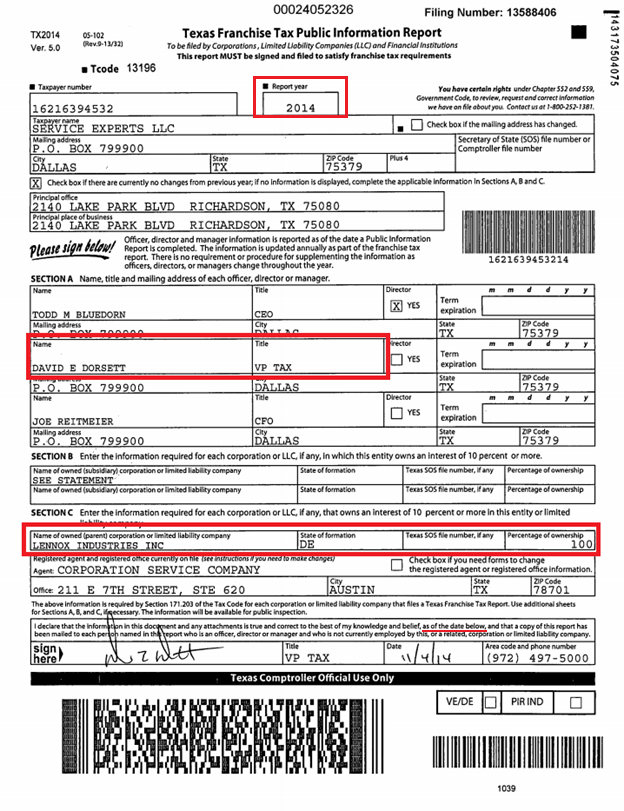

How do I file a Texas franchise report?

The Texas Annual Franchise Tax Report can be submitted online or by mail. Either way, you'll need to visit the Texas Comptroller website. On the state website, go to the Franchise Tax page. If you wish to file online, click “webfile eSystems Login.” If you wish you to file by mail, click “Forms.”

Can I Efile Texas franchise tax return?

Texas Franchise reports may be submitted electronically with approved tax preparation provider software.

Where do I send my Texas franchise tax public information report?

If the report is not a combined report and the circle was blackened in error, notify our office in writing (Texas Comptroller of Public Accounts, P.O. Box 149348, Austin, TX 78714-9348).

Do I need to file a Texas franchise tax report?

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

What is the due date for Texas franchise tax Return 2022?

May 16, 2022Due Date An annual report is due May 15 of each report year. Report Year The year in which the franchise tax report is due. The 2022 annual report is due May 16, 2022. Accounting Period Accounting Year Begin Date: Enter the day after the end date on the previous franchise tax report.

How do I file Texas franchise tax no tax due report electronically?

1:544:50How to File a No Tax Information Report - YouTubeYouTubeStart of suggested clipEnd of suggested clipNo tax due information report return select the radio button next to the file no text dueMoreNo tax due information report return select the radio button next to the file no text due information report and select continue. Now select the report year for which you are filing.

How much is the Texas franchise tax?

0.375%Tax Rates, Thresholds and Deduction LimitsItemAmountTax Rate (retail or wholesale)0.375%Tax Rate (other than retail or wholesale)0.75%Compensation Deduction Limit$390,000EZ Computation Total Revenue Threshold$20 million2 more rows

What is the income threshold for Texas franchise tax?

Reports and PaymentsFor franchise tax reports originally due…The no tax due threshold is…on or after Jan. 1, 2020, and before Jan. 1, 2022$1,180,000on or after Jan. 1, 2018, and before Jan. 1, 2020$1,130,000on or after Jan. 1, 2016, and before Jan. 1, 2018$1,110,0005 more rows

Who is exempt from Texas franchise tax?

A nonprofit corporation organized under the Development Corporation Act of 1979 (Article 5190.6, Vernon's Texas Civil Statutes) is exempt from franchise and sales taxes. The sales tax exemption does not apply to the purchase of an item that is a project or part of a project that the corporation leases, sells or lends.

