How to value your franchise opportunities

- 1. Be transparent with all costs A potential franchisee will always ask how you arrived at your initial franchise-fee, so make sure you are prepared by formulating a comprehensive breakdown of your franchise set-up costs. ...

- 2. Foster a mutually beneficial relationship ...

- 3. Consult the professionals ...

- 4. Select a suitable profit-assessment model ...

- 5. Adapt and survive

Should you buy a franchise business?

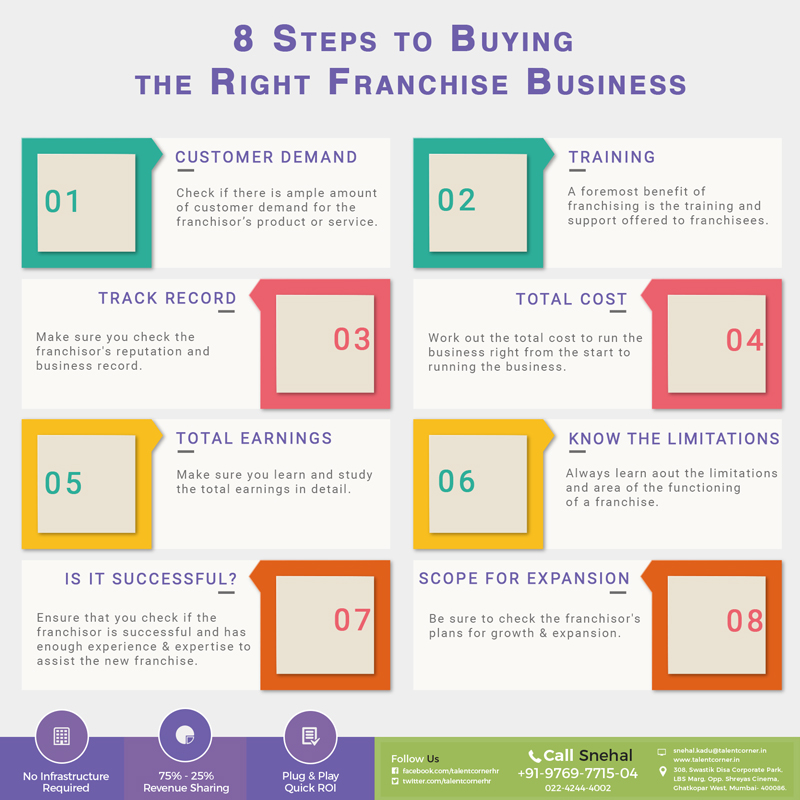

Others also have their unique reasons on why they buy a franchise business. One of the few good reasons of buying a franchise business is that it lets you avoid all those potential risks experienced by other start ups. This is also a one way of being smart.

How much will it cost to franchise my Business?

There are currently 14 registration states with franchise registration fees ranging from $250 to $750 plus additional legal fees leaving you potentially $15,000 to $25,000 out of pocket. A Federally Registered Trademark will set you back $1,750 to $7,500.

What does it cost to franchise a business?

Franchise costs include the purchase of equipment and the start-up costs. You typically spend $18,500-$8500 to franchise your business. It depends on your franchise team, the industry you are in, and the level of support you need to decide what amount of costs you will incur.

How can we increase a franchise business?

- You could start the business with the intention of franchising your idea

- You open one location that is a success and want to expand to more locations so you decide to use franchisees for the new locations instead of owning them

- You open multiple locations and then decide to sell the locations to a franchisee or franchisees

How many EBITDA multiples are there?

How to determine shorthand valuation?

What is sound valuation?

How long is FF&E depreciated?

What is an intangible asset?

What is balance sheet?

What is the killer of small businesses?

See 2 more

What is a good EBITDA for a franchise?

From a banker's perspective, EBITDA should be at minimum of 1.2 times the debt payment of the business. For example, a franchise with a monthly loan payment of $5,000 needs to generate a minimum of $6,000 EBITDA per month.

What is franchise value?

We define franchise value as the present value of the future profits that a firm is expected to earn as a going concern. Profits are those gains beyond what is required to cover all costs, including the cost of capital.

How do you determine if a franchise is a good investment?

The most profitable franchises are the ones with the highest ROI, therefore, you want to find a franchise that demonstrates large profit margins, and relatively low operational expenses. A good place to start is low overhead franchises.

What is a good ROI for a franchise?

The General Rules of Thumb However, there is an oft-repeated rule of thumb that, after the second full year in business, a franchisee should be realistically able to anticipate a 15- 20% per year ROI plus an equitable salary for whatever work they do in the business.

