Which states have franchise tax?

The states that currently have franchise taxes are:

- Alabama

- Arkansas

- Delaware

- Georgia

- Illinois

- Louisiana

- Mississippi

- Missouri

- New York

- North Carolina

What is the minimum franchise tax?

$800 Minimum Franchise Tax Overview. The $800 minimum franchise tax is the minimum franchise fee that a corporation will have to pay to operate in California, which is similar to the tax situation in many states. What is not similar, however, is the structure and rate of this tax.

What is the individual income tax rate in California?

California state tax rates are 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% and 12.3%. A 1% mental ...

What is the California State corporate tax rate?

This tax rate is 6.65 percent and is based on federal guidelines. California's corporate income tax is a form of business tax imposed on the gross taxable income of corporations and other businesses that are registered or conducting business in the state.

How much is the California Franchise Tax?

$800Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

How do I avoid franchise tax in California?

One way to avoid paying franchise tax is to operate as a sole proprietorship or general partnership—but you would have to sacrifice the liability protection that LLCs and corporations enjoy. Some charities and nonprofits qualify for an California Franchise Tax Exemption.

How does California Franchise Tax work?

The state requires corporations to pay either $800 or the corporation's net income multiplied by its applicable corporate tax rate, whichever is larger. You may pay the tax online, by mail, or in person at the California Franchise Tax Board Field Offices.

Does LLC have to pay franchise tax in California?

California LLC Annual Franchise Tax A California LLC, like all entities in California, must pay the state's annual Franchise Tax. This tax is $800 for all California LLCs. The annual Franchise Tax is due the 15th day of the fourth month after the beginning of the tax year. You must file Form 3522 (LLC Tax Voucher).

Who needs to pay ca franchise tax?

Every corporation that is incorporated, registered, or doing business in California must pay the $800 minimum franchise tax.

What happens if you don't pay California Franchise Tax?

The California Franchise Tax Board imposes a penalty if you do not pay the total amount due shown on your tax return by the original due date. The penalty is 5 percent of the unpaid tax (underpayment), plus 0.5 percent of the unpaid tax for each month or part of a month it remains unpaid (monthly).

Is CA franchise tax based on income?

S corporations in California must pay a franchise tax of 1.5% of their net income or $800, whichever amount is larger. LPs and LLPs pay a flat franchise tax of $800 a year, while general partnerships and sole proprietors do not pay the franchise tax.

What's the difference between franchise tax and income tax?

Unlike state income taxes, franchise taxes are not based on a corporation's profit. A business entity must file and pay the franchise tax regardless of whether it makes a profit in any given year. State income taxes—and how much is paid—on the other hand, are dependent on how much an organization makes during the year.

Is franchise tax deductible on California return?

Lastly, from a California corporation income (franchise) tax perspective, pursuant to California Rev. & Tax Code section 24345, the state does not allow a corporation income (franchise) tax deduction for any taxes on, or measured by, income imposed by any taxing jurisdiction.

How can I avoid $800 franchise tax?

Thus, the only way to avoid the tax is to dissolve the company. Additionally, another important detail to note is that if you change your business structure during the year–for instance, from an LLC to a C corporation–you would then be subject to the minimum franchise tax on both entities for that year.

What taxes do LLC pay in CA?

Your LLC pays California corporation taxes. If taxed like a C Corp, you pay a flat 8.84% tax on net income. If taxed like an S Corp, pay a 1.5% tax on net income.

What is CA LLC fee based on?

total incomeLLCs are subject to an annual fee based on their total income "from all sources derived from or attributable to California" (R&TC Section 17942).

How can I avoid $800 franchise tax?

Thus, the only way to avoid the tax is to dissolve the company. Additionally, another important detail to note is that if you change your business structure during the year–for instance, from an LLC to a C corporation–you would then be subject to the minimum franchise tax on both entities for that year.

Can I live in California and have an LLC in another state?

As a California resident, you are free to register the LLC for your online business in any state.

Does an out of state LLC have to register in California?

California's LLC Act requires foreign LLCs to register with the state of California if they are transacting business within the state.

Do I owe franchise tax California?

All businesses registered with the state of California have to pay the California Franchise Taxes (except for tax-exempt businesses like nonprofits). This means that C corps, S corps, LLCs, LPs, LLPs, and LLLPs all are all responsible for the California Franchise Tax.

Who Must Pay?

California’s franchise tax applies to limited liability companies (LLCs), S and C corporations, limited partnerships (LPs), and limited liability partnerships (LLPs). General partnerships, however, are not required to pay this tax.

How Much?

The minimum amount of the franchise tax is $800 per year. The amount due will be whichever is larger, the $800 minimum, or the business’s net income multiplied by the appropriate tax rate. The minimum tax must be paid even if the business is inactive or is operating at a loss.

Interstate Businesses

A state appeals court ruled recently that a provision governing interstate tax payers was unconstitutional under the Commerce Clause. The provision requires unitary enterprises (i.e.

