How to file your California state tax return

- E-file and pay for free with CalFile through the Franchise Tax Board’s website. You’ll need to create an account.

- File for free through an online tax-filing service.

- E-file through a fee-based tax-filing service.

- Download forms through the FTB website. ...

Full Answer

Where do I file California Franchise Tax?

File online | FTB.ca.gov.

How do I pay the $800 franchise tax?

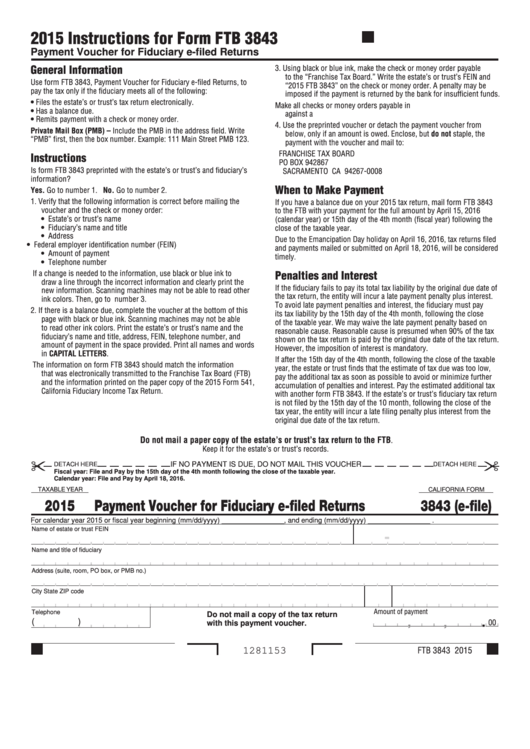

If you start to operate an LLC business in California, you need to pay the first $800 fee in the 4th month after the approval of your LLC. After that, you will also need to pay another $800 in annual tax due date on April 15th every year. To pay that, you need to file Form 3522, called the LLC Tax Voucher.

Can you pay CA franchise tax Online?

California's Franchise Tax Board has made it easier to pay your individual and business state-related taxes online.

How do I pay my business franchise tax in California?

How to Pay CA Franchise Tax Board TaxesWeb Pay – Individual and Business taxpayers.Mail – Check, Money Order.In-Person at Franchise Tax Board Field Offices.Credit Card – Online through Official Payments Corporation at: www.officialpayments.com.

What happens if you don't pay California Franchise Tax?

The California Franchise Tax Board imposes a penalty if you do not pay the total amount due shown on your tax return by the original due date. The penalty is 5 percent of the unpaid tax (underpayment), plus 0.5 percent of the unpaid tax for each month or part of a month it remains unpaid (monthly).

How can I avoid $800 franchise tax?

For tax years beginning on or after January 1, 2021, and before January 1, 2024, LLCs that organize, register, or file with the Secretary of State to do business in California are not subject to the annual tax of $800 for their first tax year.

What is California franchise tax?

Every corporation that is incorporated, registered, or doing business in California must pay the $800 minimum franchise tax.

How do I pay my 800 LLC fees?

You can pay the $800 annual tax with Limited Liability Company Tax Voucher (FTB 3522) by the 15th day of the 4th month after the beginning of the current tax year. You can estimate and pay the LLC fee with Estimated Fee for LLCs (FTB 3536) by the 15th day of the 6th month after the beginning of the current tax year.

How do I contact the California Franchise Tax Board?

Taxpayers with general questions can call (800) 852-5711 or visit our website at ftb.ca.gov .

Do I have to pay franchise tax in California the first year?

Newly Incorporated or Qualified Corporations Your first tax year is not subject to the minimum franchise tax. After the first year, your tax is the larger of your California net income multiplied by the appropriate tax rate or the minimum franchise tax.

Do sole proprietors pay franchise tax in California?

Sole proprietors and general partnerships don't have to pay the California Franchise Tax, but they also don't have any personal liability protection.

Does my business need to file a California tax return?

It is mandatory for all corporations to file annual tax returns, even if the business was inactive or did not receive income.

Do you have to pay the $800 California C corp fee the first year?

California law generally imposes a minimum franchise tax of $800 on every corporation incorporated, qualified to transact business, or doing business in California. A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year.

What is the due date for Texas franchise tax Return 2022?

May 16, 2022Due Date An annual report is due May 15 of each report year. Report Year The year in which the franchise tax report is due. The 2022 annual report is due May 16, 2022. Accounting Period Accounting Year Begin Date: Enter the day after the end date on the previous franchise tax report.

