First, go to www.comptroller.texas.gov. This is where you’ll register for both a sales tax permit and a franchise tax account. Actually, most people go ahead and sign up for both at the same time. You should have received your webfile number in a letter when you registered for your sales tax permit.

Full Answer

How to fill out franchise tax form in Texas?

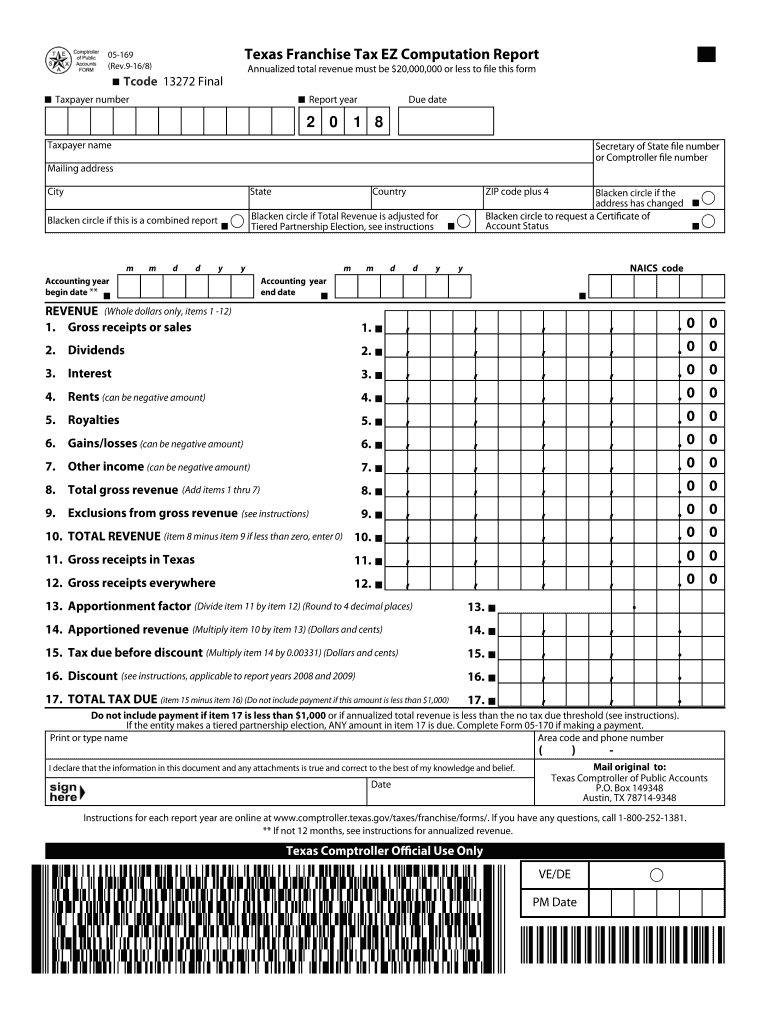

To successfully file your Texas Franchise Tax Report, you’ll need to complete these steps:

- Determine your due date and filing fees.

- Complete the report online OR download a paper form.

- Submit your report to the Texas Comptroller of Public Accounts.

What is the Texas franchise law?

Texas has not enacted franchise specific laws and is not a franchise registration state. However, Texas has enacted Business Opportunity Laws and, before offering or selling a franchise in Texas, you must first file a one-time Business Opportunity Exemption Notice with the Texas Secretary of State.

Are franchise fees taxable in Texas?

Tax vs. Fees – thin Texas and the 5 Judicial Circuit 5th Circuit Court of Appeals held that Cable franchise fees are “FEES,” NOT TAXES Franchise fees are not a tax, however, but essentially a form of rent or fee: the price or fee paid to rent use of public right-of-ways. See, e.g., City of St. Louis v.

How to file Texas franchise tax?

File and Pay Franchise Tax

- Approved Tax Preparation Software Providers

- Filing and Payment Requirements

- Request an Extension

- Report Common Owner Information

How do I open a franchise in Texas?

Texas has not enacted franchise specific laws and is not a franchise registration state. However, Texas has enacted Business Opportunity Laws and, before offering or selling a franchise in Texas, you must first file a one-time Business Opportunity Exemption Notice with the Texas Secretary of State.

How much is Texas franchise fee?

