Franchise tax report forms should be mailed to the following address: Texas Comptroller

Texas Comptroller of Public Accounts

The Texas Comptroller of Public Accounts is an executive branch position created by the Texas Constitution. As with nearly every other executive branch head in Texas, the Comptroller is popularly elected every four years concurrently with the governor and the other elected executive branch …

Full Answer

Who has to pay Texas franchise tax?

Franchise tax taxes all the businesses involved in the process from the manufacturer to the end distributor. It can be considered a tax for the privilege of doing business in Texas. Who Needs to File for Texas Franchise Tax? The short answer is everyone who has nexus in Texas has to file & pay Texas franchise tax.

When are franchise taxes due Texas?

When are franchise tax reports due? Your Texas LLC’s Annual Franchise Tax Report (and the Public Information Report) are due on or before May 15th every year. Your LLC’s first reports are due in the year following the year that your LLC was approved. Examples: If your Texas LLC is approved on August 5th 2021, then you have to file by May 15th 2022

How to file a sales tax return in Texas?

The basic steps are:

- Determine where you have sales tax nexus;

- Register for the appropriate sales tax permit.

- Choose and implement a service or software to automate tax collection and calculation.

- Track due dates and file sales tax returns according to each state’s schedule.

Is Texas franchise tax deductible?

Yes, they are allowed a COGS deduction for the Texas franchise tax. Oil and gas extraction falls under the definition of production in TTC 171.1012(a)(2). How are Internal Revenue Code (IRC) Section 179 expense limitations and federal bonus depreciation amounts determined for Texas COGS?

Where do I file my Texas Public information report?

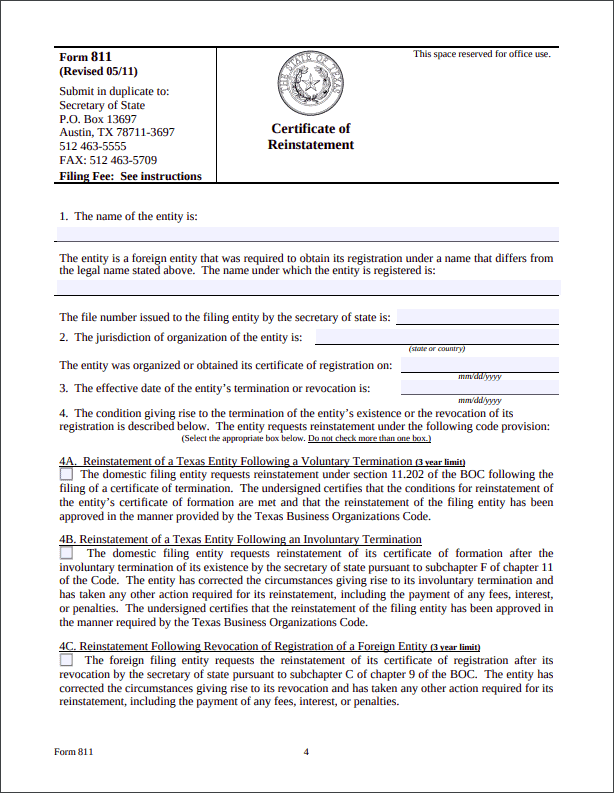

How do I submit my documents to the secretary of state for filing?Online: SOSDirect (electronic filing of many, but not all, types of documents)Fax: (512) 463-5709.Mail: Corporations Section. P. O. Box 13697. Austin, Texas 78711-3697.Delivery: James Earl Rudder Office Building. 1019 Brazos. Austin, Texas 78701.

Where do I send my Texas franchise tax?

