Is there a franchise tax in Delaware?

All corporations incorporated in the State of Delaware are required to file an Annual Report and to pay a franchise tax. Exempt domestic corporations do not pay a tax but must file an Annual Report.

How do Delaware franchise taxes work?

If your company has authorized 5,000 shares or fewer, your total Delaware franchise tax amount is $175. If you've authorized 5,001 to 10,000 shares, your franchise tax is $250. For every** additional 10,000 shares** authorized after that, you pay another $85 in franchise tax, up to a maximum of $200,000.

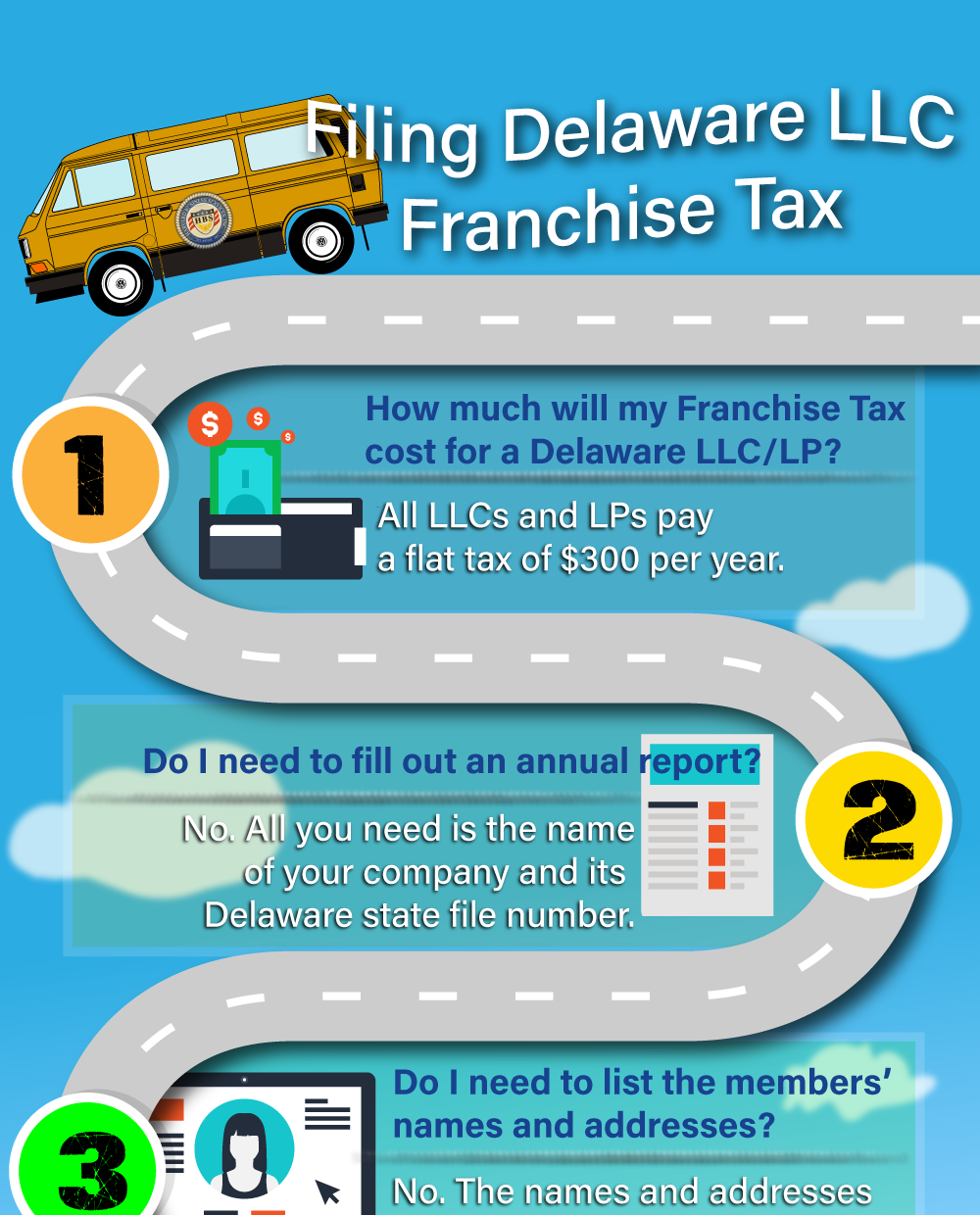

How much is Delaware LLC franchise tax?

$300.00LLC/Partnership Tax Information All Domestic and Foreign Limited Liability Companies, Limited Partnerships, and General Partnerships formed or registered in Delaware are required to pay an annual tax of $300.00. There is no requirement to file an Annual Report.

How much is Delaware franchise fee?

Cost. The minimum Delaware franchise tax fee is $175 with a $50 filing fee. The minimum Delaware franchise tax and annual report payment is $225 for domestic corporations.

What happens if I don't pay Delaware franchise tax?

If you don't pay the Delaware Franchise Tax and file the Annual Report for two straight years, the State of Delaware will administratively dissolve the Corporation. If you have any questions about forming your new Delaware LLC, LP, or Corporation, give us a call today.

How can I avoid $800 franchise tax?

The only way to avoid the annual $800 California franchise fee is to dissolve your company, file a 'final' income tax return with the FTB and to submit the necessary paperwork.

What happens if I dont pay Delaware LLC tax?