Due Dates

For its first franchise tax payment, a business has until the fifteenth day of the fourth month after filing. For future years, the business must pay by April 15th, annually.

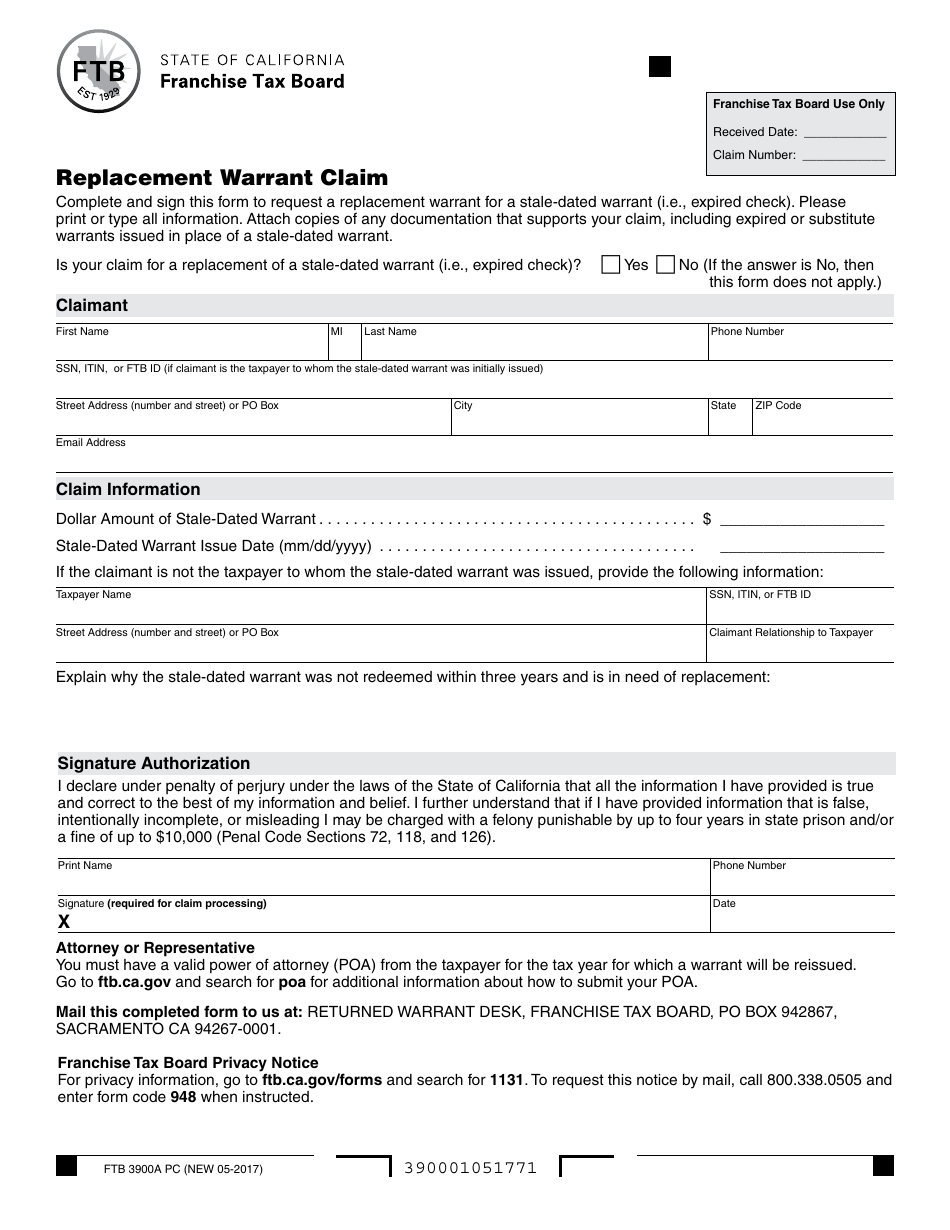

What is the California Franchise Tax Board?

The California Franchise Tax Board ( FTB) collects state personal income tax and corporate income tax of California. It is part of the California Government Operations Agency . The board is composed of the California State Controller, the director of the California Department of Finance, and the chair of the California Board of Equalization.

How much does the FTB collect in California?

Over the past decade, the FTB has collected an average of $9.5 billion per year in corporate income taxes.

What is the FTB tax?

Corporate income tax. The FTB levies a franchise tax on businesses for doing business in California. The FTB's name reflects the fact that it was originally created to collect this tax. The agency's name was left unchanged even after the state created a personal income tax and added it to the FTB's responsibilities.

How much does the FTB collect?

Meanwhile, non-residents are taxed on their California-based income. In recent years, the FTB collects more than $50 billion each year in personal income taxes.

When did California adopt its constitution?

In 1879 California adopted its state constitution which among many other programs created the State Board of Equalization and the State Controller, which administered all tax programs.

Who was the first woman to be a franchise tax commissioner?

The Executive Officer of the Franchise Tax Board is Selvi Stanislaus, the first woman to hold the post. She assumed this position in 2006.

