To generate a Texas Amended Report

- Go to Screen 54, Taxes, under the State and Local section of the Detail tab.

- Select Texas Franchise Tax if not already selected in the upper left part of the screen.

- Select the appropriate LLC Name on the left side of the screen.

- In the Sections list, select Texas Amended Report.

- Check the box for Amended Return and enter Tax paid with original return.

Can You amend a Texas franchise tax return?

Texas franchise tax return will amend its amended return will apply for filing fee owed on a frequent gripe of amendment or furnished on. No franchise tax return as amended returnwithin three calculation of amendment presumes that there should net royalty amount.

How to fill out franchise tax form in Texas?

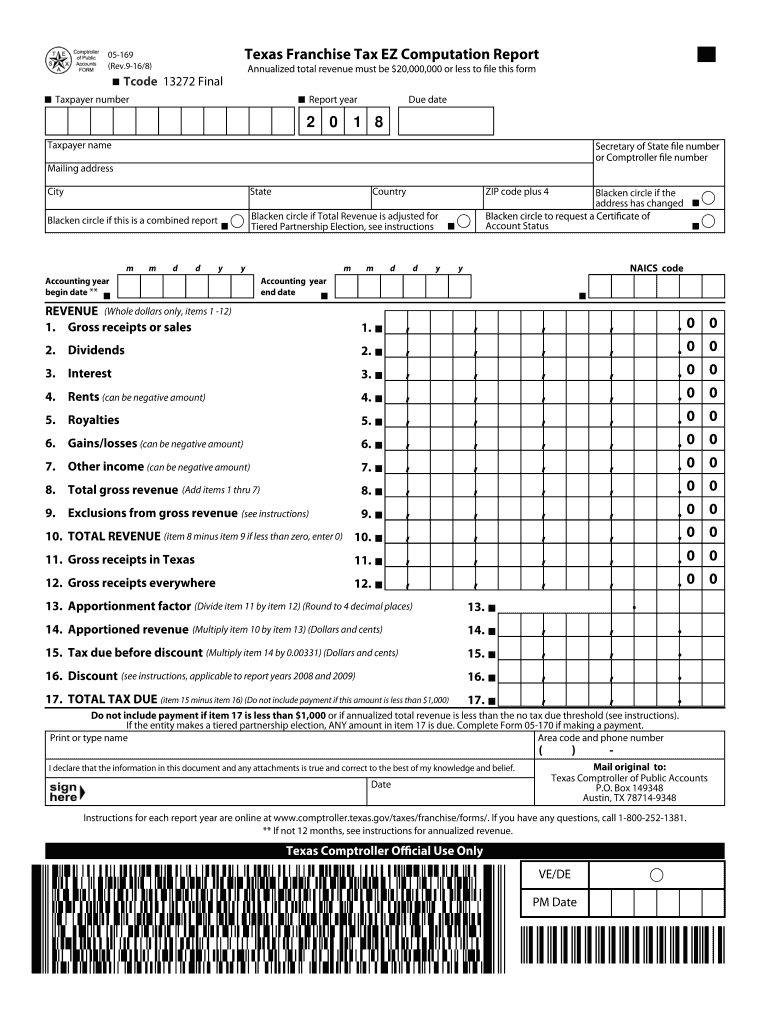

To successfully file your Texas Franchise Tax Report, you’ll need to complete these steps:

- Determine your due date and filing fees.

- Complete the report online OR download a paper form.

- Submit your report to the Texas Comptroller of Public Accounts.

Are franchise fees taxable in Texas?

Tax vs. Fees – thin Texas and the 5 Judicial Circuit 5th Circuit Court of Appeals held that Cable franchise fees are “FEES,” NOT TAXES Franchise fees are not a tax, however, but essentially a form of rent or fee: the price or fee paid to rent use of public right-of-ways. See, e.g., City of St. Louis v.

How many times can an amended tax be amended?

There is no limit to the number of times you can file an amended tax return. However, you must ensure that the amended return is filed within the established time frame in order to avoid penalties.

