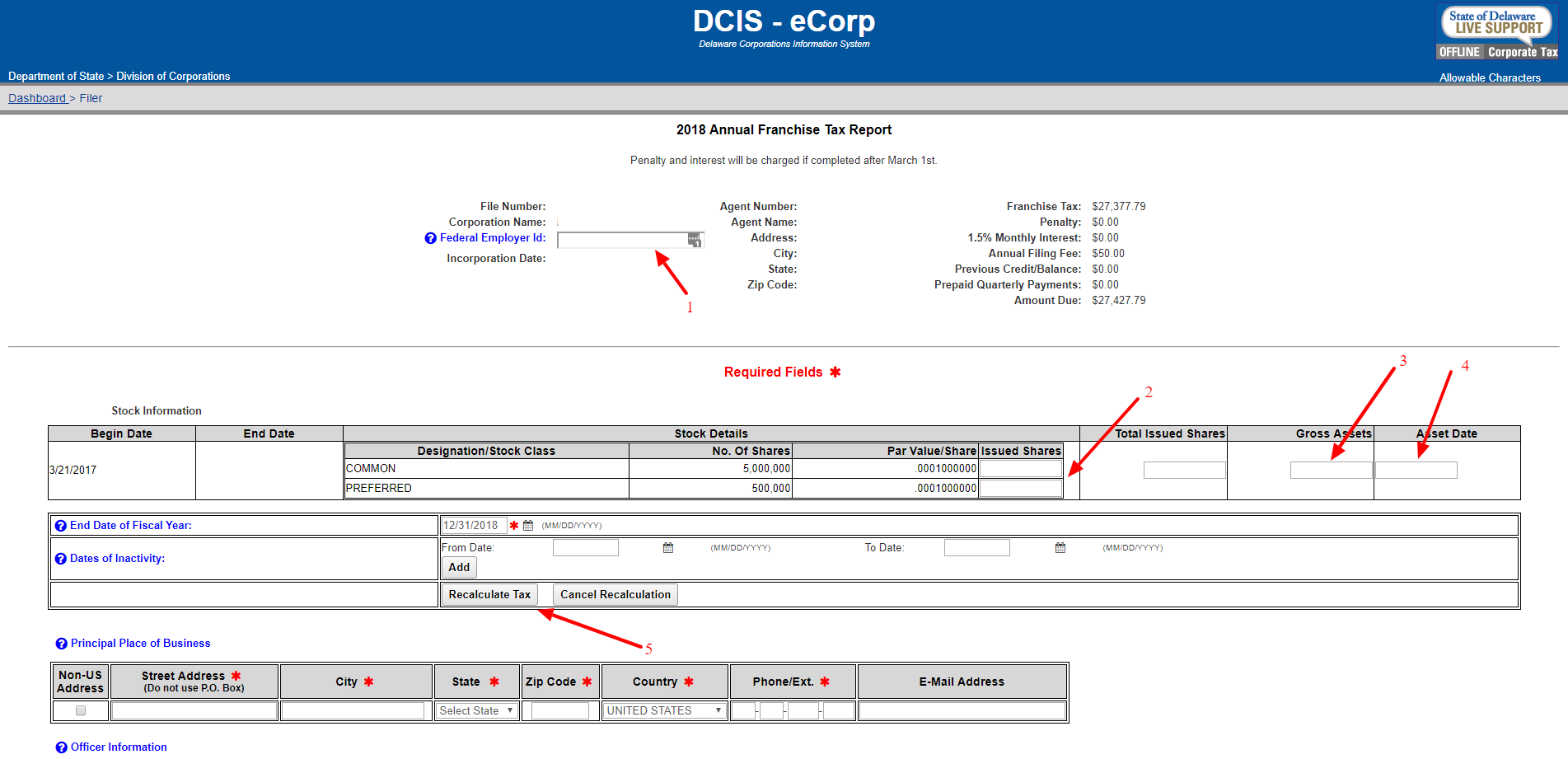

Steps to filing the Delaware Annual Report and Franchise Tax

- Go to the Delaware Division of Corporations Website Domestic corporations can only file online. Use the link below to get started.

- Enter Business Entity File Number After clicking the “Pay taxes/File annual report” button on the Division of Corporations website, you’ll need to enter the Business Entity File Number. ...

- Enter Corporation Information ...

- Pay the Franchise Tax and Annual Report Fee ...

Full Answer

Do I have to pay Delaware franchise tax?

In the state of Delaware, most companies and corporations that are incorporated in the state are legally required to pay an annual franchise tax. This tax pays for the privilege of being incorporated in the state, even if the company does business elsewhere. The Delaware Department of State, Division of Corporations, administers the franchise tax program.

How much is Delaware franchise tax?

The minimum Delaware franchise tax fee is $175 with a $50 filing fee. The minimum Delaware franchise tax and annual report payment is $225 for domestic corporations. The Delaware franchise tax for this business is simple. It is a flat fee of $30 due on June 1. The Delaware franchise tax for a corporation is slightly more complicated.

When can you file Delaware state taxes?