Tax Rates, Thresholds and Deduction LimitsItemAmountTax Rate (retail or wholesale)0.475%Tax Rate (other than retail or wholesale)0.95%Compensation Deduction Limit$350,000EZ Computation Total Revenue Threshold$10 million2 more rows

Do I need to file a Texas franchise tax return?

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

How do I file a Texas franchise tax?

The Texas Annual Franchise Tax Report can be submitted online or by mail. Either way, you'll need to visit the Texas Comptroller website. On the state website, go to the Franchise Tax page. If you wish to file online, click “webfile eSystems Login.” If you wish you to file by mail, click “Forms.”

What is the Texas franchise tax rate for 2022?

Entities using the EZ computation method forego any credits for that report year, including the temporary credit for business loss carryforwards. The franchise tax rate for entities choosing to file using the EZ computation method is 0.331% (0.00331).

Is Texas franchise tax same as income tax?

Texas calls its tax on businesses a franchise tax. The difference between corporate income tax and a corporate franchise tax is that income taxes apply to profit while franchise taxes do not apply to profit.

What happens if you don't file Texas franchise tax?

In Texas, failure to file your franchise tax returns or pay your franchise tax liability will cause you to lose your limited liability protection. The Texas Tax Code provides for personal liability for the management of a company if there is a failure to file a report or pay a tax or penalty.

Does my LLC have to pay franchise tax in Texas?

Therefore, each taxable entity that is organized in Texas or doing business in Texas is subject to franchise tax, even if it is treated as a disregarded entity for federal income tax purposes and is required to file a franchise tax report.

Who is exempt from Texas franchise tax?

A nonprofit corporation organized under the Development Corporation Act of 1979 (Article 5190.6, Vernon's Texas Civil Statutes) is exempt from franchise and sales taxes. The sales tax exemption does not apply to the purchase of an item that is a project or part of a project that the corporation leases, sells or lends.

Who must file franchise tax in Texas?

The short answer is everyone who has nexus in Texas has to file & pay Texas franchise tax. (If you need some nexus or sales tax guidance, click here to download our “10 Steps of Sales Tax” PDF.)

How much does it cost to file a Texas franchise tax report?

How much does the Texas annual franchise tax report cost? There is no filing fee for your franchise tax report. The only payment due is any franchise tax owed for that filing year, plus a $1 service fee for online payments.

How do I find my Texas franchise tax number?

XT Numbers: The number begins with the letters XT followed by six digits. They are for filing franchise tax reports, and they are printed in the upper right corner of the notification letter you receive from our office. We mail these letters to each taxable entity about six weeks before the due date of the next report.

Is there an annual fee for LLC in Texas?

There are no annual registration fees imposed on LLCs in Texas. However, your LLC may need to file an annual franchise tax statement with the Texas Comptroller.

How much does it cost to get a LLC in Texas?

How much does it cost to form an LLC in Texas? The Texas Secretary of State charges a $300 filing fee, plus an additional state-mandated 2.7% convenience fee to file an LLC Certificate of Formation.

How much does an LLC cost per year in Texas?

Texas LLC Certificate of Formation ($300) The fee for a mail filing is $300 and the fee for an online filing is $308. The filing fee is a one-time fee. You don't have to pay any monthly (or annual) fees to maintain your Texas LLC.

How much is a EIN number in Texas?

To obtain an EIN for your Texas business, you must file a Form SS-4. There is no fee for applying for an EIN.

How many steps are there to start a business in Texas?

There are seven basic steps to starting a business in Texas.

Who to talk to about tax?

Talk to a tax consultant, accountant, or attorney to check that you meet all legal requirements.

How much does it cost to file a FDD in Texas?

Texas is a Franchise Filing State. The one-time Texas FDD filing fee is $25.

What is a business opportunity in Texas?

The definition of a “business opportunity” under the Texas Business Opportunity Act is broad and includes franchise relationships. However, if you maintain a current and valid FDD and are in compliance with the Federal Franchise Rule ( learn more about the Federal Franchise Rule) and the FTC’s FDD disclosure requirements, you may claim an exemption to the business opportunity laws. Once an exemption notice is filed, you will be in compliance with Texas’s business opportunity laws.

What is an exemption notice in Texas?

