To maintain a Delaware Corporation

Delaware General Corporation Law

The Delaware General Corporation Law is the statute governing corporate law in the U.S. state of Delaware. It has been the most important jurisdiction in United States corporate law since the early 20th century. Over 50% of publicly traded corporations in the United States and 60% of the Fortune 500 are incorporated in the state.

How much do they take out in taxes in Delaware?

This document must be filed annually. Income tax in the state of Delaware consists of six brackets. The tax rates in those brackets range from a low of 2.2 percent to a high of 6.6 percent. A majority of taxpayers in the state of Delaware file their taxes electronically.

Which states have franchise tax?

The states that currently have franchise taxes are:

- Alabama

- Arkansas

- Delaware

- Georgia

- Illinois

- Louisiana

- Mississippi

- Missouri

- New York

- North Carolina

What is the corporate tax rate for Delaware?

Delaware has a flat corporate income tax rate of 8.700% of gross income. The federal corporate income tax, by contrast, has a marginal bracketed corporate income tax.Delaware's maximum marginal corporate income tax rate is the 10th highest in the United States, ranking directly below California's 8.840%.

Why do companies incorporate in Delaware?

Why Do Companies Incorporate in Delaware?

- Low and competitive corporate taxes

- Friendly political scene

- Up-to-date and corporation-friendly business environment

- Ideal legal culture, lawyers, and judges who quickly and expertly address and solve corporate cases

- Simple filing process for small businesses and protection from penalties

What happens if I don't pay my Delaware franchise tax?

If you don't pay the Delaware Franchise Tax and file the Annual Report for two straight years, the State of Delaware will administratively dissolve the Corporation. If you have any questions about forming your new Delaware LLC, LP, or Corporation, give us a call today.

How do I avoid paying Delaware franchise tax?

If you don't want to pay your Delaware franchise tax yourself, you can hire a registered agent to do it for you. The registered agent will charge a small fee to complete the filing of your Delaware franchise tax. The goal of the Delaware franchise tax is to make owning a business in Delaware simple.

How do Delaware franchise taxes work?

If your company has authorized 5,000 shares or fewer, your total Delaware franchise tax amount is $175. If you've authorized 5,001 to 10,000 shares, your franchise tax is $250. For every** additional 10,000 shares** authorized after that, you pay another $85 in franchise tax, up to a maximum of $200,000.

What taxes do I pay for a Delaware LLC?

LLC/Partnership Tax Information All Domestic and Foreign Limited Liability Companies, Limited Partnerships, and General Partnerships formed or registered in Delaware are required to pay an annual tax of $300.00. There is no requirement to file an Annual Report.

What is the Delaware tax loophole?

Companies and wealthy individuals can use Delaware to avoid paying some taxes in other states. So there's a thing called the Delaware Loophole, which essentially enables companies to avoid paying state corporate income tax where they earn the revenue.

What is the minimum Delaware franchise tax?

The Annual Franchise Tax assessment is based on the authorized shares. Use the method that results in the lesser tax. The total tax will never be less than $175.00, or more than $200,000.00.

What are gross assets for Delaware franchise tax?

Discussion: Total gross assets are “total assets” reported on U.S. Form 1120 Schedule L for tax year ending prior to filing the Delaware franchise tax report.

Why do companies incorporate in Delaware?

Delaware doesn't impose income tax on corporations registered in the state which don't do business in the state. Also, shareholders who don't reside in Delaware need not pay tax on shares in the state. For these reasons, Delaware is sometimes referred to as a tax haven.

How is franchise tax calculated?

Example of a Franchise Tax The state calculates its franchise tax based on a company's margin which is computed in one of four ways: Total revenue multiplied by 70% Total revenue minus cost of goods sold (COGS) Total revenue minus compensation paid to all personnel.

Why is it better to form an LLC in Delaware?

Delaware is often considered one of the best states to form an LLC because it has limited fees and tax obligations. In fact, many businesses choose to form an LLC in Delaware even if they don't intend on doing business in Delaware.

Can I file my LLC and personal taxes separate?

The IRS disregards the LLC entity as being separate and distinct from the owner. Essentially, this means that the LLC typically files the business tax information with your personal tax returns on Schedule C. The profit or loss from your businesses is included with the other income your report on Form 1040.

