Are franchise fees taxable in Texas?

Tax vs. Fees – thin Texas and the 5 Judicial Circuit 5th Circuit Court of Appeals held that Cable franchise fees are “FEES,” NOT TAXES Franchise fees are not a tax, however, but essentially a form of rent or fee: the price or fee paid to rent use of public right-of-ways. See, e.g., City of St. Louis v.

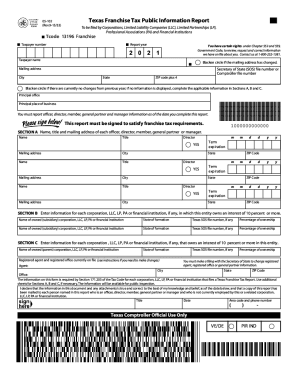

How to fill out franchise tax form in Texas?

To successfully file your Texas Franchise Tax Report, you’ll need to complete these steps:

- Determine your due date and filing fees.

- Complete the report online OR download a paper form.

- Submit your report to the Texas Comptroller of Public Accounts.

What is the LLC tax in Texas?

What Is the LLC Tax in Texas?

- "No Tax Due" Threshold. LLCs and other eligible entities do not owe the franchise tax if the company's annualized total revenue is $1 million or less, as of returns due ...

- Determining the Tax Base. ...

- Tax Rates. ...

- E-Z Computation. ...

- No Income Tax. ...

When are franchise taxes due Texas?

When are franchise tax reports due? Your Texas LLC’s Annual Franchise Tax Report (and the Public Information Report) are due on or before May 15th every year. Your LLC’s first reports are due in the year following the year that your LLC was approved. Examples: If your Texas LLC is approved on August 5th 2021, then you have to file by May 15th 2022

Who pays Texas franchise tax?

In Texas, businesses with $1.18 million to $10 million in annual receipts pay a franchise tax of 0.375%. Businesses with receipts less than $1.18 million pay no franchise tax.

Does an LLC pay franchise tax in Texas?

Texas, however, imposes a state franchise tax on most LLCs. The tax is payable to the Texas Comptroller of Public Accounts (CPA). In general terms, the franchise tax is based on an LLC's "net surplus" (the net assets of the LLC minus its members' contributions).

Do I have to file Texas franchise tax?

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

Who is exempt from Texas franchise tax?

A nonprofit corporation organized under the Development Corporation Act of 1979 (Article 5190.6, Vernon's Texas Civil Statutes) is exempt from franchise and sales taxes. The sales tax exemption does not apply to the purchase of an item that is a project or part of a project that the corporation leases, sells or lends.

What happens if you dont pay franchise tax in Texas?

Penalties and Interest A $50 penalty is assessed on each report filed after the due date. If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed. If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

What taxes do LLC pay in Texas?

The two types of business taxes for an LLC in Texas are sales tax and the Texas franchise tax. All businesses are subject to sales tax.

Who Must file Texas franchise tax report?

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

What is the Texas franchise tax threshold for 2022?

$1,230,000For the 2022 report year, a passive entity as defined in Texas Tax Code Section 171.0003; an entity that has total annualized revenue less than or equal to the no tax due threshold of $1,230,000; an entity that has zero Texas gross receipts; an entity that is a Real Estate Investment Trust (REIT) meeting the ...

Does Texas LLC have to file tax return?

Yes. The legal formation of an entity – not an entity's treatment for federal income tax purposes – determines filing responsibility for Texas franchise tax.

How do I calculate Texas franchise tax?

The Texas franchise tax calculation is based on margin, which can be calculated using one of the following methods: Total revenue times 70% Total revenue minus cost of goods sold (COGS) Total revenue minus compensation.

What states have franchise tax?

The specific states that impose a franchise tax include Delaware, Alabama, Arkansas, Illinois, Georgia, Louisiana, Missouri, Mississippi, North Carolina Oklahoma, New York, Texas, Tennessee, Pennsylvania, and West Virginia.

How do I file a Texas franchise tax?

The Texas Annual Franchise Tax Report can be submitted online or by mail. Either way, you'll need to visit the Texas Comptroller website. On the state website, go to the Franchise Tax page. If you wish to file online, click “webfile eSystems Login.” If you wish you to file by mail, click “Forms.”

Is there an annual fee for LLC in Texas?

There are no annual registration fees imposed on LLCs in Texas. However, your LLC may need to file an annual franchise tax statement with the Texas Comptroller.

How are single member LLCs taxed in Texas?

Introduction to Texas Single Member LLCs Essentially, this means that single member LLCs are taxed in the same way as sole proprietorships. Members of the single member LLC will report the losses and profits of the company on the Schedule C form of their personal tax return.

