Total gross assets are “total assets” reported on U.S. Form 1120 Schedule L for tax year ending prior to filing the Delaware franchise tax report. Thus, for a calendar-year taxpayer, total assets reflected in a corporation’s March 1, 2021 Delaware franchise tax filing should tie to Form 1120, Schedule L for the tax year ending in 2020.

How do I calculate Delaware franchise tax bill?

Assumed Par Value Capital Method With this method your Delaware Franchise Tax bill is calculated based on issued shares, authorized shares and total gross assets. Divide total gross assets by total issued shares. This will give you your assumed par value. Multiply your assumed par value by your total authorized shares.

How much tax do you pay on authorized shares in Delaware?

Authorized Share Method 5000 shares or less, pay the minimum $175 tax. 5001 to 10,000 shares pay $250 tax. For each additional 10,000 shares, add $75 to the tax total, with a maximum franchise tax of $180,000. So if your Delaware corporation has a million authorized shares, your annual franchise tax will be approximately $7,500.

How much does it cost to file Delaware business taxes?

Payment can be submitted with an electronic check or credit card. Once payment is submitted, you're finished. The minimum Delaware franchise tax fee is $175 with a $50 filing fee. The minimum Delaware franchise tax and annual report payment is $225 for domestic corporations. The Delaware franchise tax for this business is simple.

How much does it cost to open a franchise in Delaware?

Once payment is submitted, you're finished. The minimum Delaware franchise tax fee is $175 with a $50 filing fee. The minimum Delaware franchise tax and annual report payment is $225 for domestic corporations. The Delaware franchise tax for this business is simple.

How do I avoid franchise tax in Delaware?

There are ways to reduce your Delaware franchise costs in certain circumstances. To reduce the taxes paid by a startup, use the Assumed Par Value method. This method calculates the taxes by total assets. As long as your issued shares constitute a third to half of your authorized shares, this method will save you money.

What is included in Delaware annual report?

Your corporation's Delaware annual report is pre-populated with certain information including the exact legal name of the entity, total number of authorized shares, class and par value of the shares and a breakdown of the franchise tax and fees due.

Are franchise taxes based on income?

A franchise tax is a government levy (tax) charged by some US states to certain business organizations such as corporations and partnerships with a nexus in the state. A franchise tax is not based on income. Rather, the typical franchise tax calculation is based on the net worth of or capital held by the entity.

Who is subject to Delaware franchise tax?

Delaware Division of Corporations1. If you form a corporation in Delaware, you must pay an annual Franchise Tax for the privilege of incorporating in Delaware. This Franchise Tax is payable to the Delaware Division of Corporations. The fee is based on the number of authorized shares within the corporation.

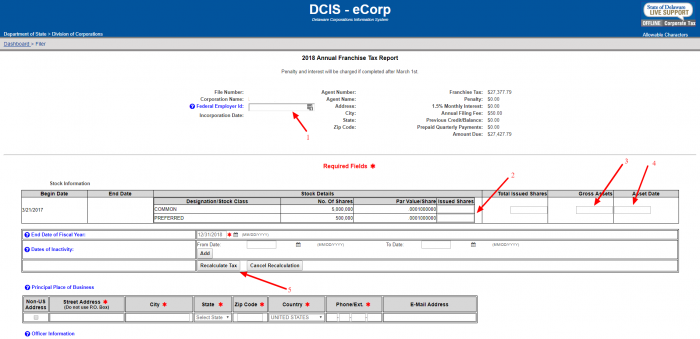

How do I fill out an Annual Report in Delaware?

The Delaware Annual Report and/or franchise tax must be filed online through the Delaware Corporations Information System.On the state website, you'll need to enter your 7-digit Business Entity File Number. ... Then, click “Continue.” This will automatically begin the filing process.

Do I have to pay Delaware franchise tax?

Any corporation that is incorporated in Delaware (regardless of where you conduct business) must file an Annual Franchise Tax Report and pay Franchise Tax for the privilege of incorporating in Delaware. Franchise Taxes and annual Reports are due no later than March 1st of each year.

What are taxable gross receipts?

Gross receipts are the total amounts the organization received from all sources during its annual accounting period, without subtracting any costs or expenses. Page Last Reviewed or Updated: 20-May-2022.

How is franchise tax calculated?

Divide your total gross assets by your total issued shares carrying to 6 decimal places. ... Multiply the assumed par by the number of authorized shares having a par value of less than the assumed par. ... Multiply the number of authorized shares with a par value greater than the assumed par by their respective par value.More items...

What are the typical criteria for nexus for income franchise tax purpose?

Nexus is typically created for income tax purposes if an entity: Derives income from sources within the state. Owns or leases property there. Has employees there who are engaged in activities that exceed "mere solicitation"

How is Delaware corporate tax calculated?

