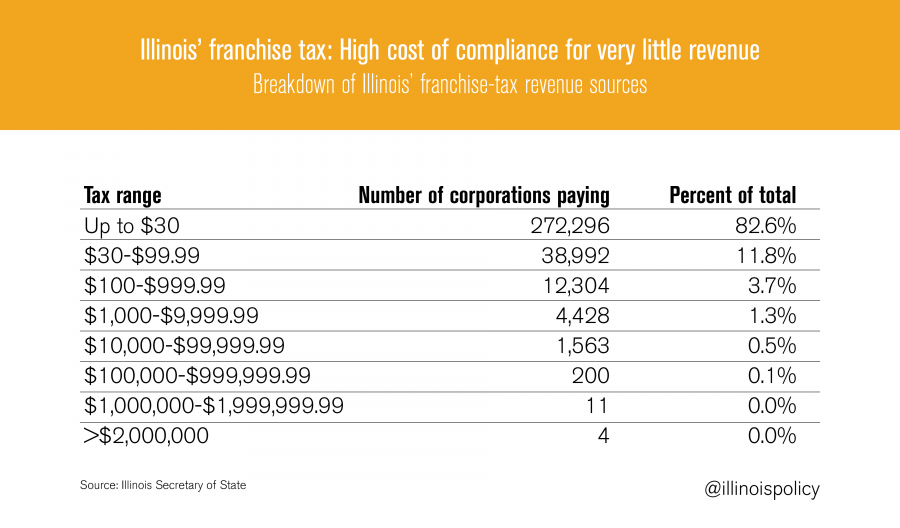

In fact, 95% of corporations in Illinois account for just 6% of revenues from taxes on paid-in capital. [9] In essence, even though all corporations face the additional burden of calculating and paying their franchise taxes, most of the revenues the tax raises come from only a small portion of filers.

Who administers Illinois franchise tax?

Similarly, Illinois’ franchise tax is administered by the Secretary of State rather than the Department of Revenue, which means separate filings, separate due dates, and a separate administrative regime.

What is franchise tax?

In general, a franchise tax is a tax on corporations that is separate from the corporate income tax. [1] . Most states impose a fixed or graduated fee on corporations incorporated or doing business there, but the term “franchise tax” is most commonly used to describe a tax based on some measure of a company’s net worth or capital value.

Why was the franchise tax controversial?

The choice of paid-in capital as the basis of the franchise tax was controversial even in 1872, so much so that Chicago railroad companies fought the tax all the way to the U.S. Supreme Court. They argued that paid-in capital was an inappropriate, vaguely defined basis for the tax, and that the tax was unconstitutional. In its decision in favor of the State of Illinois, the Supreme Court said that Illinois’ method of determining a corporation’s tax liability was “probably as fair as any other” method. [11] Hardly a resounding endorsement, even then.

How much did franchise tax raise in 2018?

Taxes on paid-in capital, the three components of the franchise tax, raised $179 million in calendar year 2018, about 0.47% of general fund tax revenues.

How much is corporation tax?

Finally, there is an “additional tax” on increases to paid-in capital, imposed at a higher rate (0.15%). The annual and initial taxes have a minimum of $25 (over and above the $75 annual report filing fee) and a maximum of $2 million, but the additional tax has no cap.

When was franchise tax enacted?

The franchise tax was originally conceived as a fee companies paid for the privilege of being considered “corporations.”. It was enacted in Illinois in 1872 , when the “corporation” as a modern American institution was a relatively new idea.

What is the income tax rate in Illinois?

Illinois has a flat income tax that features a 4.95% rate. This means that no matter how much money you make, you pay that same rate. Sales and property taxes in Illinois are among the highest in the nation.

What is the Illinois sales tax rate?

The general merchandise sales tax applies to almost all other products purchased for use in Illinois. The base rate is 6.25%. However most areas have additional local taxes between 1% and 4.75%. The highest combined sales tax in Illinois is 11% in the city of River Grove, and Chicago’s top sales tax rate is 10.25%.

What are the tax credits for Illinois?

For example, the Illinois Property Tax Credit is equal to 5% of Illinois property tax paid on a principal residence. If you paid $1,000 in property taxes in 2020, you could claim a credit of $50 on your income tax return – that’s $50 less that you end up paying in taxes.