Although Limited Partnerships, Limited Liability Companies and General Partnerships formed in the State of Delaware do not file an Annual Report, they are required to pay an annual tax of $300.00. Taxes for these entities are due on or before June 1st of each year. Penalty for non-payment or late payment is $200.00.

What taxes does a Delaware LLC have to pay?

This means that the LLC itself does not pay taxes and does not have to file a return with the State of Delaware. As the sole member of your LLC, you must report all profits (or losses) of the LLC on Schedule C and submit it with your Delaware personal income tax return (Form 200).

What is filing fee for LLC Delaware?

$90LLC Cost #1: Certificate of Formation The company's Certificate of Formation is required to be filed with Delaware to form a Delaware LLC. While the state filing fee is $90, there may be additional fees depending on how quickly you would like to receive your evidence of formation for your Delaware LLC.

Is Delaware a franchise registration state?

Delaware does not have any franchise registration laws and is considered a non-registration state. Franchisors interested in offering or selling franchises in Delaware do not need to register or file anything with the state of Delaware to begin selling.

What are gross assets for Delaware franchise tax?

Total Gross Assets shall be those “total assets” reported on the U.S. Form 1120, Schedule L (Federal Return) relative to the company's fiscal year ending the calendar year of the report. The tax rate under this method is $400.00 per million or portion of a million.

How do you determine a franchise fee?

Franchise marketing fees are usually based on your monthly revenue. For instance, if your average monthly revenue is $25, 000, and the franchisor charges a 2% marketing fee, you'll have to pay your franchisor $500. (That's $6, 000 annually.)

What is the minimum franchise tax in Delaware?

The minimum tax is $175.00, for corporations using the Authorized Shares method and a minimum tax of $400.00 for corporations using the Assumed Par Value Capital Method. All corporations using either method will have a maximum tax of $200,000.00.

What taxes do LLCs pay in Delaware?

This means that the LLC itself does not pay taxes and does not have to file a return with the State of Delaware. As the sole member of your LLC, you must report all profits (or losses) of the LLC on Schedule C and submit it with your Delaware personal income tax return (Form 200).

How do franchise owners pay taxes?

There are usually two major tax kinds that franchise owners are required to pay. The first would be the franchise, and the other is the run of the mill federal/state income. Both are usually assessed on a yearly basis, and if you fail to remit, your business risk being delisted from doing business in the said state.

Are Delaware franchise taxes paid in arrears?

Your notification of annual report and franchise tax due is sent to a corporation's registered agent in December or January of each year. Delaware requires these reports to be filed electronically. Franchise taxes are generally due in arrears for the prior calendar year.

How much is Delaware franchise tax?

Effective January 1, 2018, a domestic stock or non-stock for profit corporation incorporated in the State of Delaware is required to pay annual franchise tax. The minimum tax is $175.00, for corporations using the Authorized Shares method and a minimum tax of $400.00 for corporations using the Assumed Par Value Capital Method.

How to multiply authorized shares?

Multiply the number of authorized shares with a par value greater than the assumed par by their respective par value. Example: 250,000 shares $5.00 par value = $1,250,000

What is Delaware Franchise Tax?

Delaware franchise tax is a tax charged by the state of Delaware for the right to own a Delaware company. The tax does not affect income or company activity. The tax is required to maintain the company's good standing in Delaware.

Why do you need to use franchise tax in Delaware?

The Delaware franchise tax is beneficial to corporations because it is a simple process to submit and calculate payment. The Delaware franchise tax is also beneficial to businesses as it is a small fee in comparison to other states.

How much is the late fee for franchise tax in Delaware?

If you pay your Delaware franchise tax late, you'll be charged a late fee. The late fee is $125.00 and a 1.5 percent monthly interest afterward.

What information is required to file a franchise tax in Delaware?

When filing a franchise tax in Delaware, all the must be submitted is the physical address of the business and the name of the registered agent. This can be a business owner or someone else. By not requiring more information, businesses that file their franchise tax in Delaware can maintain privacy.

What happens if you don't file Delaware franchise tax?

If you don't file your Delaware franchise tax on time, you will be charged a late fee.

What is Delaware's court of chancery?

Delaware has what is called a Court of Chancery. This allows the state to adjudicate corporate litigation. The corporate laws and cases decided in Delaware are often used by the Supreme Court to influence decisions.

How much does it cost to register a foreign business in Delaware?

Foreign File. Business that are formed out of state but are registered to do business in Delaware must pay a $125 registration fee. Foreign corporations, those that are formed outside of Delaware, cannot file online. To file as a foreign corporation, mail in the necessary documents.

What are Delaware franchise taxes?

A franchise tax, sometimes called a privilege tax, is a fee you pay for the “privilege” of doing business in a certain state.

Who has to pay the franchise tax?

You must pay the Delaware franchise tax if your Delaware business is one of the following:

When are Delaware annual reports due?

Notification of Annual Report and Franchise Taxes due are sent to all Delaware Registered Agents in December of each year. Delaware has mandated electronic filing of domestic corporations Annual Reports.

How much is the annual report fee for a foreign corporation?

Foreign Corporations. Foreign Corporations are required to file an Annual Report on or before June 30th. The fee for filing the Annual Report is $125.00. Foreign corporations are assessed a penalty of $125 if the Annual Report is not filed.

Do corporations pay franchise tax in Delaware?

Corporate Annual Report and Franchise Tax Payments. All corporations incorporated in the State of Delaware are required to file an Annual Report and to pay a franchise tax. Exempt domestic corporations do not pay a tax but must file an Annual Report. The filing fee for filing an Annual Report or Amended Annual Report for exempt domestic ...