Full Answer

How many years of financials should a franchise have?

What is franchise training?

Who contributed to the 10 steps?

Is Forbes opinion their own?

See 1 more

About this website

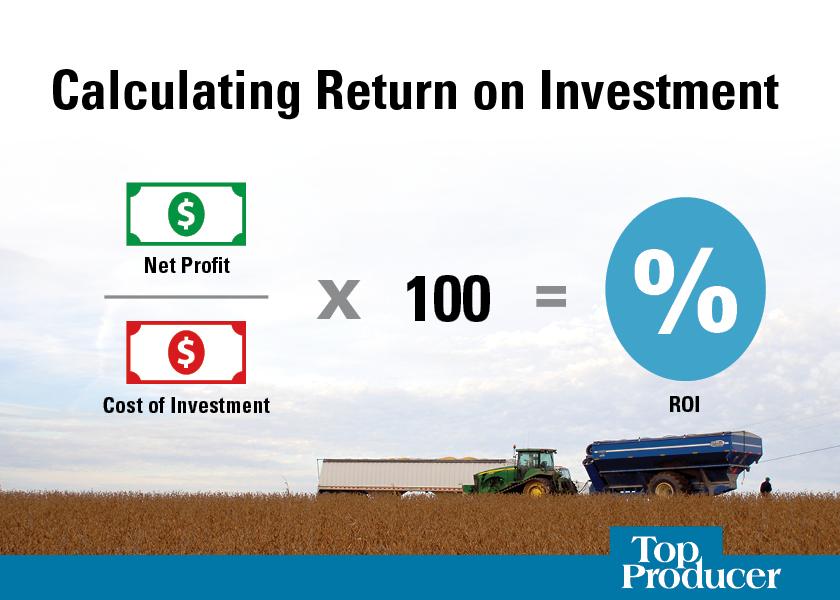

How is franchise ROI calculated?

Calculating and evaluating a Franchising ROI Look for an ROI on your capital investment that falls in the neighborhood of 15%. In other words, for every $100,000 of capital you invest, look to make at least $15,000 per year in returns.

How do I evaluate a franchise opportunity?

To check if a franchise is viable you need to ask the franchisor the following questions:Does the business operate in a large and growing market? ... Is the growth in the market likely to be sustainable? ... Are attainable margins sufficient to cover franchise fees? ... Can the product or service demand a price premium?More items...

How do you determine if a franchise is a good investment?

The most profitable franchises are the ones with the highest ROI, therefore, you want to find a franchise that demonstrates large profit margins, and relatively low operational expenses. A good place to start is low overhead franchises.

What is a good return on investment for a franchise?

What is an “acceptable” investment is 100% up to the investor. However, there is an oft-repeated rule of thumb that, after the second full year in business, a franchisee should be realistically able to anticipate a 15- 20% per year ROI plus an equitable salary for whatever work they do in the business.

Why do we have to evaluate our franchise?

Evaluating the franchise's history, financials, business model and support structure will give you a good idea of what you're getting into as a franchisee, as well as reassure you that all is well and the company is a successful one, not just one that looks successful.

How can a prospective franchisee evaluate a franchise opportunity explain?

How to Evaluate a Franchise Opportunity1) Speak to the Franchise Business Development Person. ... 2) Read the Franchise Disclosure Document. ... 3) Determine the Level of Initial and Ongoing Support for Franchisees. ... 4) Look at the Franchise Fees and Costs. ... 5) Speak to Current and Former Franchisees.More items...•

What are the 3 conditions of a franchise agreement?

The key elements of a franchise agreement generally include: Territory rights. Minimum performance standards. Franchisors services requirements.

How much is my franchise worth?

Franchises are often valued based on a multiple of revenue, cash flow, or earnings before interest, taxes, depreciation, and amortization (EBITDA). As the name implies, the EBITDA method adds back some expenses to the earnings total, and a franchise can be valued at 4 to 5 times EBITDA.

How much should you invest in a franchise?

You should expect to pay anywhere from $10,000 to $100,000 in initial fees when buying a franchise. You will also pay monthly fees for marketing and royalties. This article is for people who are looking for a complete guide to buying a franchise business.

What is a good failure rate for a franchise?

IFA surveys suggest that, in the USA, 92% of franchise businesses are still operating after 5 years. This is compared to an 80% national small business failure rate.

How long does it take for a franchise to become profitable?

One common misconception when it comes to operating a franchise is that once you sign on the dotted line and open for business, the customers and revenue will start flowing. This is typically not the case. It normally takes a year or two to become profitable.

What is ROI in business?

