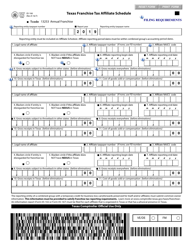

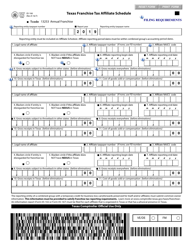

How to fill out franchise tax form in Texas?

To successfully file your Texas Franchise Tax Report, you’ll need to complete these steps:

- Determine your due date and filing fees.

- Complete the report online OR download a paper form.

- Submit your report to the Texas Comptroller of Public Accounts.

What is the Texas franchise law?

Texas has not enacted franchise specific laws and is not a franchise registration state. However, Texas has enacted Business Opportunity Laws and, before offering or selling a franchise in Texas, you must first file a one-time Business Opportunity Exemption Notice with the Texas Secretary of State.

Are franchise fees taxable in Texas?

Tax vs. Fees – thin Texas and the 5 Judicial Circuit 5th Circuit Court of Appeals held that Cable franchise fees are “FEES,” NOT TAXES Franchise fees are not a tax, however, but essentially a form of rent or fee: the price or fee paid to rent use of public right-of-ways. See, e.g., City of St. Louis v.

How to file Texas franchise tax?

File and Pay Franchise Tax

- Approved Tax Preparation Software Providers

- Filing and Payment Requirements

- Request an Extension

- Report Common Owner Information

What is a business opportunity in Texas?

How much does it cost to file a FDD in Texas?

What is an exemption notice in Texas?

What is the Texas Business Opportunity Act?

What is an authorized signature?

Is Texas a franchise state?

See 1 more

What states are franchise states?

For franchisors with a federally registered trademark, the Franchise Filing States include: Connecticut, Florida, Kentucky, Nebraska, North Carolina, South Carolina, South Dakota, Texas, and Utah. For franchisors without federally registered trademarks Georgia and Louisiana also require filings.

Which state is not a franchise registration state?

Alaska is not a franchise registration state and does not require FDD registration or filing. Learn More about franchising in Alaska. Arizona is not a franchise registration state and does not require FDD registration or filing.

How many states have franchise laws?

The Federal Franchise Rule is the overarching federal law that governs the offer and sale of franchises throughout the United States, in all fifty states.

How do I start a franchise in Texas?

Texas Franchise Law and Filing Franchisors must complete and file a Business Opportunity Exemption Notice (Texas Form 2703) with the Texas Secretary of State and pay a one-time filing fee of $25 prior to offering or selling a franchise in Texas.

Is Texas an FDD registration state?

Texas is a Franchise Filing State. The one-time Texas FDD filing fee is $25. The Internicola Law Firm, P.C.

What states require FDD?

States That Require FDD Registration or FilingCalifornia.Hawaii.Illinois.Indiana.Maryland.Michigan.Minnesota.New York.More items...

What are the legal requirements for a franchise?

Generally, the offer and sale of franchises find legal basis in laws such as:The Indian Contract Act, 1872.The Foreign Exchange Management Act, 1999 (FEMA).The Competition Act, 2002.The Trademarks Act, 1999.The Copyright Act, 1957.The Patents Act, 1970.The Design Act, 2000.The Income Tax Act, 1961.More items...

What is franchise registration?

Franchise Registration States are those states which require that franchisors register that franchise disclosure document with them before the franchisor can offer or sell franchises in the state.

What federal agency regulates franchises?

Federal Trade CommissionFranchise Rule | Federal Trade Commission.

Who pays Texas franchise tax?

In Texas, businesses with $1.18 million to $10 million in annual receipts pay a franchise tax of 0.375%. Businesses with receipts less than $1.18 million pay no franchise tax.

Who is subject to Texas franchise tax?

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

What is Texas franchise tax based on?

Franchise tax is based on a taxable entity's margin. Unless a taxable entity qualifies and chooses to file using the EZ computation, the tax base is the taxable entity's margin and is computed in one of the following ways: total revenue times 70 percent; total revenue minus cost of goods sold (COGS);

Is California a franchise registration state?

Yes. California is a franchise registration state. So, you must register your FDD with the California Department of Financial Protection and Innovation (DFPI) prior to offering or selling franchises in California. California charges initial franchise registrants a $675 fee.

Is Ohio a franchise registration state?

