How do I file franchise tax in Texas?

- Enter your username and password.

- Once you’re successfully logged in, click “WebFile/Pay Taxes and Fees.”

- Enter your 11-digit Texas taxpayer number.

- Under the heading “Available Taxes/Fees,” click “Franchise Tax.”

- You’ll then be prompted to enter your Webfile number.

Full Answer

Who has to pay Texas franchise tax?

Franchise tax taxes all the businesses involved in the process from the manufacturer to the end distributor. It can be considered a tax for the privilege of doing business in Texas. Who Needs to File for Texas Franchise Tax? The short answer is everyone who has nexus in Texas has to file & pay Texas franchise tax.

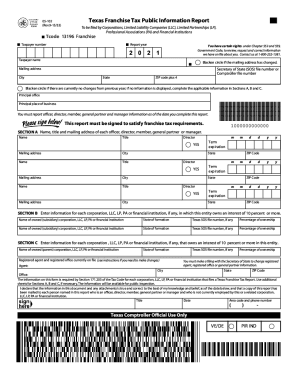

How to fill out franchise tax form in Texas?

To successfully file your Texas Franchise Tax Report, you’ll need to complete these steps:

- Determine your due date and filing fees.

- Complete the report online OR download a paper form.

- Submit your report to the Texas Comptroller of Public Accounts.

How to file franchise tax Texas non-proft 501c3?

Most nonprofit entities in Texas can receive tax exemption from both the state’s franchise tax and the sales tax. To get it, you’ll first need to file for and receive exemption on the federal level. Once the IRS has designated you as a 501 (c)3, you’ll need to file the application form AP-204, which you can find here.

How to file franchise tax Texas non-proft?

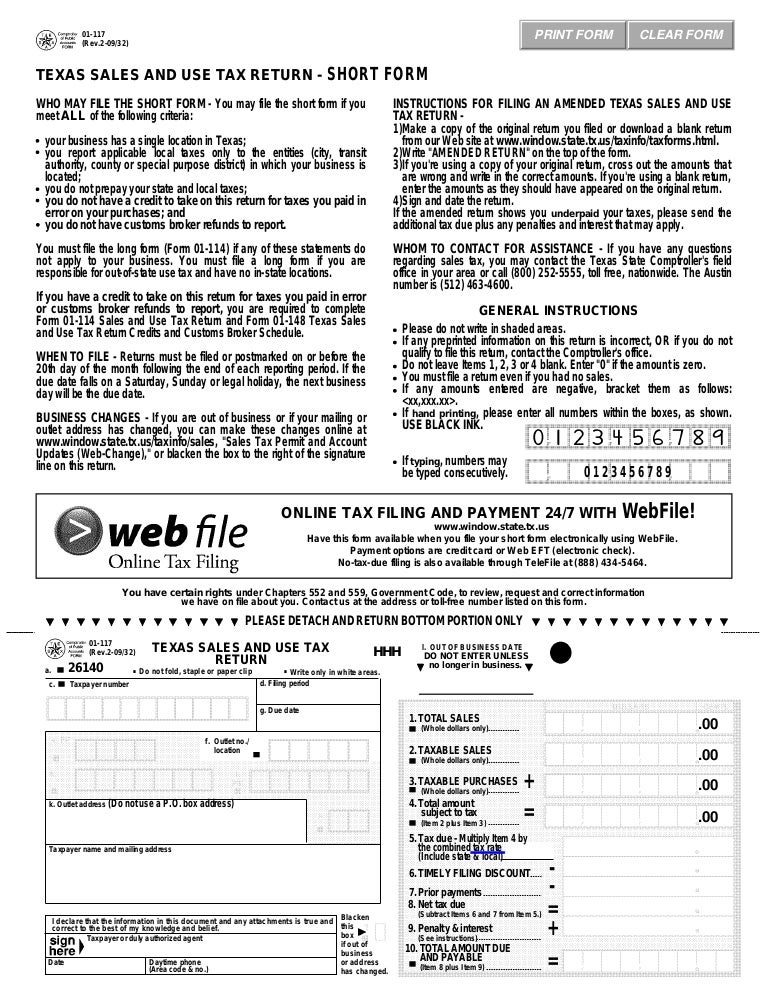

There are three ways to file the Texas Franchise Tax Report: No Tax Due; EZ Computation; Long Form; If your business falls under the $1,110,000 revenue limit, then you don’t owe any franchise tax. If you are above the limit, you can choose to fill out and file the EZ Computation form or to take the time to fill out the Long Form.

