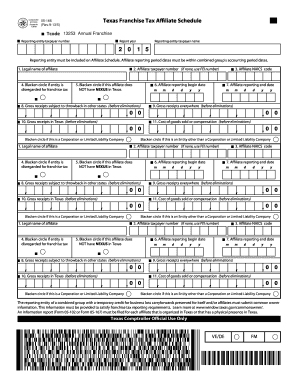

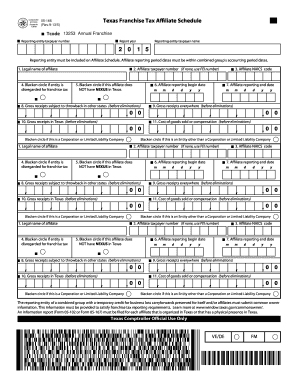

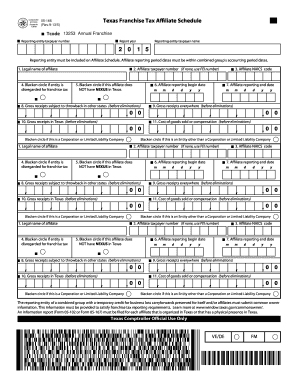

If this affiliate is a disregarded entity for federal income tax reporting purposes, the reporting entity may blacken this circle and treat the entity as disregarded for franchise tax reporting purposes. Blackening this circle means that the disregarded entity will not unwind its operations from its “parent” entity and

Full Answer

Do I have to pay taxes with affiliate marketing?

You may pay corporate tax if your affiliate-marketing company is incorporated. You will not pay any federal tax as a limited liability company, though you will have to file an informational return. As owner of the limited liability company, you will pay individual income tax on the income earned from your company.

Is this refund taxable?

You are not required to report the refund as income if you didn’t itemize your deductions on your federal tax return the tax year for which you received the refund. Example: You received a refund of $300 in 2021 for your overpayment of taxes in 2020 and took the standard deduction. You received a form 1099-G that reflects the $300 refund.

Are franchise fees taxable in Texas?

Tax vs. Fees – thin Texas and the 5 Judicial Circuit 5th Circuit Court of Appeals held that Cable franchise fees are “FEES,” NOT TAXES Franchise fees are not a tax, however, but essentially a form of rent or fee: the price or fee paid to rent use of public right-of-ways. See, e.g., City of St. Louis v.

Can I pay the Franchise Tax Board online?

Use Web Pay to pay your taxes online from your bank account. No registration required. Pay today or schedule payments up to one year in advance. Consequently, does Franchise Tax Board take credit cards?

What is franchise tax in Texas?

The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.

When are Texas franchise tax returns due 2021?

Due to statewide inclement weather in February 2021, the Texas Comptroller of Public Accounts is automatically extending the due date for 2021 Texas franchise tax reports to June 15, 2021, consistent with the Internal Revenue Service (IRS). See Comptroller Hegar’s press release.

How much is the penalty for filing taxes after the due date?

Penalties and Interest. A $50 penalty is assessed on each report filed after the due date. If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed. If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

Do franchise tax filers get a reminder?

Most franchise tax filers will receive an email in lieu of a mailed reminder to file or seek an extension. If we do not have your email address on file (if you are a first-year filer, for example), we will mail a reminder notice to you.

What is a disregarded entity?

"Disregarded" describes when an entity is treated as a division or part of its owner. A disregarded entity does not file tax returns in its own name , but its activity is included in the return of its owner. The rules as to when an entity may be disregarded differ between federal and state tax reporting. Entities disregarded for federal income tax purposes are not disregarded for F&E taxes except for limited liability companies whose single member (SMLLC) is a corporation.

What is SMLLC in tax?

A SMLLC is disregarded for franchise, excise tax purposes when it is disregarded for federal income tax purposes, and its single member is a “corporation.”. A “corporation” in this context means any entity that is classified as a corporation for federal income tax purposes.

Can an entity be disregarded for federal income tax purposes?

Entities disregarded for federal income tax purposes are not disregarded for F&E taxes except for limited liability companies whose single member (SMLLC) is a corporation.

What is franchise tax in Texas?

Texas franchise tax is a “privilege tax” for doing business in Texas. Part of this privilege includes liability protections provided by state law. The franchise tax is administered by the Texas Comptroller of Public Accounts.

When are Texas franchise tax reports due?

Texas franchise tax reports are due in advance, not in arrears. This is easier explained with an example. Let’s say your Texas LLC is approved on August 5th 2019. So your LLC franchise tax reports are due the following year, by May 15th 2020. your LLC’s report year will be 2020.

What is a tiered partnership in Texas?

A Tiered Partnership election (for Texas franchise tax purposes) applies to an LLC that is in a parent/child relationship, also referred to as parent/subsidiary relationship.

What is the tax number of an LLC?

Your LLC’s Taxpayer Number is an 11-digit number that is issued by the Texas Comptroller. This number is used to identify your LLC for state tax obligations and filings. If you ever call the Comptroller’s Office, they’ll use your Taxpayer Number to lookup your LLC. Also, when you use WebFile (the online filing system) you’ll need this number.

Do LLCs pay franchise tax in Texas?

Most LLCs don’t pay franchise tax, but still have to file. Again, about 90% of Texas LLCs don’t have to pay franchise tax. Your Texas LLC won’t have to pay franchise tax if either of the following are true: your LLC’s annualized total revenue for the tax year is below the “ No Tax Due Threshold “.

Can an LLC sue in Texas?

the Comptroller has the power to forfeit the right of your LLC to transact business in this state (as per section 171.251 and section section 171.252 of the Texas Tax Code), your LLC being denied the right to sue or defend itself in a Texas court,

Does Texas require LLC to file estimated tax returns?

No. Texas doesn’t require that your LLC file estimated tax reports or payments.

What Is a Disregarded Entity?

The term disregarded entity refers to a business entity that's a separate entity from its owner, but that is considered to be one in the same as the owner for federal tax purposes. The business owner essentially wants the IRS to "disregard" the fact that the business is a separate entity when it comes time to file taxes.

Why is a single member LLC considered a disregarded entity?

Single-member LLCs are viewed as disregarded entities because the LLC is a separate entity from its sole member for liability purposes and is registered with the state or state where it conducts business.

Why are multimember LLCs not disregarded entities?

Multimember LLCs are not disregarded entities because they do pay business taxes as a partnership does. They still benefit from liability protection, but the company is required to pay income taxes. Likewise, partnerships are not disregarded entities.

Why is it important for a business to separate from its owner?

Generally, businesses are separate entities from their owners. For liability purposes, the separation is an important aspect for business owners.

Does filing federal taxes as a disregarded entity change the way you file?

If you decide to file federal taxes as a disregarded entity, this does not change the way that you file employment taxes. You'll still need to file any employment or payroll taxes just as you did before, using your EIN. Deciding to become taxed as a disregarded entity does not have an impact on types of taxes besides federal taxes.

Is a business entity separate from its owner?

Many of the most common business entities are separate from their owners, including corporations, limited liability companies ( LLCs ), and partnerships. The vast majority of businesses are taxed separately from the business owner; the business and its owner use completely different tax forms.

Is a sole proprietorship a pass through entity?

Currently, the only business entity that is a pass-through entity, where the business is not separate from the owner, is the sole proprietorship. Sole proprietors file their Schedule C business tax form as part of their own personal income taxes. However, unlike other business forms, there isn't any liability protection offered to sole proprietors.