Ohio is classified as a non-registration state because it has no laws requiring franchisors to register with the state before offering or selling their franchise. But Ohio does have laws relating to the sale or offering of business opportunities under its Business Opportunity Purchasers Protection Act, Ohio Rev.

Is Arizona a franchise registration state?

Because Arizona is not a franchise registration state, franchisors do not need to separately register their Franchise Disclosure Document (FDD) with the state before offering or selling a franchise in the state. Arizona is, however, a business opportunity state.

Is North Carolina a franchise registration state?

North Carolina Franchise Law The State of North Carolina is a franchise filing state. This means that before offering and selling a franchise in the State of North Carolina a franchisor must first ensure that its Franchise Disclosure Document is current and filed with the North Carolina Secretary of State.

States That Require FDD Registration or Filing

All franchises in the United States are governed by the Federal Trade Commission (FTC) under a set of franchise-specific regulations. These regulations most notably include the Federal Franchise Rule, which was enacted in 1979.. The Federal Franchise Rule requires franchisors to give prospective franchisees “the material information they need in order to weigh the risks and benefits of such ...

Texas Franchise Law and Filing | Franchising a Business in Texas

Classification: Filing State Filing Fee: $25 Renewal Fee: $0 Expiration: n/a. Franchisors must complete and file a Business Opportunity Exemption Notice (Texas Form 2703) with the Texas Secretary of State and pay a one-time filing fee of $25 prior to offering or selling a franchise in Texas.Many franchisors want to avoid any costly mistakes, so they request help from an accomplished franchise ...

What Is the Texas Franchise Tax? 5 Things You Should Know

Over the last two years, the number of business affected by the Texas franchise tax has increased rapidly. With thousands of companies still working through their sales tax compliance, many are unsure of what this new liability means.

Texas Franchise Law | Vinson Franchise Law Firm

Summary of Texas laws on franchising by an experienced, specialized franchise law firm.

Texas Franchise Tax - Texas Secretary of State

The Texas franchise tax is a privilege tax imposed on each taxable entity chartered/organized in Texas or doing business in Texas. Reporting Change for Passive Entities Effective for franchise tax reports originally due on or after Jan. 1, 2011, a passive entity that is registered (or required to be registered) with either the Texas Secretary … Continue reading "Texas Franchise Tax"

Texas Business Licenses & Permits - Greg Abbott

Texas Business Licenses & Permits - Greg Abbott

What is franchise tax in Texas?

The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.

When are Texas franchise tax returns due 2021?

Due to statewide inclement weather in February 2021, the Texas Comptroller of Public Accounts is automatically extending the due date for 2021 Texas franchise tax reports to June 15, 2021, consistent with the Internal Revenue Service (IRS). See Comptroller Hegar’s press release.

When is nexus due in Texas?

The Comptroller's office has amended Rule 3.586, Margin: Nexus, for franchise tax reports due on or after Jan. 1, 2020. A foreign taxable entity with no physical presence in Texas now has nexus if, during any federal accounting period ending in 2019 or later, it has gross receipts from business done in Texas of $500,000 or more. ...

Do franchise tax filers get a reminder?

Most franchise tax filers will receive an email in lieu of a mailed reminder to file or seek an extension. If we do not have your email address on file (if you are a first-year filer, for example), we will mail a reminder notice to you.

When is Texas franchise tax due?

A Texas entity registered with the SOS on Dec. 20, 2020. It became subject to franchise tax on its registration date. So, on its 2021 “first annual” franchise tax report, it enters 12/20/2020 as its accounting year begin date.

When is Texas SOS registration?

A Texas entity registered with the SOS on Dec. 20, 2020.

What is an unregistered entity?

To end the franchise tax reporting responsibility of an unregistered entity (i.e., an entity not registered with the SOS) that is not or is no longer subject to franchise tax, the unregistered entity must do the following with the Texas Comptroller of Public Accounts: satisfy all filing requirements through the date it was no longer subject to ...

What happens when franchise tax reports are filed?

When franchise tax reports are filed or payments are made, sometimes errors or omissions occur. Our office sends notices letting the taxpayer know that there is a problem with the account.

What is SOS in Texas?

An entity registered with the Texas Secretary of State (SOS) must satisfy all state tax filing requirements before it can reinstate, terminate, merge or convert its business. This applies to both Texas-formed and out-of-state-formed entities.

When does the SOS start in Texas?

An out-of-state-formed entity registers with the SOS July 31, 2020, but it sent employees to Texas on June 19, 2020, to submit bids for the new construction contracts it won. This entity enters 06/19/2020 as its accounting year begin date for its “first annual” franchise tax report.

