You can do so by following these steps:

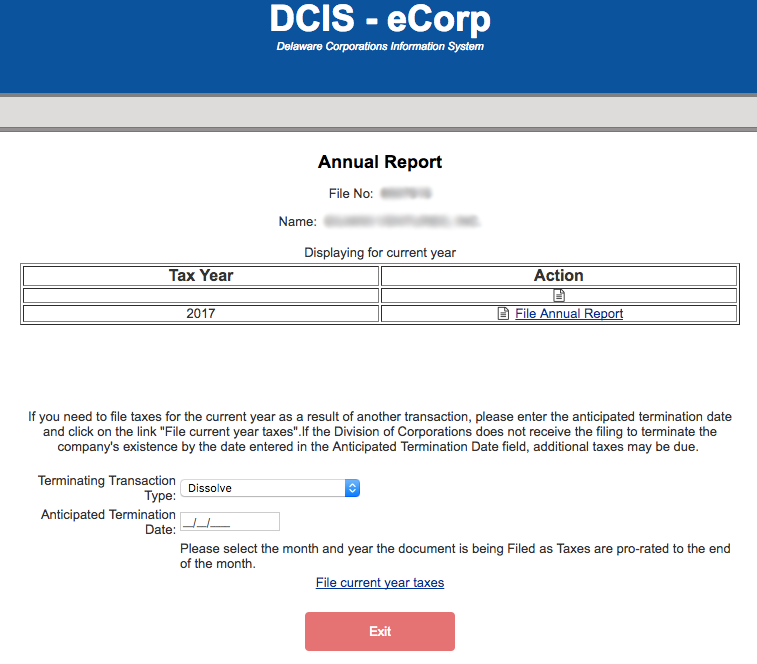

- Go to https://corp.delaware.gov/paytaxes/

- Enter your 7 digit Business Entity File Number. (You can look yours up here .)

- A web form will ask you for all of the annual report information mentioned above

- Pay your tax and filing fee by credit card or electronic debit payment

How much do they take out in taxes in Delaware?

This document must be filed annually. Income tax in the state of Delaware consists of six brackets. The tax rates in those brackets range from a low of 2.2 percent to a high of 6.6 percent. A majority of taxpayers in the state of Delaware file their taxes electronically.

Which states have franchise tax?

The states that currently have franchise taxes are:

- Alabama

- Arkansas

- Delaware

- Georgia

- Illinois

- Louisiana

- Mississippi

- Missouri

- New York

- North Carolina

What is the corporate tax rate for Delaware?

Delaware has a flat corporate income tax rate of 8.700% of gross income. The federal corporate income tax, by contrast, has a marginal bracketed corporate income tax.Delaware's maximum marginal corporate income tax rate is the 10th highest in the United States, ranking directly below California's 8.840%.

Why do companies incorporate in Delaware?

Why Do Companies Incorporate in Delaware?

- Low and competitive corporate taxes

- Friendly political scene

- Up-to-date and corporation-friendly business environment

- Ideal legal culture, lawyers, and judges who quickly and expertly address and solve corporate cases

- Simple filing process for small businesses and protection from penalties

What happens if I don't pay Delaware franchise tax?

If you don't pay the Delaware Franchise Tax and file the Annual Report for two straight years, the State of Delaware will administratively dissolve the Corporation. If you have any questions about forming your new Delaware LLC, LP, or Corporation, give us a call today.

How do I check the status of my Delaware corporation?

You can check the status of an entity online. There are two options of online status available, status ($10) or status with tax & history information ($20). Please note: requesting an online status will NOT generate an official certificate of good standing.

Do I have to pay Delaware franchise tax?

Any corporation that is incorporated in Delaware (regardless of where you conduct business) must file an Annual Franchise Tax Report and pay Franchise Tax for the privilege of incorporating in Delaware. Franchise Taxes and annual Reports are due no later than March 1st of each year.

How do I avoid franchise tax in Delaware?