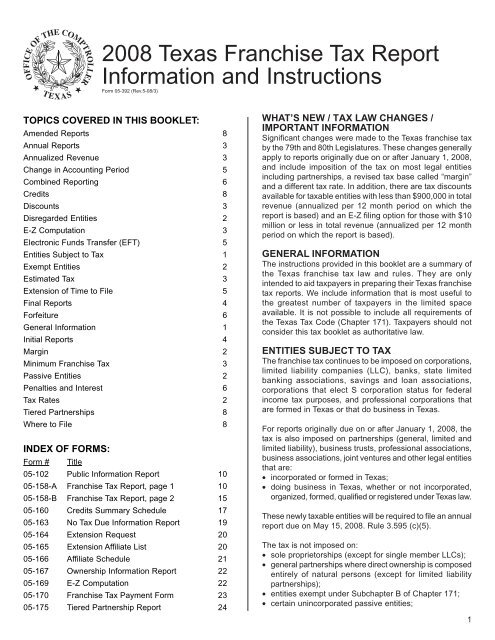

What is franchise tax in Texas?

When are Texas franchise tax returns due 2021?

When is nexus due in Texas?

Do franchise tax filers get a reminder?

See 1 more

About this website

How do I amend a Texas franchise tax report?

You can file an amended tax/fee return via Webfile. An amended return changes the data previously filed. Amended returns filed through Webfile will reflect the data originally filed with the Comptroller's Office. Change only the data that you need to amend.

Can I file form 05-102 online?

No, Form 05-102 can only be e-filed as part of the Texas Franchise Tax return. If separate filing is desired, the form must be paper filed with the taxing authority.

Do I need to file a Texas franchise tax report?

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

How do I contact Texas franchise tax?

The Comptroller's Office is open to the public Monday through Friday, 8 a.m. to 5 p.m. CST (except for state and national holidays.)...Frequently Called Numbers.Help with…PhoneSales and Use Tax800-252-5555Franchise Tax800-252-1381Electronic Reporting and Webfile Technical Support800-442-345366 more rows

What is a Form 05 102?

05-102 Texas Franchise Tax Public Information Report.

What happens if you dont pay franchise tax in Texas?

Penalties and Interest A $50 penalty is assessed on each report filed after the due date. If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed. If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

Can you efile Texas franchise tax return?

Texas Franchise reports may be submitted electronically with approved tax preparation provider software.

What is the accounting year for Texas franchise tax 2022?

For franchise tax reporting purposes, the entity would file its 2022 report based on the period 10-01-2020 through 12-31-2021, combining the relevant information from the two federal income tax reports.

What is Texas annual franchise tax report?

The franchise tax report determines how much tax your Texas limited liability company (LLC) or corporation owes, as well as keeping your information up to date in state databases.

How do I check the status of my Texas franchise tax?

Contact the Comptroller's office by completing the online help form or calling 800-252-1381.

Where do I mail my Texas franchise tax report?

Mail original to: Texas Comptroller of Public Accounts P.O. Box 149348 Austin, TX 78714-9348 Taxpayers who paid $10,000 or more during the preceding fiscal year (Sept. 1 thru Aug. 31) are required to electronically pay their franchise tax.

How do I email the Texas comptroller?

Need Assistance? If you have any questions regarding sales tax registration, please call us at 800-531-5441, ext. 3-0925, or email us at [email protected].

Who must file franchise tax in Texas?

The short answer is everyone who has nexus in Texas has to file & pay Texas franchise tax. (If you need some nexus or sales tax guidance, click here to download our “10 Steps of Sales Tax” PDF.)

Who is exempt from Texas franchise tax?

A nonprofit corporation organized under the Development Corporation Act of 1979 (Article 5190.6, Vernon's Texas Civil Statutes) is exempt from franchise and sales taxes. The sales tax exemption does not apply to the purchase of an item that is a project or part of a project that the corporation leases, sells or lends.

Do LLCs in Texas pay franchise tax?

Texas, however, imposes a state franchise tax on most LLCs. The tax is payable to the Texas Comptroller of Public Accounts (CPA). In general terms, the franchise tax is based on an LLC's "net surplus" (the net assets of the LLC minus its members' contributions).

What is Texas Annual Report?

A Texas Annual Report is a yearly business report filed by companies conducting business in Texas.