Do I need to file a Texas franchise tax return?

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

What form do u fill out for franchise tax in Texas?

A franchise tax report supporting the amount of tax due (Form 05-158, Texas Franchise Tax Report (PDF), or Form 05-169, Texas Franchise Tax EZ Computation Report (PDF)) must be filed.

How do I file a Texas franchise no tax due?

1:544:50How to File a No Tax Information Report - YouTubeYouTubeStart of suggested clipEnd of suggested clipContact the franchise tax office section at 1-800-531-545 extension 34402 for more information aboutMoreContact the franchise tax office section at 1-800-531-545 extension 34402 for more information about this error. If you did not receive an error message select continue.

Who files Texas franchise tax?

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

How much is franchise tax for LLC in Texas?

Tax Rates, Thresholds and Deduction LimitsItemAmountTax Rate (retail or wholesale)0.375%Tax Rate (other than retail or wholesale)0.75%Compensation Deduction Limit$370,000EZ Computation Total Revenue Threshold$20 million2 more rows

Can you efile Texas franchise tax return?

Texas Franchise reports may be submitted electronically with approved tax preparation provider software.

What is the Texas franchise tax threshold for 2022?

$1,230,000For the 2022 report year, a passive entity as defined in Texas Tax Code Section 171.0003; an entity that has total annualized revenue less than or equal to the no tax due threshold of $1,230,000; an entity that has zero Texas gross receipts; an entity that is a Real Estate Investment Trust (REIT) meeting the ...

What is the due date for Texas franchise tax Return 2022?

15, 2022, the balance of the amount of tax that will be reported as due on Nov. 15, 2022, using TEXNET (tax type code 13080 Franchise Tax Extension), Webfile or by submitting a paper Extension Request (Form 05-164) if the entity has paid all of the tax due with its first extension.

Is Texas franchise tax based on income?

Calculating the Franchise Tax The Texas Franchise Tax is calculated on a company's margin for all entities with revenues above $1,230,000. The margin's threshold is subject to change each year. The margin can be calculated in one of the following ways: Total Revenue Multiplied by 70 Percent.

Does an LLC have to file a tax return in Texas?

Unlike many other states, Texas doesn't require LLCs to file annual reports. Texas imposes a franchise tax on most LLCs, which is payable to the Texas Comptroller of Public Accounts. Franchise tax is based on the LLC's “net surplus,” which is the net assets minus member contributions.

What is the no tax due threshold for Texas franchise tax?

The no tax due threshold is as follows: $1,230,000 for reports due in 2022-2023. $1,180,000 for reports due in 2020-2021. $1,130,000 for reports due in 2018-2019.

Where do I mail my Texas franchise tax report?

Mail original to: Texas Comptroller of Public Accounts P.O. Box 149348 Austin, TX 78714-9348 Taxpayers who paid $10,000 or more during the preceding fiscal year (Sept. 1 thru Aug. 31) are required to electronically pay their franchise tax.

What form is franchise tax?

Form 100, California Corporation Franchise or Income Tax Return.

Does a single member LLC pay franchise tax in Texas?

Therefore, each taxable entity that is organized in Texas or doing business in Texas is subject to franchise tax, even if it is treated as a disregarded entity for federal income tax purposes and is required to file a franchise tax report.

What is the Texas franchise tax threshold for 2022?

$1,230,000For the 2022 report year, a passive entity as defined in Texas Tax Code Section 171.0003; an entity that has total annualized revenue less than or equal to the no tax due threshold of $1,230,000; an entity that has zero Texas gross receipts; an entity that is a Real Estate Investment Trust (REIT) meeting the ...

What is the accounting year for Texas franchise tax 2022?

For franchise tax reporting purposes, the entity would file its 2022 report based on the period 10-01-2020 through 12-31-2021, combining the relevant information from the two federal income tax reports.

