Steps to filing the Delaware Annual Report and Franchise Tax

- Go to the Delaware Division of Corporations Website Domestic corporations can only file online. Use the link below to get started.

- Enter Business Entity File Number After clicking the “Pay taxes/File annual report” button on the Division of Corporations website, you’ll need to enter the Business Entity File Number. ...

- Enter Corporation Information ...

- Pay the Franchise Tax and Annual Report Fee ...

Full Answer

Which states have franchise tax?

The states that currently have franchise taxes are:

- Alabama

- Arkansas

- Delaware

- Georgia

- Illinois

- Louisiana

- Mississippi

- Missouri

- New York

- North Carolina

What is the corporate tax rate for Delaware?

Delaware has a flat corporate income tax rate of 8.700% of gross income. The federal corporate income tax, by contrast, has a marginal bracketed corporate income tax.Delaware's maximum marginal corporate income tax rate is the 10th highest in the United States, ranking directly below California's 8.840%.

When are Delaware LLC franchise taxes due?

The annual franchise tax of the Delaware LLC is due on June 1 every year. The annual report filing fee payable to the Secretary of State for Delaware must be paid on or before that date. The Delaware Limited Liability Company (LLC) requires an annual franchise tax payment.

What is Delaware corporate income tax?

Delaware's corporate income tax rate is 8.7% and is based on the federal taxable income of the corporation. What entities must file and/or pay Delaware corporate income tax? If your corporation is domestic or foreign and conducts business in Delaware, you'll be required to file a corporate income return.

Can I file my Delaware State taxes online?

File your 2021 Personal Income Tax Return online. File a late return for tax year 2018, 2019, or 2020.

What is Delaware franchise tax filing?

The Franchise Tax for a Delaware LLC or a Delaware LP is a flat annual rate of $300. A non-stock/non-profit company is considered exempt by the State of Delaware. This type of company does not pay the standard annual Delaware Franchise Tax, but must still file and pay the annual report fee of $25 per year.

Do you have to file an annual report for an LLC in Delaware?

Although Limited Partnerships, Limited Liability Companies and General Partnerships formed in the State of Delaware do not file an Annual Report, they are required to pay an annual tax of $300.00. Taxes for these entities are due on or before June 1st of each year.

How do I get an annual report in Delaware?

The state of Delaware does not maintain an online database that allows anyone to view a copy of documents on file for a company. Therefore, in order to obtain a copy of a filed annual report, the document must be requested from the secretary of state's office for a fee.

What happens if I don't pay Delaware franchise tax?

If you don't pay the Delaware Franchise Tax and file the Annual Report for two straight years, the State of Delaware will administratively dissolve the Corporation. If you have any questions about forming your new Delaware LLC, LP, or Corporation, give us a call today.

How do I avoid franchise tax in Delaware?

There are ways to reduce your Delaware franchise costs in certain circumstances. To reduce the taxes paid by a startup, use the Assumed Par Value method. This method calculates the taxes by total assets. As long as your issued shares constitute a third to half of your authorized shares, this method will save you money.

Do I have to pay Delaware franchise tax?

Any corporation that is incorporated in Delaware (regardless of where you conduct business) must file an Annual Franchise Tax Report and pay Franchise Tax for the privilege of incorporating in Delaware. Franchise Taxes and annual Reports are due no later than March 1st of each year.

How do I pay my Delaware LLC taxes?

Your Annual Franchise Tax can only be paid online and cannot be filed by mail. You can make payment using a credit card or your checking account. Your Annual Franchise Tax must be paid by June 1st every year. Your first payment is due the calendar year following the year that your LLC was approved.

How do I close an LLC in Delaware?

Steps to Cancel a Delaware LLCConsult the LLC Operating Agreement. ... Take a Member Vote. ... Appoint a Manager to Wind up the LLC's Affairs. ... Payoff Creditors, Current and Forseeable, before paying Members. ... Pay The Delaware Franchise Tax. ... Pay the LLC's members. ... File a Certificate of Cancellation.More items...

What is the Delaware Annual Report?

The Delaware Annual Report is a set of business information that must be submitted to the Division of Corporations by March 1 each year after incorporation. This report is submitted online and is due at the same time franchise tax must be paid.

What is Delaware LLC tax?

LLC/Partnership Tax Information All Domestic and Foreign Limited Liability Companies, Limited Partnerships, and General Partnerships formed or registered in Delaware are required to pay an annual tax of $300.00. There is no requirement to file an Annual Report.