Please keep the following in mind: Corporate Income Tax Rate: 8.7% of federal taxable income allocated and apportioned to Delaware based on an equally weighted three-factor method of apportionment.

Does an LLC have to pay franchise tax in Delaware?

Yes, franchise tax fees are a requirement by all Delaware LLCs regardless of their business activities. This is a fee charged by the state for the privilege of maintaining a business within its jurisdiction and keeps your company in good standing and not related to the annual revenue of the business.

Who must pay Delaware gross receipts tax?

the seller ofDelaware's Gross Receipts Tax is a tax on the total gross revenues of a business, regardless of their source. This tax is levied on the seller of goods or services, rather than on the consumer. Gross receipts tax rates currently range from . 0945% to .

Does Delaware require annual reports?

All corporations incorporated in the State of Delaware are required to file an Annual Report and to pay a franchise tax. Exempt domestic corporations do not pay a tax but must file an Annual Report. The filing fee for filing an Annual Report or Amended Annual Report for exempt domestic corporations is $25.

Can I get a copy of a Delaware Annual Report?

If you wish to order a copy of an annual report, please call 302-739-3073 for more information. NOTE: Alternative entities (Limited Liability Companies, Limited Partnerships, and General Partnerships) do not currently file annual reports. Annual reports are required for domestic and foreign corporations only.

What is the Delaware annual franchise tax?

$300The Franchise Tax for a Delaware LLC or a Delaware LP is a flat annual rate of $300. A non-stock/non-profit company is considered exempt by the State of Delaware. This type of company does not pay the standard annual Delaware Franchise Tax, but must still file and pay the annual report fee of $25 per year.

Does Delaware require a statement of information?

Required Statement of Information Domestic Stock Corporations & Limited Liability Companies must file a complete statement of information (Annual Report) at the end of each year of operation.

How much is Delaware franchise tax?

Effective January 1, 2018, a domestic stock or non-stock for profit corporation incorporated in the State of Delaware is required to pay annual franchise tax. The minimum tax is $175.00, for corporations using the Authorized Shares method and a minimum tax of $400.00 for corporations using the Assumed Par Value Capital Method.

How to multiply authorized shares?

Multiply the number of authorized shares with a par value greater than the assumed par by their respective par value. Example: 250,000 shares $5.00 par value = $1,250,000

When are Delaware franchise taxes due?

Franchise Taxes and annual Reports are due no later than March 1st of each year. An annual Franchise Tax Notification is mailed directly to the corporation’s registered agent. Blank Franchise Tax Returns are not available. The Delaware Division of Corporations will require all Annual Franchise Tax Reports and alternative entity taxes ...

When are Delaware corporation tax returns due?

Franchise Taxes and annual Reports are due no later than March 1st of each year.

Do corporations have to file taxes in Delaware?

Corporations incorporated in Delaware but not conducting business in Delaware are not subject to corporate income tax, [30 Del.C, Section 1902 (b) (6)] but do have to pay Franchise Tax administered by the Delaware Department of State. Any corporation that is incorporated in Delaware (regardless of where you conduct business) must file an Annual ...

Do Delaware corporations have to file annual reports?

All corporations incorporated in the State of Delaware are required to file an Annual Report and to pay a franchise tax. Exempt domestic corporations do not pay a tax but must file an Annual Report. The Annual Report filing fee for all other domestic corporations is $50.00 plus taxes due upon filing of the Annual Report.

What are Delaware franchise taxes?

A franchise tax, sometimes called a privilege tax, is a fee you pay for the “privilege” of doing business in a certain state.

Who has to pay the franchise tax?

You must pay the Delaware franchise tax if your Delaware business is one of the following:

What is the Delaware chapter 8 tax?

Title 8 Chapter 5 § 501 of the Delaware code requires that every corporation now existing or hereafter to be incorporated under the laws of this State, shall pay an annual tax, for the use of the State, by way of license for the corporate franchise as prescribed in this chapter.

When are Delaware tax notices issued?

All Tax Notices are printed in December of the year that tax is due and sent to the Registered Agent. The Registered Agent is designated by the corporation through the initial formation or a filing submitted by the corporation that designates another Delaware Registered Agent. Please contact your Delaware Registered Agent if you require another copy of your notice.

What is chapter 5 503?

Title 8 Chapter 5 § 503 states that all corporations accepting the provisions of the Constitution of this State and coming under Chapter 1 of this title , and all corporations which have heretofore filed or may hereafter file a certificate of incorporation under said chapter, shall pay to the Secretary of State as an annual franchise tax whichever of the applicable amounts as prescribed by Title 8 Chapter 5 § 503 (1) and (2).