What is the Delaware annual franchise tax?

$300The Franchise Tax for a Delaware LLC or a Delaware LP is a flat annual rate of $300. A non-stock/non-profit company is considered exempt by the State of Delaware. This type of company does not pay the standard annual Delaware Franchise Tax, but must still file and pay the annual report fee of $25 per year.

What happens if you don't dissolve an LLC Delaware?

If you do not legally and officially cancel your LLC or dissolve your corporation, your company will continue to be held responsible for the annual Delaware Franchise Tax Fee as well as your annual Registered Agent Fee until either the Registered Agent resigns or until the State of Delaware voids the company.

What is the corporate tax rate in Delaware?

8.7%Every domestic or foreign corporation doing business in Delaware, not specifically exempt under Section 1902(b), Title 30, Delaware Code, is required to file a corporate income tax return (Form 1100 or Form 1100EZ) and pay a tax of 8.7% on its federal taxable income allocated and apportioned to Delaware.

How do I dissolve an entity in Delaware?

To dissolve your domestic corporation in Delaware, you must provide the completed Certificate of Dissolution form to the Department of State by mail, fax or in person, along with the filing fee. Include a Filing Cover Memo with your name, address and telephone/fax number to enable them to contact you if necessary.

How do I dissolve a Delaware LLC?

Steps to Cancel a Delaware LLCConsult the LLC Operating Agreement. ... Take a Member Vote. ... Appoint a Manager to Wind up the LLC's Affairs. ... Payoff Creditors, Current and Forseeable, before paying Members. ... Pay The Delaware Franchise Tax. ... Pay the LLC's members. ... File a Certificate of Cancellation.More items...

What is Delaware Franchise Tax?

Delaware franchise tax is a tax charged by the state of Delaware for the right to own a Delaware company. The tax does not affect income or company activity. The tax is required to maintain the company's good standing in Delaware.

Why do you need to use franchise tax in Delaware?

The Delaware franchise tax is beneficial to corporations because it is a simple process to submit and calculate payment. The Delaware franchise tax is also beneficial to businesses as it is a small fee in comparison to other states.

How much is the late fee for franchise tax in Delaware?

If you pay your Delaware franchise tax late, you'll be charged a late fee. The late fee is $125.00 and a 1.5 percent monthly interest afterward.

What information is required to file a franchise tax in Delaware?

When filing a franchise tax in Delaware, all the must be submitted is the physical address of the business and the name of the registered agent. This can be a business owner or someone else. By not requiring more information, businesses that file their franchise tax in Delaware can maintain privacy.

What happens if you don't file Delaware franchise tax?

If you don't file your Delaware franchise tax on time, you will be charged a late fee.

What is Delaware's court of chancery?

Delaware has what is called a Court of Chancery. This allows the state to adjudicate corporate litigation. The corporate laws and cases decided in Delaware are often used by the Supreme Court to influence decisions.

How much does it cost to register a foreign business in Delaware?

Foreign File. Business that are formed out of state but are registered to do business in Delaware must pay a $125 registration fee. Foreign corporations, those that are formed outside of Delaware, cannot file online. To file as a foreign corporation, mail in the necessary documents.

What are Delaware franchise taxes?

A franchise tax, sometimes called a privilege tax, is a fee you pay for the “privilege” of doing business in a certain state.

Who has to pay the franchise tax?

You must pay the Delaware franchise tax if your Delaware business is one of the following:

What happens if you don't pay Delaware Franchise Tax?

If you don’t pay the Delaware Franchise Tax and file the Annual Report for two straight years, the State of Delaware will administratively dissolve the Corporation. For more Franchise Tax FAQs.

How much do Delaware corporations pay?

Delaware Corporations pay a minimum of $225/year, due March 1 st of each year if you have less than 5,000 Authorized Shares. If you have more than 5,001 Authorized Shares Delaware Corporations pay a minimum of $400/year or a maximum of $200,000.

What happens if you miss a Delaware corporation tax payment?

So if anyone were to research the company, a missed Franchise Tax payment is there on the company’s history. This may be unappealing to potential investors, lenders, etc.

