What is the minimum franchise tax?

$800 Minimum Franchise Tax Overview. The $800 minimum franchise tax is the minimum franchise fee that a corporation will have to pay to operate in California, which is similar to the tax situation in many states. What is not similar, however, is the structure and rate of this tax.

What is the definition of franchise tax?

The term franchise tax refers to a tax paid by certain enterprises that want to do business in some states. Also called a privilege tax, it gives the business the right to be chartered and/or to...

What is the Tennessee franchise tax rate?

The franchise tax rate is 25 cents per $100, or major fraction thereof, applied to the greater of a taxpayer’s net worth or the book value o f property owned or used in Tennessee at the close of the tax year covered by the required return.

What type of tax is excise tax?

- Excise tax is an indirect tax imposed on the manufacturing, selling, or license of particular products and services. ...

- The seller or producer pays excise duty that is later embedded in the market price paid by the consumer.

- It can be filed both online and offline. ...

How do I avoid franchise tax in Tennessee?

Seventeen different types of entities are exempt from the franchise and excise taxes.Industrial Development Corporations.Masonic lodges and similar lodges.Regulated Investment Companies owning 75% in United States, Tennessee, or local bonds.Federal and state credit unions.Venture Capital Funds.More items...

Who is exempt from TN franchise and excise tax?

There are some exemptions to filing franchise and excise tax. For example, certain limited liability companies, limited partnerships and limited liability partnerships whose activities are at least 66% farming or holding personal residences where one or more of its partners or members reside are exempt.

Who is subject to Tennessee franchise tax?

All Corporations, LLCs, and Partnerships, regardless of their tax status with the IRS, are subject to the Tennessee Franchise tax and Tennessee Excise tax. The franchise tax has a minimum payment of $100. Franchise tax is figured at . 25% of the net worth of corporation or the tangible property.

Does a single member LLC pay franchise and excise tax in Tennessee?

A SMLLC will not be disregarded if its single member is not classified as a corporation for federal tax purposes. In such cases, the SMLLC will be treated as a separate entity for franchise and excise tax purposes, and it must file its own separate franchise and excise tax return.

What qualifies as doing business in Tennessee?

Tennessee's statutory definition of “doing business” is very broad and encompasses “any activity purposefully engaged in within Tennessee by a person with the object of gain benefit, or advantage.” Tenn.

Who must register to do business in Tennessee?

A standard business license is needed from your county and/or municipal clerk if your gross receipts are $10,000 or more. You are not allowed to operate until your required license is obtained and posted in your business' location.

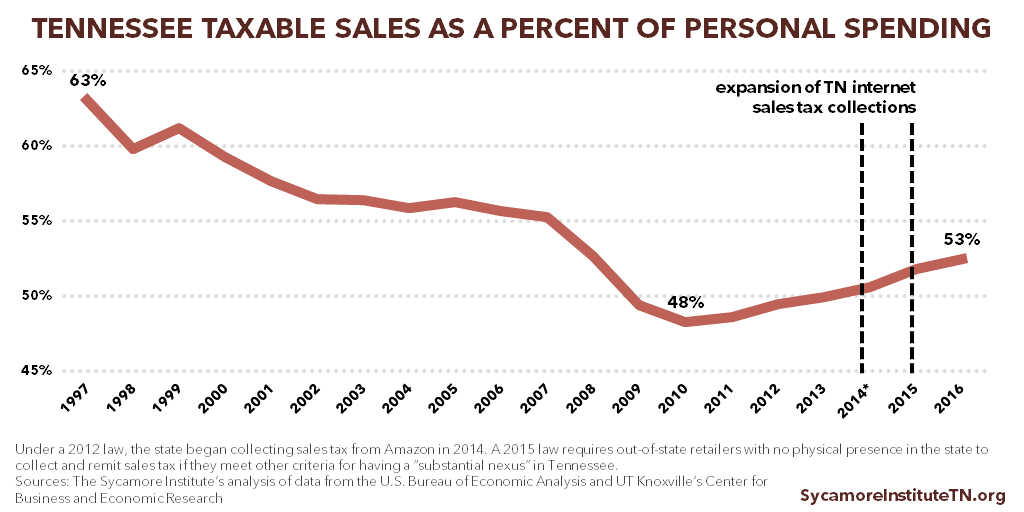

Who is exempt from Tennessee business tax?

Businesses with less than $10,000 in taxable sales sourced to a county are exempt from the state business tax in that county, and businesses with less than $10,000 in taxable sales sourced to a municipality are exempt from the municipality business tax in that municipality.

What is an excise tax example?