When does the franchise tax year end for 2021?

An entity that is terminating this year entered the accounting year end date of 12/31/2020 on its 2021 annual franchise tax report. On its 2021 final franchise tax report, it will enter its accounting year begin date as 01/01/2021. Accounting Year End Date.

Earn Money Selling Franchises

Do you love helping people? Does the idea of being your own boss appeal to you? A career as a Franchise Consultant lets you have it all: a flexible, home-based business with incredible earning potential. And here’s the best part—your work will make a difference! IFPG provides:

Learn More About IFPG

IFPG Consultants have one common goal: helping aspiring entrepreneurs realize their dreams of business ownership.

Schedule a Free Tour with IFPG

Tell us a bit about you... I'm Interested in Franchise Consultant Training I'm a Franchise Consultant I'm a Franchisor I'm a Vendor

Non-Registration States

The following States do not require filing or registration to be able to sell Franchises in the State. They only require that the Franchisor follow the FTC Guidelines and have an approved FDD.

Filing States

A Filing State is one that requires the Franchisor to file and pay a fee, but does not require the Franchisor to submit documents and seek approval to sell Franchises, like a registration State.

How many types of franchise state registrations are there?

There are (3) primary franchise state registration types, which could change at any time so please refer to each state’s current rules & regulations. The three primary types of franchise state registrations are as follows:

What is the filing state for franchises?

Filing States: A filing state is one that requires the franchisor to file and pay a fee, but does not require the franchisor to submit documents and seek approval to sell franchises, like a registration state. Connecticut is a franchise filing state and has a franchise filing fee of $400. Florida is a franchise filing state ...

What is the franchise fee in South Carolina?

South Carolina is a franchise filing state and has a filing fee of $100. Texas is a franchise filing state and has a filing fee of $25. Utah is a franchise filing state and has a filing fee of $100.

What is the franchise fee in Connecticut?

Connecticut is a franchise filing state and has a franchise filing fee of $400. Florida is a franchise filing state and has a franchise filing fee of $100. Kentucky is a franchise filing state and has a franchise filing fee of $0. Maine is a franchise filing state and has a filing fee of $25.

What is accurate franchising?

Accurate Franchising consultants provide strategic planning, sales support/training, marketing, operations, legal, financing and real estate assistance – all designed to help business owners grow. To provide the personalized and time-intensive consultation required, Accurate Franchising currently limits the program to five clients at a time.

Which states do not require registration to sell franchises?

They only require that the franchisor follow the FTC guidelines and have an approved FDD. Alabama. Alaska.

Do you need a franchise disclosure document to sell in a state?

These states require registration and approval of Franchise Disclosure Document prior to selling in or from the state. These fees can and may change depending on the state regulators.

What is a business opportunity in Texas?

The definition of a “business opportunity” under the Texas Business Opportunity Act is broad and includes franchise relationships. However, if you maintain a current and valid FDD and are in compliance with the Federal Franchise Rule ( learn more about the Federal Franchise Rule) and the FTC’s FDD disclosure requirements, you may claim an exemption to the business opportunity laws. Once an exemption notice is filed, you will be in compliance with Texas’s business opportunity laws.

How much does it cost to file a FDD in Texas?

Texas is a Franchise Filing State. The one-time Texas FDD filing fee is $25.

What is an exemption notice in Texas?

By filing an exemption notice, you are certifying that you have a properly issued Franchise Disclosure Document (FDD) that complies with the Federal Franchise Rule. Once you file your one-time exemption notice you may sell franchises in Texas under a properly issued and compliant FDD.

What is the Texas Business Opportunity Act?

Texas Business Opportunity Act – This is a link to the actual text of the Texas Business Opportunity Act as published by the Texas Secretary of State. The Act defines what constitutes a business opportunity, registration and disclosure requirements imposed on sellers of business opportunities , and the exemption for franchisors.

What is an authorized signature?

Authorized signature affirming that your franchise offering is in compliance with the Federal Franchise Rule and regulations issued by the FTC; and

Is Texas a franchise state?

Texas has not enacted franchise specific laws and is not a franchise registration state. However, Texas has enacted Business Opportunity Laws and, before offering or selling a franchise in Texas, you must first file a one-time Business Opportunity Exemption Notice with the Texas Secretary of State. By filing an exemption notice, you are certifying ...