Is Texas a good state to form an LLC?

Texas offers many advantages to LLCs formed in the state. Notably, its business environment and economic strength, asset protection for the members of the LLC, tax benefits, and a great deal of flexibility. If your business has a physical location in Texas, it is probably best to form your LLC in Texas.

How often do you have to renew your LLC in Texas?

Due Date: Texas LLC annual reports are due by May 15 every year. Late Filings: Any annual report received after May 15 will result in a $50 late fee.

How Do I Get Compliant?

Despite the confusion surrounding the franchise tax, getting compliant is a straightforward process. Here’s what you’ll need to do:

How to calculate franchise tax in Texas?

Despite the confusion surrounding the franchise tax, getting compliant is a straightforward process. Here’s what you’ll need to do: 1 Compare your total revenues in Texas to the thresholds defined above. 2 If your revenues are more than $1.18 million you likely have franchise tax liability. 3 You might also be liable if you’re registered to collect sales tax in Texas. 4 Identify which tax rate applies to your business. 5 Calculate how much you owe. 6 File a return every year by May 15 th and pay the proper amount to the department of revenue.

What is the franchise tax nexus in Texas?

If your revenues in Texas in a single year are above $1.18, you have franchise tax nexus. However, the number of businesses that meet this threshold has drastically increased over the last few years – primarily due to the creation of economic nexus.

What is the tax rate for a business with $1.18 million?

Businesses with $1.18 million to $10 million in annual receipts are taxed at a rate of 0.575%. Businesses with more than $10 million in revenue pay a franchise tax of 1%. A foreign taxable entity with no physical presence in Texas now has nexus if, during any federal accounting period ending in 2019 or later, it has gross receipts ...

What happens if you lose your Texas business license?

Plus, losing your license to do business in Texas could cause you to lose your entire $1.18 million in annual revenues in Texas going forward. If that wasn’t enough, failure to comply with the franchise tax can also impact your other taxes. For example, Texas can take your sales tax refund to cover your debt on the franchise tax.

When did Texas update franchise tax?

But when Texas implemented economic nexus in October 2019, they updated their franchise tax to affect businesses with a sufficient economic presence. They also presumed that anyone with a sales tax permit has franchise tax. This new definition went into effect for the 2020 franchise tax year.

What is the penalty for non compliance?

The penalty for non-compliance starts with 10% late fee based on an estimate of what you owe. And sometimes there’s an additional 10% late fee, called a jeopardy determination, added on top. If you’re registered with the secretary of state, they’ll also revoke your right to do business in the state until you’re compliant.

How much is Texas state tax?

For most businesses, the Texas state tax is 1 percent of the taxable margin; for wholesalers and retailers, it's 0.5 percent. Any entity with annual revenue of $10 million or less can elect to file an E-Z Computation report and pay an amount that is determined by multiplying total revenue by an apportionment factor and then multiplying ...

How long does it take to file a franchise tax return in Texas?

All taxable entities must file a franchise tax report, regardless of annual revenue. The initial franchise tax report is due one year and 89 days after the organization is recognized as a business in Texas.

What is LLC tax in Texas?

What Is the LLC Tax in Texas? Texas imposes a tax on non-exempt organizations doing business in the state. This is known as the Texas franchise tax, and it is considered a “privilege tax” -- you pay it for the privilege of operating in this region. The amount of franchise tax due depends on a business’ revenue.

How to calculate franchise tax?

A company's franchise tax bill is determined by a formula that takes into account total revenue, cost of goods sold and compensation. Start with the lesser amount of three calculations: total revenue minus cost of goods sold; total revenue minus compensation; or total revenue times 70 percent. The result is the "taxable margin.".

When did Texas start franchise tax?

The Texas business tax as currently structured dates to 2006, after the Texas Supreme Court ruled the state's school finance system unconstitutional. Needing a new source of education funding, the Texas Legislature overhauled the franchise tax -- what has been considered a "largely voluntary" tax -- to make it mandatory for all businesses defined as taxable entities. Current law requires any taxable entity doing business in the state of Texas to file a franchise tax report, regardless of the amount of tax due.

Do you have to pay franchise tax in Texas?

Any entity with a total annual revenue of less than $300,000 is not required to pay franchise tax. These entities are still required to file the Texas franchise tax report, and can be penalized and fined for not doing so.

Do non profit organizations have to file annual franchise tax reports?

If an organization receives exemption from the tax, it does not have to file annual franchise tax reports.

What is franchise tax in Texas?

The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. For general information, see the Franchise Tax Overview.

When are Texas franchise taxes due 2021?