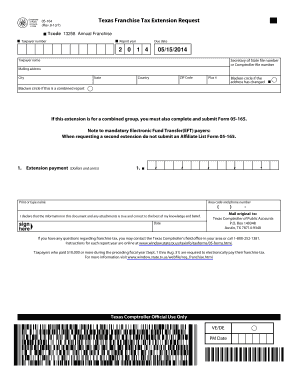

Mail original to: Texas Comptroller of Public Accounts P.O. Box 149348 Austin, TX 78714-9348 Taxpayers who paid $10,000 or more during the preceding fiscal year (Sept. 1 thru Aug. 31) are required to electronically pay their franchise tax.

Where do I mail my Texas PIR?

If the information is not available online, request a copy of the most recent PIR by contacting us at [email protected], or write to the Texas Comptroller of Public Accounts, Open Records Division, P. O. Box 13528, Austin, Texas 78711-3528.

Can you e file Texas Public information report?

No, Form 05-102 can only be e-filed as part of the Texas Franchise Tax return. If separate filing is desired, the form must be paper filed with the taxing authority.

How do I file Texas franchise tax no tax due report electronically?

1:544:50How to File a No Tax Information Report - YouTubeYouTubeStart of suggested clipEnd of suggested clipNo tax due information report return select the radio button next to the file no text dueMoreNo tax due information report return select the radio button next to the file no text due information report and select continue. Now select the report year for which you are filing.

What is Texas Public information report?

The Public Information Report (“PIR”) and Ownership Information Report (“OIR”) – which are separate from the various Texas franchise tax return forms – provide basic information about a Texas entity including the entity's address and governing authority and must be filed with the Texas Comptroller annually, typically ...

How often do you file a public information report in Texas?

annuallyNotes: Public information reports are due annually unless the organization has been granted exemption from the Texas Comptroller. File two copies. An officer, director, manager, member, partner, or agent must file.

Who Must file Texas franchise tax public information report?

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

What is the due date for Texas franchise tax Return 2022?

Franchise tax reports are due on May 15 each year. If May 15 falls on a Saturday, Sunday or legal holiday, the next business day becomes the due date.

Can you efile Texas franchise tax return?

Texas Franchise reports may be submitted electronically with approved tax preparation provider software.

How much does it cost to file an annual report in Texas?

The filing fee for form 802 is $5. Important Information: The Public Information Report is filed along with the annual franchise tax with the Texas Comptroller of Public Accounts. No additional filings are required by the Texas Secretary of State.

How do I check the status of my Texas franchise tax?

Contact the Comptroller's office by completing the online help form or calling 800-252-1381.

How do I file a Texas franchise tax?

The Texas Annual Franchise Tax Report can be submitted online or by mail. Either way, you'll need to visit the Texas Comptroller website. On the state website, go to the Franchise Tax page. If you wish to file online, click “webfile eSystems Login.” If you wish you to file by mail, click “Forms.”

What is the due date for Texas franchise tax Return 2022?

Franchise tax reports are due on May 15 each year. If May 15 falls on a Saturday, Sunday or legal holiday, the next business day becomes the due date.

Do I have to file a Texas franchise tax return?

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

Can you efile Texas franchise tax return?

Texas Franchise reports may be submitted electronically with approved tax preparation provider software.

What is franchise tax in Texas?

The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.

When are Texas franchise tax returns due 2021?

Due to statewide inclement weather in February 2021, the Texas Comptroller of Public Accounts is automatically extending the due date for 2021 Texas franchise tax reports to June 15, 2021, consistent with the Internal Revenue Service (IRS). See Comptroller Hegar’s press release.

When is nexus due in Texas?

The Comptroller's office has amended Rule 3.586, Margin: Nexus, for franchise tax reports due on or after Jan. 1, 2020. A foreign taxable entity with no physical presence in Texas now has nexus if, during any federal accounting period ending in 2019 or later, it has gross receipts from business done in Texas of $500,000 or more. ...

Do franchise tax filers get a reminder?

Most franchise tax filers will receive an email in lieu of a mailed reminder to file or seek an extension. If we do not have your email address on file (if you are a first-year filer, for example), we will mail a reminder notice to you.