What are franchise taxes in Arkansas?

What is the purpose of the Arkansas Franchise Tax? Arkansas LLC Franchise Tax is a “privilege tax”. Meaning, it's a flat-rate tax of $150 per year for the privilege to do business in the state. The purpose of the tax is to generate revenue for the State of Arkansas.

Can I pay form 3522 online?

Make a payment online using Web Pay for Businesses. LLCs can make an immediate payment or schedule payments up to a year in advance. For more information, go to ftb.ca.gov/pay. If paying by Web Pay, do not file form FTB 3522.

What is the requirement for a franchisor to provide a copy of the franchise agreement?

The franchisor must comply with the requirements set forth in Rule 310.113.4. For the purpose of subsection (d) of the rule, the franchisor should provide a signed statement by the franchisee (s) that all of the franchisor’s obligations have been completely performed. In addition, for the purpose of verification of the signatures, it is recommended that the franchisor also provide a copy of the signed franchise agreement.

When does a franchisor have to file an amendment to registration?

A franchisor shall promptly file an application to amend the registration when there has been ANY material change in the information contained in the original application as submitted, amended or renewed. (See Section 31123)

How to contact DFPI CA?

If you have questions about the California Franchise Investment Law, contact the Consumer Services Office (“CSO”) toll-free at (866) 275-2677 or (916) 327-7585 or by email, [email protected]. The Department provides guidance but does not provide legal advice.

Who signs the franchisor application?

An authorized officer, manager or general partner of the franchisor should sign the application. If this form is signed by hand (i.e., with a “wet signature”) and submitted via paper copy to the Department, the form must be notarized (see Notary Acknowledgment instructions below). If this form is electronically signed using an e-signature software and submitted through DocQNet, no notarization is required.

Can a franchisor renew their franchise?

A franchisor who has previously registered a franchise may renew the registration for an additional period before the expiration of the registration . (See Section 31121) If the registration period has expired and the franchisor has not filed for a renewal of the registration, the franchisor must file an application for registration in accordance with Corporations Code section 31111.

Can a single franchise have multiple org-IDs?

A single franchisor may have multiple Org-IDs if it offers multiple franchise programs (e.g., one Org-ID is assigned to a unit franchise program, another Org-ID is assigned to a sub-franchisor program, and another Org-ID is assigned to an area representative program). Application Identification Number (App-ID)

Is advertising filed separately from registration?

Advertising should be filed separate from Registration or Renewal Applications.

What is franchise tax in California?

The California annual franchise tax is exactly what it sounds like—a tax that the state's business owners must pay yearly. It is simply one of the costs of doing business if you choose to register your entity in California. The franchise tax is a special business tax required in California and about a dozen other U.S. states.

How long do you have to file a franchise tax return?

Generally, however, the entity must pay a franchise tax whether the company is fully active, inactive, operating at a loss, or files a return for a period shorter than 12 months. This rule holds for all types of business entities subject to the franchise tax, making this business expense extremely difficult to escape.

What is the minimum franchise tax due?

For corporations, the $800 figure is the minimum franchise tax due. The state requires corporations to pay either $800 or the corporation's net income multiplied by its applicable corporate tax rate, whichever is larger.

When are franchise taxes due?

For corporations, the minimum franchise tax is due the first quarter of each accounting period . For LLCs, the first-year annual franchise tax is due the 15th day of the fourth month from the date you file your business with the secretary of state.

Is a limited liability company subject to franchise tax?

If your business is any of the types that offer limited liability—including limited liability company (LLC), S corporation, C corporation, limited partnerships (LP), or limited liability partnership (LLP)—it will be subject to the California annual franchise tax. Sole proprietorships, general partnerships, and tax-exempt nonprofits are not required to pay this tax.

What is California sales tax?

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration (CDTFA) and pay the state's sales tax, which applies to all retail sales of goods and merchandise except those sales specifically exempted by law. The use tax generally applies to the storage, use, or other consumption in California of goods purchased from retailers in transactions not subject to the sales tax. Use tax may also apply to purchases shipped to a California consumer from another state, including purchases made by mail order, telephone, or Internet.

What is use tax in California?

The use tax generally applies to the storage, use, or other consumption in California of goods purchased from retailers in transactions not subject to the sales tax. Use tax may also apply to purchases shipped to a California consumer from another state, including purchases made by mail order, telephone, or Internet.