By filing an exemption notice, you are certifying that you have a properly issued Franchise Disclosure Document (FDD) that complies with the Federal Franchise Rule. Once you file your one-time exemption notice you may sell franchises in Texas under a properly issued and compliant FDD.

What is the Texas Business Opportunity Act?

Texas Business Opportunity Act – This is a link to the actual text of the Texas Business Opportunity Act as published by the Texas Secretary of State. The Act defines what constitutes a business opportunity, registration and disclosure requirements imposed on sellers of business opportunities , and the exemption for franchisors.

Is Texas a franchise state?

Texas has not enacted franchise specific laws and is not a franchise registration state. However, Texas has enacted Business Opportunity Laws and, before offering or selling a franchise in Texas, you must first file a one-time Business Opportunity Exemption Notice with the Texas Secretary of State. By filing an exemption notice, you are certifying ...

What is a franchise license?

You need both a Franchise License and a General Distinguishing Number (GDN or P-number) to buy, sell, service, or exchange new motor vehicles, motorcycles, or towable RVs (including travel trailers, but not including utility trailers/semitrailers).

Can you transfer a franchise license to another person?

This license is not transferrable to another person or another business entity. A separate franchise license is required for each separate showroom. Multiple vehicle line-makes may be sold in the same showroom, so long as each line-make is listed on the franchise license.

Can a dealer license a service only facility?

The dealer may not obtain a service-only facility license to service a particular line-make of new motor vehicles, unless the dealer is also franchised and licensed to sell that line-make.

Does TXDMV license repair?

TxDMV does not license a facility that performs only non-warranty repairs.

How to check if a franchise is active in Texas?

How can I check my business’s Texas Franchise Tax status? You can check on the Texas Franchise Tax account status of your company (or another company) by conducting an online Taxable Entity Search on the Comptroller’s website. To search for a business, enter its name, 11-digit Texas taxpayer ID number, 9-digit Federal Employer Identification Number (FEIN) or Texas SOS file number. Once you locate the business you’re looking for, click on the blue “Details” button to the left of the business name. Under the “Franchise Search Results” tab, you’ll see an item called “Right to Transact Business in Texas.” If the right to transact business is “Active,” then the entity is still entitled to conduct business in Texas.

How often do you need to file a franchise tax return in Texas?

But whether or not tax is owed, you’ll need to file a Texas Franchise Tax Report every year to keep your business in good standing.

What does independent Texas do?

When you hire Independent Texas to form your Texas company or serve as your registered agent, we keep your state correspondence organized, send you multiple reminders ahead of the franchise tax due date, and provide affordable franchise report filing service.

What is franchise tax in Texas?

The Texas Franchise Tax is an annual business privilege tax processed by the Texas Comptroller of Public Accounts. Essentially, it’s a tax levied on business owners in exchange for the opportunity to do business in Texas. Here's what you should know about it.

What happens if you don't get your franchise tax report in Texas?

If the Comptroller’s office does not receive your franchise tax report (and payment, if you owe one) within 45 days of the deadline, they are required by law to forfeit your business’s right to transact business in Texas. This forfeiture is essentially a loss of corporate liability protection: business owners will become liable for the debts of the business, and the entity will not be permitted to defend itself in a court of law.

How to pay taxes on Webfile?

Log in to WebFile. From the eSystems menu, select WebFile / Pay Taxes and Fees.

What is total revenue in Texas?

Total Revenue This is the total income from your entire business during the tax year—including gross receipts or sales, dividends, interest, rents, royalties and other income—minus federal statutory deductions. The dollar amounts you list on your Texas Franchise Tax Report will correspond with specific line items on your business’s IRS tax return.

How to file a franchise tax report in Texas?

How to File. There are three ways to file the Texas Franchise Tax Report: No Tax Due. EZ Computation. Long Form. If your business falls under the $1,110,000 revenue limit, then you don’t owe any franchise tax. If you are above the limit, you can choose to fill out and file the EZ Computation form or to take the time to fill out the Long Form.

What is franchise tax in Texas?

What is the Texas Franchise Tax? The Texas Franchise Tax is levied annually by the Texas Comptroller on all taxable entities doing business in the state. The tax is based upon the entity’s margin, and can be calculated in a number of different ways.

How many types of franchise tax extensions are there?

There are four different types of Franchise Tax Extensions, depending upon your situation.