In general, an excise tax is a tax is imposed on the sale of specific goods or services, or on certain uses. Federal excise tax is usually imposed on the sale of things like fuel, airline tickets, heavy trucks and highway tractors, indoor tanning, tires, tobacco and other goods and services.

Who must pay TN business tax?

Business tax consists of two separate taxes: the state business tax and the city business tax. With a few exceptions, all businesses that sell goods or services must pay the state business tax.

What taxes do LLC pay in Tennessee?

Tennessee LLC Taxes The franchise tax imposed on LLCs is 0.25 percent of the real and tangible worth or net worth of a property in the state of Tennessee (whichever is greater). The minimum payment for the state franchise tax is $100.

Do I have to renew my LLC Every year in Tennessee?

The State of Tennessee requires you to file an annual report for your LLC. You can mail in the report or complete it online at the Secretary of State website. You can download an annual report form already containing key information for your LLC from the SOS website.

How do I pay franchise tax in Tennessee?

Electronic Filing and Payment: All franchise and excise returns and associated payments must be submitted electronically. This can be accomplished by using the Tennessee Taxpayer Access Point (TNTAP). A TNTAP logon should be created to file this tax. Click here for help creating your logon.

Who is tax exempt in TN?

Any person 65 years of age or older having a total annual income below specific limits is completely exempt from the tax. Total annual income means income from any and all sources, including social security....Age 65 or Older with Limited Income.Tax Year(s)Single FilersJoint Filers2015 and after$37,000$68,0003 more rows

Do you pay franchise tax in Tennessee?

If you are a corporation, limited partnership, limited liability company, or business trust chartered, qualified, or registered in Tennessee or doing business in this state, then you must register for and pay franchise and excise taxes.

How do I get a farm tax exempt number in Tennessee?

Those who want to receive a certificate should fill out an application and file it with Revenue. Receipt of a certificate serves as the notice of sales tax-exempt status. Every fourth year, the Department of Revenue reissues agricultural certificates of exemption to all current exemption holders.

What is an obligated member LLC in Tennessee?

- An “Obligated member” is a member or partner of an obligated member entity. that is fully liable for the debts, obligations and liabilities of the entity, as. provided in Tenn. Code Ann. § 67-4-2008(b)-(d), and that has filed appropriate.

What is franchise tax in Tennessee?

The excise tax is 6.5% of the net taxable income. Net taxable income starts with federal taxable income and certain adjustments are applied to arrive at net taxable income for Tennessee purposes.

When are F&E taxes due?

The due date is 15 th day of the fourth month after year end or the extended due date of the accompanying federal tax return.

What percentage of gross income must be from passive investment income?

At least 66.67% of the entity’s gross income must either be from passive investment income or the combination of passive investment income and farming.

Is an LLC taxable?

The most common type of legal entity we encounter is the LLC. There are numerous exemptions for F&E purposes that allow an LLC to not be taxable. The most common exemptions are:

What is franchise tax in Tennessee?

Tennessee franchise tax is an annual tax paid upon the value of an entity's assets. Many states place a separate tax, known as a privilege or franchise tax, on certain types of businesses. This is usually a tax imposed for the right to do business in a given state.

What is franchise tax?

The franchise tax is an additional yearly tax levied on the value of that real property on top of the real property taxes the entities already pay. Most business owners have their own attitudes on how they approach franchise and excise taxes, except perhaps for those businesses with significant hard assets that are unduly impacted or ...

What is substantial nexus in Tennessee?

Substantial nexus includes a direct or indirect connection between the taxpayer and the state, with the taxpayer being required to pay these taxes. Examples of what counts as substantial nexus are:

What is a taxpayer in Tennessee?

A taxpayer who's organized or commercially active in Tennessee. A taxpayer with ongoing business activity in the state and who has gross receipts that are attributable to customers. A taxpayer who licenses intangible property to another party in Tennessee and who gets income from that use.

When did Tennessee change its tax rules?

In 1999, however, tax rules changed to extend these taxes to other entities, such as limited partnerships and limited liability companies. Previously, taxpayers who did business in Tennessee were subject to excise and franchise taxes.

How much is franchise tax?

The rate of franchise tax is 25 cents per $100 of value, so a business pays about $25 for every $10,000 worth of value. Due to this rather low rate, the total tax for an average company that doesn't own much expensive equipment isn't high, considering that the assets are valued at cost minus depreciation.

Do business owners look at excise taxes?

Many business owners look at excise and franchise taxes as the cost of doing business. They generally don't feel the expense is big enough to take efforts to avoid or minimize the cost of the tax. However, others use whatever means they can to minimize their tax.