There are three main ways to release a California Franchise Tax Board bank levy:

- Prove a financial hardship

- Show that the money belonged to someone else

- Show that the levy took funds that are exempt from the levy

- Prove another extraordinary circumstance

...

- Home.

- help.

- disagree or resolve an issue.

- appeal a decision.

Can you negotiate with California Franchise Tax Board?

The Offer in Compromise (OIC) program allows you to offer a lesser amount for payment of an undisputed tax liability.

How do I stop Franchise Tax Board garnishment?

The most effective way to stop garnishments or other levies is to pay in full. After you have paid, contact the number listed on your order. Have your payroll, bank, or other payor fax number prior to calling.

How do I waive penalty FTB?

You may file a reasonable cause - claim for refund to request that we waive a penalty for reasonable cause.Reasonable Cause – Individual and Fiduciary Claim for Refund (FTB 2917)Reasonable Cause – Business Entity Claim for Refund (FTB 2924)

How do I get through the California Franchise Tax Board?

Taxpayer inquiries Taxpayers with general questions can call (800) 852-5711 or visit our website at ftb.ca.gov .

Can you negotiate with the Franchise Tax Board?

The Offer in Compromise (OIC) program allows you to offer a lesser amount for payment of a nondisputed final tax liability. If you are an individual or business taxpayer who does not have the income, assets, or means to pay your tax liability now or in the foreseeable future, you may be an OIC candidate.

Does the state of California forgive tax debt?

California Tax Debt Forgiveness: Is It a Real Thing? California will forgive tax debt via a Franchise Tax Board Offer in Compromise. An FTB Offer in Compromise is an agreement between the California state taxing authorities, the FTB, and the taxpayer to settle the tax debt for less than the amount owed.

Can you get tax penalties waived?

Taxpayers may request a waiver of the penalty amount as long as the request is in writing and the principal tax and interest amounts due are paid. Written requests for a waiver of the penalty will be considered on a case-by-case basis. If the waiver is denied, the penalties will be billed at a future date.

What happens if I dont pay FTB?

The California Franchise Tax Board imposes a penalty if you do not pay the total amount due shown on your tax return by the original due date. The penalty is 5 percent of the unpaid tax (underpayment), plus 0.5 percent of the unpaid tax for each month or part of a month it remains unpaid (monthly).

What is reasonable cause for FTB penalty abatement?

In order for a penalty to be canceled, reasonable cause must exist. Reasonable cause means the act occurred despite the exercise of ordinary business care and prudence and the failure was due to events beyond the filer's control.

Why do I owe the Franchise Tax Board?

The California Franchise Tax Board is responsible for collecting personal income tax and corporate income tax in the State of California. California taxpayers are required to pay their taxes to the FTB. However, after filing their taxes, many taxpayers still have an outstanding tax bill with the FTB.

Do I have to pay California Franchise Tax?

Every corporation that is incorporated, registered, or doing business in California must pay the $800 minimum franchise tax.

