What is the annual California Franchise Tax?

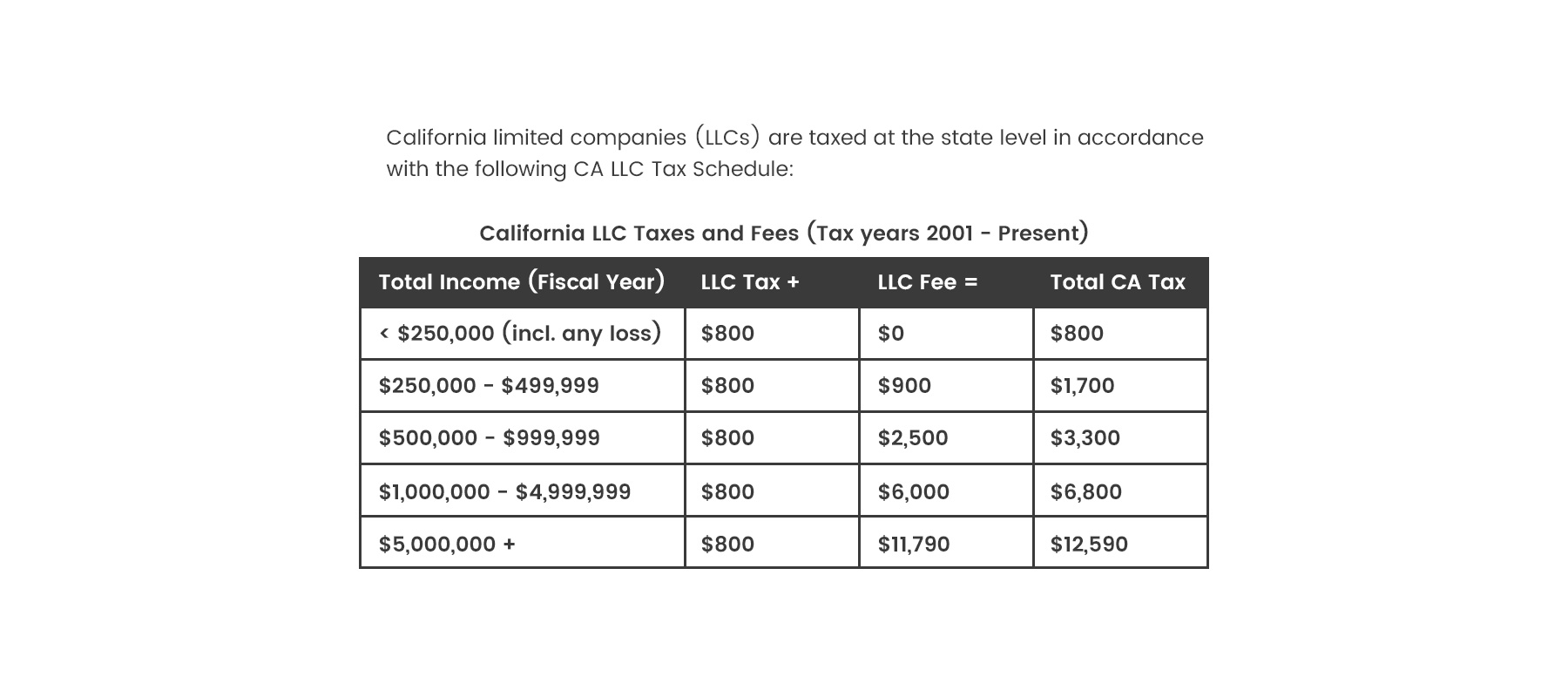

California Franchise Tax is the annual tax for conducting business in California. For noncorporate entities, it is a flat fee of $800. For corporate entities, the fee is a minimum of $800. Failure to pay the franchise tax will result in a minimum penalty of 5% and a maximum penalty of 25% of the unpaid tax.

When is ca form 568 due?

What is the due date for CA Form 568? March 15th California Multi-member LLC’s must file their LLC tax return (FTB Form 568) by the 15th day of the 3rd month following the close of the taxable year March 15th for calendar year filers ). California grants an automatic 6 month state tax extension for LLC’s to file their return.

When is the last day to file taxes in California?

The tax filing deadline for California state income tax returns has been extended to May 17 along with the federal tax filing deadline. The extension from April 15 to May 17 will give more time to taxpayers to prepare their tax returns and so to pay the taxes owed. However, this extension only applies to filing and paying federal income taxes due.

When is ca 568 due?

What is the due date for CA Form 568? This form allows LLCs to pay tax on the income of the previous year. No matter their income, all LLCs are required to file this form. The due date is by the fourth month after the end of a taxable year. Form 568 can be considered a summary of the financial activity of an LLC during a tax year.

Is California Franchise Tax due in the first year?

Newly Incorporated or Qualified Corporations Your first tax year is not subject to the minimum franchise tax. After the first year, your tax is the larger of your California net income multiplied by the appropriate tax rate or the minimum franchise tax.

What is the deadline for franchise tax?

Affected taxpayers who would have had an October 17, 2022, tax filing deadline now have until February 15, 2023, to file. However, tax year 2021 tax payments originally due on April 18, 2022, are not eligible for the extension.

