When do I need to file my annual Franchise Tax Report?

You can file your LLC Annual Franchise Tax Report as early as January 1st each year. Again though, your first Franchise Tax filing year doesn’t start until the year after your LLC is approved. Will my LLC get a reminder to file and pay the Annual Franchise Tax Report?

When do I have to pay my franchise tax?

The obligation to pay the tax begins the year after the business entity was formed and must be filed each year by May 1. Businesses may file and pay their Annual Franchise Tax as early as January 1.

What are the annual Franchise Tax fees and information required?

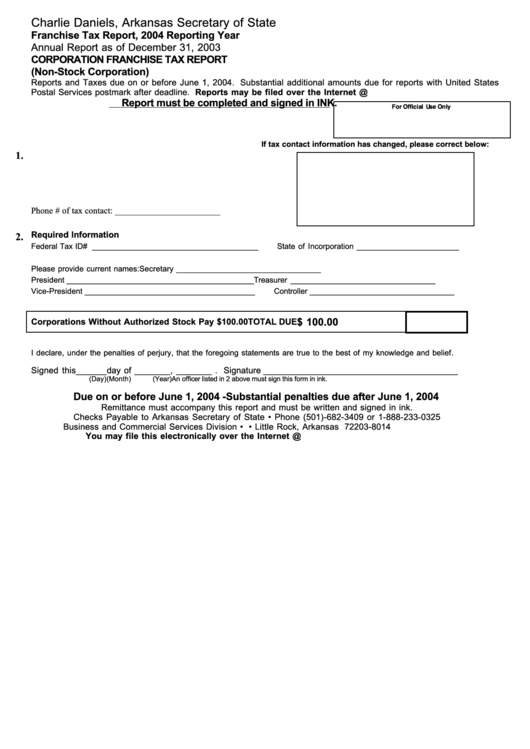

The Annual Franchise Tax fees and information required vary depending on the type of corporation. Corporations that issue stock to shareholders must pay a minimum Annual Franchise Tax of $150 or 0.3 percent of their outstanding capital stock, whichever is greater. Tax contact information (name, address, phone number, email address)

What happens if you don't pay franchise tax Arkansas?

If you don't pay your Arkansas Franchise Tax for three years, your LLC will enter revoked status.

Do I have to pay franchise tax in Arkansas?

§ 26-54-101 et al., also known as the “Arkansas Corporate Franchise Tax Act of 1979”, requires all Corporations, LLC's, Banks, and Insurance Companies registered in Arkansas to pay an annual franchise tax.

How much is the annual franchise tax in Arkansas?

$150Corporate Franchise TaxFranchise Tax TypeCurrent RateCorporation/Bank without Stock$300Limited Liability Company$150Insurance Corporation Legal Reserve Mutual, Assets Less Than $100 million$300Insurance Corporation Legal Reserve Mutual, Assets Greater Than $100 million$4005 more rows

How is Arkansas franchise tax calculated?

Arkansas LLCs and corporations without stock will pay a fixed amount for their franchise tax. Corporations with stock, however, will pay 0.3% of their total outstanding capital stock OR $150 – whichever is greater.

How do I pay my business taxes in Arkansas?

New users sign up at www.atap.arkansas.gov or click on the ATAP link on our web site www.dfa.arkansas.gov. ATAP is a web-based service that allows taxpayers, or their designated representative, online access to their tax accounts and related information.

How much are LLC taxes in Arkansas?

All LLCs operating in Arkansas must file an annual report and pay a flat-rate tax of $150 each year. The $150 tax and the annual report together are known as the Annual LLC Franchise Tax Report.

Does Arkansas have an annual report?

In the state of Arkansas, every business entity is required to complete an annual report filing. Arkansas requires that you file by May 1st of each year, otherwise you may fall into noncompliance and face fees and penalties.

How much does it cost to start an LLC in Arkansas?

How much does it cost to form an LLC in Arkansas? The Arkansas Secretary of State charges a $45 fee to file the Articles of Organization online and $50 if filed by mail. You can reserve your LLC name with the Arkansas SOS for $25 if filed by mail or $22.50 if filed online.

What is Arkansas state income tax?

Arkansas has a graduated individual income tax, with rates ranging from 2.00 percent to 5.50 percent. Arkansas also has a 1.0 to 5.9 percent corporate income tax rate.

Is Arkansas getting rid of state income tax?

Rates. The top individual income tax rate in Arkansas is reduced from 5.5% to 4.9% for tax years beginning on or after January 1, 2022, and the corporation income tax rate imposed on both domestic and foreign corporations is reduced from 5.9% to 5.3% for tax years beginning on or after January 1, 2023.

What is a franchise tax report?

As a registered business entity, a company gains personal liability protection for its owners, certain tax deductions, business name protection, and possibly other benefits. In exchange for this protection, the state serves a tax and it is managed via the annual franchise tax report.

How do I find my SOS File Number Arkansas?

Q: How can I find the filing number for my company? A: Please go to https://www.sos.arkansas.gov/corps/search_all.php and look up the company by name. Your filing number will be listed with your company information.

What is Arkansas state income tax?

Arkansas has a graduated individual income tax, with rates ranging from 2.00 percent to 5.50 percent. Arkansas also has a 1.0 to 5.9 percent corporate income tax rate.

Do nonprofits pay franchise tax in Arkansas?