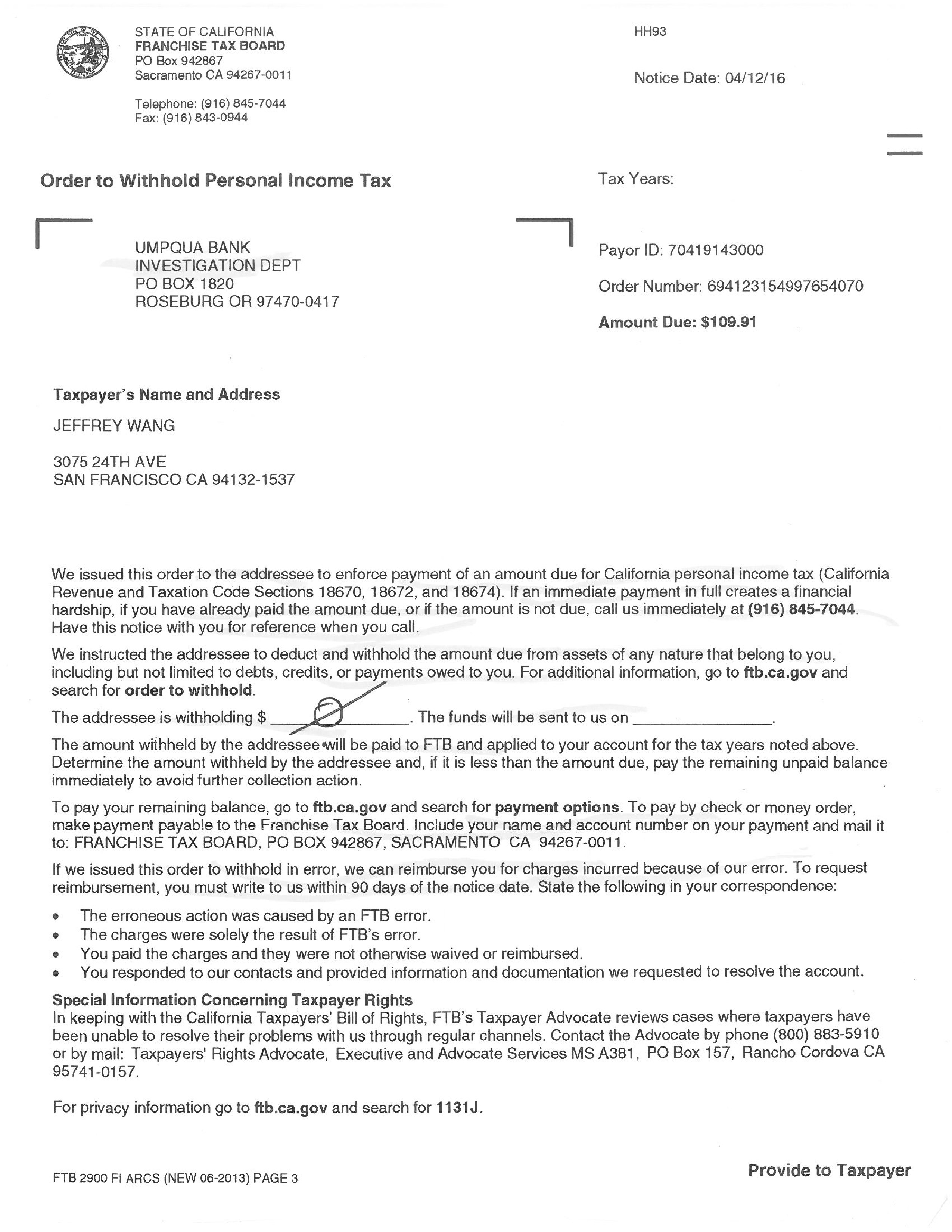

Can the Franchise Tax Board taking money from bank account?

We issue orders to withhold to legally take your property to satisfy an outstanding balance due. We may take money from your bank account or other financial assets or we may collect any personal property or thing of value belonging to you but in the possession and control of a third party.

How do I stop a levy from the Franchise Tax Board?

Stopping A California FTB Bank Levy Before It Starts Pay In Full – Pay off the debt completely. Payment Plan – Paying off the debt in the monthly payment. Offer In Compromise – Settling a tax debt for less than the amount owed. Hardship Request – Tax debt collections are stopped for one year (six months in some cases)

Can you stop a tax wage garnishment?

The easiest way to release and stop a wage garnishment/levy by the IRS or the State is to pay your taxes in full plus any penalties and interest that may have been assessed as late fees.

How can I stop a garnishment in California?

File an Exemption – In California you may be able to stop the Wage Garnishment through filing an exemption. You may be able to have the wage garnishment stop or reduce the amount being garnished if you can show that the money is needed to support you or your family.

Can Franchise Tax Board taking money from bank account?

We issue orders to withhold to legally take your property to satisfy an outstanding balance due. We may take money from your bank account or other financial assets or we may collect any personal property or thing of value belonging to you but in the possession and control of a third party.

What happens if you lose at the SBE?

In contrast, if the taxpayer loses at the SBE, the taxpayer can bring suit in California Superior Court for a de novo trial. This one-way appeal right, something only the taxpayer has, is a nice taxpayer protection. If you do sue in Superior Court, you will have a regular judge, not a tax specialist.

Can you contest federal taxes in California?

If you have an IRS dispute, you can fight it administratively with the auditor and at the IRS Appeals Office. If necessary, you can go to U.S. Tax Court, where you can contest the taxes before paying.

Can a SBE member vote for a client?

You might get clear signals that an individual SBE member cannot—or will not—vote for your client. Sometimes a “no” vote in this circumstance can have its own kind of empowerment. Indeed, where this happens, one of the most unique features of California's tax system kicks in: money.

Is the SBE a judge?

California's five member SBE has a very tough job. They try to resolve and administer California's tax laws, and most of them are not tax professionals. They are not judges, so it is okay to talk to them ex parte .

Can the SBE bend the rules?

Of course, you can’t count on that. In many ways, the deck is stacked against you as a California taxpayer. Notably, the SBE doesn't just hear income tax appeals.

Does California have a tax court?

Many states have a state tax court, but California does not. It has a State Board of Equalization (SBE). It is a five-member administrative body—the only elected tax commission in the U.S.—that functions much like a court.

Can the SBE hear income tax appeals?

Notably, the SBE doesn't just hear income tax appeals. It also hears sales and use tax cases, and even property tax appeals. If you are unable to resolve an income tax, property tax, or sales or use tax matter, you can appeal it to the SBE.

1. You disagree with a letter from us

We may send you a letter in the mail. If you disagree, gather supporting information/documents and contact us 1 .

2. If the information you provided is not enough

If you agree with our decision, follow the instructions on the letter.

3. If we deny your claim for refund

If you disagree with our denial of your claim for refund, you can submit an appeal 6 .

How long does it take to respond to a FTB request?

A response or resolution is not met within normal FTB processing timeframes. If there’s no “normal response time” then 30 days from the date of your original submission to FTB for assistance.

What is internal FTB?

An internal FTB system does not perform in the manner intended (withholding, processing, billing, etc.). 3. Best Interest of the Taxpayer. You claim you’re not receiving fair and equitable treatment including where you allege unsatisfactory treatment by FTB employees.

