The filing process of the franchise tax report is as follows:

- The first step is to visit the Texas Comptroller of Public Accounts site and log in with the username and password that is registered in the site.

- Select the option WebFile/Pay Taxes and Fees and then fill up all the information the site is asking for.

Full Answer

What is the minimum franchise tax?

$800 Minimum Franchise Tax Overview. The $800 minimum franchise tax is the minimum franchise fee that a corporation will have to pay to operate in California, which is similar to the tax situation in many states. What is not similar, however, is the structure and rate of this tax.

What is a public information report?

Public reports contain information of vital importance to prospective buyers including covenant, conditions and restrictions which govern the use of property, costs and assessments for maintaining homeowners' associations and common areas, and other material disclosures.

Who has to pay Texas franchise tax?

Franchise tax taxes all the businesses involved in the process from the manufacturer to the end distributor. It can be considered a tax for the privilege of doing business in Texas. Who Needs to File for Texas Franchise Tax? The short answer is everyone who has nexus in Texas has to file & pay Texas franchise tax.

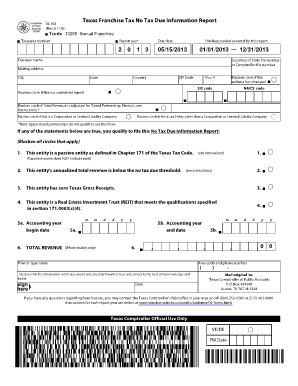

How to file Texas franchise annual report?

To successfully file your Texas Franchise Tax Report, you’ll need to complete these steps:

- Determine your due date and filing fees.

- Complete the report online OR download a paper form.

- Submit your report to the Texas Comptroller of Public Accounts.

Should I use an annual report service, hire an attorney, or prepare and file my own reports?

This question largely comes down to personal preferences, but we do have some general insights. The DIY route can be quite a bit of work, as you’ll...

I’ve heard the most about LegalZoom. Are they the best annual report service?

LegalZoom is the most well-known of all business services companies, thanks to its long track record and extensive advertising campaigns. That said...

When is my Franchise Tax Public Information Report due each year?

It doesn’t matter when you formed your LLC, as every LLC operating in Texas has the same May 15th deadline for filing its annual Franchise Tax Publ...

Does Texas require LLCs to file initial reports?

In some states, LLCs are also required to file initial reports. These reports are typically quite similar to annual reports, with the difference be...

What if I need more time to complete my Franchise Tax Public Information Report?

If you’re running short on time, you’ll be happy to hear that Texas does offer extensions for Franchise Tax Public Information Reports. For more in...

Where can I find more official information about Texas’ LLC annual reporting requirements?

Texas provides more helpful info online about its Franchise Tax Public Information Reports than every other state offers for its annual reports. Th...

What is franchise tax in Texas?

The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.

When are Texas franchise tax returns due 2021?

Due to statewide inclement weather in February 2021, the Texas Comptroller of Public Accounts is automatically extending the due date for 2021 Texas franchise tax reports to June 15, 2021, consistent with the Internal Revenue Service (IRS). See Comptroller Hegar’s press release.

How much is the penalty for filing taxes after the due date?

Penalties and Interest. A $50 penalty is assessed on each report filed after the due date. If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed. If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

Do franchise tax filers get a reminder?

Most franchise tax filers will receive an email in lieu of a mailed reminder to file or seek an extension. If we do not have your email address on file (if you are a first-year filer, for example), we will mail a reminder notice to you.

How to file a franchise tax report in Texas?

How to File. There are three ways to file the Texas Franchise Tax Report: No Tax Due. EZ Computation. Long Form. If your business falls under the $1,110,000 revenue limit, then you don’t owe any franchise tax. If you are above the limit, you can choose to fill out and file the EZ Computation form or to take the time to fill out the Long Form.

How many types of franchise tax extensions are there?

There are four different types of Franchise Tax Extensions, depending upon your situation.

What is franchise tax in Texas?

What is the Texas Franchise Tax? The Texas Franchise Tax is levied annually by the Texas Comptroller on all taxable entities doing business in the state. The tax is based upon the entity’s margin, and can be calculated in a number of different ways.

How is Total Revenue Calculated?

Total revenue is calculated by taking revenue amounts reported for federal income tax and subtracting statutory exclusions.

How much is franchise tax in Texas?