What is taxable income in Illinois?

When filing an income tax return in Illinois, taxpayers begin with their federal adjusted gross income (AGI, or taxable income, is income minus certain deductions). From there, certain items may be added back in, and others may be subtracted. Among the most important items that are taxable federally but not in Illinois are retirement and Social Security income, as well as distributions from a 529 college savings plan.

What is the Illinois property tax credit?

For example, the Illinois Property Tax Credit is equal to 5% of Illinois property tax paid on a principal residence.

How much is property tax in Illinois?

Property tax: 2.16% average effective rate. Gas tax: 38.7 cents per gallon of regular gasoline, 46.2 cents per gallon of diesel. The state of Illinois has a flat income tax, which means that everyone, regardless of income, is taxed at the same rate.

How do I calculate my adjusted gross income?

First, we calculate your adjusted gross income (AGI) by taking your total household income and reducing it by certain items such as contributions to your 401 (k).

What is Illinois corporate franchise tax?

The Corporate Franchise Tax is essentially a fee that businesses must pay to the Illinois Secretary of State for the privilege of doing business in the State of Illinois and it is calculated based upon either the value of the corporation’s property or based upon the corporation’s total Paid-in Capital. Paid-in Capital is the amount of money that a corporation receives from its shareholders in exchange for the issuance of stock in the company.

Which states have franchise tax?

Those states include Alabama, Arkansas, North Carolina, Oklahoma, Tennessee, Texas, and West Virginia. Most states are moving towards eliminating their Corporate Franchise Taxes all together with the goal of attracting more business owners to incorporate and do business in their states.

When is Illinois corporate annual report due?

If you have an Illinois Corporate Annual Report due in 2020 , expect to have your usual franchise tax amount be lowered by the new law. These lower tax assessments will likely benefit larger corporations and those corporations that have high amounts of Paid-In Capital.

When is the first $100,000 exempt from taxes?

On or after January 1, 2023 and prior to January 1, 2024, the first $100,000 in liability is exempt from the tax imposed under this Section.”

What is the difference between franchise and income tax?

There are several differences between a franchise tax and income tax. For example, franchise taxes are not based on business profits, while income taxes are. Regardless of whether profit is made, a business made pay franchise tax, whereas income tax and the amount paid is based on the organization’s earnings during that particular year.

What states have franchise tax?

In 2020, some of the states that implement such tax practices are: Alabama. Arkansas.

What is franchise tax in West Virginia?

West Virginia. Franchise taxes are charged to corporations, partnerships, and other corporate entities such as limited liability companies. Limited Liability Company (LLC) A limited liability company (LLC) is a business structure for private companies in the United States, one that combines aspects of partnerships and corp. .

What is indirect tax?

Indirect Taxes Indirect taxes are basically taxes that can be passed on to another entity or individual. They are usually imposed on a manufacturer or supplier who then. Gross Income. Gross Income Gross income refers to the total income earned by an individual on a paycheck before taxes and other deductions.

Do sole proprietorships pay franchise tax?

Although companies usually have to pay franchise tax based on where they are operating and registered in each state, sole proprietorships are not often subject to franchise taxes. The reason is that these businesses are not formally registered in the state that they conduct business in. Additional entities that are not subject to franchise tax are: ...

Do fraternal organizations pay franchise taxes?

However, franchise taxes do not apply to fraternal organizations, non-profits, and some limited liability corporations. Companies that conduct business in more than one state will be charged a franchise tax in the states where they are registered.

Do franchise taxes replace state taxes?

It is important to make note that franchise taxes do not replace federal or state income taxes. They are simply add-on taxes in addition to income taxes. Much like any other tax, franchise taxes must be paid annually as well. The amount that must be paid differs by the tax rules that govern each state.

When will Illinois franchise tax be phased out?

The Illinois franchise tax is scheduled to be completely phased out in 2024, which will provide significant tax savings for corporations with large paid-in capital allocated to Illinois and eliminate an administrative burden for all corporations doing business in Illinois. Taxpayers should be aware, however, that although ...

When are franchise taxes due?