Return on Investment (ROI) A calculation of the monetary value of an investment versus its cost. The ROI formula is: (profit minus cost) / cost. If you made $10,000 from a $1,000 effort, your return on investment (ROI) would be 0.9, or 90%.

What are the points to consider in evaluating franchise agreement?

When it comes to finance, there are three main elements you should consider in any franchise opportunity: the initial investment, working capital and ongoing fees. Underestimating the amount of money needed to start and successfully run a franchise unit is one of the biggest reasons why franchisees fail.

How can a lawyer help in evaluating a franchise opportunity?

They can help you negotiate with a franchisor by explaining what changes the franchisor might be willing to make and which ones will likely be rejected. An attorney with franchise experience can also assist you in evaluating the franchise opportunity and writing your own business plan.

What are your criteria for selecting a franchise?

What are the criteria for selecting a franchise?SELECTING A FRANCHISE Your Abilities Costs Demand Competition Brand name Training & Support Expansion Plans Franchisor's Experience.• How much money will this franchise cost before it becomes profitable?More items...

What is the most important consideration in franchising business?

Important considerations for your franchise model include fee and royalty percentage, terms of agreement, size of territory awarded to each franchisee, geographic areas in which you are willing to offer franchises, the specifics of your training program, and more.

7 things to investigate before you buy a franchise

Buying a franchise can be a great pathway to running your own business. Before signing on, make sure you’ve sought advice and considered these seven key areas.

What Criteria Should I Use When Evaluating a Franchise Opportunity?

The International Franchise Association recommends using these 8 criteria to help you select the best franchise for your needs.

10 Criteria for Assessing a Franchise - FranBest

In the weeks to come, I will be posting in-depth advice for finding and evaluating promising franchise companies. Feel free to subscribe to our feed, or download our free franchise guide (see button on top page). Also, read 10 Criteria for Choosing a Franchise at FranBest.

Franchise Marketing Plans and Strategies

Get free access to our comprehensive resource center created by expert franchise consultants. Includes how-to-franchise materials such as informative franchise videos, whitepapers, webinars, interviews and more.

How to run a cash flow analysis?

To run a cash flow analysis, you’ll first need to know how much the investment is going to cost (to the best of your ability). After you’ve made contact with a franchisor to show interest, request the business’s franchise disclosure document (or FDD). The FDD is an invaluable resource to have as you put together your budget for franchise investment and it must conform to Federal Trade Commission (FTC) guidelines.

Is it difficult to project return on investment?

Working with an experienced accountant or another financial advisor, it’s not difficult to project the return on investment you can expect to achieve given different performance variables if you have a few pieces of information at your fingertips:

How many years of financials should a franchise have?

Financial Statements - Unless the franchisor is a start-up there should be three (3) years of audited financials available. Look for a continuing and growing stream of revenues from franchisee royalties. Initial franchise fees should not represent the preponderance of revenues unless it’s a start-up.

What is franchise training?

Franchisor Training Programs - Franchisee training should be comprehensive and presented by more than one person. Training that includes a portion of onsite training for new franchisees provides real world franchise experience that the classroom can’t duplicate.

Who contributed to the 10 steps?

Contributing to the 10 steps was Mario Herman, a Washington D.C. based franchise attorney.

Is Forbes opinion their own?

Opinions expressed by Forbes Contributors are their own.

Why is franchising more difficult to calculate?

Thus, a franchising ROI is more difficult to calculate because that portion of the initial investment (time/effort) can’t be quantified. And because franchise owners are investing time and effort plus money, they should expect a higher ROI than they would for a passive investment vehicle.

How to calculate return on time investment?

Calculating a reasonable return on your investment of time is more difficult, because many variables are involved. Start by assigning a value to your time. How much are you accustomed to earning in exchange for your work hours? For example, if you can fairly easily trade your time for $60,000 per year in wages/income, that’s reasonable way to value your full-time time/effort investment. Look for a business that can provide you with some increase in the return on this investment of your time.

What is the annual rate of return on a passive investment?

Most people would agree that over time, a strong annual rate of return on a passive investment would be 5-12%. An ROI of more than 12% for a passive investment is usually considered excellent.

How long does it take for a franchise to mature?

This initial growth curve is usually fairly steep. For most businesses, it takes 2-3 years for the business to mature. For this reason, when we look at a franchising ROI, we analyze income figures beginning with the third year of operation. This helps us more accurately measure the average annual return the business is likely to produce.

What if the third year gross income was $90,000?

What if in this same example, the third-year typical gross income was only $90,000? In that case, you would clear the same return on the capital you invested, but the ROI on your time investment would be zero. Then, the obvious question would be: why take the risk? Unless there are compelling soft benefits, it would be better to keep looking for a different business with higher returns while you remain in your current job.