Is Delaware a tax free State?

Delaware has a graduated tax rate ranging from 2.2% to 5.55% on income under $60,000. The maximum income tax rate is 6.60% on income of $60,000 or over.

What is the annual franchise tax fee in Delaware?

Delaware LLCs do not have to file an Annual Report (like Corporations do), but they do have to pay a flat-rate Annual Franchise Tax of $300 each year. The $300 tax must be paid by every LLC formed in Delaware, regardless of income or business activity.

What are gross assets for Delaware franchise tax?

Discussion: Total gross assets are “total assets” reported on U.S. Form 1120 Schedule L for tax year ending prior to filing the Delaware franchise tax report.

Do LLC pay taxes in Delaware?

A. Delaware treats a single-member “disregarded entity” as a sole proprietorship for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the State of Delaware.

Why do companies incorporate in Delaware?

The state offers some tax benefits. Delaware doesn't impose income tax on corporations registered in the state which don't do business in the state. Also, shareholders who don't reside in Delaware need not pay tax on shares in the state. For these reasons, Delaware is sometimes referred to as a tax haven.

When are Delaware annual reports due?

Notification of Annual Report and Franchise Taxes due are sent to all Delaware Registered Agents in December of each year. Delaware has mandated electronic filing of domestic corporations Annual Reports.

How much is the annual report fee for a foreign corporation?

Foreign Corporations. Foreign Corporations are required to file an Annual Report on or before June 30th. The fee for filing the Annual Report is $125.00. Foreign corporations are assessed a penalty of $125 if the Annual Report is not filed.

How much does it cost to file an amended annual report?

The filing fee for filing an Annual Report or Amended Annual Report for exempt domestic corporations is $25. For an Annual Report or Amended Annual Report for non-exempt domestic corporations the filing fee is $50. Taxes and Annual Reports are to be received no later than March 1st of each year.

Do corporations pay franchise tax in Delaware?

Corporate Annual Report and Franchise Tax Payments. All corporations incorporated in the State of Delaware are required to file an Annual Report and to pay a franchise tax. Exempt domestic corporations do not pay a tax but must file an Annual Report. The filing fee for filing an Annual Report or Amended Annual Report for exempt domestic ...

How to contact Delaware Division of Corporations?

Please contact the Delaware Division of Corporations at (302) 739-3073 if you have any questions or concerns about a solicitation.

How much is the Delaware annual report?

Foreign Corporations must file an Annual Report with the Delaware Secretary of State on or before June 30 each year. A $125.00 filing fee is required to be paid. If the Annual Report and remittance is not received by the due date, a $125.00 penalty will be added to filing fee.

How to report deceptive solicitation in Delaware?

If a Delaware business entity received such a solicitation or sent payment as a result of receiving this solicitation, please complete a complaint form complaint form and immediately contact the Consumer Protection Unit of the Attorney General’s Office at (302) 577-8600 or 1-800-220-5424.

When are franchise taxes due?

All active Domestic Corporation Annual Reports and Franchise Taxes for the prior year are due annually on or before March 1st and are required to be filed online. Failure to file the report and pay the required franchise taxes will result in a penalty of $200.00 plus 1.5% interest per month on tax and penalty.

Do you have to file an annual report?

There is no requirement to file an Annual Report. The annual taxes for the prior year are due on or before June 1st. Failure to pay the required annual taxes will result in a penalty of $200.00 plus 1.5% interest per month on tax and penalty. There is no proration on alternative entity taxes. Annual taxes are assessed if the entity is active in ...

Who must license a business in Delaware?

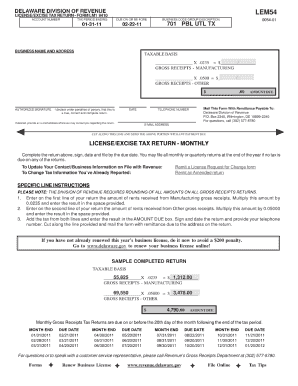

Businesses that operate in Delaware must be licensed by the Division of Revenue and pay gross receipts tax.

Who pays Delaware tax?

Delaware Legal Entities (those incorporated and operating in Delaware) Franchise Tax and Annual Reports (paid to the Division of Corporations), and Corporate Income Tax (paid to the Division of Revenue).

What is Delaware gross receipts tax?

For businesses that operate in Delaware. Gross receipts tax (due either monthly or quarterly, depending on the business' total gross receipts) Certain industries operating in Delaware also have other tax obligations to the Division of Revenue: Alcoholic Beverages.