How do I sell my franchise business?

Selling Your Franchise in Three Simple StepsStep 1: Prepare Your Franchise for Sale. Start by contacting your franchisor. ... Step 2: Market Your Franchise for Sale. Most business brokers use online portals and their own proprietary databases to market businesses for sale. ... Step 3 – Negotiate and Close the Deal.

Where do I list my franchise for sale?

Whether you are ready to sell or you are just considering it, here are our top tips for selling an existing franchise:List your franchise for sale on FranchiseFlippers.com. ... List your franchise on other online business listing websites. ... Reach out to fellow franchise owners in your franchise system personally.More items...

How do franchise owners get paid?

How do franchise owners get paid? Franchise owners can pay themselves a salary or depending on their business entity, they may be able to take a draw from their accumulated equity.

What are the risks of owning a franchise?

5 Risk Factors to Consider Before Buying a FranchiseFads. Successful and well-known franchisors have usually been in business for several years, but there are certainly some newer franchise brands that are doing very well. ... Regionality and Seasonality. ... Recession Resistance. ... Capital Risk. ... Government Regulations.

How much do franchise owners make?

When researchers accounted for the inflations caused by the few top franchises, it was established that the average annual income of 51 percent of franchisees is less than 50,000 dollars. The study also found that only 7 percent of franchise owners earn over 250,000 dollars a year.

Is owning a franchise passive income?

Using the definition above, yes, a franchise can definitely be passive income! In fact, many franchises are set up with the goal of passive income in mind. That's why some franchisees end up owning multiple locations of the same franchise, with a separate staff and minimal oversight to run each one.

How long does it take for a franchise to become profitable?

One common misconception when it comes to operating a franchise is that once you sign on the dotted line and open for business, the customers and revenue will start flowing. This is typically not the case. It normally takes a year or two to become profitable.

Is owning a franchise profitable?

Buying a franchise might seem like easy money, but those royalties and fees will quickly cut into profit margins. The majority of franchise owners earn less than $50,000 per year.

What is the failure rate for a franchise?

Pretty much every year the survey has been conducted has shown between 8-12% of franchise businesses left their franchise each year. This is for a variety of reasons, including retirement, selling, ill-health and financial failure.

What is the most profitable franchise to own in 2022?

Most Profitable FranchisesDunkin'7-Eleven.Planet Fitness.JAN-PRO.Taco Bell.Orangetheory Fitness.Great Clips.Mac Tools.More items...•

What are the rules of thumb for determining whether franchising is a good choice for a particular business?

Stable Environment: For growth of any business it is required to be in stable environment as often changing variables are not feasible for survival and growth of any business, so if business is in stable environment then only it should proceed towards franchising as an option for expansion.

Is owning a franchise profitable?

Buying a franchise might seem like easy money, but those royalties and fees will quickly cut into profit margins. The majority of franchise owners earn less than $50,000 per year.

What is a Franchise REALLY Worth? How to Value any Franchise.

Serving clients nationally from offices in Fairhope, Alabama and Baton Rouge, Louisiana. Contact William at [email protected] or by phone at 251-990-5934 (Fairhope) or 225-465-5799 (Baton Rouge).

Ways to Calculate the Value of a Small Business | ZenBusiness Inc

It's a good idea to know the value of your business, even if you don't have immediate plans to sell. Here are three ways you can calculate the value of your small business.

Franchise Appraisal: The Valuation of Your Franchise Business

Conducting A Franchise Appraisal & Determining Business Value January 20, 2021. Franchisees may need to conduct a valuation of their franchise business for a number of reasons.

How many EBITDA multiples are there?

Common EBITDA multiples are three or four, though as low as two and as high as five are sometimes seen as well. I find this technique a good guide and a quick way to assess whether a seller is pricing his or her business at least somewhat reasonably. It should not, however, be the final word.

How to determine shorthand valuation?

But the small, privately-held businesses that change hands on a daily basis lack the luxury of such a clear-cut benchmark. Various rules of thumb exist for determining shorthand valuations—two times revenue, for example, or three to four times EBITDA (earnings before interest, taxes, depreciation, and amortization).

What is sound valuation?

A sound valuation relies on multiple factors, all vetted to the extent possible by due diligence. Revenue is a useful guide to performance and provides some indicator of future direction. Assets (accurately valued) plus a multiple of cash flow represent a good starting point for a total value.

How long is FF&E depreciated?

No buyer would pay that for it. So how to value it? Per IRS rules, most FF&E of the type found in restaurants is depreciated over seven years . That means you can deduct one-seventh of the original purchase price per year of age to arrive at a fair market value (FMV) that the IRS would not likely challenge. Obviously, if the FF&E is seven or more years old, it has no value for transaction purposes.

What is an intangible asset?

One type of asset we did not touch on is the intangible asset. In some industries this might be intellectual property like patents (which can easily be worth a million dollars each). In franchised businesses the franchise fee itself, which represents the right to do business using that brand, has value. Determining what this contributes to valuation is a question of what it would cost to buy into the franchise today and more importantly how much of the original term of the franchise agreement remains (assuming the franchisor’s practice is to transfer the existing agreement).

What is balance sheet?

The balance sheet is one of the triumvirate of basic financial reports (the other two being the income statement, also known as the profit and loss statement or just P&L, and the statement of cash flows). It lists the assets, liabilities, and resultant owners’ equity for a company.

What is the killer of small businesses?

Yet until those credit sales are collected, there is no cash to pay employees or vendors or buy new inventory. Poor cash flow —sometimes resulting from owners who will do just about anything to make the sale—is a major killer of small businesses.

What is the EBITDA multiple for a business?

"Most businesses are sold on a multiple of proven cash flow, through EBITDA or seller's discretionary earnings (owner benefit items that have been expensed through the business). If you're going to sell, you want to eliminate as much seller discretionary earnings as you can because it creates a clean EBITDA multiple for the valuation," said Randy Jones, Head of Originations at ApplePie Capital.

How much is a cash flow multiplier worth?

The average range for cash flow multipliers is four to five times EBITDA. Therefore, if a business has clean tax returns showing $100,000 in EBITDA and an assumed five times cash flow multiplier, that business would be worth $500,000. However, if that same business could prove only $60,000 in EBITDA, and the multiplier remained the same, it would be worth $300,000.

Why should sellers be able to demonstrate positive trends in gross sales and EBITDA?

The seller should be able to demonstrate positive trends in gross sales and EBITDA because doing so will increase the value of the unit in question.

How long should a franchise owner spend on operating costs?

Understanding how franchises are valued. To get the most money from the sale of an existing franchise unit, the seller should prepare to spend two to three years controlling operating costs and creating clean financial records. Franchise owners that cannot or do not take the time to do so run the risk of losing money in the long run.

How long should lease rates be held steady?

A lender will want to see that lease rates are held steady for at least the length of the loan terms.

Can you refinance a franchise?

Finally, buyers who already own successful franchises have the option of refinancing their existing units to pay the down payment on new loans. For example, if you currently have a loan of $200,000 and you need $50,000 in cash, you could refinance at $250,000. This option is only available from a few lenders, including ApplePie Capital.

Can a first time buyer finance a unit?

If the seller can prove that his or her unit has predictable positive revenue trends, it will be much easier for a first-time buyer to finance the unit . If trends are negative, the seller may have to finance some of the deal in order for the transaction to move smoothly.

CONSIDERING SELLING YOUR FRANCHISE BELOW COST?

If you are considering selling your existing franchise for less than the cost to start a new franchise, you may not need a valuation. Talk with us to see if a franchise value estimate is best for your situation. In some cases we can guide you to the best strategy and plan to sell your business without needing a value estimate.

DO YOU KNOW THE BEST STRATEGY FOR SELLING YOUR FRANCHISE?

Are you familiar with what a business broker does and if a broker is your best option? Do you know how and if you should try to sell your franchise on your own? Is your franchisor a good partner to help you? Are there other options to consider? Franchise Flippers can help you assess all your options so you can determine which sales strategy is appropriate for your unique situation..

FREE GUIDANCE FROM A FRANCHISE RESALE EXPERT

Selling your business is a big decision. Contact us for a FREE CONSULTATION today. We’ are happy to answer your questions and help you determine your next steps.

Why use SDE multiple?

One major problem with using an SDE multiple to value a business is that the number is backward-looking. When valuing a business, it is important to look at the future, even if you’re the seller. You will want to present a case to potential buyers that your business’ revenues and profits will grow and the business should have a higher multiple as a result.

Why is EBITDA used in cash flow analysis?

Because EBITDA discounts items like depreciation and amortization, it may overstate a company’s ability to cover its liabilities and ignore needed upgrades or replacement of assets. EBITDA is not a substitute for cash flow, and cannot account for the impact made by day-to-day use of cash to cover the expense of the company’s operations. It should always be used with additional cash flow analysis, such as discounted cash flow (DCF).

What are the factors that influence the SDE multiple?

Independence from the owner (owner risk) And many other variables. The biggest factors influencing the SDE multiple are usually owner risk and industry outlook. If the business is highly dependent on you or another owner, it cannot be easily transferred to new ownership and the business’ valuation will suffer.

What is SDE in business valuation?

SDE is the pretax income of your business before non-cash expenses, owner’s compensation, interest expense and income, and one-time expenses that aren’t expected to continue in the future.

How does SDE work?

This is done by adding back in expenses listed on your tax return that aren’t necessary to run your business. This includes your salary as the business owner and any one-time expenses that aren’t expected to recur in the future.

What are tangible assets?

Tangible assets are physical goods owned by the business that you can put a value on. Some examples include real estate (if the business owns any property), accounts receivable, and cash on hand. These are generally not included in the SDE multiple. All tangible assets should be added into the valuation separately (as shown in the examples below) if you are purchasing them.

How much is the multiplier for small business?

In most cases, small businesses are given a business-specific multiplier of between one and four. The multiplier can be impacted by your geographic location, the risk of your industry, or a number of things related to your business.

What does a number in parentheses mean?

A number in parentheses indicates a note at the end of the list.

What does a number beside a franchise mean?

A number in parentheses beside a franchise indicates a note at the end of the list.

What are the rules of thumb?

Keep in mind that rules of thumb are just that. Every business is different and rules of thumb will never take the place of a business valuation or even an opinion of value. Rules of thumb are also not intended to create a specific value or to be used for an appraisal.

Who is William Bruce?

William Bruce is a business broker and appraiser who subscribes to the Business Brokerage Press publications. He consults nationally on issues involved in business transfers and valuation. He may be reached at [email protected] or (251) 990-5934. His business brokerage website may be viewed at www.WilliamBruce.net.

What is Forbes Finance Council?

Forbes Finance Council is an invitation-only organization for executives in successful accounting, financial planning and wealth management firms.

Is item 19 a good sign?

And, if the franchisor has been able to fund the company primarily with royalty fees and not had to continually borrow and take on debt, that’s a good sign.

Who is Patrick Galleher?

Patrick Galleher is the Managing Partner for Boxwood Partners, a merchant bank in Richmond, Virginia, where he leads sell-side transactions.

Is there more to feel right about franchises than the price?

In other words, there’s more that should feel right about the franchise system than the price. Otherwise, you’ll pay for it later.

Should I dive deep into franchises before buying?

Therefore, if you’re a savvy investor looking to buy a franchise, I’d recommend diving deep into the system and getting your hands a little dirty before buying in. Here are five tips I’d suggest:

How many EBITDA multiples are there?

Common EBITDA multiples are three or four, though as low as two and as high as five are sometimes seen as well. I find this technique a good guide and a quick way to assess whether a seller is pricing his or her business at least somewhat reasonably. It should not, however, be the final word.

How to determine shorthand valuation?

But the small, privately-held businesses that change hands on a daily basis lack the luxury of such a clear-cut benchmark. Various rules of thumb exist for determining shorthand valuations—two times revenue, for example, or three to four times EBITDA (earnings before interest, taxes, depreciation, and amortization).

What is sound valuation?

A sound valuation relies on multiple factors, all vetted to the extent possible by due diligence. Revenue is a useful guide to performance and provides some indicator of future direction. Assets (accurately valued) plus a multiple of cash flow represent a good starting point for a total value.

How long is FF&E depreciated?

No buyer would pay that for it. So how to value it? Per IRS rules, most FF&E of the type found in restaurants is depreciated over seven years . That means you can deduct one-seventh of the original purchase price per year of age to arrive at a fair market value (FMV) that the IRS would not likely challenge. Obviously, if the FF&E is seven or more years old, it has no value for transaction purposes.

What is an intangible asset?

One type of asset we did not touch on is the intangible asset. In some industries this might be intellectual property like patents (which can easily be worth a million dollars each). In franchised businesses the franchise fee itself, which represents the right to do business using that brand, has value. Determining what this contributes to valuation is a question of what it would cost to buy into the franchise today and more importantly how much of the original term of the franchise agreement remains (assuming the franchisor’s practice is to transfer the existing agreement).

What is balance sheet?

The balance sheet is one of the triumvirate of basic financial reports (the other two being the income statement, also known as the profit and loss statement or just P&L, and the statement of cash flows). It lists the assets, liabilities, and resultant owners’ equity for a company.

What is the killer of small businesses?

Yet until those credit sales are collected, there is no cash to pay employees or vendors or buy new inventory. Poor cash flow —sometimes resulting from owners who will do just about anything to make the sale—is a major killer of small businesses.