What are the costs required by franchisors?

Other costs are prescribed by the franchisor, such as royalties and advertising fund dollars – you will pay a certain percentage of your gross sales for these items. Royalties are always a cost required by franchisors since this is how they make money fund the support they provide.

How often do franchises spend their capital?

For most franchises, outside of working capital demands, these capital expenditures occur every three to five years. Therefore, they are “chunky” but can be meaningful – around 3-5% of total annual revenue. So, be sure to budget for these items in your long-term plans.

What are the costs of a business?

Costs are the cash expenditures you incur to manage and grow your business. These costs include personnel, marketing and advertising, product costs, rent, royalties, and utilities. Most of these costs are market-related; for example, the rent prices are determined by the area in which you would like to set up shop.

What are the components of cash flow?

For every business, there are three critical components of generating cash flow (money you can put in the bank): revenue, costs, and capital outlays. All of these are critical to understanding any franchise you are evaluating.

What is owner earnings?

Owner’s earnings are the profits that will accrue to you as the owner. If you are planning on working in the business, you would be considered the manager, and would not have to pay out that cost to someone else. If you are a semi-absentee owner, you will have a manager on staff that would oversee the day-to-day aspects of the operations.

What is revenue in business?

Revenue (also called gross sales) is the amount of sales you produce in the business. The total revenue you generate in the business is the most critical determinant of the long-term cash flow of the enterprise.

Why do businesses operate within a band of reasonableness?

This is because the market is competitive, and the customer will move to a competitor if one business is charging too much.

When is ROI calculated?

ROI is calculated after expiry of the operation of investment). Profit used in ROI

What is ROI in math?

words, ROI allows measuring the result in relation to the means used to obtain it.

What is the decision of investment?

The decision of investment is a strategic decision and it is an integral part of the general policy of the company . The purpose of this paper is to present the manner in which the ROI (Return On Investment) indicator can be used in the analysis of investment projects. Understanding the concept of investment is the first issue addressed. Then ROI is analyzed, highlighting the advantages and limitations of its use. They are addressed the aspects related to the manner in which the size of the ROI indicator is influenced by the method of valuation of assets, but also by the method of calculation of the working capital. The research results can be used by any investor to select based on ROI indicator, an investment project of several possible. As well, ROI may serve after completion of the investment to measure its profitability.

What is management performance?

assessing management performance is the profits earned on the asset used. By compari ng

What is investment program?

In an investment program are established the objectives, actions and means to. achieve the objectives, performance, and how to combine and use the resources. Financial. effects of the investment will be felt for several years. The success of an investm ent project. requires achieving its objectives.

Is ROI positive or negative?

The value of ROI can be positive or negative. A negative ROI indicates an

Is ROI bigger or smaller?

ROI is bigger the investment situation is better. The aim of the company’s manager is to

What are the key indicators of success in the WIRE project?

Business-related indicators that are important to the WIRE project’s success include: increased retention of participating entrepreneurs, decreased mentoring time required per entrepreneur, reduced time spent responding to and solving problems faced by entrepreneurs, increased capital leveraged within entrepreneurs’ businesses, increased sales, and a greater diversity of products offered by entrepreneurs (see fig. 7 for a complete list of relevant business metrics and priorities determined through interviews with WIRE project staff & leadership). The business metrics were determined based on traditional ROI models, combined with interviews of key staff members and organizational leaders to identify important business metrics to the organization. The effectiveness of the WIRE project on entrepreneur’s business metrics are important to the reputation of E4I on the whole, and their ability to execute and justify training and mentorship programs in the future.

Does E4I take profit from entrepreneurs?

There are several key considerations to note in this report. First, E4I is a non-profit organization that does not take a profit from the sales of entrepreneurs in the WIRE program, and therefore the ROI numbers presented in this analysis did not include sales data. Despite the short duration of the project, we collected sales data in the three months prior to and approximately four months post training that do provide insight into changes in sales at the individual level, and highlight how other companies may potentially profit from entrepreneurs’ sales.

How many years of financials should a franchise have?

Financial Statements - Unless the franchisor is a start-up there should be three (3) years of audited financials available. Look for a continuing and growing stream of revenues from franchisee royalties. Initial franchise fees should not represent the preponderance of revenues unless it’s a start-up.

What is franchise training?

Franchisor Training Programs - Franchisee training should be comprehensive and presented by more than one person. Training that includes a portion of onsite training for new franchisees provides real world franchise experience that the classroom can’t duplicate.

Who contributed to the 10 steps?

Contributing to the 10 steps was Mario Herman, a Washington D.C. based franchise attorney.

Is Forbes opinion their own?

Opinions expressed by Forbes Contributors are their own.