What is the penalty for failure to file annual franchise tax report?

Title 8 Chapter 5 § 502 (c) states that a penalty of $200.00 is assessed for failure to file the Annual Franchise Tax report by March 1st. Title 8 Chapter 5 § 504 (c) states if the tax of any corporation remains unpaid after the due dates established by this section, the tax shall bear interest at the rate of 1.5 percent for each month or portion thereof until fully paid.

Do Delaware corporation taxes continue to accrue?

Taxes continue to accrue on a corporation until a legal document filing is received and filed with the State of Delaware. The document needs to officially terminate the existence of the corporation in the State of Delaware. (i.e. Certificate of Dissolution, Certificate of Merger, etc…)

Can a large corporate filer be recalculated?

No, if it has been identified as a Large Corporate Filer the Taxes cannot be recalculated, it is a flat fee. However, pro-rations apply when terminating existence.

How much is franchise tax in Delaware?

For corporations using the Authorized Shares Method, the minimum franchise tax is $175 and the maximum franchise tax is $200,000. For corporations using the Assumed Par Value Capital Method, the minimum franchise tax is $350 and the maximum tax is $200,000 ; however, for the 2018 tax year, the minimum will increase to $400.

When are Delaware franchise taxes due?

The Delaware annual report and franchise tax payment are both due by March 1. Your notification of annual report and franchise tax due is sent to a corporation's registered agent in December or January of each year. Delaware requires these reports to be filed electronically.

What is the franchise tax for 2018?

For corporations using the Assumed Par Value Capital Method, the minimum franchise tax is $350 and the maximum tax is $200,000; however, for the 2018 tax year, the minimum will increase to $400.

What is franchise tax in California?

The California franchise tax, for example, is equal to the larger of your California net income multiplied by the 8.84 percent tax rate or the $800 minimum tax.

What is the penalty for not filing taxes in Delaware?

The penalty for failing to make a timely filing and payment is $200 plus penalty interest of 1.5 percent per month on the unpaid tax balance (and your entity will not be in good standing with Delaware until paid, which can cause delays if your company is anticipating a financing or sale).

How much is the additional 10,000 authorized shares?

and for each additional 10,000 authorized shares or portion thereof = add $75 (to be increased to $85 effective for the 2018 tax year)

Is Delaware a franchise state?

If you are a startup that has chosen Delaware as its state of incorporation, you are likely aware that you are subject to Delaware franchise tax. While this article provides an overview of the Delaware franchise tax, startups that are based in other states or that conduct business in other states should be aware that they may also be subject to franchise taxes in those other states. While the typical franchise tax is based on a corporation's net worth or capital, the tax can also be based on other criteria such as income or gross receipts.

How much is franchise tax in Delaware?

5001 to 10,000 shares pay $250 tax. For each additional 10,000 shares, add $75 to the tax total, with a maximum franchise tax of $180,000. So if your Delaware corporation has a million authorized shares, your annual franchise tax will be ...

Do foreign corporations pay annual tax?

Foreign Corporations, Nonprofits, Limited Liability Companies, General Partnerships, Limited Partnerships and Limited Liability Partnerships pay a flat-rate annual fee or tax. Corporations formed in Delaware are a whole different story. There are two methods that corporations can figure their annual franchise tax.

Key Observations

Authorizing excessive shares of stock can result in a higher annual franchise tax liability. A large widely held public company might have difficulty reducing their authorized and/or issued shares but a start-up technology or life sciences company may have more flexibility.

Filing Deadline

A corporation that is incorporated in Delaware must file an Annual Report online at https://corp.delaware.gov/paytaxes/ by March 1 each year and pay any taxes that are due.

Annual Report Filing Fee

The Delaware Annual Report filing fee for a non-exempt domestic corporation is $50.00 per year.

Annual Report Franchise Tax

In addition to the filing fee, a domestic corporation (refers to a corporation incorporated in Delaware) must pay a Delaware Franchise Tax each year by March 1. There are two methods to calculate the tax: 1) the Authorized Shares Method; and 2) the Assumed Par Value Capital Method. A corporation has a choice as to which method to use.

Large Corporate Filer

A Large Corporate Filer is an entity that had a class or series of stock listed on a national securities exchange and reported in its financial statements, prepared in accordance with U.S. GAAP or International Financial Reporting Standards (IFRS), and included in its most recent annual report filed with the U.S.

Estimated Tax

Taxpayers owing $5,000.00 or more must pay estimated taxes in quarterly installments with 40% due June 1, 20% due by September 1, 20% due by December 1, and the remainder due March 1.

Calculating the Delaware Franchise Tax

The following table is used to compute a corporation’s Delaware Franchise Tax using the Authorized Shares Method: