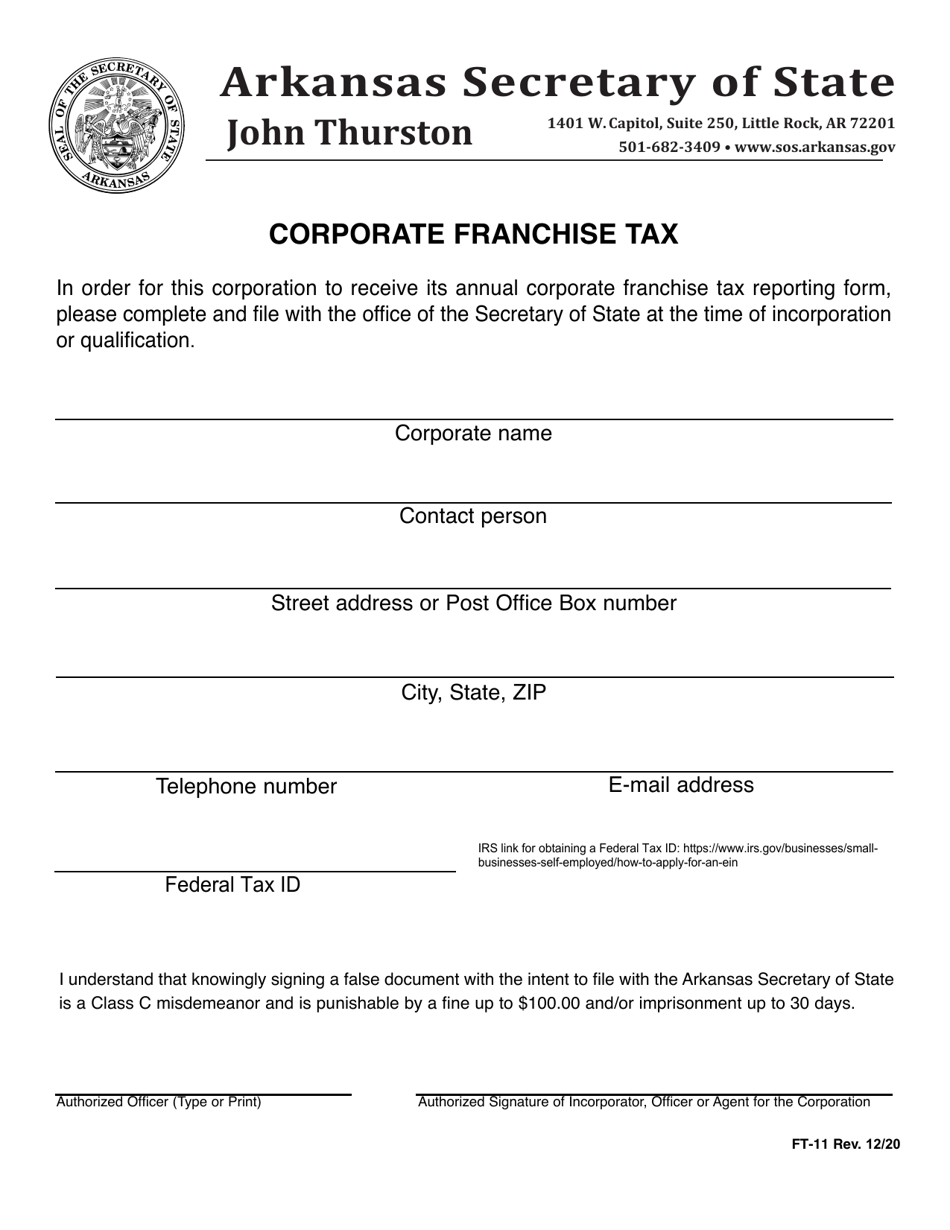

Corporate Franchise Tax

| Franchise Tax Type | Current Rate |

| Corporation/Bank with Stock | 0.3% of the outstanding capital stock; $ ... |

| Corporation/Bank without Stock | $300 |

| Limited Liability Company | $150 |

| Insurance Corporation Legal Reserve Mutu ... | $300 |

Which states have franchise tax?

The states that currently have franchise taxes are:

- Alabama

- Arkansas

- Delaware

- Georgia

- Illinois

- Louisiana

- Mississippi

- Missouri

- New York

- North Carolina

How to file and pay sales tax in Arkansas?

- Taxpayer is registered with the state for the type of tax that is being transmitted and has been issued an account ID.

- Tax payment is transmitted in the format required by Arkansas.

- Tax payment is transmitted with the correct tax type code for the specific type of tax being paid.

Are services taxable in Arkansas?

While Arkansas' sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes. This page describes the taxability of services in Arkansas, including janitorial services and transportation services. To learn more, see a full list of taxable and tax-exempt items in Arkansas .

Are food and meals taxable in Arkansas?