Does Texas LLC have to file tax return?

Yes. The legal formation of an entity – not an entity's treatment for federal income tax purposes – determines filing responsibility for Texas franchise tax.

Do single member LLCs pay franchise tax in Texas?

Updated May 5, 2022: Texas single member LLC filing requirements include paying a franchise tax and possibly state employment taxes. Single member LLCs in Texas are not required to file an annual report.

What taxes does an LLC pay in Texas?

The two types of business taxes for an LLC in Texas are sales tax and the Texas franchise tax. All businesses are subject to sales tax.

What is the threshold for filing Texas franchise tax?

Reports and PaymentsFor franchise tax reports originally due…The no tax due threshold is…on or after Jan. 1, 2020, and before Jan. 1, 2022$1,180,000on or after Jan. 1, 2018, and before Jan. 1, 2020$1,130,000on or after Jan. 1, 2016, and before Jan. 1, 2018$1,110,0005 more rows

How much is the franchise tax in Texas?

0.375%Tax Rates, Thresholds and Deduction LimitsItemAmountTax Rate (retail or wholesale)0.375%Tax Rate (other than retail or wholesale)0.75%Compensation Deduction Limit$390,000EZ Computation Total Revenue Threshold$20 million2 more rows

How do I find my Texas franchise tax number?

XT Numbers: The number begins with the letters XT followed by six digits. They are for filing franchise tax reports, and they are printed in the upper right corner of the notification letter you receive from our office. We mail these letters to each taxable entity about six weeks before the due date of the next report.

What is Chapter 171 of the Texas tax Code?

(a) A franchise tax is imposed on each taxable entity that does business in this state or that is chartered or organized in this state. (b) The tax imposed under this chapter extends to the limits of the United States Constitution and the federal law adopted under the United States Constitution.

How to file a franchise tax report in Texas?

How to File. There are three ways to file the Texas Franchise Tax Report: No Tax Due. EZ Computation. Long Form. If your business falls under the $1,110,000 revenue limit, then you don’t owe any franchise tax. If you are above the limit, you can choose to fill out and file the EZ Computation form or to take the time to fill out the Long Form.

What is franchise tax in Texas?

What is the Texas Franchise Tax? The Texas Franchise Tax is levied annually by the Texas Comptroller on all taxable entities doing business in the state. The tax is based upon the entity’s margin, and can be calculated in a number of different ways.

How many types of franchise tax extensions are there?

There are four different types of Franchise Tax Extensions, depending upon your situation.

How is Total Revenue Calculated?

Total revenue is calculated by taking revenue amounts reported for federal income tax and subtracting statutory exclusions.

Who is required to submit a check to the Texas Comptroller?

Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment form with a check or money order made payable to the Texas Comptroller. Please put the reporting entity’s Texas taxpayer number and the report year on the check.

What does "timely" mean in Texas?

Timely means the request is received or postmarked on or before the due date of the original report. Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment form with a check or money order made payable to the Texas Comptroller.

What is a passive entity in Texas?

For the 2021 report year, a passive entity as defined in Texas Tax Code Section 171.0003; an entity that has total annualized revenue less than or equal to the no tax due threshold of $1,180,000; an entity that has zero Texas gross receipts; an entity that is a Real Estate Investment Trust (REIT) meeting the qualifications specified in Texas Tax Code Section 171.0002 (c) (4); or an entity that is a pre-qualified new veteran-owned business External Link: undefined as defined in Texas Tax Code Section 171.0005 can file a No Tax Due Report.

Can a combined group file a 2021 report?

For the 2021 report year, an entity, including a combined group, can file using the EZ Computation if it has annualized total revenue of $20 million or less. Any entity that does not elect to file using the EZ Computation, or that does not qualify to file a No Tax Due Report, should file the Long Form report.

Who Needs to File for Texas Franchise Tax?

The short answer is everyone who has nexus in Texas has to file & pay Texas franchise tax. (If you need some nexus or sales tax guidance, click here to download our “10 Steps of Sales Tax” PDF.)

How to extrapolate franchise tax webfile number?

You do that by changing the last digit of your sales tax number to one more and changing the R to an X.

What is threshold 1 for taxes?

Threshold 1 – If your sales in the entire country are less than $1.18M, you’ll file a No Tax Due Information Report. You have to file, but you don’t have to pay the tax.

What is the link to file an extension in Texas?

If you need to file an extension, this is the link: https://comptroller.texas.gov/taxes/franchise/filing-extensions.php. Remember, the extension is an extension to file, NOT an extension to pay. You still have to pay by the original deadline.

Where to put nation wide revenue?

After filling in your accounting year begin and end dates, you’ll come to the total revenue box. This is where you’ll put your nation-wide revenue.

Is franchise tax difficult in Texas?

Filing Texas franchise tax isn’t difficult, but it is a bit of a process, so we’ll walk you through it.

Is franchise tax the same as sales tax in Texas?

The first thing to know when it comes to Texas franchise tax is that it is NOT the same as sales tax. Sales tax only taxes the end consumer. Franchise tax taxes all the businesses involved in the process from the manufacturer to the end distributor. It can be considered a tax for the privilege of doing business in Texas.

How to file a franchise tax report in Texas?

If you have a business in Texas, then you must learn how to file a Texas franchise tax report as soon as possible in order to avoid all the late fees. This report is filed after the closing of the sales tax account. The filing process of the franchise tax report is as follows: 1 The first step is to visit the Texas Comptroller of Public Accounts site and log in with the username and password that is registered in the site. 2 Select the option WebFile/Pay Taxes and Fees and then fill up all the information the site is asking for. 3 Once you have entered the WebFile number, the site will show you a number of returns that are required to be filed by you. 4 After filing all the returns, make a call to the state and request them to give you a final return based upon the returns you have filed. 5 The state will update the account in less than 48 hours, so when you will log in the account after 48 hours, you will find a final return. 6 In case your business is not registered with the Secretary of State, you must send a letter to them stating that you have closed your business on this date of the year and want that the state took up all your tax responsibilities. 7 If your business is registered, then demand a certificate of termination. This certificate will eliminate the state’s responsibilities on your taxes.

When do franchises file taxes in Texas?

Every business who are carrying out their transactions in Texas is bound to file an annual franchise tax report by the 15th of March every year.

How long does it take to get a final tax return?

The state will update the account in less than 48 hours, so when you will log in the account after 48 hours, you will find a final return.

What to do if your business is not registered with the state?

In case your business is not registered with the Secretary of State, you must send a letter to them stating that you have closed your business on this date of the year and want that the state took up all your tax responsibilities.

What happens if a business is registered?

If your business is registered, then demand a certificate of termination. This certificate will eliminate the state’s responsibilities on your taxes.

Do you need a Texas tax number to file a franchise?

A Texas Taxpayer number is also required to file a Franchise Tax Report. So this number is also mandatory.

Do you have to make somethings before filing a franchise tax return in Texas?

You require to make somethings before filing a Franchise Tax Report in Texas. The checklist should be as follows:

What happens if you don't get your franchise tax report in Texas?

If the Comptroller’s office does not receive your franchise tax report (and payment, if you owe one) within 45 days of the deadline, they are required by law to forfeit your business’s right to transact business in Texas. This forfeiture is essentially a loss of corporate liability protection: business owners will become liable for the debts of the business, and the entity will not be permitted to defend itself in a court of law.

How often do you need to file a franchise tax return in Texas?

But whether or not tax is owed, you’ll need to file a Texas Franchise Tax Report every year to keep your business in good standing.

What is a webfile number?

Your WebFile number.This number, which begins with “FQ,” is the temporary access code that allows you to create a WebFile account. After you log in to the system for the first time and complete your franchise tax questionnaire (addressed in the next step), you’ll receive a permanent WebFile number beginning with “XT” for your franchise tax account.

What does independent Texas do?

When you hire Independent Texas to form your Texas company or serve as your registered agent, we keep your state correspondence organized, send you multiple reminders ahead of the franchise tax due date, and provide affordable franchise report filing service.

What is franchise tax in Texas?

The Texas Franchise Tax is an annual business privilege tax processed by the Texas Comptroller of Public Accounts. Essentially, it’s a tax levied on business owners in exchange for the opportunity to do business in Texas. Here's what you should know about it.

How to calculate annualized revenue?

To find annualized revenue, divide your business’s total revenue by the number of days since it became subject to the franchise tax, then multiply the result by 365.

How to check if a franchise is active in Texas?

How can I check my business’s Texas Franchise Tax status? You can check on the Texas Franchise Tax account status of your company (or another company) by conducting an online Taxable Entity Search on the Comptroller’s website. To search for a business, enter its name, 11-digit Texas taxpayer ID number, 9-digit Federal Employer Identification Number (FEIN) or Texas SOS file number. Once you locate the business you’re looking for, click on the blue “Details” button to the left of the business name. Under the “Franchise Search Results” tab, you’ll see an item called “Right to Transact Business in Texas.” If the right to transact business is “Active,” then the entity is still entitled to conduct business in Texas.

Industry Classification Code

SIC Code: Enter the code that is appropriate for the taxable entity or the code that reflects the overall business activity of a combined group. View the 1987 Standard Industrial Classification (SIC) codes External Link: undefined .

Accounting Year Begin Date

Annual Report: Enter the day after the end date on the previous franchise tax report.

Accounting Year End Date

Annual Report: Enter the last accounting period end date for federal income tax purposes in the year before the year the report is originally due.

Qualification Questions

Is this entity a passive entity as defined in Section 171.0003 of the Texas Tax Code?

Revenue

Enter the amount of total revenue using the instructions for Items 1-10 of Form 05-158-A. Note: Passive entities, REITs and new veteran-owned businesses may enter zero.

How much is franchise tax in Texas?

Costs vary from state to state. Some are free while others can be several hundred dollars. How much you pay for the Texas Franchise Tax depends entirely on your LLC’s total annual revenue. If your business revenue falls under the “ no tax due” threshold, it will not owe a tax. The current threshold is $1,180,000, so if your LLC doesn’t make that much in a year, you won’t be responsible for any payments. But businesses that bring in more than that will be subject to a 0.375% Franchise Tax on retail and wholesales goods and 0.75% on all other revenue.

How Much Does the Texas LLC Annual Report Fee Cost?

If you’re putting together a budget for all your LLC’s costs – like formation costs, name reservation fees, and initial operating expenses – it’s important to include annual filings like this one, just so that there are no surprises.

What is the Texas Annual Report? Why is it Important?

It’s similar to a census in that its purpose is to collect the necessary contact and structural information about each Texas business.

What Happens if You Don’t File?

How bad could it be if I just fly under the radar?” The short answer: don’t try it. Failing to file your Franchise Tax and Public Information Report can yield some serious consequences.

What is LLC annual report?

In Texas, an LLC’s annual report consists of two parts: a Franchise Tax and a Public Information Report. Each LLC must submit these filings to the Texas Comptroller every year to keep their information current. Unsure how to go about it? Never even heard of it? No worries at all. That’s why we’re here. Keep reading for everything you need to know.

What happens if you change your registered agent in Texas?

For example, if you change your registered agent, or your current agent resigns, you’ll need to keep the state informed so they can update their contact information. Miss one of their communications and your LLC in Texas might end up falling out of good standing or, even worse, administratively dissolved.

When are LLC taxes due?

Instead, these filings are due on May 15th each year. If May 15th falls on a weekend or holiday, the due date will simply move to the next business day.