Costs vary from state to state. Some are free while others can be several hundred dollars. How much you pay for the Texas Franchise Tax depends entirely on your LLC’s total annual revenue. If your business revenue falls under the “ no tax due” threshold, it will not owe a tax. The current threshold is $1,180,000, so if your LLC doesn’t make that much in a year, you won’t be responsible for any payments. But businesses that bring in more than that will be subject to a 0.375% Franchise Tax on retail and wholesales goods and 0.75% on all other revenue.

How Much Does the Texas LLC Annual Report Fee Cost?

If you’re putting together a budget for all your LLC’s costs – like formation costs, name reservation fees, and initial operating expenses – it’s important to include annual filings like this one, just so that there are no surprises.

What is the Texas Annual Report? Why is it Important?

It’s similar to a census in that its purpose is to collect the necessary contact and structural information about each Texas business.

What Happens if You Don’t File?

How bad could it be if I just fly under the radar?” The short answer: don’t try it. Failing to file your Franchise Tax and Public Information Report can yield some serious consequences.

What is LLC annual report?

In Texas, an LLC’s annual report consists of two parts: a Franchise Tax and a Public Information Report. Each LLC must submit these filings to the Texas Comptroller every year to keep their information current. Unsure how to go about it? Never even heard of it? No worries at all. That’s why we’re here. Keep reading for everything you need to know.

What happens if you change your registered agent in Texas?

For example, if you change your registered agent, or your current agent resigns, you’ll need to keep the state informed so they can update their contact information. Miss one of their communications and your LLC in Texas might end up falling out of good standing or, even worse, administratively dissolved.

When are LLC taxes due?

Instead, these filings are due on May 15th each year. If May 15th falls on a weekend or holiday, the due date will simply move to the next business day.

How to file a franchise tax report in Texas?

If you have a business in Texas, then you must learn how to file a Texas franchise tax report as soon as possible in order to avoid all the late fees. This report is filed after the closing of the sales tax account. The filing process of the franchise tax report is as follows: 1 The first step is to visit the Texas Comptroller of Public Accounts site and log in with the username and password that is registered in the site. 2 Select the option WebFile/Pay Taxes and Fees and then fill up all the information the site is asking for. 3 Once you have entered the WebFile number, the site will show you a number of returns that are required to be filed by you. 4 After filing all the returns, make a call to the state and request them to give you a final return based upon the returns you have filed. 5 The state will update the account in less than 48 hours, so when you will log in the account after 48 hours, you will find a final return. 6 In case your business is not registered with the Secretary of State, you must send a letter to them stating that you have closed your business on this date of the year and want that the state took up all your tax responsibilities. 7 If your business is registered, then demand a certificate of termination. This certificate will eliminate the state’s responsibilities on your taxes.

When do franchises file taxes in Texas?

Every business who are carrying out their transactions in Texas is bound to file an annual franchise tax report by the 15th of March every year.

How long does it take to get a final tax return?

The state will update the account in less than 48 hours, so when you will log in the account after 48 hours, you will find a final return.

What to do if your business is not registered with the state?

In case your business is not registered with the Secretary of State, you must send a letter to them stating that you have closed your business on this date of the year and want that the state took up all your tax responsibilities.

What happens if a business is registered?

If your business is registered, then demand a certificate of termination. This certificate will eliminate the state’s responsibilities on your taxes.

Do you need a Texas tax number to file a franchise?

A Texas Taxpayer number is also required to file a Franchise Tax Report. So this number is also mandatory.

Do you have to make somethings before filing a franchise tax return in Texas?

You require to make somethings before filing a Franchise Tax Report in Texas. The checklist should be as follows:

How to contact the Texas Comptroller?

If you have any questions about filing your LLC’s “annual report” (No Tax Due & Public Information Report), you can contact the Texas Comptroller at 1-800-252-1381. Their office hours are Monday through Friday, 8am to 5pm Central Time. Previous Lesson | Next Lesson.

What happens if you don't file LLC taxes in Texas?

If these aren’t filed on time, there are penalties. Additionally, the Texas Comptroller will place your L LC “not in good standing”, and the LLC Members/Managers will become liable for any LLC taxes and filings due to the state.

What is the tax due threshold for LLCs in Texas?

The majority of LLCs in Texas fall under the no tax due threshold, which is currently $1,180,000 in annualized total revenue. Therefore, the type of Franchise Tax Report they file is the No Tax Due Report. When the No Tax Due Report is filed online via WebFile, the Public Information Report is included with it.

Can you leave a SOS file blank?

If you list a company that is not a Texas company, you can leave the “TX SOS File #” box blank.