How to file a franchise tax report in Texas?

How to File. There are three ways to file the Texas Franchise Tax Report: No Tax Due. EZ Computation. Long Form. If your business falls under the $1,110,000 revenue limit, then you don’t owe any franchise tax. If you are above the limit, you can choose to fill out and file the EZ Computation form or to take the time to fill out the Long Form.

What is franchise tax in Texas?

What is the Texas Franchise Tax? The Texas Franchise Tax is levied annually by the Texas Comptroller on all taxable entities doing business in the state. The tax is based upon the entity’s margin, and can be calculated in a number of different ways.

How many types of franchise tax extensions are there?

There are four different types of Franchise Tax Extensions, depending upon your situation.

How is Total Revenue Calculated?

Total revenue is calculated by taking revenue amounts reported for federal income tax and subtracting statutory exclusions.

Who Needs to File for Texas Franchise Tax?

The short answer is everyone who has nexus in Texas has to file & pay Texas franchise tax. (If you need some nexus or sales tax guidance, click here to download our “10 Steps of Sales Tax” PDF.)

How to extrapolate franchise tax webfile number?

You do that by changing the last digit of your sales tax number to one more and changing the R to an X.

What is threshold 1 for taxes?

Threshold 1 – If your sales in the entire country are less than $1.18M, you’ll file a No Tax Due Information Report. You have to file, but you don’t have to pay the tax.

What is the link to file an extension in Texas?

If you need to file an extension, this is the link: https://comptroller.texas.gov/taxes/franchise/filing-extensions.php. Remember, the extension is an extension to file, NOT an extension to pay. You still have to pay by the original deadline.

Is franchise tax difficult in Texas?

Filing Texas franchise tax isn’t difficult, but it is a bit of a process, so we’ll walk you through it.

Is franchise tax the same as sales tax in Texas?

The first thing to know when it comes to Texas franchise tax is that it is NOT the same as sales tax. Sales tax only taxes the end consumer. Franchise tax taxes all the businesses involved in the process from the manufacturer to the end distributor. It can be considered a tax for the privilege of doing business in Texas.

Do businesses have to file for 500k in Texas?

The longer answer is that all businesses that conduct business in TX or have passed the economic nexus threshold ($500K) have to file. That being said, there are some exceptions.

What is franchise tax in Texas?

The Texas Franchise Tax is an annual business privilege tax processed by the Texas Comptroller of Public Accounts. Essentially, it’s a tax levied on business owners in exchange for the opportunity to do business in Texas. Here's what you should know about it.

How often do you need to file a franchise tax return in Texas?

But whether or not tax is owed, you’ll need to file a Texas Franchise Tax Report every year to keep your business in good standing.

What does independent Texas do?

When you hire Independent Texas to form your Texas company or serve as your registered agent, we keep your state correspondence organized, send you multiple reminders ahead of the franchise tax due date, and provide affordable franchise report filing service.

What happens if you don't get your franchise tax report in Texas?

If the Comptroller’s office does not receive your franchise tax report (and payment, if you owe one) within 45 days of the deadline, they are required by law to forfeit your business’s right to transact business in Texas. This forfeiture is essentially a loss of corporate liability protection: business owners will become liable for the debts of the business, and the entity will not be permitted to defend itself in a court of law.

How to calculate annualized revenue?

To find annualized revenue, divide your business’s total revenue by the number of days since it became subject to the franchise tax, then multiply the result by 365.

How to check if a franchise is active in Texas?

How can I check my business’s Texas Franchise Tax status? You can check on the Texas Franchise Tax account status of your company (or another company) by conducting an online Taxable Entity Search on the Comptroller’s website. To search for a business, enter its name, 11-digit Texas taxpayer ID number, 9-digit Federal Employer Identification Number (FEIN) or Texas SOS file number. Once you locate the business you’re looking for, click on the blue “Details” button to the left of the business name. Under the “Franchise Search Results” tab, you’ll see an item called “Right to Transact Business in Texas.” If the right to transact business is “Active,” then the entity is still entitled to conduct business in Texas.

How to pay taxes on Webfile?

Log in to WebFile. From the eSystems menu, select WebFile / Pay Taxes and Fees.