How to appeal a California franchise tax decision?

To appeal a decision by the California Franchise Tax Board (FTB), you must first attempt to use all of your administrative remedies within the FTB. After you have exhausted these procedures, you may appeal your decision by submitting the proper forms by the appropriate deadline.

How long does it take to appeal a FTB?

Appeals for most notices most be filed within 30 days of the FTB notice. If you are considering filing an appeal, contact a California tax attorney immediately to avoid missing your deadline and losing your appeal rights.

What is an FTB notice?

There are many different types of FTB notices you have the right to appeal, including: Notice of Action on a protest against a tax assessment, including penalties and interest. Notice of Action on a cancellation, credit, or refund, which denies all or part of a refund. Notice of Determination Not to Abate Interest.

When will California start hearing appeals?

Beginning in January of 2018, the Office of Tax Appeals will begin hearing appeals related to California income taxes, franchise taxes, sales and use taxes, and other special taxes and fees. Appeals will be heard by a panel of three Administrative Law Judges.

What to do if you miss the deadline for tax appeal?

If you miss your deadline on an appeal of a proposed tax assessment, your best option would be to pay the tax and file a claim for a refund. You will have to send an appeal letter in order to officially file your appeal, which includes the dates of all FTB notices, the tax years and amounts at issue, a statement of the facts, ...

How to Sue the California Franchise Tax Board

My question involves a consumer law issue in the State of California. The California Franchise Tax Board claimed that I owed them back taxes for the years 2005-2009, in the amount of $130k. Starting in 2006 I began my battle with California over this absurd back taxes fight.

Re: How to Sue California Franchise Tax Board

Thank you. I have an appointment with an attorney who has sued the CTFB before and won. We will see. Thank you again.

What is the FTB in California?

The Ultimate Guide to California Franchise Tax Board (FTB) Collections. The FTB has been known to “strong-arm” former state residents. But people do fight back and win. Take the case of Gilbert Hyatt, an inventor who earned a fortune as the patent holder of the microcomputer. For twenty five years, the FTB harassed Hyatt, ...

What is Chapter 3 of the FTB?

Chapter 3 discusses the different types of FTB collections activities. We will then move on to ways the taxpayer can attempt to pay off the debt, such as an Offer in Compromise, payment plan or installment agreement.

How long did the FTB harass Hyatt?

For twenty five years, the FTB harassed Hyatt, whose case went all the way to the Supreme Court. The repercussions of an unpaid balance due to the California Franchise Tax Board (FTB) can be severe, especially for a small business owner. The law allows the FTB to pursue payment of tax debts aggressively through a number ...

Is California a good place to live?

Despite being one of the most enjoyable places to live in the United States, California can feel a rather unforgiving place. The sheer volume of taxation laws that one needs to understand, for a start, can be an exercise in frustration and aggravation if you are unable to get your head around the problem at hand.

Can the FTB levy a bank account?

From vehicle registration debts to child protection , the FTB can levy a bank account for a whole armada of reasons. To help avoid this problem, you need to work with the right legal minds to help you arrange a plan of action against this.

How much can a California FTB garnish?

In the given example, the California FTB could garnish no more than $115.50. There are cases when the FTB modifies the garnishment amount. When this happens, they mail a garnishment modification notice to inform the taxpayer.

What can you do to stop an FTB wage garnishment?

One option you can go for to stop FTB wage garnishment is to file for bankruptcy. When filing for bankruptcy, most or all of your assets will be liquidated, and the money earned will be used to pay off your outstanding debt. Filing for bankruptcy is a big decision to make. To help you decide if bankruptcy is the right way to go for you, consider the following:

How much is garnishment for FTB?

The FTB can also calculate the garnishment by the amount by which your weekly disposable earnings exceed 40 times the state hourly minimum wage (which is currently $11.00 per hour). For example, if you earn $12 per hour and work 40 hours per week, so that your weekly wage is $480. After deductions, your weekly income is $460.

How much can the FTB garnish?

The FTB can garnish up to 25% of your disposable income. Your disposable income is your personal earnings after lawful deductions such as federal income tax, social security, state income tax, and state disability. The FTB can also calculate the garnishment by the amount by which your weekly disposable earnings exceed 40 times ...

What is a FTB garnishment?

An FTB Wage Garnishment is an order issued by the California Franchise Tax Board if they see that you have delinquent debt. In a FTB wage garnishment, the FTB will be given the right to take a percentage of your income. The FTB considers balances from taxes, penalties, fees, interest, and non-tax debts owed to government agencies ...

How much can you garnish in California?

For example, if you earn $12 per hour and work 40 hours per week, so that your weekly wage is $480. After deductions, your weekly income is $460. Under California law, the FTB can garnish you the following amounts: 1 25% of $460 = $115.50 2 $460 – (40 x $11.00) = $20

What happens if you fall in between hardship and the FTB monthly payment plan proposal?

If you fall somewhere in between hardship and the FTB’s monthly payment plan proposal, a financial statement will be required and your payment will be based on your ability to pay. Sometimes the garnishment can be lower than this so you may want to consult a tax attorney to get the best results.