However, food sales do not fall within the general sales tax. Arkansas has a lower food tax that is separate from the general sales tax. The food tax only applies to unprepared foods. That means groceries typically fall within the food tax rate. On the other hand, fast food and other restaurant foods fall within the general sales tax.

How much are Arkansas franchise taxes?

Corporate Franchise TaxFranchise Tax TypeCurrent RateCorporation/Bank without Stock$300Limited Liability Company$150Insurance Corporation Legal Reserve Mutual, Assets Less Than $100 million$300Insurance Corporation Legal Reserve Mutual, Assets Greater Than $100 million$4005 more rows

Who pays franchise taxes in Arkansas?

A.C.A. § 26-54-101 et al., also known as the “Arkansas Corporate Franchise Tax Act of 1979”, requires all Corporations, LLC's, Banks, and Insurance Companies registered in Arkansas to pay an annual franchise tax.

What is the meaning of franchise tax?

The franchise tax is a kind of tax that is imposed by state law on businesses or corporations chartered within that state. The states charge this tax for the right of the business or corporation to exist as a legal entity and to do business within a particular state.

How is Arkansas franchise tax calculated?

Arkansas LLCs and corporations without stock will pay a fixed amount for their franchise tax. Corporations with stock, however, will pay 0.3% of their total outstanding capital stock OR $150 – whichever is greater.

What happens if you don't pay franchise tax Arkansas?

If you don't pay your Arkansas Franchise Tax for three years, your LLC will enter revoked status.

How much are LLC taxes in Arkansas?

All LLCs operating in Arkansas must file an annual report and pay a flat-rate tax of $150 each year. The $150 tax and the annual report together are known as the Annual LLC Franchise Tax Report.

Why do we pay franchise tax?

The term franchise tax refers to a tax paid by certain enterprises that want to do business in some states. Also called a privilege tax, it gives the business the right to be chartered and/or to operate within that state.

How can franchise tax be avoided?

One way to avoid paying franchise tax is to operate as a sole proprietorship or general partnership—but you would have to sacrifice the liability protection that LLCs and corporations enjoy. Some charities and nonprofits qualify for an California Franchise Tax Exemption.

What is an example of a franchise tax?

For example, if a corporation does only 70% of its business in that state, then tax will be calculated on a 70% margin. For a corporation that operates entirely in the state will pay franchise tax on 100% of profits. The margin calculated is then taxed as per applicable tax rates of the state.

Is Arkansas getting rid of state income tax?

Rates. The top individual income tax rate in Arkansas is reduced from 5.5% to 4.9% for tax years beginning on or after January 1, 2022, and the corporation income tax rate imposed on both domestic and foreign corporations is reduced from 5.9% to 5.3% for tax years beginning on or after January 1, 2023.

How do I pay my business taxes in Arkansas?

New users sign up at www.atap.arkansas.gov or click on the ATAP link on our web site www.dfa.arkansas.gov. ATAP is a web-based service that allows taxpayers, or their designated representative, online access to their tax accounts and related information.

What is Arkansas state income tax?

Arkansas has a graduated individual income tax, with rates ranging from 2.00 percent to 5.50 percent. Arkansas also has a 1.0 to 5.9 percent corporate income tax rate.

How do I pay my business taxes in Arkansas?

New users sign up at www.atap.arkansas.gov or click on the ATAP link on our web site www.dfa.arkansas.gov. ATAP is a web-based service that allows taxpayers, or their designated representative, online access to their tax accounts and related information.

Do nonprofits pay franchise tax in Arkansas?

Other Business Entity Types Other business entities, nonprofits, limited partnerships (LPs), limited liability partnerships (LLPs), and limited liability limited partnerships (LLLPs) must file an annual report. However, they do not pay a franchise tax.

How do I pay sales tax for my business in Arkansas?

You have three options for filing and paying your Arkansas sales tax:File online – File online at the Arkansas Taxpayer Access Point (ATAP). You can remit your payment through their online system.File by mail – You can use Form ET-1 and file and pay through the mail. ... AutoFile – Let TaxJar file your sales tax for you.

What are taxes in Arkansas?

Arkansas has a 6.50 percent state sales tax rate, a max local sales tax rate of 6.125 percent, and an average combined state and local sales tax rate of 9.47 percent. Arkansas's tax system ranks 44th overall on our 2022 State Business Tax Climate Index.

What is non-stock corporation?

Non-stock corporations are for-profit corporations that do not issue stock to shareholders. They must pay a flat-rate Annual Franchise Tax of $300.

Where to file Arkansas franchise tax?

Businesses can file their reports and pay the Annual Franchise Tax online via the Arkansas Secretary of State website . Alternatively, business owners can file by mail to the Business and Commercial Services Division at:

What happens if a business fails to file a tax return?

If a business fails to file or files past the May 1 deadline, it may be subject to penalties, interest, or worse!

