There is no separate request for a transcript available. However, practitioners and taxpayers are usually able to get them by calling 800-852-5711. Yes it would show if the FTB believes taxes are owed.

How long does it take to get a copy of my tax return?

How much is the fee for a copy of California tax return?

How to file California state taxes?

About this website

Is the Franchise Tax Board the same as IRS?

While the IRS enforces federal income tax obligations, the California Franchise Tax Board (FTB) enforces state income tax obligations. A taxpayer will face collections actions by the FTB because they have ignored the obligation, refused to pay, or are unable to pay an outstanding tax balance that is due and owing.

How do I get my tax transcripts from previous years?

You can also request a transcript by mail by calling our automated phone transcript service at 800-908-9946. Visit our Get Transcript frequently asked questions (FAQs) for more information. If you're trying to get a transcript to complete FAFSA, refer to tax Information for student financial aid applications.

How can I get copies of my tax documents?

Taxpayers can call 800-908-9946 to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer. By mail. Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail.

How do I speak to a live person at FTB?

Taxpayers with general questions can call (800) 852-5711 or visit our website at ftb.ca.gov .

How far back can you order tax transcripts?

It also shows changes made after you filed your original return. This transcript is available for the current and nine prior tax years through Get Transcript Online, and the current and three prior tax years through Get Transcript by Mail or by calling 800-908-9946.

Can I request a tax transcript online?

An IRS Tax Return Transcript can be obtained: ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

Why is my tax transcript not available?

If you don't see a return transcript available for download, it likely means that you didn't file a return for that year, or that the IRS hasn't processed the return. Record of account transcripts: Current tax year, five prior years, and any years with recent activity, such as a payment or notice.

How can I access my tax documents online?

Get a Transcript of a Tax ReturnOnline - To read, print, or download your transcript online, you'll need to register at IRS.gov. To sign-up, create an account with a username and a password.By mail - To get a transcript delivered by postal mail, submit your request online.

How long does it take to get IRS transcript online?

Transcripts arrive at the address we have on file for you within 10 calendar days from the time IRS receives your request. NOTE TO EDITOR: Below are links to help taxpayers find the information they need.

How do I contact FTB by phone?

(800) 852-5711California Franchise Tax Board / Customer service

What time does the California Franchise Tax Board open?

8 AM to 5 PM PT8 AM to 5 PM PT (general and MyFTB) 8 AM to 5 PM PT (levy, lien, wage garnishment, installment agreement, or revive, dissolve, or suspended business)

How long does it take for California tax refund?

Here are a few. How you file your California tax return — If you choose to e-file, normal processing times can take up to two weeks. If you decide to paper file, processing can take up to four weeks.

Can you view previous years tax returns online?

To view copies of your old tax returns, follow these steps: Log into your government gateway account. Choose “Self-Assessment” from the main menu. Scroll down to “Previously Filed Returns” and choose “view more previous years Self Assessments.”

Can I access my IRS records online?

You can access your federal tax account through a secure login at IRS.gov/account. Once in your account, you can view the amount you owe along with details of your balance, view 18 months of payment history, access Get Transcript, and view key information from your current year tax return.

Here’s how people can request a copy of their previous tax return

IRS Tax Tip 2021-33, March 11, 2021. Taxpayers who didn't save a copy of their prior year's tax return, but now need it, have a few options to get the information.

Where's My Refund? | FTB.ca.gov - California

Check the status of your California state refund. This Google™ translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only.

How to Get Free Copies of Your State & Federal Taxes for Past Years

Federal Tax Transcripts. If you can't get a copy from your preparer, you'll have to request one from the IRS. Visit the IRS website and download Form 4506-T, which is the Request for Transcript of ...

California Income Tax Returns Can Be e-Filed Now. Start Free.

Your 2021 California State Income Tax Return for Tax Year 2021 (Jan. 1 - Dec. 31, 2021) can be e-Filed with your IRS Income Tax Return. eFile.com makes it easy for you to prepare and e-file your IRS and or California State Tax Return (e.g resident, nonresident, or part-year resident returns).. California is the only state that allows you to prepare and eFile your CA state tax return if you ...

FTB 3516 - Request for Copy of Personal Income or Fiduciary Tax Return

State of California Franchise Tax Board Request for Copy of Personal Income or Fiduciary Tax Return Send a check or money order payable to the Franchise Tax Board for $20 for each tax year you request.

High Demand for Get Transcript

Get Transcript information is updated once per day, usually overnight. There’s no need to check more often.

Access Tax Records in Online Account

You can view your tax records now in your Online Account. This is the fastest, easiest way to:

Alternative to Requesting a Transcript Online

We recommend requesting a transcript online, since that’s the fastest method. If you can’t get your transcript online, you can request a tax return or tax account transcript by mail instead.

How to get tax transcripts?

If you're unable to register or you prefer not to use Get Transcript Online, you may order a tax return transcript and/or a tax account transcript using Get Transcript by Mail or call 800-908-9946 . Please allow 5 to 10 calendar days for delivery.

What is a tax return transcript?

A tax return transcript usually meets the needs of lending institutions offering mortgages and student loans. Note: the secondary spouse on a joint return must use Get Transcript Online or Form 4506-T to request this transcript type. When using Get Transcript by Mail or phone, the primary taxpayer on the return must make the request.

What is a 1040 transcript?