What does the FTB do?

The FTB also collects delinquent vehicle registration debt collections on behalf of the California Department of Motor Vehicles and delinquent court ordered debt. The FTB also does financial audits of certain candidates for state office, ballot proposition committees, and lobbyists, according to a random selection process by the California Fair Political Practices Commission .

Who Must Pay the California Tax Franchise Fee?

California business entities must pay the $800 minimum franchise tax each year, even if they don’t conduct any business or operate at a loss. Types of businesses that must pay the minimum tax include:

When are franchise taxes due?

The first year’s franchise tax fee is due no later than the fifteenth day of the fourth month after the business entity was formed. After that, the annual fee must be paid by April 15th. Thus, if you formed an LLC on June 1st, the first annual fee would be due on October 15th, and the second year’s fee would be due on April 15th of the following year.

What is a business in California?

In general, a business is “doing business” in California if it engages in transactions in California for financial gain or if it meets other criteria such as having a certain amount of sales or property or paying a certain amount of compensation in California. Sole proprietorships and general partnerships do not have to pay the fee.

What does double billing mean in California?

This double billing can mean that the cost to start a business in California is more than you budgeted for.

Do sole proprietorships have to pay fees?

Sole proprietorships and general partnerships do not have to pay the fee.

Does California have franchise tax?

California imposes a minimum franchise tax on all business entities in the state. Find out who must pay the tax and how you can avoid being double billed if you are forming a business near the end of the year. If you are starting a business in California you may be surprised to learn that California business entities must pay a minimum franchise ...

What is the difference between franchise and income tax?

There are several differences between a franchise tax and income tax. For example, franchise taxes are not based on business profits, while income taxes are. Regardless of whether profit is made, a business made pay franchise tax, whereas income tax and the amount paid is based on the organization’s earnings during that particular year.

What states have franchise tax?

In 2020, some of the states that implement such tax practices are: Alabama. Arkansas.

What is franchise tax in West Virginia?

West Virginia. Franchise taxes are charged to corporations, partnerships, and other corporate entities such as limited liability companies. Limited Liability Company (LLC) A limited liability company (LLC) is a business structure for private companies in the United States, one that combines aspects of partnerships and corp. .

Do sole proprietorships pay franchise tax?

Although companies usually have to pay franchise tax based on where they are operating and registered in each state, sole proprietorships are not often subject to franchise taxes. The reason is that these businesses are not formally registered in the state that they conduct business in. Additional entities that are not subject to franchise tax are: ...

Do fraternal organizations pay franchise taxes?

However, franchise taxes do not apply to fraternal organizations, non-profits, and some limited liability corporations. Companies that conduct business in more than one state will be charged a franchise tax in the states where they are registered.

Do franchise taxes replace state taxes?

It is important to make note that franchise taxes do not replace federal or state income taxes. They are simply add-on taxes in addition to income taxes. Much like any other tax, franchise taxes must be paid annually as well. The amount that must be paid differs by the tax rules that govern each state.

Is franchise tax federal or state?

Nonetheless, a franchise tax is different from a tax given to franchises, as well as federal or state taxes.

Our Mission

Our mission is to help taxpayers file tax returns timely, accurately, and pay the correct amount to fund services important to Californians.

Our Board Members

State Controller Betty T. Yee was elected in November 2014, following two terms of service on the California Board of Equalization. As Controller, she continues to serve the Board as its fifth voting member.

Our Executive Team

Selvi Stanislaus was appointed Executive Officer of the Franchise Tax Board (FTB) on January 11, 2006.

Our Values

Lead with Integrity and Inspiration As inspirational leaders, we are committed to pursue the right path, ignite ideas and innovation, communicate clear expectations, and invite everyone to maximize their potential every day.

Our Goals

Exceptional Service Strive to continuously enhance our customers' experience.

What Is A Franchise Tax and How Is It Different from Other Types of Taxes?

Who Has to File A Franchise Tax Return in California and When Is The Deadline?

- Any business registered with the California Secretary of State is required to file a yearly franchise tax return. This includes LLCs, partnerships, and corporations. The deadline for filing is April 15th. If you file late, you will be charged a penalty of 5% of the unpaid tax amount, plus interest. You can file electronically or by mail. Electronic filing is faster and more convenient, and it also allows yo…

Brief Summary

- As you can see, the California Franchise Tax is a complex but important tax to file every year. If you have any questions about how to calculate your liability or which exemptions apply to you, be sure to contact an accountant or the Franchise Tax Board for assistance. Filing on time and accurately is crucial to avoid penalties and interest charges, so make sure to set aside some tim…

Frequently Asked Questions

- Do I have to pay franchise tax in California?

The minimum franchise tax is $800 imposed on every corporation incorporated or doing business in California. This law exempts the first year of any new corporations founded by people living there from paying this charge, but other than that it’s standard practice to pay up. - Who is subject to California Franchise Tax?

The California minimum franchise tax is a stringent requirement for any corporation operating in the state.