Due to statewide inclement weather in February, the Texas Comptroller of Public Accounts automatically extended the original due date for 2021 Texas franchise tax reports to June 15, 2021. As a reminder, the extended due dates did not change. If a taxable entity required to make its franchise tax payments by electronic funds transfer ...

When is the nexus due for franchise tax?

Changes to Franchise Tax Nexus. The Comptroller's office has amended Rule 3.586, Margin: Nexus, for franchise tax reports due on or after Jan. 1, 2020. A foreign taxable entity with no physical presence in Texas now has nexus if, during any federal accounting period ending in 2019 or later, it has gross receipts from business done in Texas ...

When are franchise tax payments due?

If a taxable entity required to make its franchise tax payments by electronic funds transfer (mandatory EFT) filed for a franchise tax extension on or before June 15, the extended due date is Aug. 16. For all other taxable entities not required to make mandatory EFT payments that filed for a franchise tax extension on or before June 15, the extended due date is Nov. 15.

How much is the penalty for filing taxes after the due date?

Penalties. A $50 penalty is assessed on each report filed after the due date. If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed. If tax is paid over 30 days after the due date, a 10 percent penalty is assessed. Interest.

Do franchise tax filers get a reminder?

Most franchise tax filers will receive an email in lieu of a mailed reminder to file or seek an extension. If we do not have your email address on file (if you are a first-year filer, for example), we will mail a reminder notice to you. Electronic filing is highly encouraged for faster account updates and is mandatory for no-tax-due returns.

What is franchise tax in Texas?

What is the Texas Franchise Tax? The Texas Franchise Tax is levied annually by the Texas Comptroller on all taxable entities doing business in the state. The tax is based upon the entity’s margin, and can be calculated in a number of different ways.

How to file a franchise tax report in Texas?

How to File. There are three ways to file the Texas Franchise Tax Report: No Tax Due. EZ Computation. Long Form. If your business falls under the $1,110,000 revenue limit, then you don’t owe any franchise tax. If you are above the limit, you can choose to fill out and file the EZ Computation form or to take the time to fill out the Long Form.

How many types of franchise tax extensions are there?

There are four different types of Franchise Tax Extensions, depending upon your situation.

How is Total Revenue Calculated?

Total revenue is calculated by taking revenue amounts reported for federal income tax and subtracting statutory exclusions.

How to annualize franchise revenue?

To annualize total revenue, divide total revenue by the number of days in the period upon which the report is based, then multiply the result by 365.

What is franchise tax in Texas?

What is franchise tax? The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. What does an entity file if it is ending its existence or no longer has nexus? An entity ending its existence that is not part of a combined group must file.

What is an OIR?

Each taxable entity that is legally formed as a corporation, limited liability company, professional association, limited partnership or financial institution files a public information report (PIR). Associations, trusts and all other taxable entities file the OIR.

What is a 05-359 form?

Form 05-359, Request for Certificate of Account Status to Terminate a Taxable Entity’s Existence in Texas, if needed to terminate the entity with the Secretary of State.

When is the accounting period for the first annual report?

The accounting period covered by the first annual report will be based on the accounting period beginning on the date the entity becomes subject to franchise tax and ending on the last accounting period ending date for federal income tax purposes in the same calendar year as the beginning date. For example, for report year 2014, the accounting period ending date for an entity with a fiscal year end of Sept. 30 will be Sept. 30, 2013.

What to do if a tax return is filed incorrectly?

The entity that filed incorrectly should submit a letter with its name and taxpayer number stating that the report was filed in error and the entity will report with a combined group. The letter must also include the name and taxpayer number of the combined group's reporting entity, along with a request for a refund or authorization to transfer any tax payment from the member's account to the reporting entity's account.

Can a taxable entity file a no tax due report?

Because annualized revenue is not less than the $1,080,000 no-tax-due threshold, the taxable entity does not qualify to file a No Tax Due Report. It is eligible to file using the E-Z Computation.

Update A Franchise Tax Account

File and Pay Franchise Tax

Tax Rates, Thresholds and Deduction Limits

- Franchise tax rates, thresholds and deduction limits vary by report year. Use the rate that corresponds to the year for which you are filing.

Due Dates

- Annual Franchise Tax Reports

The annual franchise tax report is due May 15. If May 15 falls on a weekend or holiday, the due date will be the next business day. - Final Franchise Tax Reports

Before getting a Certificate of Account Status to terminate, convert, merge or withdraw registration with the Texas Secretary of State: 1. A Texas entity, terminating, converting or merging, must file its final tax report and pay any amount due in the year it plans to terminate, co…

Additional Resources