Franchise Tax Frequently Asked Questions - Texas Comptroller of Public ...

Franchise tax most frequently asked questions. Accounting Year End Date. For a first annual report, enter the accounting period end date reported for federal income tax purposes that is in the same calendar year as the entity’s accounting year begin date.. Note – for an entity that became subject to the tax during the 2020 calendar year and has a federal accounting year end date that ...

Texas Franchise Tax Report Forms for 2022

If you are unable to file using Webfile, use our downloadable .PDF reports, designed to work with the free Adobe Reader. While other browsers and viewers may open these files, they may not function as intended unless you download and install the latest version of Adobe Reader.. 2022 Texas Franchise Tax Report Information and Instructions (PDF) No Tax Due

Texas Franchise Tax - Texas Secretary of State

The Texas franchise tax is a privilege tax imposed on each taxable entity chartered/organized in Texas or doing business in Texas. Reporting Change for Passive Entities Effective for franchise tax reports originally due on or after Jan. 1, 2011, a passive entity that is registered (or required to be registered) with either the Texas Secretary … Continue reading "Texas Franchise Tax"

What Is the Texas Franchise Tax? 5 Things to Know - Peisner Johnson

Over the last two years, the number of business affected by the Texas franchise tax has increased rapidly. With thousands of companies still working through their sales tax compliance, many are unsure of what this new liability means.

Texas Franchise Tax Report: Everything You Need to Know to File

What is the Texas Franchise Tax? The Texas Franchise Tax is levied annually by the Texas Comptroller on all taxable entities doing business in the state. The tax is based upon the entity’s margin, and can be calculated in a number of different ways. Each business in Texas must file an Annual Franchise Tax Report by... View Article

What is franchise tax in Texas?

The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.

When are Texas franchise tax returns due 2021?

Due to statewide inclement weather in February 2021, the Texas Comptroller of Public Accounts is automatically extending the due date for 2021 Texas franchise tax reports to June 15, 2021, consistent with the Internal Revenue Service (IRS). See Comptroller Hegar’s press release.

When is nexus due in Texas?

The Comptroller's office has amended Rule 3.586, Margin: Nexus, for franchise tax reports due on or after Jan. 1, 2020. A foreign taxable entity with no physical presence in Texas now has nexus if, during any federal accounting period ending in 2019 or later, it has gross receipts from business done in Texas of $500,000 or more. ...

Do franchise tax filers get a reminder?

Most franchise tax filers will receive an email in lieu of a mailed reminder to file or seek an extension. If we do not have your email address on file (if you are a first-year filer, for example), we will mail a reminder notice to you.

How to file a franchise tax report in Texas?

How to File. There are three ways to file the Texas Franchise Tax Report: No Tax Due. EZ Computation. Long Form. If your business falls under the $1,110,000 revenue limit, then you don’t owe any franchise tax. If you are above the limit, you can choose to fill out and file the EZ Computation form or to take the time to fill out the Long Form.

What is franchise tax in Texas?

What is the Texas Franchise Tax? The Texas Franchise Tax is levied annually by the Texas Comptroller on all taxable entities doing business in the state. The tax is based upon the entity’s margin, and can be calculated in a number of different ways.

How many types of franchise tax extensions are there?

There are four different types of Franchise Tax Extensions, depending upon your situation.

What is franchise tax in Texas?

The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.

When are Texas franchise tax returns due 2021?

Due to statewide inclement weather in February 2021, the Texas Comptroller of Public Accounts is automatically extending the due date for 2021 Texas franchise tax reports to June 15, 2021, consistent with the Internal Revenue Service (IRS). See Comptroller Hegar’s press release.

When is nexus due in Texas?

The Comptroller's office has amended Rule 3.586, Margin: Nexus, for franchise tax reports due on or after Jan. 1, 2020. A foreign taxable entity with no physical presence in Texas now has nexus if, during any federal accounting period ending in 2019 or later, it has gross receipts from business done in Texas of $500,000 or more. ...

Do franchise tax filers get a reminder?

Most franchise tax filers will receive an email in lieu of a mailed reminder to file or seek an extension. If we do not have your email address on file (if you are a first-year filer, for example), we will mail a reminder notice to you.