Fortunately, the new legislation phases out the franchise tax beginning in 2020. The new law exempts the first $30 of a corporation’s franchise tax due in 2020, with the exemption amount increasing to $1,000 for taxes due in 2021, $10,000 for taxes due in 2022 and $100,000 for taxes due in 2023.

What is the amnesty program for Illinois?

The new law provides two amnesty programs for delinquent taxpayers. One program is for taxpayers owing franchise taxes or license fees imposed by the Illinois Business Corporation of 1983 for any tax period ending after March 15, 2008 and on or before June 30, 2019. This amnesty program is available only between October 1, 2019 and November 15, 2019. Taxpayers with unpaid franchise taxes or license fees for the relevant period can realize significant benefits by participating in the program. If a taxpayer pays all unpaid franchise taxes and license fees for any taxable period included in the amnesty program, the Secretary of State will abate and not seek to collect any interest or penalties, and it will not seek civil or criminal prosecution, for the period for which such taxes and fees are paid. Considering that unpaid franchise taxes accrue interest at a rate of 2% per month, the waiver of interest can result in significant savings. Further, amnesty will be available with respect to any taxable period for which a taxpayer pays all back franchise taxes and fees, even if the taxpayer does not pay all taxes and fees that it may owe for all periods. Amnesty is not available, however, for any taxpayer who is a party to any criminal investigation or any civil or criminal litigation pending in court for nonpayment, delinquency or fraud concerning franchise tax or license fees.

What happens if you pay franchise taxes?

If a taxpayer pays all unpaid franchise taxes and license fees for any taxable period included in the amne sty program, the Secretary of State will abate and not seek to collect any interest or penalties, and it will not seek civil or criminal prosecution, for the period for which such taxes and fees are paid.

When is the second tax amnesty in Illinois?

A second amnesty program is available for unpaid taxes owed to the Illinois Department of Revenue for taxable periods ending after June 30, 2011 and prior to July 1, 2018. Like the franchise tax amnesty program, this program runs from October 1, 2019 through November 15, 2019, and provides that the Department of Revenue will abate and not seek to collect any interest or penalties, and it will not seek civil or criminal prosecution, for any taxable period for which amnesty is granted. However, unlike the franchise tax amnesty program, a taxpayer’s failure to pay all taxes owed to Illinois for any taxable period will invalidate any amnesty under this program, and amnesty under this program is not available to any taxpayer who is a party to any criminal investigation or any civil or criminal litigation pending in court for nonpayment, delinquency or fraud concerning any taxes owed to Illinois.

What is paid in capital in Illinois?

The amount of a corporation’s paid-in capital that is allocated to Illinois is based on the percentage of the corporation’s total property and total business that is allocated to Illinois. A corporation’s paid-in capital is generally the amount of consideration paid to the corporation in connection with the issuance of shares ...

Can a corporation with paid in capital be stuck paying franchise taxes?

Given the difficulty in reducing paid-in capital, a corporation with significant paid-in capital can be stuck paying high franchise taxes even for years in which the corporation performs poorly and even if the value of the corporation drops significantly from when it received its paid-in capital. This is just one of the franchise tax traps ...

Applicability of The Franchise Tax

- The Franchise Tax is imposed upon domestic corporations and foreign corporations for the authority to transaction business in Illinois. The tax strictly applies to corporations; banks and insurance companies, which register with separate Illinois agencies, are not subject to the tax. Similarly, while LLCs have their own registration obligation with...

Franchise Tax Base

- The Franchise Tax can be split into three different taxes: the initial franchise tax, the annual franchise tax, and an additional franchise tax. The initial franchise tax is paid when a foreign corporation applies with the state for authority to transact business in the state. In the case of a domestic corporation, the initial franchise tax is due upon the first issuance of shares. An annua…

Appeals and Protests

- Because the Franchise Tax is administered by the Secretary of State, challenges to an assessment of tax must be made to the Secretary within three years after the amount to be adjusted should have been paid. Generally speaking, but not always, a corporation should file a statement of correction with the Secretary which will supply the grounds for the need for an adju…

Conclusion

- Very few states employ a tax on paid-in capital in the manner Illinois does. Foreign corporations that may be doing business in Illinois should be careful to examine their business activities to determine whether they have a Franchise Tax obligation. Most importantly, corporations engaged in mergers and acquisitions with Illinois corporations should be careful to examine how such re…