How much is franchise tax in Texas?

Costs vary from state to state. Some are free while others can be several hundred dollars. How much you pay for the Texas Franchise Tax depends entirely on your LLC’s total annual revenue. If your business revenue falls under the “ no tax due” threshold, it will not owe a tax. The current threshold is $1,180,000, so if your LLC doesn’t make that much in a year, you won’t be responsible for any payments. But businesses that bring in more than that will be subject to a 0.375% Franchise Tax on retail and wholesales goods and 0.75% on all other revenue.

How Much Does the Texas LLC Annual Report Fee Cost?

If you’re putting together a budget for all your LLC’s costs – like formation costs, name reservation fees, and initial operating expenses – it’s important to include annual filings like this one, just so that there are no surprises.

What is the Texas Annual Report? Why is it Important?

It’s similar to a census in that its purpose is to collect the necessary contact and structural information about each Texas business.

What Happens if You Don’t File?

How bad could it be if I just fly under the radar?” The short answer: don’t try it. Failing to file your Franchise Tax and Public Information Report can yield some serious consequences.

What is LLC annual report?

In Texas, an LLC’s annual report consists of two parts: a Franchise Tax and a Public Information Report. Each LLC must submit these filings to the Texas Comptroller every year to keep their information current. Unsure how to go about it? Never even heard of it? No worries at all. That’s why we’re here. Keep reading for everything you need to know.

What happens if you change your registered agent in Texas?

For example, if you change your registered agent, or your current agent resigns, you’ll need to keep the state informed so they can update their contact information. Miss one of their communications and your LLC in Texas might end up falling out of good standing or, even worse, administratively dissolved.

When are LLC taxes due?

Instead, these filings are due on May 15th each year. If May 15th falls on a weekend or holiday, the due date will simply move to the next business day.

What happens if you don't get your franchise tax report in Texas?

If the Comptroller’s office does not receive your franchise tax report (and payment, if you owe one) within 45 days of the deadline, they are required by law to forfeit your business’s right to transact business in Texas. This forfeiture is essentially a loss of corporate liability protection: business owners will become liable for the debts of the business, and the entity will not be permitted to defend itself in a court of law.

How often do you need to file a franchise tax return in Texas?

But whether or not tax is owed, you’ll need to file a Texas Franchise Tax Report every year to keep your business in good standing.

What is a webfile number?

Your WebFile number.This number, which begins with “FQ,” is the temporary access code that allows you to create a WebFile account. After you log in to the system for the first time and complete your franchise tax questionnaire (addressed in the next step), you’ll receive a permanent WebFile number beginning with “XT” for your franchise tax account.

What does independent Texas do?

When you hire Independent Texas to form your Texas company or serve as your registered agent, we keep your state correspondence organized, send you multiple reminders ahead of the franchise tax due date, and provide affordable franchise report filing service.

What is franchise tax in Texas?

The Texas Franchise Tax is an annual business privilege tax processed by the Texas Comptroller of Public Accounts. Essentially, it’s a tax levied on business owners in exchange for the opportunity to do business in Texas. Here's what you should know about it.

How to calculate annualized revenue?

To find annualized revenue, divide your business’s total revenue by the number of days since it became subject to the franchise tax, then multiply the result by 365.

How to check if a franchise is active in Texas?

How can I check my business’s Texas Franchise Tax status? You can check on the Texas Franchise Tax account status of your company (or another company) by conducting an online Taxable Entity Search on the Comptroller’s website. To search for a business, enter its name, 11-digit Texas taxpayer ID number, 9-digit Federal Employer Identification Number (FEIN) or Texas SOS file number. Once you locate the business you’re looking for, click on the blue “Details” button to the left of the business name. Under the “Franchise Search Results” tab, you’ll see an item called “Right to Transact Business in Texas.” If the right to transact business is “Active,” then the entity is still entitled to conduct business in Texas.