What happens if a Delaware registered agent resigns?

Since this is a requirement, the company will then be marked void and go inactive. This is not to be confused with a formal closure .

How to contact Delaware LLC?

If you have any questions about forming your new Delaware LLC, LP, or Corporation, give us a call today. I can be reached directly at 302-644-6265 or [email protected] .

Do you need to file an annual report in Delaware?

You are required to report the principal place of business, names, titles, and addresses for ALL Directors, and the name, title and address for ONE Officer. The State of Delaware also requires the up-to-date figures for gross assets and issued shares. What happens if you don’t meet all these ...

When are Delaware annual reports due?

Notification of Annual Report and Franchise Taxes due are sent to all Delaware Registered Agents in December of each year. Delaware has mandated electronic filing of domestic corporations Annual Reports.

How much is the annual report fee for a foreign corporation?

Foreign Corporations. Foreign Corporations are required to file an Annual Report on or before June 30th. The fee for filing the Annual Report is $125.00. Foreign corporations are assessed a penalty of $125 if the Annual Report is not filed.

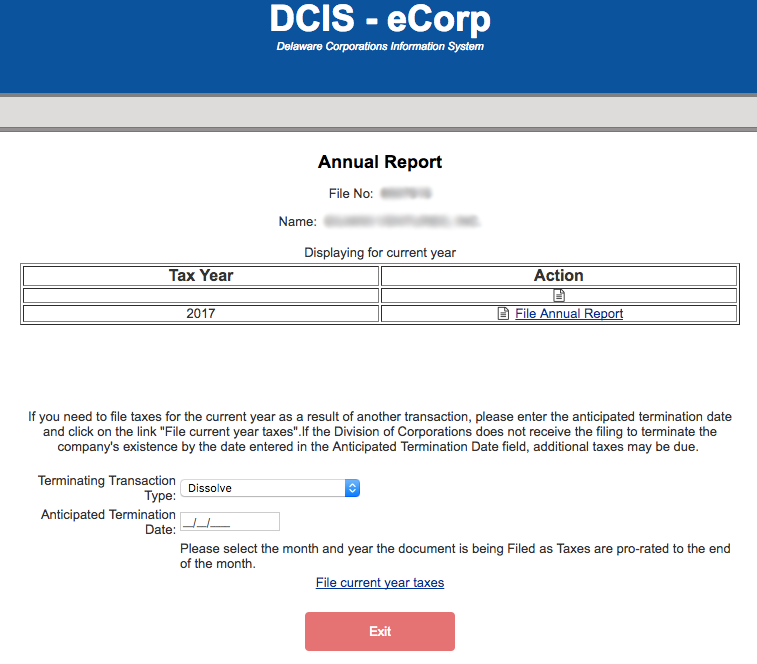

Do corporations pay franchise tax in Delaware?

Corporate Annual Report and Franchise Tax Payments. All corporations incorporated in the State of Delaware are required to file an Annual Report and to pay a franchise tax. Exempt domestic corporations do not pay a tax but must file an Annual Report. The filing fee for filing an Annual Report or Amended Annual Report for exempt domestic ...

What happens if you don't pay your franchise tax?

For example, a corporation that does not file and pay its annual Franchise Tax report for two years in a row will automatically be voided by the state. An LLC (limited liability company) or LP (limited partnership) that does not pay its Franchise Tax Fees for three years in a row will be cancelled by the state.

What Does It Mean to Have a Business Entity Voided by the State of Delaware?

The Delaware Secretary of State will not issue any type of certificates, such as a Certificate of Good Standing, for the company.

What happens if a Delaware company is void?

What Happens If Your Delaware Company is Voided? In order to keep a business entity in good standing status in the state of Delaware, an annual Franchise Tax Fee must be paid. The tax amounts and due dates vary, depending on the business entity type.

Is there a mandatory payment for a business entity?

Unfortunately, many people end up facing this situation when it comes to taking care of the annual obligations for their business entities. They know there are mandatory payments, but daily life interferes before they realize they have missed the due dates, and as a result their entity has been voided.

Can a company name be voided in Delaware?

However, the company name becomes available in the Delaware database, and anyone else can form a new company with that name.