Does Delaware have sales tax?

Businesses with employees who work in Delaware must pay withholding tax and unemployment insurance tax. Delaware does not have a sales tax.

Do businesses in certain cities have local taxes?

Businesses that operate in certain city or county limits may also have local tax requirements. Please check with the city, county, or town that you are operating in.

Do Delaware businesses file annual taxes?

They currently do not file an annual report and the tax is a flat amount. Delaware incorporated businesses who operate in Delaware pay the Division of Revenue Corporate Income Tax (due when filing annual taxes).

What are Delaware franchise taxes?

A franchise tax, sometimes called a privilege tax, is a fee you pay for the “privilege” of doing business in a certain state.

Who has to pay the franchise tax?

You must pay the Delaware franchise tax if your Delaware business is one of the following:

What is franchise tax in Texas?

The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.

When are Texas franchise tax returns due 2021?

Due to statewide inclement weather in February 2021, the Texas Comptroller of Public Accounts is automatically extending the due date for 2021 Texas franchise tax reports to June 15, 2021, consistent with the Internal Revenue Service (IRS). See Comptroller Hegar’s press release.

How much is the penalty for filing taxes after the due date?

Penalties and Interest. A $50 penalty is assessed on each report filed after the due date. If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed. If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

Do franchise tax filers get a reminder?

Most franchise tax filers will receive an email in lieu of a mailed reminder to file or seek an extension. If we do not have your email address on file (if you are a first-year filer, for example), we will mail a reminder notice to you.

What information is required to file a franchise tax in Delaware?

When filing a franchise tax in Delaware, all the must be submitted is the physical address of the business and the name of the registered agent. This can be a business owner or someone else. By not requiring more information, businesses that file their franchise tax in Delaware can maintain privacy.

What is Delaware Franchise Tax?

Delaware franchise tax is a tax charged by the state of Delaware for the right to own a Delaware company. The tax does not affect income or company activity. The tax is required to maintain the company's good standing in Delaware.

Why do you need to use franchise tax in Delaware?

The Delaware franchise tax is beneficial to corporations because it is a simple process to submit and calculate payment. The Delaware franchise tax is also beneficial to businesses as it is a small fee in comparison to other states.

How much is the late fee for franchise tax in Delaware?

If you pay your Delaware franchise tax late, you'll be charged a late fee. The late fee is $125.00 and a 1.5 percent monthly interest afterward.

What happens if you don't file Delaware franchise tax?

If you don't file your Delaware franchise tax on time, you will be charged a late fee.

What is Delaware's court of chancery?

Delaware has what is called a Court of Chancery. This allows the state to adjudicate corporate litigation. The corporate laws and cases decided in Delaware are often used by the Supreme Court to influence decisions.

How much does it cost to register a foreign business in Delaware?

Foreign File. Business that are formed out of state but are registered to do business in Delaware must pay a $125 registration fee. Foreign corporations, those that are formed outside of Delaware, cannot file online. To file as a foreign corporation, mail in the necessary documents.

Payment Information

Corporate Annual Report Information and Franchise Tax Fees

- Corporate Annual Report All active Domestic Corporation Annual Reports and Franchise Taxes for the prior year are due annually on or before March 1st and are required to be filed online. Failure to file the report and pay the required franchise taxes will result in a penalty of $200.00 plus 1.5% interest per month on tax and penalty. Annual Report Filing Fees: Effective September 1, 2019, th…

Foreign Corporations

- Foreign Corporations must file an Annual Report with the Delaware Secretary of State on or before June 30 each year. A $125.00 filing fee is required to be paid. If the Annual Report and remittance is not received by the due date, a $125.00 penalty will be added to filing fee.

LLC/Partnership Tax Information

- All Domestic and Foreign Limited Liability Companies, Limited Partnerships, and General Partnerships formed or registered in Delaware are required to pay an annual tax of $300.00. There is no requirement to file an Annual Report. The annual taxes for the prior year are due on or before June 1st. Failure to pay the required annual taxes will result in a penalty of $200.00 plus 1.5% int…

Important Consumer Alert About Tax and Annual Report Scams

- The Division of Corporations recommends that consumers be alert to deceptive solicitations. Delaware legal entities should view suspiciously any correspondence, via regular mail or e-mail, that does not come directly from the State or the entity’s Delaware registered agent. Examples of deceptive solicitations The Secretary of State’s Office works closely with law enforcement to inv…