Many states use the federal tax deadline of April 15 as the due date for state tax returns. But Delaware generally gives filers extra time. While this year is a bit different, you usually have until April 30 to file your Delaware tax return. If you need more time to file your return, you can apply for an extension.

Is there sales tax in Deleware?

There is no sales tax applied to purchases anywhere in Delaware. Delaware is one of the few states that does not have a sales tax. The other states without sales tax include Alaska (which may have local taxes), Montana, New Hampshire and Oregon.

Is there a franchise tax in Delaware?

All corporations incorporated in the State of Delaware are required to file an Annual Report and to pay a franchise tax. Exempt domestic corporations do not pay a tax but must file an Annual Report.

How do I pay my franchise tax in Delaware?

How do I pay my Delaware franchise taxes?Go to the State of Delaware - Division of Corporations franchise tax filing page.Enter your Business Entity File Number and click Continue. You can find your File Number on your Gust Launch Company Information page (it is called Delaware File Number there).

What happens if you don't pay Delaware LLC franchise tax?

If you don't pay the Delaware Franchise Tax and file the Annual Report for two straight years, the State of Delaware will administratively dissolve the Corporation. If you have any questions about forming your new Delaware LLC, LP, or Corporation, give us a call today.

How much is Delaware LLC franchise tax?

$300.00LLC/Partnership Tax Information All Domestic and Foreign Limited Liability Companies, Limited Partnerships, and General Partnerships formed or registered in Delaware are required to pay an annual tax of $300.00. There is no requirement to file an Annual Report.

How do I pay the $800 franchise tax?

Use form FTB 3522, LLC Tax Voucher, to pay the annual limited liability company (LLC) tax of $800 for taxable year 2021. ... Every LLC that is doing business in California or that has articles of organization accepted or a certificate of registration issued by the SOS is subject to the $800 annual LLC tax.More items...

How much is Delaware franchise fee?

Cost. The minimum Delaware franchise tax fee is $175 with a $50 filing fee. The minimum Delaware franchise tax and annual report payment is $225 for domestic corporations.

How can I avoid $800 franchise tax?

The only way to avoid the annual $800 California franchise fee is to dissolve your company, file a 'final' income tax return with the FTB and to submit the necessary paperwork.

Why you should not form an LLC in Delaware?

2: Delaware Carries High LLC Fees To form your LLC in Delaware, the state requires a $300 formation fee. This is one of the highest LLC formation fees in the country. Delaware also charges an annual franchise tax of $300. This tax applies to even those businesses not generating income in the state of Delaware.

Why does everyone file LLC in Delaware?

Delaware is often considered one of the best states to form an LLC because it has limited fees and tax obligations. In fact, many businesses choose to form an LLC in Delaware even if they don't intend on doing business in Delaware.

Do Delaware LLCs file tax returns?

A. Delaware treats a single-member “disregarded entity” as a sole proprietorship for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the State of Delaware.

What is filing fee for LLC Delaware?

$90LLC Cost #1: Certificate of Formation The company's Certificate of Formation is required to be filed with Delaware to form a Delaware LLC. While the state filing fee is $90, there may be additional fees depending on how quickly you would like to receive your evidence of formation for your Delaware LLC.

Do Delaware LLC pay federal taxes?

Limited Liability Companies (LLCs) Like S corporations, standard Delaware LLCs are pass-through entities and are not required to pay federal or state income tax. LLCs are, however, required to pay a flat annual tax of $300 to the state.

What is the minimum franchise tax in Delaware?

The minimum tax is $175.00, for corporations using the Authorized Shares method and a minimum tax of $400.00 for corporations using the Assumed Par Value Capital Method. All corporations using either method will have a maximum tax of $200,000.00.

Can I pay the franchise tax Board over the phone?

You may call the pay-by-phone telephone number or use the Internet 24 hours a day, year round to make your payment. To ensure your payment is timely, you must complete your call by 3 p.m. PST on or before the due date of your payment.

Can you make payments to the franchise tax Board?

Business. If you can't pay your tax bill in 90 days and want to get on a payment plan, you can apply for an installment agreement. It may take up to 60 days to process your request. Typically, you will have up to 12 months to pay off your balance.

Is Delaware a franchise registration state?

Delaware does not have any franchise registration laws and is considered a non-registration state.

When are Delaware annual reports due?

Notification of Annual Report and Franchise Taxes due are sent to all Delaware Registered Agents in December of each year. Delaware has mandated electronic filing of domestic corporations Annual Reports.

How much is the annual report fee for a foreign corporation?

Foreign Corporations. Foreign Corporations are required to file an Annual Report on or before June 30th. The fee for filing the Annual Report is $125.00. Foreign corporations are assessed a penalty of $125 if the Annual Report is not filed.

How much does it cost to file an amended annual report?

The filing fee for filing an Annual Report or Amended Annual Report for exempt domestic corporations is $25. For an Annual Report or Amended Annual Report for non-exempt domestic corporations the filing fee is $50. Taxes and Annual Reports are to be received no later than March 1st of each year.

Do corporations pay franchise tax in Delaware?