Tax Return Transcript - shows most line items including your adjusted gross income (AGI) from your original Form 1040-series tax return as filed, along with any forms and schedules. It doesn't show changes made after you filed your original return. This transcript is only available for the current tax year and returns processed during the prior three years. A tax return transcript usually meets the needs of lending institutions offering mortgages and student loans. Note: the secondary spouse on a joint return must use Get Transcript Online or Form 4506-T to request this transcript type. When using Get Transcript by Mail or phone, the primary taxpayer on the return must make the request.

What is a record of account transcript?

Record of Account Transcript - combines the tax return and tax account transcripts above into one complete transcript. This transcript is available for the current tax year and returns processed during the prior three years using Get Transcript Online or Form 4506-T.

What is a tax transcript?

A Tax Return transcript is the one most people need. It shows most items from your return (income, deductions, etc.) as you originally filed it.

Why do we need transcripts for tax returns?

Tax transcripts are often used to validate your income and tax filing status for mortgage applications, student loans, and small business loan applications. They can also be useful when you’re getting ready to prepare and file your tax return. Common Issues. Actions. Resources. Taxpayer Rights. Related Content.

What should I do?

Make sure you’ve filed your tax returns and the IRS has processed them before requesting a transcript. The IRS can’t provide certain transcripts if the IRS hasn’t processed your tax return.

What to do if IRS is not responding?

If your IRS problem is causing you financial hardship, you’ve tried repeatedly and aren’t receiving a response from the IRS, or you feel your taxpayer rights aren’t being respected, consider contacting Taxpayer Advocate Service (TAS).

How to get a copy of W-2?

To obtain copies of IRS Forms W-2 or 1099 you filed with your tax return, first contact the employer who issued it. If you still need a copy from the IRS, complete Form 4506, Request for Copy of Tax Return, and mail it to the IRS with the fee listed on the form, currently $50.00 for each requested return.

How long does it take to get your tax return?

If you mailed your tax return to the IRS, it will take approximately six weeks. [NOTE: If you didn’t pay all the taxes you owe, your return and your transcript may not be available until mid-May, or a week after you pay the full amount owed.] Some notes on privacy:

What does the transcript system ask for?

The system will ask for personal information and then ask you to indicate which type of transcript you want.

What is franchise tax in Texas?

The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.

When are Texas franchise tax returns due 2021?

Due to statewide inclement weather in February 2021, the Texas Comptroller of Public Accounts is automatically extending the due date for 2021 Texas franchise tax reports to June 15, 2021, consistent with the Internal Revenue Service (IRS). See Comptroller Hegar’s press release.

Do franchise tax filers get a reminder?

Most franchise tax filers will receive an email in lieu of a mailed reminder to file or seek an extension. If we do not have your email address on file (if you are a first-year filer, for example), we will mail a reminder notice to you.

How long does it take to get a copy of my tax return?

5. or federal disaster. Include a check or money order for the total amount due, made out to the Franchise Tax Board. It may take up to four weeks from the date of your request to receive a copy of your return.

How much is the fee for a copy of California tax return?

There is a $20.00 fee for each tax return year you request. There is no charge for a copy of your return if you're requesting a return for a tax year in which you were the victim of a designated California state disaster#N#5#N#or federal disaster.

How to file California state taxes?

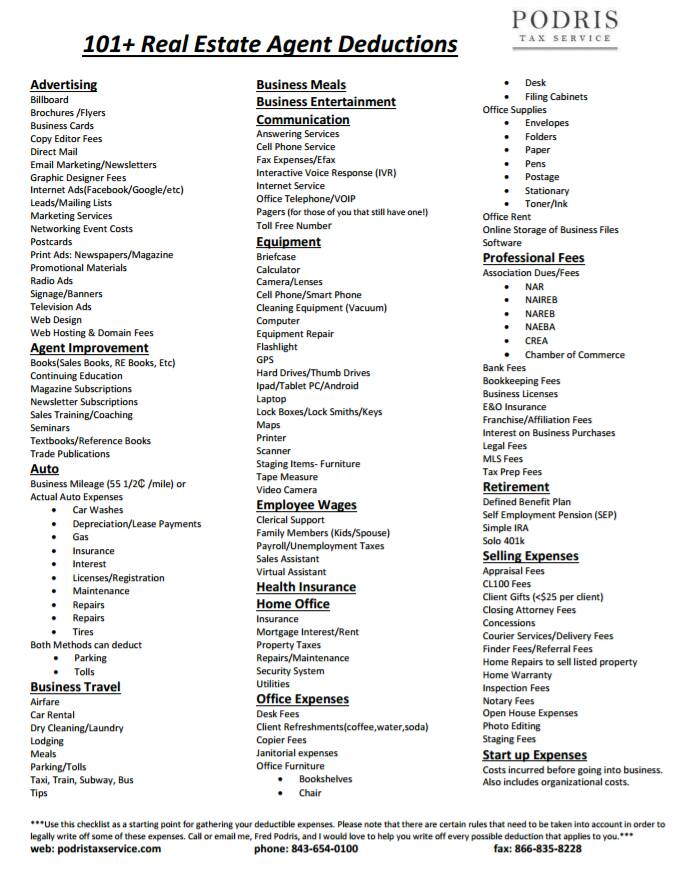

For written requests, provide all of the following: 1 Your name (and spouse if joint return) or business name 2 Current address 3 Phone number 4 Your identification number such as a:#N#Social security number#N#California corporation ID#N#Federal employer identification number 5 Address shown on last return filed 6 Tax year (s) of returns requested 7 Your signature, officer’s or authorized representative’s signature 8 Business entities: include the title of the officer or trustee