Other Business Entity Types Other business entities, nonprofits, limited partnerships (LPs), limited liability partnerships (LLPs), and limited liability limited partnerships (LLLPs) must file an annual report. However, they do not pay a franchise tax.

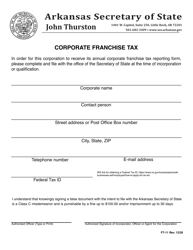

What is SOS filing number Arkansas?

For assistance with this form contact Business and Commercial Services by phone 501-682-3409, toll free 888-233-0325 or by email, [email protected]. Arkansas Secretary of State.

Does Georgia have a franchise tax?

Corporations – Due Date: March 15 (S Corps) or April 15 (C corps) Georgia imposes a net worth tax (like a franchise tax) in addition to the corporate income tax. The net worth tax is based on a corporation's issued capital stock, paid-in surplus, and earned surplus employed within Georgia.

How much is the Arkansas LLC franchise tax?

Arkansas LLC Franchise Tax is a “privilege tax”. Meaning, it’s a flat-rate tax of $150 per year for the privilege to do business in the state. The purpose of the tax is to generate revenue for the State of Arkansas. Again, the $150 tax is due every year (starting after the year of LLC formation), whether or not your LLC makes any money ...

What is the annual report for an LLC in Arkansas?

Note: Most states have an LLC Annual Report that must be filed every year. The Annual Report in Arkansas is called the Annual Franchise Tax Report. There is no other “annual report” for an Arkansas LLC.

What happens if an LLC ignores the Franchise Tax Report?

If your LLC continues to ignore the Annual Franchise Tax Report requirement, the state will send you a final warning called the “Notice of Subject to Forfeiture”. If the Annual Franchise Tax Report is still not filed, the state will revoke the LLC’s corporate charter and authority.

What happens if an LLC is not filed?

If the Annual Franchise Tax Report is still not filed, the state will revoke the LLC’s corporate charter and authority. This strips the LLC of its power, rights, and protections. [ Section 26-54-111]

How to contact Arkansas Secretary of State?

Arkansas Secretary of State Contact Info. If you have any questions about Annual Franchise Tax, you can contact the Arkansas Secretary of State at 501-682-3409. Their hours are Monday through Friday, 8am – 4:30pm Central Time.

What is the purpose of the Arkansas state tax?

The purpose of the tax is to generate revenue for the State of Arkansas.

When are LLC tax returns due?

Example 1: If your LLC went into existence on January 10, 2021, your LLC’s first Annual Franchise Tax Report is due by May 1, 2022.

What is non-stock corporation?

Non-stock corporations are for-profit corporations that do not issue stock to shareholders. They must pay a flat-rate Annual Franchise Tax of $300.

Where to file Arkansas franchise tax?

Businesses can file their reports and pay the Annual Franchise Tax online via the Arkansas Secretary of State website . Alternatively, business owners can file by mail to the Business and Commercial Services Division at:

What happens if a business fails to file a tax return?

If a business fails to file or files past the May 1 deadline, it may be subject to penalties, interest, or worse!

Does CorpNet handle annual reports?

While the state’s forms are not overly complicated, businesses can save time and ensure their paperwork is completed accurately and quickly by letting CorpNet handle the annual report filings for them. What busy business owners can’t benefit from having one less task on their plate?

When do you have to pay franchise tax?

Businesses may file and pay their Annual Franchise Tax as early as January 1.

Can Arkansas revoke a company's franchise?

Worst Case: The state might even revoke a company’s authority to do business in Arkansas if it continues to ignore its franchise tax reporting and payment responsibilities.

Who is Nellie Akalp?

Nellie Akalp is an entrepreneur, small business expert, speaker, and mother of four amazing kids. As CEO of CorpNet.com, she has helped more than half a million entrepreneurs launch their businesses. Akalp is nationally recognized as one of the most prominent experts on small business legal matters, contributing frequently to outlets like Entrepreneur, Forbes, Huffington Post, Mashable, and Fox Small Business. A passionate entrepreneur herself, Akalp is committed to helping others take the reigns and dive into small business ownership. Through her public speaking, media appearances, and frequent blogging, she has developed a strong following within the small business community and has been honored as a Small Business Influencer Champion three years in a row.

When will Arkansas franchise taxes be collected?

Franchise Taxes to be collected by DFA. LITTLE ROCK, Arkansas (November 17, 2020) – As a result of Act 819 of the 2019 session, the Arkansas Department of Finance and Administration (DFA) will accept and process franchise taxes beginning January 1, 2021.

Who must file franchise taxes in Arkansas?

Companies in Arkansas that that must file franchise taxes include banks, legal reserve mutual insurance companies, insurance companies with authorized capital stock, limited liability companies, non-stock corporations, and stock corporations. Companies that have registered franchise tax accounts with the Secretary of State’s Office will be made ...

How many companies pay franchise tax in Arkansas?

Companies that conduct business in Arkansas are required to pay this annual tax. Approximately 150,000 companies pay franchise taxes each year in Arkansas. Franchise tax collections totaled $28 million in 2019.

When will franchise tax return be available for 2021?

Additionally, a hard copy of the franchise tax return will be provided by mail by March 1, 2021.

Who is the point of contact for registering and launching a business in the state?

The Secretary of State’s Office will continue to serve as the point of contact for registering and launching a business in the state as well as defining the organizational structure of the business.