Corporate Annual Report and Franchise Tax Payments. All corporations incorporated in the State of Delaware are required to file an Annual Report and to pay a franchise tax. Exempt domestic corporations do not pay a tax but must file an Annual Report. The filing fee for filing an Annual Report or Amended Annual Report for exempt domestic ...

What information is required to file a franchise tax in Delaware?

When filing a franchise tax in Delaware, all the must be submitted is the physical address of the business and the name of the registered agent. This can be a business owner or someone else. By not requiring more information, businesses that file their franchise tax in Delaware can maintain privacy.

What is Delaware Franchise Tax?

Delaware franchise tax is a tax charged by the state of Delaware for the right to own a Delaware company. The tax does not affect income or company activity. The tax is required to maintain the company's good standing in Delaware.

Why do you need to use franchise tax in Delaware?

The Delaware franchise tax is beneficial to corporations because it is a simple process to submit and calculate payment. The Delaware franchise tax is also beneficial to businesses as it is a small fee in comparison to other states.

How much is the late fee for franchise tax in Delaware?

If you pay your Delaware franchise tax late, you'll be charged a late fee. The late fee is $125.00 and a 1.5 percent monthly interest afterward.

What happens if you don't file Delaware franchise tax?

If you don't file your Delaware franchise tax on time, you will be charged a late fee.

What is Delaware's court of chancery?

Delaware has what is called a Court of Chancery. This allows the state to adjudicate corporate litigation. The corporate laws and cases decided in Delaware are often used by the Supreme Court to influence decisions.

How much does it cost to register a foreign business in Delaware?

Foreign File. Business that are formed out of state but are registered to do business in Delaware must pay a $125 registration fee. Foreign corporations, those that are formed outside of Delaware, cannot file online. To file as a foreign corporation, mail in the necessary documents.

How to contact Delaware Division of Corporations?

Please contact the Delaware Division of Corporations at (302) 739-3073 if you have any questions or concerns about a solicitation.

When are franchise taxes due?

All active Domestic Corporation Annual Reports and Franchise Taxes for the prior year are due annually on or before March 1st and are required to be filed online. Failure to file the report and pay the required franchise taxes will result in a penalty of $200.00 plus 1.5% interest per month on tax and penalty.

How much is the Delaware annual report?

Foreign Corporations must file an Annual Report with the Delaware Secretary of State on or before June 30 each year. A $125.00 filing fee is required to be paid. If the Annual Report and remittance is not received by the due date, a $125.00 penalty will be added to filing fee.

How to report deceptive solicitation in Delaware?

If a Delaware business entity received such a solicitation or sent payment as a result of receiving this solicitation, please complete a complaint form complaint form and immediately contact the Consumer Protection Unit of the Attorney General’s Office at (302) 577-8600 or 1-800-220-5424.

Who Needs to Pay the Delaware Franchise Tax?

The Delaware franchise tax must be paid by all companies that are incorporated in Delaware, regardless of whether or not you’ve generated any revenue or profit (technically, this filing is the “franchise tax and annual report”).

Can a Tax Preparer File the Delaware Franchise Tax on Your Behalf?

Yes, there are a number of Delaware Franchise Tax filing providers who can do these steps on your behalf. However, you’ll need to provide them all the same information we discussed above, which means you’ll still have to do the work of finding and assembling it.

What are Delaware franchise taxes?

A franchise tax, sometimes called a privilege tax, is a fee you pay for the “privilege” of doing business in a certain state.

Who has to pay the franchise tax?

You must pay the Delaware franchise tax if your Delaware business is one of the following:

Who administers Delaware tax requirements?

The Delaware Division of Revenue administers the tax requirements for numbers 2, 3 and 4 (above).

What is the rate of corporate income tax in Delaware?

2. If you form a corporation in Delaware, you must file Corporate Income Tax with the Delaware Division of Revenue at a rate of 8.7% of federal taxable income allocated and apportioned to Delaware, based on an equally weighted three-factor method of apportionment. The factors are property, wages and sales in Delaware as a ratio of property, ...

Is Delaware withholding tax?

Delaware withholding is required, provided such payments are subject to withholding under the Internal Revenue Code (Chapter 11, Title 30, Delaware Code), and is remitted to the Delaware Division of Revenue. The Delaware Division of Revenue administers the tax requirements for numbers 2, 3 and 4 (above). Doing Business in Delaware.

Does Delaware have sales tax?

For all businesses: Delaware does not have a state or local sales tax. Delaware does, however, have an annual business license requirement, as well as a gross receipts tax that is imposed on the seller of goods or provider of services.

Do you pay franchise tax in Delaware?

1. If you form a corporation in Delaware, you must pay an annual Franchise Tax for the privilege of incorporating in Delaware. This Franchise Tax is payable to the Delaware Division of Corporations . The fee is based on the number of authorized shares within the corporation.

Do you have to register a business in Delaware?

If incorporated in another state but doing business in Delaware, you must still register with the Delaware Division of Corporations.

Does Delaware require withholding for wages?

Delaware withholding is required, provided such payments are subject to withholding under the Internal Revenue Code (Chapter 11, Title 30 , Delaware Code), and is remitted to the Delaware Division of Revenue.