Does CorpNet handle annual reports?

While the state’s forms are not overly complicated, businesses can save time and ensure their paperwork is completed accurately and quickly by letting CorpNet handle the annual report filings for them. What busy business owners can’t benefit from having one less task on their plate?

When do you have to pay franchise tax?

Businesses may file and pay their Annual Franchise Tax as early as January 1.

Can Arkansas revoke a company's franchise?

Worst Case: The state might even revoke a company’s authority to do business in Arkansas if it continues to ignore its franchise tax reporting and payment responsibilities.

Who is Nellie Akalp?

Nellie Akalp is an entrepreneur, small business expert, speaker, and mother of four amazing kids. As CEO of CorpNet.com, she has helped more than half a million entrepreneurs launch their businesses. Akalp is nationally recognized as one of the most prominent experts on small business legal matters, contributing frequently to outlets like Entrepreneur, Forbes, Huffington Post, Mashable, and Fox Small Business. A passionate entrepreneur herself, Akalp is committed to helping others take the reigns and dive into small business ownership. Through her public speaking, media appearances, and frequent blogging, she has developed a strong following within the small business community and has been honored as a Small Business Influencer Champion three years in a row.

What is an Arkansas Franchise Tax Report?

Regardless of business activity or income, all Arkansas limited liability companies (LLCs) must file reports and pay $150 annually. Combined, these two aspects become the annual LLC franchise tax report.

How to pay Arkansas franchise tax?

You can submit payment as early as Jan. 1. To pay by mail, download the annual franchise tax PDF form. Make a check or money order out to the Arkansas Secretary of State and mail along with your paperwork.

What are the taxes on income?

The tax rates increase depending upon the higher amounts of income, with the breakdown as follows: 1 Net income up to $3,000 taxed at 1 percent 2 Net income from $3,001 to $6,000 taxed at 2 percent 3 Net income from $6,001 to $11,000 taxed at 3 percent 4 Net income from $11,001 to $25,000 taxed at 5 percent 5 Net income from $25,001 to $100,000 taxed at $940, plus 6 percent of any amount more than $25,000 6 Net income of more than $100,000 taxed at $5,440, plus 6.5 percent of the amount more than $100,000

What is the minimum franchise tax for an LLC?

Income goes to each LLC member, and these members pay federal and state taxes. LLCs also must pay the minimum corporation franchise tax of $150.

How much tax do you pay for a business?

In addition, tax rates typically vary among each state, with corporate rates ranging from 4 to 9 percent. A few states don't have corporate income taxes.

What is the tax rate for income from $25,001 to $100,000?

Net income from $25,001 to $100,000 taxed at $940, plus 6 percent of any amount more than $25,000

When are Arkansas business taxes due?

If your tax year follows the calendar year, your payment is due March 15. As stated, Arkansas businesses must pay taxes, and the type they pay depends upon their franchise type: Arkansas corporations: This type of entity must submit the state's corporation franchise tax and graduated corporate income tax.

How to form a business in Arkansas?

Business corporations, nonprofit corporations, professional corporations, limited partnerships, limited liability partnerships and limited liability companies are formed in Arkansas by filing with the Business Services Division of the Office of Secretary of State. The above entities that form in other states must file with the Arkansas Secretary of State as “foreign” entities in order to transact business in the state.

What does "issued corporate name" mean?

The issuance of a corporate name by the Secretary of State means that the name is distinguishable for filing purposes on the records of the Corporations Division. (A.C.A. 4-27-401)

What is a business filing in Arkansas?

Any filing related to a business entity that is incorporated or organized under the laws of the state of Arkansas.

What is franchise tax in Arkansas?

The franchise tax is a privilege tax imposed on corporations, including banking corporations and limited liability companies that are incorporated in Arkansas. The tax is also imposed on foreign corporations and limited liability companies that transact business in Arkansas.

How much does it cost to get a certificate of authority?

The filing fee is $300.00 for business corporations and $300.00 for nonprofit corporations and can be filed online.

What does the Arkansas Code stand for?

It stands for “Arkansas Code Annotated” and is often referred to as “the Code.” In short, it is Arkansas state law. Laws regarding corporations, LLCs and partnerships are found in Title 4 of the Code. The BCS Division has established links herein to many of the Code sections that may be relevant to our customers.

What is a registered agent in Arkansas?

The registered agent is the “mailbox” for the corporation. He or she is the person or entity designated by the corporation to receive any service of legal action or other official communication on its behalf. The registered agent may or may not be an owner, shareholder or officer of the corporation. Many corporations use their attorney or a professional corporate service company for this service. The registered agent’s address must be a street address in Arkansas, and the agent must be located at that address. Please review A.C.A. 4-27-501 (profit) or 4-33-501 (nonprofit). A post office box or “mail drop” may not be used as the registered agent address.