There are ways to reduce your Delaware franchise costs in certain circumstances. To reduce the taxes paid by a startup, use the Assumed Par Value method. This method calculates the taxes by total assets. As long as your issued shares constitute a third to half of your authorized shares, this method will save you money.

How do I find my Delaware corporation number?

The Delaware file number can be located in several different places. You can find it on the cover letter we send with your approved company documents and on your receipt. The state will stamp it in the margin of your filed Certificate of Formation or Certificate of Incorporation.

Do Delaware LLC pay taxes?

A. Delaware treats a single-member “disregarded entity” as a sole proprietorship for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the State of Delaware.

What happens if I dont pay Delaware LLC tax?

Although Limited Partnerships, Limited Liability Companies and General Partnerships formed in the State of Delaware do not file an Annual Report, they are required to pay an annual tax of $300.00. Taxes for these entities are due on or before June 1st of each year. Penalty for non-payment or late payment is $200.00.

How much is franchise tax for LLC in Delaware?

$300The Franchise Tax for a Delaware LLC or a Delaware LP is a flat annual rate of $300. A non-stock/non-profit company is considered exempt by the State of Delaware. This type of company does not pay the standard annual Delaware Franchise Tax, but must still file and pay the annual report fee of $25 per year.

What is the annual franchise tax fee in Delaware?

Delaware LLCs do not have to file an Annual Report (like Corporations do), but they do have to pay a flat-rate Annual Franchise Tax of $300 each year. The $300 tax must be paid by every LLC formed in Delaware, regardless of income or business activity.

What happens if I don't dissolve my LLC in Delaware?

If you don't file the Certificate of Cancellation, the LLC will continue to accumulate Delaware franchise tax annually. Failure to settle the tax will lead to an administrative dissolution when the franchise tax goes into arrears.

What is the Delaware tax loophole?

Companies and wealthy individuals can use Delaware to avoid paying some taxes in other states. So there's a thing called the Delaware Loophole, which essentially enables companies to avoid paying state corporate income tax where they earn the revenue.

What is Delaware franchise tax based on?

authorized sharesThe Annual Franchise Tax assessment is based on the authorized shares. Use the method that results in the lesser tax. The total tax will never be less than $175.00, or more than $200,000.00. For corporations having no par value stock the authorized shares method will always result in the lesser tax.

How long does it take to get a Delaware certificate of Good Standing?

The good news is that turnaround time for a Delaware Certificate of Good Standing is the same day. In fact, we generally deliver your Certificate of Good Standing within two hours, during normal business hours (M-F; 9:00am to 5:00pm EST).

How do I get a copy of my Delaware business license?

If you do not receive your business license renewal in the mail, you can obtain one by contacting the Delaware Division of Revenue's Public Service Office at (302) 577-8200.

How do I find Articles of Incorporation for a Delaware corporation?

Print a filing memo from the Delaware Department of State website. Pick up the filing memo in person at the John G. Townsend Bldg., 401 Federal St., Dover, DE 19901. Call (302) 739-3073 to have a fill-in-the blank filing memo sent by mail.

How do I find out who owns a company in Delaware?

You can find information on any corporation or business entity in Delaware or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

How much is Delaware franchise tax?

Effective January 1, 2018, a domestic stock or non-stock for profit corporation incorporated in the State of Delaware is required to pay annual franchise tax. The minimum tax is $175.00, for corporations using the Authorized Shares method and a minimum tax of $400.00 for corporations using the Assumed Par Value Capital Method.

How to multiply authorized shares?

Multiply the number of authorized shares with a par value greater than the assumed par by their respective par value. Example: 250,000 shares $5.00 par value = $1,250,000

When are Delaware annual reports due?

Notification of Annual Report and Franchise Taxes due are sent to all Delaware Registered Agents in December of each year. Delaware has mandated electronic filing of domestic corporations Annual Reports.

How much is the annual report fee for a foreign corporation?

Foreign Corporations. Foreign Corporations are required to file an Annual Report on or before June 30th. The fee for filing the Annual Report is $125.00. Foreign corporations are assessed a penalty of $125 if the Annual Report is not filed.

How much does it cost to file an amended annual report?

The filing fee for filing an Annual Report or Amended Annual Report for exempt domestic corporations is $25. For an Annual Report or Amended Annual Report for non-exempt domestic corporations the filing fee is $50. Taxes and Annual Reports are to be received no later than March 1st of each year.

Do corporations pay franchise tax in Delaware?

Corporate Annual Report and Franchise Tax Payments. All corporations incorporated in the State of Delaware are required to file an Annual Report and to pay a franchise tax. Exempt domestic corporations do not pay a tax but must file an Annual Report. The filing fee for filing an Annual Report or Amended Annual Report for exempt domestic ...

What are Delaware franchise taxes?

A franchise tax, sometimes called a privilege tax, is a fee you pay for the “privilege” of doing business in a certain state.

Who has to pay the franchise tax?

You must pay the Delaware franchise tax if your Delaware business is one of the following:

When are my payments due?

You must file your annual report and pay your franchise tax and filing fee by March 1.

How to calculate Delaware franchise tax?

Delaware’s default method of calculating annual franchise tax is based only on how many shares a Company has authorized in its charter: 1 5,000 shares or less (minimum tax) $175.00 2 5,001 – 10,000 shares – $250.00 3 Each additional 10,000 shares or portion thereof add $85.00 4 Maximum annual tax is $200,000.00

When are Delaware franchise taxes due in 2021?

Please note: this information is up-to-date as of April 12, 2021.

How to minimize franchise taxes?

Startups can usually minimize franchise taxes by using the Assumed Par Value method, since it calculates tax as a function of total assets. The only pitfall to watch out for is that even a company with few assets could potentially owe very large franchise taxes if it authorizes a very large number of shares but then issues a tiny percentage of them. So long as your issued shares constitute at least a third to a half of your authorized shares, the Alternative Par Method should work well for most startups.

What is the par value of a company in Delaware?

$0.001 or below), Delaware has come up with an “assumed par value,” which is the Company’s gross assets divided by all of its issued and outstanding shares . The gross assets come from U.S. Form 1120, Schedule L tax form for the same year that the Company is filing its annual report. If the Company has not filed its taxes for that year yet, then a number from a recent balance sheet will suffice and can be amended later if necessary. The par value used to compute the tax is the greater of the “assumed par value” or the actual par value listed in the certificate of incorporation.

What information is required for a Delaware corporation?

An officer of the company must enter and confirm the necessary information, which includes the physical address/location of the corporation, address of the registered agent in Delaware, a list of all directors and at least one officer, issued shares, and gross assets.

How much does a company with 5,000,000 authorized shares owe?

By way of illustration for how quickly this grows, a company with 5,000,000 authorized shares will owe $37,675.00; a company with 10,000,000 will owe $75,175.00; and for a company to hit the maximum tax, it will have to authorize just fewer than 24,000,000 shares. Again, this is based on authorized shares and not outstanding shares.

What Is A Franchise Tax?

Delaware Franchise Tax by City and County

- Unlike most other states, local governments in Delaware don’t routinely appraise property values. Instead, all counties and localities base their property taxes on the sums determined at the most recent reassessment of all property. A highlight of Delaware Franchise Tax by City and County include:

Frequently Asked Questions

- What is the minimum franchise tax in Delaware?

For companies utilizing the authorized shares method, the minimum franchise tax in Delaware is $175.00, while for those using the presumed par value capital technique, the required franchise tax is $400.00. The maximum tax for all firms employing either strategy is $200,000.00. - What happens if you don’t pay Delaware franchise tax?

A $200 penalty will be assessed if the franchise tax is not paid by the due date. This is in addition to the 1.5% monthly interest charges levied by the State of Delaware.

Expert Opinion

- Startups who choose Delaware as their place of incorporation are probably already aware that they must pay the Delaware franchise tax. A franchise tax is a state tax levied on incorporated companies. Companies must pay a fee to a state to do business there. Additionally, the methodologies used to determine your tax liability vary across states. Many startups are incorpo…