California Franchise Tax Board

The California Franchise Tax Board collects state personal income tax and corporate income tax of California. It is part of the California Government Operations Agency. The board is composed of the California State Controller, the director of the California Department of Finance, and the chair o…

What is the California Franchise Tax Board Open Data Portal?

The California Franchise Tax Board (FTB) has launched its Open Data Portal initiative in order to increase public access to one of the State’s most valuable assets – non-confidential personal income tax, corporate tax, and other tax-related data.

When is the next meeting of the Franchise Tax Board?

Information for individuals, tax professionals, and insurance providers. The next meeting of the Franchise Tax Board will be March 22.

Can I remove a review from Franchise Tax Board?

Your trust is our top concern, so businesses can't pay to alter or remove their reviews. Learn more. With so few reviews, your opinion of Franchise Tax Board could be huge. Start your review today. Had to come in for some issues related to my LLC. Roland was amazing!!

Where are the out-of-state offices of the California State Tax Office located?

Our out-of-state office locations include Houston, Chicago, and Manhattan. We administer our tax programs in collaboration with California's two other tax agencies, Board of Equalization (BOE) and Employment Development Department (EDD).

How do I talk to someone at the Franchise Tax Board?

Taxpayers with general questions can call (800) 852-5711 or visit our website at ftb.ca.gov .

Do you need an appointment for Franchise Tax Board?

Related content. Attention You must make an appointment before visiting an FTB Field office. To request an appointment, contact the field office using the links or the phone numbers listed below.

How do I make an appointment with the California Franchise Tax Board?

If an appointment is necessary, please direct the customer to the public website to self-serve and schedule their appointment. If the customer is unable to schedule the appointment, visit www.ftb.ca.gov and schedule the appointment on behalf of the customer.

What is the phone number for the Franchise Tax Board?

(800) 852-5711California Franchise Tax Board / Customer service

What are the hours of the California Franchise Tax Board?

8 AM to 5 PM PT (general and MyFTB)

Is the Franchise Tax Board the same as IRS?

While the IRS enforces federal income tax obligations, the California Franchise Tax Board (FTB) enforces state income tax obligations. A taxpayer will face collections actions by the FTB because they have ignored the obligation, refused to pay, or are unable to pay an outstanding tax balance that is due and owing.

Does the State of California forgive tax debt?

California Tax Debt Forgiveness: Is It a Real Thing? California will forgive tax debt via a Franchise Tax Board Offer in Compromise. An FTB Offer in Compromise is an agreement between the California state taxing authorities, the FTB, and the taxpayer to settle the tax debt for less than the amount owed.

How do I contact the California tax Board?

Customer service phone numbers: Tax information/Refund/Forms: 1-800-338-0505. Other assistance: 1-800-852-5711.

Does state tax debt ever go away?

Does State Tax Debt Ever Go Away? The truth is that state tax debt generally sticks around longer than federal tax debt. There is a general 10-year statute of limitations for IRS tax collection, but every state sets its own statute of limitations for tax debt. The range goes from three years to 20 years!

How do I get a person on the phone at IRS 2022?

Here's how to get through to a representative:Call the IRS at 1-800-829-1040 during their support hours. ... Select your language, pressing 1 for English or 2 for Spanish.Press 2 for questions about your personal income taxes.Press 1 for questions about a form already filed or a payment.Press 3 for all other questions.More items...•

How do you get a live person at the IRS?

Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040. Customer service representatives are available Monday through Friday, 7 a.m. to 7 p.m. local time, unless otherwise noted (see telephone assistance for more information).

Can you pay the FTB over the phone?

You may call the pay-by-phone telephone number or use the Internet 24 hours a day, year round to make your payment. To ensure your payment is timely, you must complete your call by 3 p.m. PST on or before the due date of your payment.

How do I pay $800 minimum franchise tax for an S Corp?

How do I pay the annual franchise tax?Go to www.ftb.ca.gov/pay.Choose “Bank Account”Choose Web Pay Business or Web Pay Personal, depending on the entity type. Follow the prompts to provide the requested information and pay the tax.

How do I pay the $800 franchise tax?

The state requires corporations to pay either $800 or the corporation's net income multiplied by its applicable corporate tax rate, whichever is larger. You may pay the tax online, by mail, or in person at the California Franchise Tax Board Field Offices.

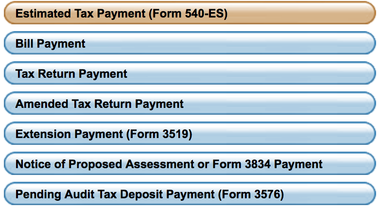

Where do I pay my California Franchise Tax?

The California Franchise Tax Board offers taxpayers four ways to pay their estimated tax payments, extension payments, or the amount due on their back taxes or current year tax returns. Web Pay – Individual and Business taxpayers. Credit Card – Online through Official Payments Corporation at: www.officialpayments.com.

Do you have to pay the $800 California C corp fee the first year?

California law generally imposes a minimum franchise tax of $800 on every corporation incorporated, qualified to transact business, or doing business in California. A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year.

Personal Income Tax Data

Personal income tax statistics that have been summarized from returns filed since 1955. This data does not contain personally identifiable information.

Corporation Tax Data

Corporation tax statistics that have been summarized from returns since 1950. This data does not contain corporation identifiable information.

Other Tax Data

Other Franchise Tax Board data that is not categorized as Personal Income Tax or Corporate Income Tax including the Tax Expenditure Report and Department of Finance Exhibits

What is the California Franchise Tax Board?

The California Franchise Tax Board (FTB) has launch ed its Open Data Portal initiative in order to increase public access to one of the State’s most valuable assets – non-confidential personal income tax, corporate tax, and other tax-related data. Its goals are to spark innovation, promote research and economic opportunities, engage public participation in government, increase transparency, and inform decision makers. "Open Data" describes data that are freely available, machine-readable, and formatted according to national technical standards to facilitate visibility and reuse of published data.

What is the FTB in California?

We administer the personal income and corporation tax programs for the State of California. The FTB collects billions of dollars annually. These funds are deposited into the State’s General Fund revenue. Each year, our department processes millions of personal income tax and business entity tax returns. We employ thousands of permanent, seasonal, and intermittent employees nationwide. Headquartered in Sacramento, our California office locations include Los Angeles, Oakland, San Diego, San Francisco, San Jose, Santa Ana, Van Nuys, and West Covina. Our out-of-state office locations include Houston, Chicago, and Manhattan. We administer our tax programs in collaboration with California's two other tax agencies, Board of Equalization (BOE) and Employment Development Department (EDD). Nearly 100 million records containing income, asset, demographic and tax return information is exchanged.

What is open data?

"Open Data" describes data that are freely available, machine-readable, and formatted according to national technical standards to facilitate visibility and reuse ...