File a Return & Pay Taxes

File a return or make a payment online by logging into our secure site using your username and password.

Register for a Permit

Online registration is a convenient, fast, and free way to register online for a permit, license, or account with the CDTFA.

Tax & Fee Rates

The California Department of Tax and Fee Administration is responsible for the administration of 37 different taxes and fees.

Received a Letter or Notice?

Did you receive a notice or letter from us? See our Letters and Notices page to learn more.

When are franchise taxes due in California?

The California Franchise Tax is due every first quarter of every accounting period of a business. It does not matter if the company is fully active, operating at a loss, or is not doing any business. During the first year, corporations will not have to pay for the minimum franchise tax. However, they will have to pay for ...

How long do you have to file franchise tax?

The 15-day Rule. The 15-day rule is also known as the short accounting period. Companies that have a first taxable year that is not more than 15 days do not have to file for franchise tax if it has incorporated within the last 15 days of the tax year and has conducted no business during said days. The state will not consider ...

How many conditions are there to waive franchise tax in California?

That is why one should research all aspects of the franchise tax. Many people do not know that there are exemptions to the rule. Currently, California has three conditions to waive the minimum franchise tax. 1. First Year Exemption. As the name suggests, the California franchise tax first-year exemption allows new corporations ...

What is the first year exemption for franchises in California?

As the name suggests, the California franchise tax first-year exemption allows new corporations that qualify or have incorporated on or after January 1 , 2000 with the Secretary of State to waive their first-year minimum franchise tax. The state will apply a franchise tax based on the net income of the corporation.

Why is franchise tax important?

Understanding the franchise tax law is important to ensure that your business will comply with the laws that the state has set. If you are in doubt, you can always research online.

What is franchise tax?

The franchise tax is something that a state levies on certain businesses. The states impose the tax for the companies’ right to exist and do business within the said area.

When do LLCs have to pay franchise tax?

LLCs that are taxed as disregarded entities have until the 15th day of the fourth month after the filing of the Articles of Organization with the Secretary of State to pay for the annual franchise tax. After the first year, they will have until the 15th of April to pay for the annual franchise tax. 2.

What Is A Franchise Tax and How Is It Different from Other Types of Taxes?

Who Has to File A Franchise Tax Return in California and When Is The Deadline?

- Any business registered with the California Secretary of State is required to file a yearly franchise tax return. This includes LLCs, partnerships, and corporations. The deadline for filing is April 15th. If you file late, you will be charged a penalty of 5% of the unpaid tax amount, plus interest. You can file electronically or by mail. Electronic...

Brief Summary

- As you can see, the California Franchise Tax is a complex but important tax to file every year. If you have any questions about how to calculate your liability or which exemptions apply to you, be sure to contact an accountant or the Franchise Tax Board for assistance. Filing on time and accurately is crucial to avoid penalties and interest charges, so make sure to set aside some tim…

Frequently Asked Questions

- Do I have to pay franchise tax in California?

The minimum franchise tax is $800 imposed on every corporation incorporated or doing business in California. This law exempts the first year of any new corporations founded by people living there from paying this charge, but other than that it’s standard practice to pay up. - Who is subject to California Franchise Tax?

The California minimum franchise tax is a stringent requirement for any corporation operating in the state.

Definitions

- Complete Application An application is complete on the date and time that the Department of Financial Protection and Innovation (Department) receives: (1) The correct filing fee (See Corporations Code section 31500); (2) a complete Franchise Disclosure Document (FDD) (clean and marked copy as applicable under Rule 310.122.1); and (3) ALL required d...

Reference Numbers

- Organization Identification Number (Org-ID) A permanent identification number is assigned to each separate franchise program. This number references the franchisor in the DocQNet database. A single franchisor may have multiple Org-IDs if it offers multiple franchise programs (e.g., one Org-ID is assigned to a unit franchise program, another Org-ID is assigned to a sub-fra…

California Corporations Code Sections

- 31111 Registration

- 31121 Renewal

- 31123 Post-Effective Amendment

- 31125 Material Modification

Rules

- Rule 310.100.2 Negotiated Sales

- Rule 310.100.4 Negotiated Sales Under Section 31109.1

- Rule 310.113.4 Release of Impound

Filling Fees

- The fees for the different types of applications noted above are set forth in Corporations Code section 31500.