How do I pay the $800 franchise tax?

The state requires corporations to pay either $800 or the corporation's net income multiplied by its applicable corporate tax rate, whichever is larger. You may pay the tax online, by mail, or in person at the California Franchise Tax Board Field Offices.

Do you have to pay the $800 California LLC fee the first year 2022?

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

Is the tax deadline extended for 2022?

For individuals, the last day to file your 2022 taxes without an extension was April 18, 2023, unless extended because of a state holiday. You could have submitted Form 4868 to request an extension to file later during the year.

What is the deadline for business taxes 2022?

For most small businesses, business tax deadlines for 2022 are on April 18, 2022. S corporations and partnerships, however, have to file tax returns by March 15, 2022.

How can I avoid $800 franchise tax?

The only way to avoid the annual $800 California franchise fee is to dissolve your company, file a 'final' income tax return with the FTB and to submit the necessary paperwork.

What happens if you don't pay California Franchise Tax?

The California Franchise Tax Board imposes a penalty if you do not pay the total amount due shown on your tax return by the original due date. The penalty is 5 percent of the unpaid tax (underpayment), plus 0.5 percent of the unpaid tax for each month or part of a month it remains unpaid (monthly).

Who is exempt from California Franchise Tax?

A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year. Business entities such as LLCs, LLPs, and LPs are subject to an $800 annual tax.

What happens if you dont pay franchise tax Board?

Penalty. 5% of the amount due: From the original due date of your tax return. After applying any payments and credits made, on or before the original due date of your tax return, for each month or part of a month unpaid.

How do I pay California Franchise Tax?

How to Pay CA Franchise Tax Board TaxesWeb Pay – Individual and Business taxpayers.Mail – Check, Money Order.In-Person at Franchise Tax Board Field Offices.Credit Card – Online through Official Payments Corporation at: www.officialpayments.com.

Who is subject to California Franchise Tax?

Every corporation that is incorporated, registered, or doing business in California must pay the $800 minimum franchise tax.

What is the due date for Texas Franchise Tax Return 2022?

Franchise tax reports are due on May 15 each year. If May 15 falls on a Saturday, Sunday or legal holiday, the next business day becomes the due date.

When can I file my California state taxes 2022?

January 3, 2022 is the first day to transmit live current year returns to FTB. We accept and process e-file returns year round. File and pay on time (April 15th) to avoid penalties and fees . Use web pay for businesses to make your payment.

What is the extended due date for C corporations?

As a reminder, the extended due date to file Form 100, California Corporation Franchise or Income Tax Return, is the 15th day of the 11th month after the close of the C Corporation's taxable year. For C Corporations operating under a calendar year, the 2020 taxable year extended due date is November 15, 2021.

What is the October 15 tax deadline?

Gather all your tax forms and get your return e-filed by the April deadline. Description:If you e-Filed an extension or did not file a 2021 Tax Return by April 18, 2022 or later and expect to owe taxes, e-File your 2021 Tax Return by Oct. 15 Oct. 17, 2022 to avoid new or additional late filing penalties.

When is the deadline to pay tax return 2021?

Pay by May 17, 2021 to avoid penalties and interest. We give you an automatic extension to file your return. No application is required. The deadline to pay is May 17, 2021. Make your extension payment for free using Web Pay. 21.

When are California state taxes due 2021?

Taxpayers will have until May 17, 2021 to file and pay income taxes. Read more. California grants you an automatic extension to file your state tax return. No form is required. You must file by October 15, 2021. Your payment is still due by May 17, 2021.

When is the deadline for a 2021 unemployment claim?

If you need more time to file, we give you an automatic extension. The deadline is December 15, 2021. No application is required.

When to write outside the USA 2021?

Write Outside the USA on May 17, 2021 at the top of your tax return in red ink.

Who can distribute estimated tax payments to beneficiaries?

A trust or decedent’s estate (for its final year) may choose to distribute (allocate) estimated tax payments to beneficiaries.

What is franchise tax in California?

The California annual franchise tax is exactly what it sounds like—a tax that the state's business owners must pay yearly. It is simply one of the costs of doing business if you choose to register your entity in California. The franchise tax is a special business tax required in California and about a dozen other U.S. states.

What is the minimum franchise tax due?

For corporations, the $800 figure is the minimum franchise tax due. The state requires corporations to pay either $800 or the corporation's net income multiplied by its applicable corporate tax rate, whichever is larger.

How long do you have to file a franchise tax return?

Generally, however, the entity must pay a franchise tax whether the company is fully active, inactive, operating at a loss, or files a return for a period shorter than 12 months. This rule holds for all types of business entities subject to the franchise tax, making this business expense extremely difficult to escape.

When are franchise taxes due?

For corporations, the minimum franchise tax is due the first quarter of each accounting period . For LLCs, the first-year annual franchise tax is due the 15th day of the fourth month from the date you file your business with the secretary of state.

Is a limited liability company subject to franchise tax?

If your business is any of the types that offer limited liability—including limited liability company (LLC), S corporation, C corporation, limited partnerships (LP), or limited liability partnership (LLP)—it will be subject to the California annual franchise tax. Sole proprietorships, general partnerships, and tax-exempt nonprofits are not required to pay this tax.